Exercise 10.3 (continued)

advertisement

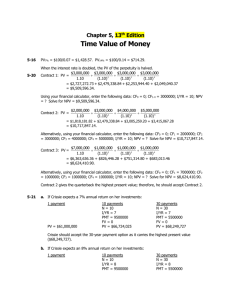

10 Annuities: Future Value and Present Value Checkpoint Questions (Section 10.1) 1. a. False. Although the payments are equal in value, they are not being paid at regular intervals of time. Therefore, the series of payments does not meet the definition of an annuity. b. False. When an annuity’s payments are made at the beginning of each period, the annuity is classified as an annuity due. c. True. When the payment interval and the compounding interval are equal, the annuity is classified as a simple annuity. d. True. When the payment interval and the compounding interval are not equal, the annuity is classified as a general annuity. e. False. The premiums are paid in advance, at the start of each month. The payments are at the beginning of each payment interval. Therefore, the payments form an annuity due. 3. The two types of annuities are distinguished by comparing the timing of the payments. If the payments are made at the end of each payment interval, the annuity is an ordinary annuity. If the payments are made at the beginning of each payment interval, the annuity is an annuity due. Exercise 10.1 Basic Problems 1. With payments at the end of every period, this is an ordinary annuity. With monthly payments and interest compounding quarterly, this is a general annuity. Hence, this is an ordinary general annuity. 3. With payments at the beginning of every period, this is an annuity due. With monthly payments and interest compounding monthly, this is a simple annuity. Hence, this is a simple annuity due. 5. Since the payments are made every quarter, the payment interval is every 3 months. The term of the annuity is 42 payments x 3 months = 126 months. Since there are 12 months in a year, the term of the annuity is 126/12 or 10 years, 6 months. 298 Fundamentals of Business Mathematics in Canada, 2/e Intermediate Problems 7. First payment interval (3 mths) Loan Advanced PMT #1 PMT #2 PMT #3 PMT #4 PMT #5 PMT #6 Start of Annuity’s Term PMT #7 End of Annuity’s Term Term of the annuity 7 x 3 months = 21 months, or 1 year, 9 months 9. a. Payments are made at the end of each year, therefore the annuity is an ordinary annuity. Payments are made annually, and interest is compounded quarterly. Since the payment interval and the compounding interval are not equal, the annuity is a general annuity. Therefore, the series of payments represents an ordinary general annuity. b. First payment: December 31, 2014; Last payment: December 31, 2018 c. Start of annuity term: December 31, 2013; End of annuity term: December 31, 2018 Math Apps (Section 10.2) Your Potential to Become a Millionaire! 1. a. The accumulated amount after 20 years will be 1 i n 1 1.0075 240 1 = $300 FV PMT = $200,366 0.0075 i 1.0075 360 1 $300 b. The amount after 30 years will be = $549,223 0.0075 480 1.0075 1 c. The amount after 40 years will be $300 = $1,404,396 0.0075 3. If the inflation rate is 2.4% compounded monthly, you will need FV PV 1 i = $1,000,000(1.002)480 = $2,609,194 40 years from now to have the same purchasing power as $1,000,000 has today. Therefore, the amount in 1(c) will have only a little more than half of the purchasing power of $1,000,000 today. You would/should not “feel” as wealthy as a person holding $1,000,000 today. n Chapter 10: Annuities: Future Value and Present Value 299 Checkpoint Questions (Section 10.2) 1. A’s future value will be (i) double B’s future value. When we inspect the future value formula 1 i n 1 FV PMT i we note that, for given values of i and n, the future value is proportional to PMT. Therefore, doubling the size of the payment will double the amount of the future value. Exercise 10.2 Basic Problems 1. Given: PMT = $100, n = 4(5.5) = 22, i = 5% 4 = 1.25% 1 i n 1 FV PMT i 1.0125 22 1 = $100 0.0125 = $2514.31 5 I/Y P/Y 4 ENTER (making C/Y = P/Y = 4) 22 N 0 PV 100 + / – PMT CPT FV Ans: 2514.31 3. Given: PMT = $2000, n = 2(7) = 14, i = 6% 2 = 3% 6 I/Y 1 i n 1 FV PMT i 1.0314 1 = $2000 0.03 = $34,172.65 P/Y 2 ENTER (making C/Y = P/Y = 2) 14 N 0 PV 2000 + / – Ans: 34,172.65 5. Given: PMT = $175, n = 12( 8 41 ) = 99, i = 1 i n 1 FV PMT i 1.0035 99 1 = $175 0 . 0035 = $20,662.71 PMT CPT FV 4.2% 12 = 0.35% 4.2 I/Y P/Y 12 ENTER (making C/Y = P/Y = 12) 99 N 0 PV 175 + / – PMT CPT FV Ans: 20,662.71 300 Fundamentals of Business Mathematics in Canada, 2/e 7. Given: PMT = $160, n = 12(20) = 240, i = 7.5% 12 = 0.625% 1 i n 1 FV PMT i 240 1.00625 1 = $160 0.00625 = $88,596.92 7.5 I/Y P/Y 12 ENTER (making C/Y = P/Y = 12) 240 N 0 PV 160 + / – PMT CPT FV Ans: 88,596.92 Exercise 10.2 (continued) Intermediate Problems 9.a. Given: PMT = $2(30) = $60, n = 12(3) = 36, i = 2.52% 12 = 0.21% 1 i n 1 FV PMT i 36 1.0021 1 = $60 0.0021 = $2241.30 2.52 I/Y P/Y 12 ENTER (making C/Y = P/Y = 12) 36 N 0 PV 60 + / – PMT CPT FV Ans: 2,241.30 b. Over the course of the three years, you will have made 36 payments of $60. This represents a total investment of 36 x $60 = $2160 of principal. Therefore, you will have earned $2241.30 – $2160 = $81.30 of interest. 