Article CCA Revision or Review v2

advertisement

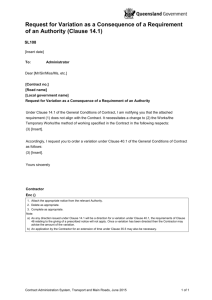

C o n s tr uc ti o n C o n tra c t s A m e ndm e n t Bi l l 2 0 1 3 Revision or Review - Update? This paper was presented at the AMINZ Breakfast in Wellington on 4 July 2014 There must be a ‘cashflow’ in the building trade. It is the very lifeblood of the enterprise.1 1. Introduction In late 2010, the Department of Building and Housing took the opportunity of the revisions to the Building Act to also consider a number of updates to the Construction Contracts Act 2002. The particular areas considered were: (1) removing the distinction between commercial construction contracts and residential construction contracts (2) improving the provisions relating to enforcement of adjudicator’s determinations (3) clarifying rights of appeal (4) removing the confidentiality of adjudication proceedings (5) extending the definition of construction work to include design, engineering and quantity surveying (as is the case in the UK) (6) removing the distinctions between adjudicators’ determinations on liability to make payment and on rights and obligations under the contract Public consultation was sought in late 2010. The Department then went to Cabinet with the recommendation to amend the Construction Contracts Act as follows: 1 i) widen its application to residential contracts ii) remove the distinction between residential and commercial contracts, except for the ability to use charging orders as a remedy for non-payment under residential contracts iii) amend and clarify the definition of residential occupier iv) widen the definition of construction work to include design, engineering and quantity survey work v) allow determinations about rights and obligations to be enforced Lord Denning in Dawnays Ltd v FG Minter [1971] 2 All ER 1389, not followed on appeal, but cited with approval by the House of Lords in Gibert-Ash (Northern) Ltd v Modern Engineering (Bristol) Ltd [1973] 3 All ER 195 at 214, Lord Diplock. Level 22, 88 Shortland Street, Auckland 1010, New Zealand phone +64 9 308 0514 | fax +64 21 696 161 | mobile +64 21 473 656 | email john@johnwalton.co.nz | www.johnwalton.co.nz vi) reduce the amount of time a defendant has to oppose an application to have an adjudication determination entered as a judgement under section 74 of the Act, to five days vii) amend and clarify how respondents may seek a time extension for preparing a response to a claim viii) require adjudicators to convene a pre-adjudication conference to answer any questions parties have about the process, unless both parties agree a preadjudication conference is unnecessary ix) clarify how an adjudication order may be appealed, contested or re-heard The Bill was introduced into Parliament early in 2013; it has had its first reading, and has been to Select Committee, where we made submissions. The Select Committee has reported back with further amendments on 11 December 2013, the second reading was on 20 March 2014 and we are awaiting the third reading, which is unlikely to happen in this Parliamentary session. Two Supplementary Order Papers have been tabled – the first by Clayton Cosgrove, suggesting a trust account for retention moneys, tabled on 17 April 2014; and the second by Julie Genter, proposing that funds should be held in trust and providing an option for a retention bond (which cannot be contracted out of), tabled on 7 May 2014. I understand the Government has its own Supplementary Order paper in preparation. I have attached a copy of the Explanatory Note which accompanies the Bill, and the Bill as tabled for second reading after the Select Committee deliberations. 2. Lessons learned from 10 years of the CCA It is fair to say that the Construction Contracts Act 2002 has not had the impact on the construction industry that it might have. It has not entirely lived up all to the expectations in its purposes outlined in section 3: (a) to facilitate regular and timely payments (b) to provide for the speedy resolution of disputes (c) to provide remedies for the recovery of payments Looking at each in turn, strangling subcontractors’ and suppliers’ cashflow has been the hallmark of residential development rather than commercial or large scale infrastructure projects, with some notable exceptions to that rather broad statement. Infrastructure developers tend to have long term relationships with a reasonably small group of 4 or 5 head contractors with the capacity to carry out such work. They, in turn, have on-going relationships with a tight group of specialist subcontractors and suppliers. It is not uncommon, for example, for the same subcontractors and suppliers to pop up on the majority of contracts within a given industry, regardless of who the head contractor is. This tends to discourage local authorities, local network operators and infrastructure developers from playing some of the more egregious cashflow games favoured by others. Page 2 Conversely, residential property developers still tend to think little of stopping payment if things aren’t going their way. You may well ask why contractors and their subcontractors do not avail themselves of the protections in Part 2 of the Act, or of the right to suspend work in Part 4. This is a combination of two issues; first, these remedies are not available for developments classed as residential; and second, there is a general reluctance on the part of contractors to get into disputes of that nature. They are concerned about cost, uncertainty of outcomes, delay and spoiling opportunities for on-going work. However, when these projects do go into dispute, they can be protracted and ultimately very