Membership Application - Friends of Kent Churches

advertisement

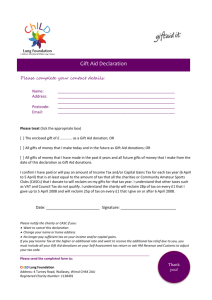

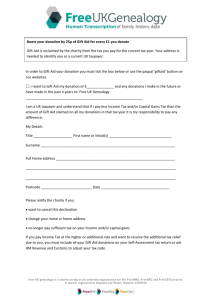

APPLICATION FOR FKC MEMBERSHIP To: Friends of Kent Churches, Membership Secretary Sue Platts, Cornerways, Sandyhurst Lane, Ashford TN25 4PF (plattsplace@hotmail.co.uk) I wish to become a Life Member and enclose a cheque for £200 I/We wish to join FKC and will pay an annual subscription of □ £ 10 (individual/churches/PCC/Historical Societies) □ £ 15 (two people at the same address) □ £ 50 (corporation) for which I/we enclose a cheque/banker’s order payable to Friends of Kent Churches or I/we have set up a Banker’s Order directly with my/our Bank I enclose a donation for Friends of Kent Churches of £ ………………….. Name …………………………………………………………………………………………………………………………. Address………………………………………………………………………………………………………………………… ……………………………………………………..………………………………. Post code …………………………… email …………………………………………………………………………….. Date …………………………………. Banker’s Order Form To: ………………………………………………………………………………………..Bank (name of bank) of: …………………………………………………………………………………………………. ………. (address) ………………………………………………………………………………………… Postcode ……………………. Please pay the sum of £……………………… to Nat West Bank, 3 High St, Maidstone ME14 1XU (sort code 60-60-08) for the credit of Friends of Kent Churches, Account No 00025607 on receipt of this form/on .......................................................... (date) (delete as appropriate) and on the same date each year debiting my account accordingly until I give you further notice in writing. This Order replaces all previous ones, if any, in favour of Friends of Kent Churches. Name ……………………………………………………………………………………………….. Account No …………………………………… Bank Sort Code …………………………. Signature …………………………………………………………….. Date ……………………… PLEASE HELP US BY COMPLETING THE GIFT AID FORM OVERLEAF Declarations by taxpayers can be used by the Friends to recover tax on your donation. GIFT AID DECLARATION FOR PAST, PRESENT AND FUTURE DONATIONS Friends of Kent Churches Charity No. 207021 Please treat as Gift Aid donations all qualifying gifts of money made □ today □ in the past 4 years □ in the future Please tick all boxes you wish to apply. I confirm I have paid or will pay an amount of Income Tax and/or Capital Gains Tax for each tax year (6 April to 5 April) that is at least equal to the amount of tax that all the charities or Community Amateur Sports Clubs (CASCs) that I donate to will reclaim on my gifts for that tax year. I understand that other taxes such as VAT and Council Tax do not qualify. I understand the charity will reclaim 28p of tax on every £1 that I gave up to 5 April 2008 and will reclaim 25p of tax on every £1 that I give on or after 6 April 2008. Donor’s details Title ------------- First name ------------------------------------------------------------------------------------Surname -------------------------------------------------------------------------------------------------------------Full home address --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------Postcode ---------------------------------Date -----------------------------------------------------------------------Signature ---------------------------------------------------------------Please notify the charity or CASC if you: □ Want to cancel this declaration □ Change your name or home address □ No longer pay sufficient tax on your income and/or capital gains. If you pay Income Tax at the higher or additional rate and want to receive the additional tax relief due to you, you must include all your Gift Aid donations on your Self Assessment tax return or ask HM Revenue and Customs to adjust your tax code.