11. Given: n = 1(25) = 25, i = 51% = 5% a. PMT = $1000 1 i n 1 FV PMT i 1.05 25 1 = $1000 0.05 = $47,727.10 b. PMT = $2000 1 i n 1 FV PMT i 25 1.05 1 = $2000 0.05 Chapter 10: Annuities: Future Value and Present Value 5 I/Y P/Y 1 ENTER (making C/Y = P/Y = 1) 25 N 0 PV 1000 + / – PMT CPT FV Ans: 47,727.10 Same I/Y, C/Y, P/Y, N, PV 2000 + / – PMT CPT FV Ans: 95,454.20 301 = $95,454.20 c. PMT = $3000 1.05 25 1 = $3000 0.05 = $143,181.30 13. a. Given: PMT = $1000, i = 5% 1 Same I/Y, C/Y, P/Y, N, PV 3000 + / – PMT CPT FV Ans: 143,181.30 = 5%, n = 5 payments 1 i n 1 FV PMT i 5 1.05 1 = $1000 0.05 = $5525.63 5 I/Y P/Y 1 ENTER (making C/Y = P/Y = 1) 5 N 0 PV 1000 + / – PMT CPT FV Ans: 5525.63 Similarly, b. FV = $12,577.89 c. FV = $21,578.56 d. FV = $33,065.95 e. FV = $47,727.10 f. FV = $66,438.85 for n = 10 for n = 15 for n = 20 for n = 25 for n = 30 15. For the first 2 years, PMT = $1200, n = 2(4) = 8, i = 10% = 2.5%. 4 10 I/Y P/Y 4 ENTER (making C/Y = P/Y = 4) 8 N The future value after 2 years is 1 i n 1 FV PMT i 1.025 8 1 = $1200 0.025 = $10,483.339 For the next 3 years, n = 4(3) = 12, PV = $10,483.339, PMT = $1200, i = 0 PV 1200 + / – PMT CPT FV Ans: 10,483.339 9% 4 = 2.25% The combined future value of these amounts at the end of the 3 years is 1 i n 1 n FV PMT + PV 1 i i 1.0225 12 1 + $10,483.339 = $1200 0.0225 302 Same P/Y, C/Y, PMT 9 I/Y 12 N 10483.339 + / – PV CPT FV Ans: 30,014.43 Fundamentals of Business Mathematics in Canada, 2/e 1.0225 12 = $16,322.666 + $13,691.765 = $30,014.43 17. Given: PMT = $100, i = 6% 12 = 0.5% a. n = 12(40) = 480 1 i n 1 FV PMT i 480 1.005 1 = $100 0.005 = $199,149.07 6 I/Y P/Y 11 ENTER (making C/Y = P/Y = 12) 480 N 0 PV 100 + / – PMT CPT FV Ans: 199,149.07 b. n = 12(35) = 420 1 i n 1 FV PMT i 420 1.005 1 = $100 0.005 = $142,471.03 Same I/Y, C/Y, P/Y, PMT, PV 420 N CPT FV Ans: 142,471.03 c. By beginning the savings program at age 25 you will have a total of $199,149.07 – $142,471.03 = $56,678.04 more than if you had waited until age 30 to begin saving. $56,678.04 You will have × 100% = 39.78% more with the early savings plan. $142,471.03 Advanced Problems 19. At age 62, when she stops making contributions, Nina’s accumulated savings will be the combined future value of the $10,000 already saved and the monthly $150 contributions. That is, 4% n = 12(32) = 384, i = 5.12 = 0.45% 1 i n 1 n FV PV 1 i + PMT i 1.0045 384 1 384 = $10,000 1.0045 + $150 0.0045 = $56,076.045 + $153,586.817 = $209,662.862 5.4 I/Y P/Y 12 ENTER (making C/Y = P/Y = 12) 384 N 10000 + / – PV 150 + / – PMT CPT FV Ans: 209,662.862 (continued) Chapter 10: Annuities: Future Value and Present Value 303 Exercise 10.2 (continued) At age 62, Nina’s accumulated savings of $209,662.862 will accumulate interest at 5.4% compounded monthly for three years, until age 65. That is, 5.4 I/Y 4% n = 12(3) = 36, i = 5.12 = 0.45% P/Y 12 ENTER FV PV 1 i n = $209,662.862 1.0045 = $246,444.65 36 (making C/Y = P/Y = 12) 36 N 209662.862 + / – PV 0 PMT CPT FV Ans: 246,444.65 At age 65, Nina will have accumulated a total of $246,444.65. 6 I/Y 21. After 10 years, Marika's RRSP will be worth 1 i n 1 FV PV 1 i n + PMT i 1.03 20 1 20 = $18,000 1.03 + $2000 0 . 03 = $32,510.002 + $53,740.749 = $86,250.751 After a further 5 years, it will be worth 1.005 60 1 + $300 0.005 = $116,339.339 + $20,931.009 = $137,270.35 FV = $86,250.751 1.005 60 P/Y 2 ENTER (making C/Y = P/Y = 2) 20 N 18000 + / – PV 2000 + / – PMT CPT FV Ans: 86,250.751 Same I/Y P/Y 12 ENTER (making C/Y = P/Y = 12) 60 N 86250.751 + / – PV 300 + / – PMT CPT FV Ans: 137,270.35 Checkpoint Questions (Section 10.3) 1. A’s present value will be (i) double B’s present value. When we inspect the present value formula 1 1 i n PV PMT i we note that, for given values of i and n, the present value is proportional to PMT. Therefore, doubling the size of the payment will double the annuity’s present value. 3. G’s present value is (iii) less than double H’s present value. The later half of G’s payments will be discounted more heavily (and therefore contribute less to G’s present value) than the earlier half of G’s payments. 304 Fundamentals of Business Mathematics in Canada, 2/e Exercise 10.3 Basic Problems 1. Given: i = 10% 4 10 I/Y = 2.5%; PMT = $100, n = 4(5.5) = 22 P/Y 4 ENTER (making C/Y = P/Y = 4) 22 N 1 1 i n PV PMT i 1 1.025 22 = $100 0 . 025 = $1676.54 3. Given: i = 100 + / – PMT 0 FV CPT PV Ans: 1676.54 6% 4 = 1.5%; PMT = $2500, n = 4(25) = 100 1 1 i n PV PMT i 1 1.015 100 = $2500 0 . 015 = $129,061.76 5. Given: i = 6 I/Y P/Y 4 ENTER (making C/Y = P/Y = 4) 100 N 2500 PMT 0 FV CPT PV Ans: -129,061.76 9% 4 = 2.25%; PMT = $727.88, n = 4(7) = 28 1 1 i n PV PMT i 1 1.0225 28 = $727.88 0.0225 = $15,000.03 9 I/Y P/Y 4 ENTER (making C/Y = P/Y = 4) 28 N 727.88 + / – PMT 0 FV CPT PV Ans: 15,000.03 Rounded to the nearest dollar, the amount borrowed was $15,000. 