- UVic LSS

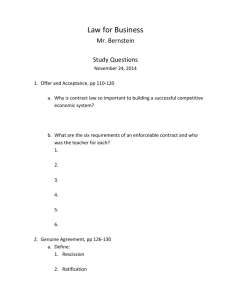

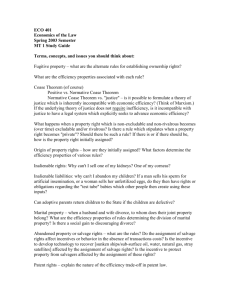

advertisement