unsatisfactory for anyone but the lawyers. The Willis Trust disputes, the Inframax litigation with Concrete Structures and the George v Canam litigation stand out in this regard. The Willis Trust litigation is also an example of the signal failure of the Act to provide appropriate remedies. That dispute turned on a failure to pay an amount claimed in a payment claim (the final payment claim). After two adjudications, two applications for judicial review, two applications to have the original adjudications enforced, appeals to the Court of Appeal and an application for leave to appeal to the Supreme Court (denied), the original contracting company (Willis Trust) is in liquidation, the trustees bankrupted and the Contractor has not, I understand, been paid a penny. That litigation is not, however, indicative of adjudication under the Act. In that one respect, the Act has been successful in providing for the speedy resolution of disputes. The growth in adjudication has shown a corresponding reduction of the number of cases going to arbitration, and a surprising number of disputes seem to go no further than the adjudicator’s determination. While it is hard to get accurate numbers, the following is reasonably clear: (1) adjudication seems to suit small value claims (as is to be expected), but a surprising number of high value disputes in major infrastructure projects are going to adjudication as a first stage, rather than the traditional Engineer’s review followed by mediation. (2) adjudication is attractive to disputants for the following reasons: (a) the process does not allow for recalcitrant or uncooperative respondents to delay and frustrate the substance getting to a determinative result – either party can get an adjudicator appointed, and there is no requirement for agreement, as in arbitration. (b) the procedure is very brief, with no requirement for formal discovery or for a hearing with sworn testimony and cross-examination – without allowing for extensions, the entire process can take less than 6 weeks from notice to determination. (c) the substance of the dispute tends to be considered promptly, by competent adjudicators – this brings the cost down considerably, and usually ends in a result that the parties can live with. Page 3 (d) the procedure enjoys the support of the Courts – initially, the pay-now-arguelater approach in the Act was not fully understood, but following reasonably clear statements from the High Court, any reluctance to abandon traditional protections (eg, arguable defence) seems to have gone. (3) few cases go beyond the adjudication stage, as most parties will live with the result. In my view, therefore, the Act has been a considerable success. I say this, not just because I am a busy adjudicator, but also as a commercial barrister who advises on a considerable number of significant infrastructure projects. The way to improve the Act, in my view, is not to weaken its provisions, but to widen its use and to strengthen the remedies it provides. If one reverts to the purposes of the Act in section 3, and the events which gave rise to the UK legislation (in 1996), the NSW legislation (in 1999) and our own legislation in 2002, the mischief the legislation was to address was an industry which had become dysfunctional and disputatious, primarily over payment. The protections afforded by the Act were firmly aimed at contractors not getting paid. One of the initial difficulties with tying the amendments to the Construction Contracts Act to the Building Act reforms was that the Department viewed the amendments from the perspective of consumer protection, where in fact one of the drivers of the original legislation was to protect contractors from non-payment. 3. The 2013 Amendment Bill In general terms the amendments are welcome. The Act has been restructured to largely remove the commercial/ residential distinction. The default payment terms, rights to suspend work and enforcement of adjudicators’ determinations will be available to residential contractors; adjudicators’ determinations will be enforceable, whether they concern liability for payment or rights and obligations; designers, engineers and quantity surveyors will enjoy the protections and be subject to the limitations in the Act; the basis for extending the time for a response has reduced any perceived benefit in claimant ambush; there is greater provision for informing and educating potential and reluctant users of the Act; and the time for opposing entry of an adjudicator’s determination has been reduced from 15 working days to 5. There are, however, a number of disappointments: (1) Charging orders are not to be available where an owner is an individual who is occupying or intends to occupy the property as a dwellinghouse. (2) The enforcement provisions have been left largely untouched. (3) The opportunity has not been taken to clarify a number of drafting issues which have plagued the Act from the start, for example the ability of adjudicators to rule on their own jurisdiction, clarification of the appointment process, provision for awarding interest, removal of references to nominating bodies and a host of other small changes which would avoid confusion. Page 4 Charging orders The current difficulty with the distinction between residential and commercial construction contracts manifests itself first with a notice of adjudication requesting approval for the issue of a charging order. That raises the immediate question for adjudicators – who are the parties to the construction contract? is one of them a residential occupier? meaning an individual who is occupying or intends to occupy the property as a dwellinghouse? It is