7. Given: i = 8.75% 12 = 0.72916 %; PMT = $350, n = 12(11 1 1 i n PV PMT i 1 1.0072916 137 = $350 0.0072916 = $30,259.20 5 ) = 137 12 8.75 I/Y P/Y 12 ENTER (making C/Y = P/Y = 12) 137 N 350 PMT 0 FV CPT PV Ans: -30,259.20 Chapter 10: Annuities: Future Value and Present Value 305 Exercise 10.3 (continued) 9. Given: Term = 20 years; j = 4.8% compounded monthly; PMT = $1000 per month Therefore, i = 4.8% = 0.4% and n = 12(20) = 240 12 The amount required to purchase the annuity 4.8 I/Y is its present value. P/Y 12 ENTER (making C/Y = P/Y = 12) 1 1 i n 240 N PV PMT i 1000 PMT 0 FV 1 1.004 240 CPT PV = $1000 0.004 Ans: –154,093.30 = $154,093.30 Intermediate Problems 11. PMT = $1000 and i = 7% in all parts. a. For n = 5, 1 1 i n PV PMT i 1 1.07 5 = $1000 0.07 = $4100.20 Similarly, b. For n = 10 PV = $7023.58 c. For n = 20, PV = $10,594.01 d. For n = 30, PV = $12,409.04 e. For n = 100, PV = $14,269.25 f. For n = 1000, PV = $14,285.71 7 I/Y P/Y 1 ENTER (making C/Y = P/Y = 1) 5 N 1000 PMT 0 FV CPT PV Ans: –4,100.20 13. The economic value of the contract at the date of termination is the present value of the remaining payments. 5% = 0.625% Given: PMT = $90,000, n = 12(3) = 36, i = 7.12 1 1 i n PV PMT i 1 1.00625 36 = $90,000 0 . 00625 = $2,893,312.18 The settlement amount is $2,893,312.18. 306 7.5 I/Y P/Y 12 ENTER (making C/Y = P/Y = 12) 36 N 90000 PMT 0 FV CPT PV Ans: –2,893,312.18 Fundamentals of Business Mathematics in Canada, 2/e 15. i = 912% = 0.75% The three year service contract has PMT = $75 and n = 36. The current economic value of the three year contract is 9 I/Y 1 1 i n PV PMT P/Y 12 ENTER i (making C/Y = P/Y = 12) 36 N 1 1.0075 36 75 + / – PMT = $75 0 . 0075 0 FV = $2358.51 CPT PV Since the phone is “free” with the three year Ans: 2,358.51 contract, the total cost of the phone and three years’ worth of service is $2358.51. With the “no contract” provider, Marika will have PMT = $40 and n = 36 1 1 i n Same I/Y, P/Y, C/Y, N, FV PV PMT 40 + / – PMT i 0 FV 1 1.0075 36 CPT PV = $40 Ans: 1,257.87 0 . 0075 = $1257.87 In addition to the current economic value of the three years of service, Marika will also have to purchase the phone, so the total cost of the phone and three years’ worth of service is $639.99 + $1257.87 = $1897.86. In current dollars, it is $2358.51 – $1897.86 = $460.65 cheaper to buy the phone for $639.99 and choose the “no contract” provider. 17. The appropriate price to pay is the present value of the future payments discounted at the required rate of return. Hence, 1 1 i n n Price = PMT + FV 1 i i 1 1.0325 30 = $50 0.0325 = $1332.18 + $1000 1.0325 30 6.5 I/Y P/Y 2 ENTER (making C/Y = P/Y = 2) 30 N 50 PMT 1000 FV CPT PV Ans: –1,332.18 Chapter 10: Annuities: Future Value and Present Value 307 Exercise 10.3 (continued) 19. Given: Term = 25 years; j = 4.8% compounded monthly; PMT = $1000/month for the first 15 years and $1500/month for the next 10 years, The amount Isaac will pay is the present value of the annuity. The present value, 15 years from now, of 120 payments of $1500 is 4.8 I/Y 1 1.004 120 PV = $1500 P/Y 12 ENTER 0.004 (making C/Y = P/Y = 12) 120 N = $142,733.952 1500 PMT 0 FV CPT PV Ans: –142,733.95 The combined present value, today, of the preceding amount & 180 payments of $1000 is 1 1.004 180 $142,733.952 4.8 I/Y + $1000 PV = 0.004 1.004180 P/Y 12 ENTER = $69,575.924 + $128,137.046 = $197,712.97 (making C/Y = P/Y = 12) 180 N 1000 PMT 142,733.952 FV CPT PV Ans: –197,712.97 21. a. Original loan = Present value of all payments 1 1 i n Original loan = PMT i 1 1.019 40 = $808.15 0.019 = $22,500.06 b. Balance = Present value of the remaining 40 – 2(8.5) = 23 payments 1 1.019 23 = $808.15 0.019 = $14,945.45 308 3.8 I/Y P/Y 2 ENTER (making C/Y = P/Y = 2) 40 N 808.15 + / – PMT 0 FV CPT PV Ans: 22,500.06 Same I/Y, P/Y, C/Y, PMT, FV 23 N CPT PV Ans: 14,945.45 Fundamentals of Business Mathematics in Canada, 2/e Exercise 10.3 (continued) 23. Selling price = Down payment + Present value of the monthly payments PMT = $295.88, n = 12(3.5) = 42, i = 7.5% = 0.625% 12 1 1 i n PV of monthly payments = PMT i 1 1.00625 42 = $295.88 0.00625 = $10,899.99 7.5 I/Y P/Y 12 ENTER (making C/Y = P/Y = 12) 42 N 295.88 PMT 0 FV CPT PV Ans: –10,899.99 Thus, the selling price was $2000 + $10,899.99 = $12,899.99 25. Mrs. Chan is willing to pay $100,000 at the start and a total of 16 quarterly payments of $6250. The present value of the quarterly payments is 1 1 i n PV PMT i 1 1.0125 16 = $6250 0.0125 = $90,126.83 5 I/Y P/Y 4 ENTER (making C/Y = P/Y = 4) 16 N 6250 PMT 0 FV CPT PV Ans: -90,126.83 The total present value of Mrs. Chan’s offer is $100,000 + $90,126.83 = $190,126.83. Mr. Seebach’s offer is worth $195,000 – $190,126.83 = $4873.17 more in current dollars. Advanced Problems 27. Let PMT represent the normal monthly pension payment at age 60. The choice at age 55 is between: 7.5 I/Y (i) receiving 0.85PMT per month for 28 years, or P/Y 12 ENTER (ii) waiting 5 years and then receiving PMT (making C/Y = P/Y = 12) per month for 28 5 = 23 years. 336 N The economic values of the two alternatives are their 1 PMT present values at age 55. For option (i), 0 FV 1 1.00625 336 CPT PV PV = 0.85(PMT) 0 . 00625 Ans: -140.2785 × 0.85 =-119.24 = 119.24(PMT) Chapter 10: Annuities: Future Value and Present Value 309 For option (ii), the present value at age 60 of the12(23) = 276 monthly payments of PMT is 1 1 i n PV PMT i 1 1.00625 276 = PMT 0 . 