SCORP Companion Report E

advertisement

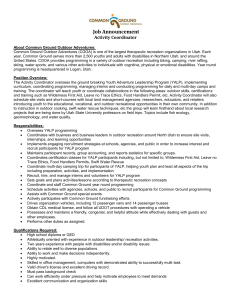

COMPANION REPORT E OUTDOOR RECREATION IN NEW MEXICO ECONOMIC CONTRIBUTIONS NEW MEXICO STATEWIDE COMPREHENSIVE OUTDOOR RECREATION PLAN AUGUST 2015 THIS PAGE INTENTIONALLY LEFT BLANK CONTENTS OUTDOOR RECREATION | ECONOMIC CONTRIBUTIONS 1 Introduction 1 Direct Spending Impact of Events 1 Visitors from Neighboring States 2 Visitors from Neighboring States Who Participate in Outdoor Recreation 2 Spending by Visitors from Neighboring States Who Participate in Outdoor Recreation and Attend Outdoor Events 2 Estimating Up To Include All Out-of-State Visitors 3 Spending by Recreation Activities 3 FIGURES AND TABLES LIST OF FIGURES Figure E-1. Total Vistor Spending, by Visitors’ Most Recent Recreation Activities 4 OUTDOOR RECREATION | ECONOMIC CONTRIBUTIONS INTRODUCTION According to a study conducted by the Outdoor Industry Association, outdoor recreation generates $6.1 billion in direct consumer spending in New Mexico, directly supporting 68,000 New Mexico jobs, providing $1.7 billion in wages and salaries, and contributing $458 million in state and local tax revenue.1 These estimates are based on trip-related spending and equipment spending on human-powered and motorized recreation, both from state residents and out-of-state visitors, but exclude attendance at special events. These economic contributions, which represent only direct expenditures, not “ripple effects,” rank New Mexico 38th among all states. On a per capita basis, however, outdoor recreation has a larger impact in New Mexico than in many other states. Outdoor recreation spending contributes $2.91 per New Mexico resident, which ranks 21st among the 50 states (Utah ranked 9th, Colorado ranked 22nd, and Arizona ranked 44th). Based on the above study, the total economic impact of outdoor recreation in New Mexico results in $8.1 billion in total economic output, 95,000 jobs, $2.6 billion in wages and salaries, and 853 million in state and local tax revenue.2 These total economic output figures rank New Mexico 40th among all states, but 20th on a per capita basis (Utah ranked 5th, Colorado ranked 23rd, and Arizona ranked 41st). DIRECT SPENDING IMPACT OF EVENTS Travel is one element of economic impact, as measured by the spending of out-of-state visitors. As a subset of travel, the following analysis examines the direct spending impact of outdoor events. This analysis examines direct expenditures (i.e., the direct infusion of dollars into the state) by out-of-state travelers who attend outdoor events, but it excludes recirculation effects. Based on available data and data created as part of this study, the following graphical concept displays the logic by which the impact of events is measured: 100% 72% 30% 1 Overnight Visitors from Neighboring States Overnight Visitors from Neighboring States Who Participate in Outdoor Recreation Overnight Visitors from Neighboring States Who Participate in Outdoor Recreation and Attended an Outdoor Event Outdoor Recreation Association. 2013. The Economic Contributions of Outdoor Recreation: Technical Report on Methods and Findings. Prepared by Southwick Associates. 2 Total economic impact accounts for ripple effects of direct impact, which are the sum of direct effects that discount direct spending, indirect effects that amplify spending, and induced effects on related industries. E-2 | OUTDOOR RECREATION: ECONOMIC CONTRIBUTIONS One challenge in estimating direct spending by visitors is that data for the two population subsets above is based on visitors from neighboring states rather than on visitors from all states in the United States.3 The analysis below examines only economic impacts of visitors from neighboring states who attended outdoor events and then develops an estimate upward to account for those who attend from other states at the end of the analysis. Visitors from Neighboring States According to the New Mexico Tourism Department, there are about 14,600,000 overnight visitors in New Mexico annually, of which 70 percent (10,220,000) are primary visitors. About 40.2 percent of these primary visitors come from the neighboring states of Texas (Longwoods estimate of 16.2%), Colorado (Longwoods estimate of 7.0%), Arizona (Longwoods estimate of 7.0%), Utah (Corona Insights estimate of 5.0%), and Oklahoma (Corona Insights estimate of 5.0%).4 Therefore, there are approximately 4,108,000 overnight primary visitors from neighboring states annually. Visitors from Neighboring States Who Participate in Outdoor Recreation According to the Corona Insights out-of-state visitor panel, 72 percent of overnight visitors from neighboring states participated in outdoor recreation during a visit within the past 3 years.5 Therefore, about 2,958,000 out-of-state visitors from neighboring states participate in outdoor recreation annually. Spending by Visitors from Neighboring States Who Participate in Outdoor Recreation and Attend Outdoor Events Total Spending on Most Recent Trip of Visitors Who Attended an Outdoor Event The panel results suggest that approximately 42 percent of out-ofstate visitors who participated in outdoor recreation also participated in or attended an outdoor recreation event during their most recent trip, equating to about 1,242,400 out-of-state visitors from neighboring states at outdoor recreation events annually.6 These event-going visitors spent, on average, $1,130 on their most recent overnight visit, and half of them spent $800 or more. 3 The research targeted only visitors from neighboring states because their incidence within the population of those states was high enough that they could be surveyed efficiently. Lower incidence rates of visitation from more distant states meant that research among those groups was not cost-effective within the project budget for the Statewide Comprehensive Recreation Plan update. 