easy enough to identify a property constructed as a dwellinghouse. Whether or not a contracting party intends to occupy the property is an entirely different issue altogether. For many family homes, the registered proprietors are trustees of family trusts. One or more of them may also be beneficiaries. The trust is not disclosed on the title to the property, and in practice most construction contracts do not disclose the existence of the trust either. They are typically signed by the parties who occupy the property and who treat the property as being theirs regardless of the existence of the trust. Most property developers will also say that they intend to occupy the properties themselves, or the beneficiaries of their trusts will, for very good tax reasons. For contractors, this puts them in a hopeless position. They don’t search the register to see who owns the property, and even if they did it would not disclose the existence of a trust; and not to put too fine a point on it, developers do tend to say what suits their interests best. The net result is that residential contractors are often the most exposed to poor behaviour (particularly when it comes to payment) and they are not best served by the Act. Enforcement I do not propose to go through the problems with enforcement in any detail. It is the underlying ethos of the Act that the payer must either protect its position by following the required process, or pay now and argue later. Adjudication provides clear support for that ethos by also providing for the disputing party to hold the money, rather than be pushed to insolvency by having its cashflow strangled. Yet, the practice has been that while an adjudicator’s determination can be obtained promptly, enforcement in the District Court is where it falters in the mire of lists and procedures. 4. Is Mainzeal Property & Construction Relevant? Part of the delay in the progress of the Bill is a result in part, at least, of the failure of Mainzeal Property & Construction. It is not my place to comment on the reasons for the failure of Mainzeal. Coming as it did, just before the Bill was introduced into the House, it was inevitable that both the Ministry and the responsible Minister should ask the question whether or not the Construction Contracts Act might offer some additional protections for subcontractors and suppliers in such an eventuality. Page 5 My initial temptation was to think back to the Wage Earners’ and Contractors’ Liens Act. It is not entirely clear why this valuable little Act was repealed (though it is easy enough to guess), or why it does not curry favour today. It’s protections seemed to me as a young lawyer, simple and effective. I have, for some years, included as standard a provision in contracts, that contractors must prove they are paying their subcontractors and suppliers if they wish to maintain the project cashflow, and including a right (rarely used) for the owner to pay suppliers and subcontractors directly (at the cost of the head contractor). This has helped to change practice in the industries in which I am most closely involved, but it is hardly a productive area for regulation. To my mind, the simplest answer to this complex problem is to mirror the provisions in the Act as they relate to owners who are not respondents, when a charging order is sought. It would be a relatively simple matter for a subcontractor to include the owner in any payment disputes, and for the owner to underwrite payment by the head contractor. Owners would then ensure that such the payments would flow further down the contractual chain. I doubt such a simple solution will find favour. Retentions 5. As mentioned above, there are two Supplementary Order Papers, proposing protections for securing retentions. To my mind, this is a blind alley. Retentions, historically, were to withhold money from the contractor’s cashflow to deal with defects. Typically, it is very hard to get a contractor to focus on completing minor outstanding work and rectifying niggling defects once they are de-mobilised from the site. So, it has become customary to withhold a percentage of progress payments as an incentive to contractors to complete this work. Those retentions were traditionally only released on expiry of the defect notification period (anywhere between 3 and 12 months, and in some cases longer), and once all defects had been rectified. If the contractor refused to rectify the defects, the retentions would be used as a fund to cover the cost of the owner doing so. This causes some practical difficulties: (1) the money has actually been earned, but has not been paid to the contractor, and is unsecured (2) the contractor will similarly withhold retentions from subcontractors, but not necessarily at the same percentages as it is subject to, which can create an imbalance (3) contractors will tend to factor in the retentions, and the cashflow consequences, into their bids, potentially reducing the incentive (4) if the owner or head contractor goes into liquidation, then the retentions are lost and the payee (whether contractor or head contractor) is unsecured Page 6 (5) retentions have become a general fund for default, rather than being fixed for the purposes of defects There have been cases over the years, trying to impose trusts and other fiduciary responsibilities, but these have all failed. This is the background to the Supplementary Order Papers. The difficulty I have with the proposals is that they are very easily circumvented by simply changing the cashflow, or doing away with retentions altogether in favour of another mechanism to secure the rectification of defects. It also seems to me that while