00625 = 131.34(PMT) Same I/Y, P/Y, C/Y, FV 276 N 1 PMT CPT PV Ans: –131.34 Same I/Y, P/Y, C/Y 60 N 0 PMT The PV at age 55 of this amount is PV FV 1 i 131.34 FV n CPT PV Ans: –90.37 = 131.34(PMT) 1.00625 60 = 90.37(PMT) Hence, the pension-at-age-55 option has a 119.24( PMT ) 90.37( PMT ) 100% 90.37( PMT ) = 31.9% higher economic value 29. a. Given: For Annuity A, PMT = $100; i = 8%; n = 20 For Annuity B, PMT = $100; i = 8%; n = 40 PVB $1192.46 (i) = 1.21455 PV A $981.81 Therefore, PVB is 21.46% larger than PVA . FVB $25,905.65 (ii) = 5.6610 FV A $4576.20 Therefore, FVB is 466.10% larger than FVA . b. Given: For Annuity A, PMT = $100; n = 30; i = 8% For Annuity B, PMT = $100; n = 30; i = 9% PVB $1027.37 (i) = 0.9126 PV A $1125.78 Therefore, PVB is (1 – 0.9126)100% = 8.74% smaller than PVA . FVB $13,630.75 (ii) = 1.2032 FV A $11,328.32 Therefore, FVB is 20.32% larger than FVA . Checkpoint Questions (Section 10.4) 1. The payments are at the end of each payment interval (ordinary annuity) and the payment interval is not equal to the compounding interval (general annuity). 3. c Number of compoundings per year 2 = 0.16 12 Number of payments per year i2 is the interest rate per payment interval. In this case, it is the interest rate per month. It Nominal annual rate 6% will be approximately equal to = 0.5% per month. 12 12 310 Fundamentals of Business Mathematics in Canada, 2/e The correct value will be smaller than 0.5% because i2 compounded 6 times must equal i = 6% = 3% per half year. 2 Exercise 10.4 Basic Problems 1. i = 7% = 7%; 1 c Number of compoundings per year 1 = = 0.5 Number of payments per year 2 i2 1 i c 1 = 1.07 0 .5 3. i = – 1 = 0.03441 = 3.441% (per half year) Number of compoundings per year 5% 2 = 2.5%; c = = 0.16 Number of payments per year 2 12 i2 1 i c 1 = 1.0250.16 – 1 = 0.00412 = 0.412% (per month) 5. i = c 8% 2 = 4%; n = 1(27) = 27; Number of compoundings per year 2 = =2 Number of payments per year 1 i2 1 i c 1 = 1.04 – 1 = 0.0816 2 1 i n 1 a. FV PMT i 1.0816 27 1 = $1000 0.0816 = $89,630.08 1 1 i n b. PV PMT i 1 (1 0.0816) 27 = $1000 0.0816 = $10,780.86 Chapter 10: Annuities: Future Value and Present Value 8 I/Y P/Y 1 ENTER C/Y 2 ENTER 27 N 0 PV 1000 PMT CPT FV Ans: –89,630.08 (continued) Same I/Y, C/Y, P/Y, N, PMT 0 FV CPT PV Ans: –10,780.86 311 Intermediate Problems 7. i = Number of compoundings per year 4 4.5% = 1.125%; n = 1(10) = 10; c = =4 Number of payments per year 4 1 i2 1 i c 1 = 1.01125 4 – 1 = 0.045765086 1 i n 1 FV PMT i 4.5 I/Y P/Y 1 ENTER C/Y 4 ENTER 1.04576508610 1 = $3500 0.045765086 10 N 3500 + / – PMT 0 PV CPT FV Ans: 43,162.14 = $43,162.14 5.5% = 1.375%; n = 12(13) = 156; 4 Number of compoundings per year 4 c = = 0. 3 Number of payments per year 12 9. a. i = i2 1 i c 1 = 1.01375 0.3 – 1 = 0.004562485 1 i n 1 FV PMT i 5.5 I/Y P/Y 12 ENTER C/Y 4 ENTER 156 N 1.004562485 1 = $185 0.004562485 156 = $41,936.99 185 + / – PMT 0 PV CPT FV Ans: 41,936.99 b. Over 13 years, Larissa will have deposited a total of $185(156) = $28,860 of her own money. Since her investment has accumulated to $41,936.99 at the end of the 13 year period, Larissa has earned $41,936.99 – $28,860 = $13,076.99 of interest. 11. The amount required to purchase the annuity is the present value of the payments discounted at the rate of return on the annuity. PMT = $2500, n = 12(20) = 240, i = 6.75%, Number of compoundings per year 1 = = 0.08 3 c 12 Number of payments per year i2 1 i c 1 = = 1.0675 0.083 – 1 = 0.00545813044 1 1 i n PV PMT i 1 1.0054581304 4 240 = $2500 0 . 0054581304 4 = $333,998.96 312 6.75 I/Y P/Y 12 ENTER C/Y 1 ENTER 240 N 2500 PMT 0 FV CPT PV Ans: 333,998.96 Fundamentals of Business Mathematics in Canada, 2/e Exercise 10.4 (continued) 9 I/Y 13. a. i = 9% 2 = 4.5% ; n = 2(8) = 16; FV PV 1 i = 5000(1+.045)16 = $10,111.85 n P/Y 2 ENTER (making C/Y = P/Y = 2) 16 N 0 PMT 5000 + / – PV 9% = 4.5%; n = 1(8) = 8; 2 Number of compoundings per year 2 c = =2 Number of payments per year 1 b. i = i2 1 i c 1 = 1.045 – 1 = 0.092025 CPT FV Ans: 10,111.85 2 1 i n 1 FV PMT i 1.092025 1 = $900 0.092025 8 = $9,998.73 15. a. Selling price = Down payment + Present value of the monthly payments Given: PMT = $259.50; n = 12(3.5) = 42. 1 = 0.08 3 , and Then i = 7.5% = 7.5%, c = 12 1 i2 1 i c 1 = 1.0750.083 – 1 = 0.006044919 1 1 i n PV PMT i 1 1.006044919 42 = $259.50 0.006044919 = $9600.00 Thus, the selling price was $2000 + $9600.00 = $11,600.00. 9 I/Y P/Y 1 ENTER C/Y 2 ENTER 8 N 900 + / – PMT 0 PV CPT FV Ans: 9,998.73 7.5 I/Y P/Y 12 ENTER C/Y 1 ENTER 42 N 259.50 PMT 0 FV CPT PV Ans: –9600.00 b. Immediately after the 12th payment, there are 42 – 12 = 30 payments remaining outstanding on the loan. The loan balance is the PV of the remaining payments. 1 1 i n PV PMT i 1 1.006044919 30 = $259.50 0.006044919 = $7100.36 Chapter 10: Annuities: Future Value and Present Value Same I/Y, P/Y, C/Y, PMT, FV 30 N CPT PV Ans: –7100.36 313 Exercise 10.4 (continued) 17. The current balance is the present value of the remaining payments. Given: PMT = $1167.89/month, j = 6.6% compounded semiannually, and time remaining in the mortgage’s term = 4 years, 7 months 2 0.16 Then i = 3.3%, n = 12(4) + 7 = 55, and c = 12 i2 1 i 1 = 1.033 c 0.16 – 1 = 0.0054258653 6.6 I/Y P/Y 12 ENTER C/Y 2 ENTER 55 N 1 1.0054258653 55 Balance = $1167.89 0.00542586 532 = $55,406.95 1167.89 + / – PMT 0 FV CPT PV Ans: 55,406.95 19. The fair market value of the share is the combined present value of the 30 quarterly dividend payments of $1.63, and the $25 that will be paid in 7.5 years from