wounds pharmaceutical

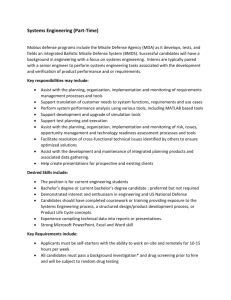

advertisement

Soaring cost of military drugs could hurt budget http://www.statesman.com/news/news/national-govt-politics/the-soaring-cost-of-militarydrugs/nThwF/ By Jeremy Schwartz American-Statesman, Last year, the Pentagon spent more on pills, injections and vaccines than it did on Black Hawk helicopters, Abrams tanks, Hercules C-130 cargo planes and Patriot missiles — combined. Some of the prescription drugs that have fueled the military’s skyrocketing pharmaceutical budget are the same ones that have medicated the civilian world over the past decade. Since 2002, the Department of Defense has spent more than $5 billion on Lipitor, Plavix, Advair, Nexium and Singulair. Rather than a reflection of the drugs needed to treat wounded troops, the top-selling prescriptions signal an increase in aging military retirees covered by the military’s health program, Tricare, with drugs for arthritis, osteoporosis and diabetes costing billions. The Department of Defense also spent more than $380 million on erectile dysfunction drugs and $238 million on testosterone therapy drugs over the decade. But the military drug purchases also paint a picture of a fighting force increasingly reliant on antidepressants, psychotropic drugs and powerful narcotic painkillers that critics call dangerous and that have been involved in a growing number of prescription drug overdoses. The military spent at least $2.7 billion on antidepressants and more than $1.6 billion on opioid painkillers such as Oxycontin and hydrocodone over the past decade. More than $507 million was spent on the sleeping pill Ambien and its generic equivalents. The details come from an unprecedented American-Statesman analysis of nearly every individual drug purchase made by the Department of Defense since 2002. The paper’s analysis also showed that many drug manufacturers saw their revenue from military sales soar over a decade that featured two wars and a large influx of beneficiaries covered by Tricare, the military’s health program. They were led by giant Pfizer, with more than $8 billion in sales from the Department of Defense since 2002. Abbott’s sales jumped nearly 300 percent and Novartis more than doubled its military sales to around $400 million in 2011, according to data provided by the military. In one sense, the drug analysis is but another reminder of skyrocketing health care costs. Veterans groups say paying for the health needs of America’s fighting force and retirees is a cost of war and part of the nation’s moral debt to its troops. Yet experts say that the rapidly rising cost of health care for active and retired service members — the overall military health budget has nearly doubled since 2002 — could imperil the nation’s safety by potentially siphoning off money that needs to be spent for training and weapon systems. High-priced specialty drugs, in particular, will continue to drive military drug spending, predicted Jim Wilson, a University of Texas College of Pharmacy professor and former head of the Army’s pharmacy programs. “They will just eat your budget alive,” Wilson said. Department of Defense drug spending has ballooned by more than 123 percent since 2002, from $3 billion to $6.8 billion in 2011, according to Tricare officials. That outpaces by nearly double the overall pharmaceutical sales in the United States, which grew about 67 percent over that time,according to annual reports from IMS Health, which tracks sales for drug companies. “If we don’t address it soon, it may harm our national security in the long run,” the centrist think tank Third Way wrote in a February report about ballooning defense health budgets. “It will also impact operational effectiveness and threaten health care benefits for active duty troops and their families.” Retirees driving costs Although the military’s prescription drug costs skyrocketed as U.S. troops fought simultaneous conflicts in Iraq and Afghanistan, the wars played only a small role in the increase. Active-duty troops account for only about 10 percent of prescriptions filled under Tricare. Rather, experts say what has driven higher prescription drug budgets has been the surge in retirees — those who serve at least 20 years — who are receiving military prescription drug benefits and the increased use of retail pharmacies, where drugs are significantly more expensive than on military installations. But before the paper’s analysis, identifying which companies have benefited most from the skyrocketing drug spending, and which drugs are driving that growth, has been difficult. Sales records are kept by two different agencies within the Defense Department. The Defense Logistics Agency, the central purchaser for the military, oversees pharmaceutical purchases from wholesalers who act as middlemen between manufacturers and military hospitals and clinics. (Those largely unknown distributors are ranked higher on the Fortune 500 list of largest companies