4 Estimates based on Longwoods International 2012 and 2013 TravelUSA datasets. Primary visitors spent at least one night and most of their trip in New Mexico. 5 The New Mexico Tourism 2013 Annual Report estimated that 53 percent of visitors participated in outdoor recreation in 2012. The definition of “outdoor recreation” in this report was much narrower than the definition in the out-of-state panel, and the annual report counted all visitors, including in-state visitors, rather than visitors from neighboring states only. 6 This estimate includes 36 percent who were sure they had participated in an outdoor recreation event, plus half of the 12 percent who were unsure if they did or not. OUTDOOR RECREATION: ECONOMIC CONTRIBUTIONS | E-3 However, not all who attended a special event spent that money because of the event. Indeed, 45 percent of event attendees traveled to New Mexico primarily for the event, but the event was a secondary reason for 44 percent, and another 11 percent traveled for a reason not related to the event they attended. Therefore, the event did not produce the entire impact of the spending above. For those who indicated that attending the event was a secondary reason or not a reason for their trip, we discounted their in-state spending to only the proportion of their nights spent in New Mexico specifically for the event out of all nights spent. Applying this across all visitors, we estimated that those who attended an event spent $900 because of the event, even if they spent more in the state during their visit. Spending on Most Recent Trip Due to an Outdoor Event To estimate total spending, the above analyses estimate that 1,242,400 annual event-goers from neighboring states attend outdoor events in New Mexico and that they spend an average of $900 per group. Using an average of 2.9 people per group based on visitor estimates from the Department of Tourism, a total spending estimate for outdoor recreation events is approximately $385 million by visitors from contiguous states. This represents a floor on the estimates, and the figures will be higher when considering the impact of out-of-state visitors from noncontiguous states who attend outdoor events, as noted below. Estimating Up To Include All Out-of-State Visitors If all out-of-state visitors have the same spending habits and participate in outdoor recreation events in the same proportion as those from neighboring states, then 2,348,800 visitors participate in or attend outdoor recreation events, creating a total economic impact of $729 million. SPENDING BY RECREATION ACTIVITIES Visitor spending and associated economic impacts likely differ by the type of activity in which visitors participate. Figure E-1 shows the average spending on a most recent trip by out-of-state visitors who participated in that activity at least once in the past 3 years. The green bars represent outdoor recreation activities, and the blue bars represent other activities that were asked as part of the panel screening process. These estimates represent total direct spending, which was measured by asking how much money was spent inside the state for eight specific categories (e.g., lodging, food, shopping) and for “all other expenses.” Note that spending estimates vary widely and accuracy depends on the sample size (items followed by an asterisk are based on fewer than 30 responses). The estimates in Figure E-1 represent visitor spending based on the visitors’ recreation activities during their most recent trip. It does not mean that the activity was the primary reason for the trip, only that the activity was conducted during the visit, so a causal effect cannot be concluded. Visitors participated in multiple activities for the most part; indeed, 73 percent participated in two or more activities, and 40 percent participated in four or more activities. The contributions of any one activity cannot therefore be disentangled from other activities taken on the trip. E-4 | OUTDOOR RECREATION: ECONOMIC CONTRIBUTIONS FIGURE E-1. TOTAL VISTOR SPENDING, BY VISITORS’ MOST RECENT RECREATION ACTIVITIES Despite these limitations, it does provide insight into activities in which “high total revenue” visitors tend to participate. As would be expected, people who are visiting family and friends and people who camp tend to spend less money, likely due to lower lodging costs. On the other end of the spectrum, those who are visiting on business tend to spend the most, though the sample size of that group was small. In terms of outdoor recreation, those who participate in individual sports and those who participate in water activities tend to import the most money into New Mexico, due to high spending per day, longer stays, or both.