now. For the 30 quarterly dividend payments, i= 5.5% 2 = 2.75%; PMT = $1.63; n = 30; c Number of compoundings per year = 0.5 Number of payments per year i2 1 i c 1 = 1.0275 – 1 = 0.013656747 The PV of the 30 quarterly dividend payments is 1 1 i n PV PMT i 1 1.013656747 30 = $1.63 0.013656747 = $39.901 For the final $25 payment, i = 5.52% = 2.75%; n = 15 0.5 PV FV 1 i = 25(1+.0275)-15 = $16.642 Hence, the fair market value of the share is $39.901 + $16.642 = $56.54. -n 314 5.5 I/Y P/Y 4 ENTER C/Y 2 ENTER 30 N 1.63 PMT 25 FV CPT PV Ans: – 56.54 Fundamentals of Business Mathematics in Canada, 2/e Advanced Problems 21. Cost to purchase the annuity = PV of all payments First calculate the PV, 15 years from now, of the last 10 years’ payments of PMT = $1500/month with 1 = 0.08 3 , n = 12(10) = 120, and j = 5%, m = 1, c = 12 i2 1 i 1 = 1.05 – 1 = 0.00407412378 1 1 i n 1 1.00407412378 120 PV PMT = $1500 0.00407412 378 i = $142,148.386 c 0.08 3 Next determine the combined PV of this amount and the first 15 years’ payments of PMT = $1000/month with the same i2 and n = 12(15) = 180. 1 1.00407412378 180 $142,148.386 PV = + $1000 0.00407412378 1.0515 = $68,375.804 + $127,385.158 = $195,760.96 5 I/Y P/Y 12 ENTER C/Y 1 ENTER 120 N 1500 PMT 0 FV CPT PV Ans: –142,148.386 Same I/Y, P/Y, C/Y 180 N 1000 PMT 142148.386 FV CPT PV Ans: –195,760.96 23. The $43.2 million figure is simply the sum of all the monthly payments over the 7 years. That is, 36($400,000) + 48($600,000) = $43,200,000 The current economic value of the deal is the present value of all the payments discounted at 4% compounded annually. The corresponding interest rate per payment interval is i2 1 i c 1 = 1.040.083 – 1 = 0.00327374 The present value, 3 years from now, of the last 48 payments is 1 1 i n PV PMT i 1 1.00327374 48 = $600,000 0 . 00327374 = $26,610,998.79 The present value today of the preceding amount and the first 36 payments is 1 1.00327374 36 $26,610,998.79 + $400,000 PV 0.00327374 1.04 3 = $37,219,997 The current economic value of the deal is $37,220,000, rounded to the nearest $1000. Chapter 10: Annuities: Future Value and Present Value 4 I/Y P/Y 12 ENTER C/Y 1 ENTER 48 N 600,000 PMT 0 FV CPT PV Ans: –26,610,998.79 Same I/Y, P/Y, C/Y 36 N 26,610,998.79 FV 400,000 PMT CPT PV Ans: –37,219,997 315 Checkpoint Questions (Section 10.5) 1. a. False. The focal date is at the end of the last payment interval. Since payments are at the beginning of each payment interval, the focal date is one payment interval after the final payment. b. True. The focal date is at the beginning of the first payment interval. Since payments are at the beginning of each payment interval, the focal date coincides with the first payment. c. False. The book value of long-term lease liability is equal to the PV of the remaining lease payments. Exercise 10.5 Basic Problems 1. a. Given: PMT = $100, n = 300, i = 6% 12 = 0.5% BGN mode 1 i n 1 FV (due) = PMT 1 + i i 300 1.005 1 = $100 (1.005) 0.005 = $69,645.89 6 I/Y P/Y 12 ENTER (making C/Y = P/Y = 12) 300 N 0 PV 100 + / – PMT CPT FV Ans: 69,645.89 b. If instead, i = 8% 12 = 0.6 % 1.00 6 300 1 1.00 6 FV (due) = $100 0.00 6 = $95,736.66 BGN mode 3. a. Given: PMT = $1000, n = 2(25) = 50, i = 1 1 i n PV (due) = PMT 1 + i i 1 1.015 50 (1.015) = $1000 0 . 015 = $35,524.68 Same P/Y, C/Y Same N, PV, PMT 8 I/Y CPT FV Ans: 95,736.66 3% 2 = 1.5% BGN mode 3 I/Y P/Y 2 ENTER (making C/Y = P/Y = 2) 50 N 1000 PMT 0 FV CPT PV Ans: –35,524.68 (continued) 316 Fundamentals of Business Mathematics in Canada, 2/e Exercise 10.5 (continued) BGN mode b. If instead, i = 4% 2 Same P/Y, C/Y, N Same PMT, FV 4 I/Y = 2% 1 1.02 50 (1.02) PV (due) = $1000 0.02 = $32,052.08 Intermediate Problems 5. a. Given: PMT = $2000, n = 38, i = 8% 1 CPT PV Ans: –32,052.08 = 8% 1 i n 1 FV (due) = PMT 1 + i i 1.08 38 1 (1.08) = $2000 0.08 = $475,882.44 b. If instead, i = 8% 4 =2% , c 4 1 = 4; and i2 1 i 1 = 1.02 – 1 = 0.082432160 c 4 1.082432160 38 1 1.082432160 FV (due) = $2000 0.082432160 = $506,532.59 7. Given: PMT = $2000 every 6 months. For the first 11 years, j = 8% compounded semiannually. We have a simple annuity due with n = 2(11) = 22, i = 4% 1 i n 1 FV (due) = PMT 1 + i i 1.04 22 1 (1.04) = $2000 0. 04 = $71,235.777 For the next 14 years, j = 7% compounded semiannually. We have a simple annuity due with n = 2(14) = 28, i = 3.5% The overall future value is 1.035 28 1 (1.035) $71,235.777( 1.035 28 ) + $2000 0.035 = $186,649.985 + $95,821.599 = $282,471.58 Giorgio’s RRSP is worth $282,471.58 today. Chapter 10: Annuities: Future Value and Present Value BGN mode 8 I/Y P/Y 1 ENTER (making C/Y = P/Y = 1) 38 N 0 PV 2000 + / – PMT CPT FV Ans: 475,882.44 BGN mode Same I/Y, P/Y, N, PMT, PV C/Y 4 ENTER CPT FV Ans: 506,532.59 BGN mode 8 I/Y P/Y 2 ENTER (making C/Y = P/Y = 2) 22 N 0 PV 2000 + / – PMT CPT FV Ans: 71,235.777 BGN mode Same C/Y, P/Y, PMT 7 I/Y 28 N 71235.777 + / – PV CPT FV Ans: 282,471.58 317 Exercise 10.5 (continued) 9. a. Given: PMT = $500, n = 4(6.5) = 26, i = Compoundin gs per year c= = Payments per year 1 4 7.6% 1 = 7.6%, = 0.25 i2 1 i c 1 = 1.076 0.25 – 1 = 0.0184813196 1.0184813196 1 (1.0184813196) FV (due) = $500 0.01848131 96 = $16,803.44 Amount in mutual fund will be $16,803.44. BGN mode 7.6 I/Y P/Y 4 ENTER C/Y 1 ENTER 26 N 26 0 PV 500 + / – PMT CPT FV Ans: 16,803.44 b. Earnings = $16,803.44 26($500) = $3803.44 11. 