than even the world’s largest drug makers.) Meanwhile the Defense Department’s Tricare Management Activity — which oversees the military’s health program — pays for drugs bought through the mail and at retail pharmacies, the latter representing by far the greatest cost within the military’s prescription drug benefit. The Statesman analyzed drug purchases by the two agencies over the past decade, reviewing almost 500,000 purchases through retail and military pharmacies. The analysis did not include mailorder drugs, which represent around 15 percent of total military prescription drug spending. For many companies, military sales outpaced their overall growth over the past decade. In determining sales numbers, the Statesman took into account the mergers and acquisitions that were common throughout the drug industry over the past 10 years and assigned sales numbers to companies as they are currently structured. Military sales add credibility Military sales represent only about 2 percent of overall U.S. pharmaceutical revenue. Yet experts say selling drugs to the Department of Defense can be more valuable to manufacturers than simple market share. Drug companies strive to get on the department’s formulary — a list of preferred medications that are largely available in every military hospital and pharmacy. Marv Shepherd, director of UT’s pharmacoeconomic program, said persuading military doctors to prescribe certain drugs can translate into long-term prescribing patterns when doctors leave the military and enter the civilian medical world. Military approval can also help drugmakers market their product to civilian hospitals and emergency rooms, said San Antonio-based military attorney Dan Hargrove, who has represented whistleblowers in military prescription fraud cases. “If the Army adopted a drug, that gave it credibility,” he said. “Other (medical providers) believed it must have been good if the Army was using it on soldiers.” Hargrove said that was the case with Novo Nordisk, a Danish drugmaker that convinced Army doctors to use its expensive NovoSeven drug to treat battlefield trauma, even though it had been approved by the FDA only to treat bleeding episodes in patients with hemophilia. In a 2011 whistleblower lawsuit that resulted in a $25 million settlement with the company, the government claimed Novo Nordisk provided funding for research trials and plied military doctors with donations and gifts in its successful effort to persuade Army doctors to employ the drug, which can cost $10,000 per dose, for the off-label use. Such marketing efforts aren’t that unusual. According to the Center for Public Integrity, between 1998 and 2007, the pharmaceutical industry spent about $1.7 million for more than 1,400 trips for Defense Department doctors and pharmacists to places such as Paris, Las Vegas and New Orleans. Novo Nordisk did not admit wrongdoing. Yet studies have shown the drug doesn’t help traumatic bleeding and can cause potentially deadly blood clots. The Baltimore Sun reported that two soldiers died of clot-related complications after receiving the drug in Baghdad. Despite the setback, the company’s military sales were at least $475 million between 2002 and 2011. They grew from $11 million in 2002 to $102 million a decade later, according to the analysis. NovoSeven accounted for about 7 percent of the company’s military sales over that time. Sales of NovoSeven were even higher outside the military. In 2010, the company reported the drug had worldwide sales of nearly $1.6 billion — as much as $250 million of which came from so-called off-label uses similar to the military’s, according to the Sun. NovoSeven wasn’t the only highly profitable drug that was used by the military for off-label purposes. Seroquel, also known as quetiapine fumarate, a powerful anti-psychotic approved for schizophrenia and bipolar disorder, was prescribed throughout the past decade to troops suffering from insomnia and post-traumatic stress disorder. In 2010, the drug’s maker, AstraZeneca, without admitting wrongdoing, agreed to pay $520 million to settle a lawsuit brought by the federal government for illegally marketing the drug for anxiety, PTSD and sleeplessness. In March, Seroquel was finally taken off the U.S. Central Command formulary; military doctors must now request a waiver to prescribe the drug. Before its removal, however, AstraZeneca sold at least $340 million worth of Seroquel to the Department of Defense, the paper’s analysis showed. The company’s military sales at retail and military pharmacies increased from about $200 million in 2002 to $380 million in 2011. Seroquel made up about 11 percent of the company’s total military sales over the decade, according to the analysis. Narcotic painkiller manufacturers selling to the military also enjoyed robust sales growth over the past decade. According to the analysis, the military purchased at least $1.6 billion of opioid painkillers between 2002 and 2011. While medical