Utility Models

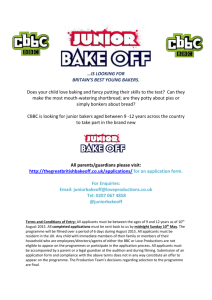

advertisement