𝑗 Given: PMT = $75, n = 24, i = 𝑚 = 6% 12 = 0.5% 1 i n 1 FV (due) = PMT 1 + i i 1.005 24 1 (1.005) = $75 0.005 = $1916.93 BGN mode 6 I/Y P/Y 12 ENTER (making C/Y = P/Y = 12) 24 N 75 + / – PMT 0 PV CPT FV Ans: 1,916.93 Over the 24 months, you will have deposited a total of $75 x 24 = $1800 of principal. Therefore, you will have earned $1916.93 – $1800 = $116.93 of interest. 13. a. The initial long-term liability reported is the present value of all lease payments discounted at the interest rate the firm would pay to borrow money. The lease payments form a simple annuity due having PMT = $2100, n = 4(5) = 20, and i = 84% = 2% BGN mode 1 1 i n PV (due) = PMT 1 + i i 1 1.02 20 (1.02) = $2100 0.02 = $35,024.77 The initial lease liability will be $35,024.77. 8 I/Y P/Y 4 ENTER (making C/Y = P/Y = 4) 20 N 0 FV 2100 + / – PMT CPT PV Ans: 35,024.77 b. The liability remaining at the end of the 4th year will be the present value of the remaining 4 payments. That is, 1 1.02 4 BGN mode (1.02) Lease liability = $2100 Same I/Y, P/Y, C/Y, FV 0.02 Same PMT = $8156.15 4 N CPT PV Ans: 8,156.15 318 Fundamentals of Business Mathematics in Canada, 2/e Exercise 10.5 (continued) 15. The lease consists of 36 beginning of month payments of $575, as well as a payment of 0.20($20,000) = $4000 at the end of the 3 year period. The initial lease liability is the present value of all the payments, including the final lump sum payment, discounted at the cost of borrowing. The series of $575 payments form a general annuity due having PMT = $575, n = 12(3) = 36, and i = 84% = 2% c= Compoundings per year = Payments per year 4 12 = 0. 3 i2 1 i c 1 = 1.020.3 – 1 = 0.00662271 BGN mode 1 1.00662271 36 (1.00662271) PV of lease payments = $575 0 . 00662271 = $18,485.161 8 I/Y P/Y 12 ENTER C/Y 4 ENTER 36 N 575 + / – PMT For the lump sum, PV of the $4000 lump sum n = 4(3) = 12, and i = 84% = 2% 4000 + / – FV CPT PV PV= FV 1 i = $4000(1+0.02)-12 =$3153.973 n Ans: 21,639.13 Hence, the total lease liability is $18,485.161 + $3153.973 = $21,639.13. By buying rather than leasing, one will save $21,639.13 - $20,000 = $1639.13. 17. For the monthly payment option, PMT = $38.50, n = 12(5) = 60, i = 1 1 i n PV (due) = PMT 1 + i i 4.8 I/Y 1 1.004 (1.004) = $38.50 0.004 = $2058.28 For the annual payment option, PMT = $455, n = 5, i = 4.8% = 0.4%, 12 Compoundings per year 12 = 1 = 12 Payments per year = 0.4%, BGN mode 60 c= 4.8% 12 P/Y 12 ENTER (making C/Y = P/Y = 12) 60 N 38.50 + / – PMT 0 FV CPT PV Ans: 2058.28 and i2 1 i c 1 = 1.004 12 – 1 = 0.0490702075 1 1.049070208 5 (1.049070208) PV (due) = $455 0 . 049070208 = $2071.90 Rino will save $2071.90 $2058.28 = $13.62 by choosing the monthly payment option. BGN mode 4.8 I/Y P/Y 1 ENTER C/Y 12 ENTER 5 N 455 + / – PMT 0 FV CPT PV Ans: 2071.90 Chapter 10: Annuities: Future Value and Present Value 319 19. The current economic value of Rosie’s offer is the present value of her payments. The payments form a simple annuity due having PMT = $1900, n = 5, i = 2.5% 1 1 i n PV (due) = PMT 1 + i i 1 1.025 5 (1.025) = $1900 0.025 = $9047.75 Rosie Senario’s offer is worth $9047.75 – $8500 = $547.75 more in current dollars. 21. The amount of savings required is the present value of the withdrawals. Given: PMT = $40,000, n = 16, i = 6% 1 1 i n PV (due) = PMT 1 + i i 1 1.06 16 (1.06) = $40,000 0.06 = $428,489.96 Karsten must have $428,489.96 in savings at age 65. BGN mode 5 I/Y P/Y 2 ENTER (making C/Y = P/Y = 2) 5 N 1900 PMT 0 FV CPT PV Ans: –9,047.75 BGN mode 6 I/Y P/Y 1 ENTER (making C/Y = P/Y = 1) 16 N 40000 PMT 0 FV CPT PV Ans: –428,489.96 Advanced Problems 23. The amount in the RRSP will be the future value of all the contributions. 4% PMT = $2000, n = 10, i = = 1%, c = 4 Compoundings per year 4 = =4 Payments per year 1 i2 1 i 1 = 1.01 – 1 = 0.04060401 The amount in the RRSP after 10 years is 1 i n 1 FV (due) = PMT 1 + i i c 4 1.0406040110 1 (1.04060401) = $2000 0 . 04060401 = $25,057.31 BGN mode 4 I/Y P/Y 1 ENTER C/Y 4 ENTER 10 N 2000 + / – PMT 0 PV CPT FV Ans: 25,057.31 The amount after 25 years is the future value of $25,057.31 an additional 15 years later plus the future value of the last 15 years' contributions. That is, 320 Fundamentals of Business Mathematics in Canada, 2/e 1.0406040115 1 (1.04060401) + $25,057.31 1.0406040115 Amount = $4000 0 . 04060401 = $129,243.10 BGN mode Same I/Y, P/Y, C/Y 15 N 4000 + / – PMT 25,057.31 + / – PV CPT FV Ans: 129,243.10 25. Compare the present values of the alternative payment streams to determine the lower cost policy. Each payment stream forms an ordinary annuity due with i = 4.8% = 0.4%. 