experts acknowledge that the powerful painkillers play a crucial role in treating wounded and aging members of the military, a September Statesman investigation also found that Texas veterans of the Iraq and Afghanistan conflicts were dying of opioid overdoses at an even greater rate than suicides. Three opioid manufacturers being investigated by a Senate committee after being accused of promoting misleading information about their drugs’ safety — Endo Laboratories, Purdue Pharmaceuticals and Johnson & Johnson — saw combined sales of $135 million in 2002. By 2011, annual military sales for the three companies, which also manufacture drugs other than opioid painkillers, had jumped to $259 million. Drug benefits expanded Though off-label prescriptions for war wounds that were eventually determined to be of dubious benefit cost the military millions, the current defense health budget crisis dates from a year before terrorists struck the Twin Towers. That’s when Congress passed Tricare for life, giving military retirees over 65 with at least 20 years of service access to generous lifetime military drug benefits. (Those who leave the military before 20 years are served by the Department of Veterans Affairs, a separate entity.) Previously, retirees were funneled into Medicare, which covers less for drugs. Retirees argued that post-Cold War base closures meant it had become increasingly difficult to get free, on-base health care, which they received on a space available basis. Veterans complained that the U.S. government had broken recruitment pledges to provide free or reduced-price medical care for life. Beyond dramatically expanding the number of beneficiaries, the new program also allowed them to fill their prescriptions at retail pharmacies, where drugs are vastly more expensive to the government than in military hospitals or through the mail. The impact of Tricare for Life was immediate. By 2004, Tricare pharmacy costs had more than doubled, to $4.75 billion. Though lawmakers knew the program would dramatically increase military health costs, critics say they didn’t do enough to ensure funding to pay for it. Congress continued to expand military pharmacy benefits in subsequent years, giving National Guard and Reserve troops and retirees access to Tricare prices. In 2008, the Defense Business Board estimated that all the new benefits since 2001 had increased defense health costs 42 percent. In recent years, the Pentagon has taken a number of steps to rein in pharmaceutical spending, including overhauling its formulary system and requiring higher copays for expensive drugs. In 2010, military officials embarked on a large-scale marketing effort to persuade troops and retirees to use mail-order pharmaceuticals in place of more expensive retail pharmacies. They have also sought to recoup rebates from manufacturers for drugs sold through retail pharmacies, though manufacturers have fought the effort in court. Earlier this year, the White House proposed another series of increased copays, enrollment fees and higher premiums, particularly for the growing number of retirees covered by Tricare. However, the measures were largely rejected by the U.S. House and Senate when they passed the Defense Authorization Act earlier this year. The White House has threatened to veto the bill. Still, analysts say that without meaningful action, the climbing cost of caring for the nation’s fighting forces will soon exact a high price. “It’s a national security concern,” said Mieke Eoyang, director of the national security program for Third Way. “It’s something we have to come to grips with as a nation.” UNPRECEDENTED ANALYSIS For this story, the American-Statesman conducted an unprecedented analysis of nearly every individual drug purchase made by the Department of Defense since 2002 , reviewing almost 500,000 purchases through retail and military pharmacies. Data Editor Christian McDonald and reporter Jeremy Schwartz previously teamed up to analyze crime numbers along the Texas-Mexico border and poverty among elderly residents in Central Texas and were part of the Statesman investigative team that determined causes of death for Texas veterans of Iraq and Afghanistan as part of the Uncounted Casualties series that ran Sept. 30-Oct. 2. DETAILS BEHIND THE DATA This report is based on data from several sources. The Defense Logistics Agency provided sales data by drug manufacturer from 2002 to 2011; transactions representing a tiny fraction of total sales lacked manufacturer or drug name data. Tricare Management Activity provided 10 years of sales data from retail pharmacies by drug and manufacturer, figures representing money paid to pharmacies and not directly to manufacturers. Sales totals reflect companies as they are currently constituted, taking into account mergers and acquisitions that occurred over the decade. IMS Health, a health care market research firm, provided overall U.S. pharmaceutical sales data. Military drug sales increase CLOSE