12 For the Sun Life option, PMT = $51.75/month, n = 120 1 1.004 120 (1.004) PV(due) = $51.75 0.004 = $4944.02 For the Atlantic Life option, PMT = $44.25/month for the first 5 years, and PMT = $60.35/month for the subsequent 5 years. The present value, 5 years from now, of the final 5 years’ payments is 1 1.004 60 (1.004) PV(due) = $60.35 0.004 = $3226.423 BGN mode 4.8 I/Y P/Y 12 ENTER (making C/Y = P/Y = 12) 120 N 51.75 PMT 0 FV CPT PV Ans: –4944.02 BGN mode Same I/Y, P/Y, C/Y Same FV 60 N 60.35 PMT CPT PV Ans: –3226.423 The present value today of all the premiums is 1 1.004 60 $3226.423 (1.004) + $44.25 0.004 1.004 60 = $4904.90 Bram will save $39.12 by choosing the Atlantic Life policy. BGN mode Same I/Y, P/Y Same C/Y, N 44.25 PMT 3226.423 FV CPT PV Ans: –4904.897 Chapter 10: Annuities: Future Value and Present Value 321 Review Problems Intermediate Problems 1. a. PMT = $1000, n = 2(20) = 40, i = 8.52% = 4.25% 1 i n 1 FV PMT i 1.0425 40 1 = $1000 0.0425 = $100,822.83 8.5 I/Y P/Y 2 ENTER (making C/Y = P/Y = 2) 40 N 0 PV 1000 + / – PMT Same I/Y, PV P/Y 1 ENTER (making C/Y = P/Y=1) 20 N b. PMT = $2000, n = 20, i = 8.5% 1.085 20 1 FV = $2000 0.085 = $96,754.03 CPT FV Ans: 100,822.83 2000 + / – PMT CPT FV Ans: 96,754.03 3. a. Initial liability = Present value of all lease payments With PMT = $1900, i = 8.25% = 0.6875%, n = 12(5) = 60 12 1 1.006875 60 Initial liability = $1900 0.006875 = $93,794.81 (1.006875) BGN mode 8.25 I/Y P/Y 12 ENTER (making C/Y = P/Y = 12) 60 N 1900 + / – PMT 0 FV CPT PV b. Liability after the first year = Present value of the remaining 48 payments 1 1.006875 48 (1.006875) = $1900 0.006875 = $77,987.28 The reduction in the liability during the first year will be $93,794.81 – $77,987.28 = $15,807.53 5. a. PMT = $1000, n = 12(12) = 144, i = 6% 12 BGN mode Same I/Y, P/Y, C/Y, PMT, FV 48 N CPT PV Ans: 77,987.28 = 0.5% 1 1 i n PV PMT i 1 1.005 144 = $1000 0 . 005 = $102,474.74 6 I/Y P/Y 12 ENTER (making C/Y = P/Y = 12) 144 N 1000 PMT 0 FV CPT PV (continued) 322 Ans: 93,794.81 Ans: -102,474.74 Fundamentals of Business Mathematics in Canada, 2/e Review Problems (continued) 5. b. PMT = $1000, n = 12(12) = 144, i = c= 6% 4 = 1.5% Compoundings per year 4 = = 0. 3 Payments per year 12 i2 1 i c 1 = 1.0150.3 – 1 = 0.004975206 1 1 i n PV PMT i P/Y 12 ENTER C/Y 4 ENTER 144 N 1000 PMT 1 1.004975206 144 = $1000 0.004975206 = $102,636.61 7. 6 I/Y PMT = $500, n = 12(20) = 240, i = 9% 12 0 FV CPT PV Ans: - 102,636.61 = 0.75% 1.0075 1 (1.0075) FV (due) = $500 0 . 0075 = $336,448.01 240 BGN mode 9 I/Y P/Y 12 ENTER (making C/Y = P/Y = 12) 240 N 500 + / – PMT 0 PV CPT FV Ans: 336,448.01 9. a. The value placed on half of the partnership is the present value of Dr. Wilson's payments discounted at 7% compounded semiannually. 7 Given: PMT = $714.60, n = 12(15) = 180, 7% 2 i= = 3.5%, c = i2 1 i 1 = 1.035 1 1 i n PV PMT i c 0.1 6 2 12 = 0.1 6 – 1 = 0.0057500395 1 1.0057500395 180 = $714.60 0 . 0057500395 = $80,000.05 The implied value of the partnership was 2($80,000) = $160,000. I/Y P/Y 12 ENTER C/Y 2 ENTER 180 N 714.60 + / – PMT 0 FV CPT PV Ans: 80,000.05 b. Total interest = 180($714.60) – $80,000 = $48,628. Chapter 10: Annuities: Future Value and Present Value 323 11. a. The original amount of the loan is the present value of all the payments. 1 1 i n Original loan = PMT i 1 1.007 180 = $587.33 0 . 007 = $59,999.80 b. Balance after 7½ years = Present value of the remaining payments 1 1.007 90 = $587.33 0.007 = $39,119.37 8.4 I/Y P/Y 12 ENTER (making C/Y = P/Y = 12) 180 N 587.33 + / – PMT 0 FV CPT PV Ans: 59,999.80 Same I/Y, P/Y, C/Y Same PMT, FV, 90 N CPT PV Ans: 39,119.37 13. a. The payments form an annuity due having PMT = $1000, n = 2(20) = 40, and i = 3.52% = 1.75% 1.0175 40 1 (1.0175) FV(due) = $1000 0.0175 = $58,235.73 b. With PMT = $2000, n = 20, and i = 3.5% 1.035 20 1 (1.035) FV(due) = $2000 0.035 = $58,538.94 BGN mode 3.5 I/Y P/Y 2 ENTER (making C/Y = P/Y = 2) 40 N 1000 + / – PMT 0 PV CPT FV Ans: 58,235.73 BGN mode 3.5 I/Y P/Y 1 ENTER (making C/Y = P/Y = 1) 20 N 2000 + / – PMT 0 PV CPT FV Ans: 58,538.94 324 Fundamentals of Business Mathematics in Canada, 2/e Review Problems (continued) 15. The payments form a general annuity due, having PMT = $50, n = 12(19) = 228, i = 84% = 2%, c 124 0. 3 , and i2 1 i 1 = 1.02 c 0. 3 – 1 = 0.00662271 1.00662271228 1 (1.00662271) FV(due) = $50 0.00662271 = $26,630.79 17. The payments represent a simple annuity due, with: PMT = $5000, n = 1(25) = 25, i = 61% =6%, 1 i n 1 FV (due) = PMT 1 + i i 1.06 25 1 (1.06) = $5000 0.06 = $290,781.91 19. Choose the payment plan with the lower economic value. For the monthly premiums, PMT = $33.71, n = 12, % and i = 3.75 = 0.3125% 12 1 1.003125 12 (1.003125) PV(due) = $33.71 0.003125 = $397.66 This is $397.66 – $387.50 = $10.16 more than the single payment falling on the focal date. Therefore, choose the single annual payment plan. BGN mode 8 I/Y P/Y 12 ENTER C/Y 4 ENTER 228 N 50 + / – PMT 0 PV CPT FV Ans: 26,630.79 BGN mode 6 I/Y P/Y 1 ENTER (making C/Y = P/Y = 1) 25 N 5000 + / – PMT 0 PV CPT FV Ans: 290,781.91 BGN mode 3.75 I/Y P/Y 12 ENTER (making C/Y = P/Y = 12) 12 N 33.71 + / – PMT 0 FV CPT PV Ans: 397.66 21. The fair market value of the contract is the combined present value of the 33 payments of $900 plus the present value of the final lump sum payment of $37,886. The 33 payments form an ordinary simple annuity with: .2% PMT = $900, n = 12(2.75) = 33, i = 712 = 0.6%, 1 1 i n n Fair market value = PMT + FV 1 i i 1 1.006 33 + $37,886 1.00633 = $900 0.006 = $26,871.697 + $31,098.926 = $57,970.62 Chapter 10: Annuities: Future Value and Present Value 7.2 I/Y P/Y 12 ENTER (making C/Y = P/Y = 12) 33 N 900 PMT 37886 FV CPT PV Ans: -57,970,62 325 Review Problems (continued) 23. The appropriate price to pay is the present value of the payments discounted at the required rate of return. The present value, 5 years from now, of the last 7 years' payments is 1 1 i n PV PMT i 1 1.0175 28 = $1500 0.0175 = $32,980.432 Today's present value of this amount and the first 5 years' payments is 1 1.015 20 20 $32,980.432 1.015 + $1500 0.015 7 I/Y P/Y 4 ENTER (making C/Y = P/Y = 4) 28 N 1500 PMT 0 FV CPT PV Ans: 32,980.432 Same P/Y, C/Y, PMT 20 N = $24,486.995 + $25,752.958 = $50,239.95 6 I/Y 32980.432 FV CPT PV Ans: 50,239.95 The appropriate price to pay is $50,239.95. 25. The amount required to purchase the annuities is the present value, on the purchase date, of all payments. Step 1: Calculate the present value, 5 years from now, of the $2500-payment annuity. The $2500 payments form a general annuity due having 4 = 0. 3 , and PMT = $2500, n = 12(15) = 180, i = 3.64% = 0.9%, c = 12 i2 1 i 1 = 1.009 – 1 = 0.002991045 c 0.3 1 1.002991045 180 (1.002991045) PV(due) = $2500 0.002991045 = $348,612.482 Step 2: Calculate today's present value of the amount from Step 1 and the $4000-payment annuity. The $4000 payments form an ordinary simple annuity having PMT = $4000, n = 4(5) = 20, i = 0.9% 1 1.009 20 $348,612.482 PV(Today) = + $4000 0.009 1.009 20 = $291,420.1706 + $72,914.2138 BGN mode 3.6 I/Y P/Y 12 ENTER C/Y 4 ENTER 180 N 2500 PMT 0 FV CPT PV Ans: -348,612.482 END mode Same I/Y P/Y 4 ENTER (making C/Y = P/Y = 4) 20 N 4000 PMT 348612.482 FV CPT PV = $364,334.38 Ans: 364,334.38 The amount required to purchase the annuity is $364,334.38. 326 Fundamentals of Business Mathematics in Canada, 2/e 27. The amount is the RRSP will be the future value of all payments. For the past 7 years, PMT = $3000, n = 2(7) = 14, i = 9% = 4.5% 2 The amount currently in Charlene's RRSP is 1 i n 1 FV PMT i 1.045 14 1 = $3000 0.045 = $56,796.328 9 I/Y P/Y 2 ENTER (making C/Y = P/Y = 2) 14 N 0 PV 3000 + / – PMT CPT FV Ans: 56,796.328 For the next 5 years, PMT = $2000, n = 4(5) = 20, i = 7.54% = 1.875% The amount in the RRSP 5 years from now will be 1.01875 20 1 $56,796.328 1.01875 20 + $2000 0.01875 7.5 I/Y P/Y 4 ENTER (making C/Y = P/Y = 4) 20 N 56,796.328 + / – PV 2000 + / – PMT CPT FV = $130,346.18 Ans: 130,346.18 Advanced Problems 29. The amount (future value) in Dr. Krawchuk’s RRSP when he left general practice was 1 i n 1 FV PMT i 1.0125 24 1 = $2000 0.0125 = $55,576.168 After an additional 2.5 years with no further contributions, this amount grew to FV PV 1 i n 5 I/Y P/Y 4 ENTER (making C/Y = P/Y = 4) 24 N 0 PV 2000 + / – PMT CPT FV Ans: 55,576.168 Same I/Y, P/Y, C/Y 10 N 55576.168 + / – PV 0 PMT = $55,576.168 1.0125 = $62,927.27 10 Chapter 10: Annuities: Future Value and Present Value CPT FV Ans: 62,927.27 327 31. Amount in the RRSP = Future value of all contributions. For the first 15 years' contributions, PMT = $2500, n = 2(15) = 30, i = 8% 4 = 2%, c = i2 1 i c 1 = 1.02 – 1 = 0.0404 The amount in the RRSP after 15 years will be 1 i n 1 FV (due) = PMT 1 + i i 4 =2 2 2 BGN mode 8 I/Y P/Y 2 ENTER C/Y 4 ENTER 1.0404 30 1 (1.0404) = $2500 0.0404 = $146,855.472 30 N 2500 + / – PMT 0 PV CPT FV Ans: 146,855.472 For the subsequent 10 years' contributions, PMT = $3000, n = 2(10) = 20, i = 2%, c = i2 1 i c 1 = 1.02 – 1 = 0.0404 4 =2 2 2 The future value, 25 years from now, of all the payments will be 1.0404 20 1 20 1 + 0.0404 $146,855.472 1.0404 + $3000 0.0404 = $324,262.707 + $93,330.035 = $417,592.74 BGN mode Same I/Y, P/Y, C/Y 20 N 146,855.472 + / – PV 3000 + / – PMT CPT FV Ans: 417,592.74 33. The current economic value of the award is the present value, on the date of the award, of all payments. Step 1: Calculate the present value, 5 years from now, of the $1000-payment annuity. The $1000 payments form an ordinary simple annuity with PMT = $1000, n = 12(10) = 120, i = 612% = 0.5%, 6 I/Y 1 1 i n P/Y 12 ENTER PV PMT (making C/Y = P/Y = 12) i 120 N 1 1.005 120 = $1000 0.005 = $90,073.453 Step 2: Calculate today's present value of the amount from Step 1 and the $800-payment annuity. The $800 payments form an ordinary simple annuity having PMT = $800, n = 12(5) = 60, i = 0.5% The combined present value of the amount from Step 1 and the $800-payment annuity is: 1 1.005 60 60 $90,073.453 1.005 + $800 0.005 = $66,777.954 + $41,380.449 328 1000 PMT 0 FV CPT PV Ans: -90,073.453 Same I/Y, P/Y, C/Y 60 N 800 PMT 90073.453 FV CPT PV Ans: -108,158.40 Fundamentals of Business Mathematics in Canada, 2/e = $108,158.40 The current economic value of the court award is $108,158.40. 35. The total amount in the RRSP after 30 years will be the future value of all contributions. The future value, 10 years from now, of the $4000 contributions will be 1.0825 10 1 BGN mode (1.0825) FV(due) = $4000 0.0825 8.25 I/Y P/Y 1 ENTER = $63,476.431 (making C/Y = P/Y = 1) 10 N 0 PV 4000 + / – PMT CPT FV Ans: 63,476.431 The future value, 30 years from now (an additional n = 20 years), of this amount and the $6000 contributions will be 1.0825 20 1 (1.0825) $63,476.431 1.082520 + 6000 0.0825 = $615,447.79 BGN mode Same I/Y, P/Y, C/Y 20 N 63,476.431 + / – PV 6000 + / – PMT CPT FV Ans: 615,447.79 Chapter 10: Annuities: Future Value and Present Value 329