laudable, retentions are simply the easiest issue to grasp hold of. Misuse of cashflow is by far a greater issue, as Lord Denning identified back in 1971. In the case of Mainzeal, while they may have been holding higher percentages of retentions than they were themselves subject to, they were holding a far greater sum based on their 56 day payment cycle. This became working capital they were actually not entitled to hold. 6. Conclusion The Construction Contracts Amendment Bill 2013 is a welcome refinement to what is already a successful statute. To the extent that it has not lived up to expectations in some areas, that is more a case of the industry not taking the purposes of the Act fully on-board than any failings inherent in the Act. I do not believe that the Ministry proposes at this stage to undertake a full scale review of the construction industry. The Act has been a simple but effective piece of legislation as it fits with practice (or at least, best practice), and it does not endeavour to reform the entire industry. That would be most unwelcome. I am optimistic that the current approach of simple protections will continue, leaving the industry participants to make the protections work. John Walton Bankside Chambers Auckland 2 July 2014 Page 7 Bills of NZ Construction Contracts Amendment Bill 2013 Explanatory note General policy statement The Construction Contracts Act 2002 (the Act)— • creates default progress payment provisions for construction contracts; and • provides an adjudication framework for disputes involving construction contracts; and • provides remedies for recovering payments under construction contracts. In 2009, the Government undertook a review of the Building Act 2004. Submissions on the review indicated broad support for the adjudication process under the Construction Contracts Act 2002 for resolving a range of building disputes. However, submitters identified areas in which the Act could be improved to help parties to resolve disputes, particularly in relation to residential construction contracts and disputes over the quality of work or rights and obligations under contracts. The building and construction sector is vital for New Zealand’s economic performance and prosperity. The Government is making changes to legislation across the sector to provide incentives for building professionals and trades people to take responsibility for the quality of their work, changes that are expected to deliver a productive, efficient, and accountable building sector. Improving the adjudication process under the Act is important in the context of these changes. The amendments in this Bill will make the existing adjudication process a faster, more cost-effective, and efficient option for people with disputes under construction contracts. The amendments will— • remove most of the distinctions between how the Act applies to residential and commercial construction contracts (except in relation to the use of charging orders as a remedy for non-payment): • widen the definition of construction work to include design, engineering, and quantity surveying work: • remove the distinction between enforcement of payment determinations and rights and obligations determinations: • speed up enforcement processes by reducing the amount of time a defendant has to oppose an application to have a determination entered as a judgment: • clarify procedural matters, such as how to seek time extensions to respond to Page 8 adjudication claims: • require adjudicators to convene a pre-adjudication conference to answer questions parties have about the process: • clarify how determinations can be appealed against, contested, and reviewed: • make other minor and technical amendments. Regulatory impact statement The Department of Building and Housing (as it then was) produced a regulatory impact statement on 21 March 2011 to help inform the main policy decisions taken by the Government relating to the contents of this Bill. A copy of this regulatory impact statement can be found at— • http://www.dbh.govt.nz/ris-construction-contracts-act-review • http://www.treasury.govt.nz/publications/informationreleases/ris Clause by clause analysis Clause 1 is the Title clause. Clause 2 provides that the Bill comes into force on 1 November 2013. Clause 3 provides that the Bill amends the Construction Contracts Act 2002 (the Act). Part 1 Amendments to preliminary provisions Clause 4 amends section 4, the overview, to reflect changes made by the Bill to the Act. Clause 5 amends section 5, the interpretation section, to— • repeal the definitions of commercial construction contract, residential construction contract, and residential occupier; and • amend the definition of construction contract; and • replace the definitions of defendant, plaintiff, and progress payment; and • amend the definition of working day; and • insert definitions of chief executive, premises, and related services. Clause 6 amends section 6 to include design, engineering, and quantity surveying work in the definition of construction work. Clause 7 amends section 9 to provide that the Act applies to contracts for design, engineering, and quantity surveying work entered into or renewed on or after 1 November 2013. Page 9 Clause 8 repeals section 10. Part 2 Amendments to principal provisions Clause 9 amends section 20, which relates to payment claims, so that all payment claims (not just claims served on residential occupiers) must be accompanied by— • an outline of the process for responding to the claim; and • an explanation of the consequences of not responding or not paying the claimed amount or a scheduled amount. Clause 10 inserts a new section 24A in a new subpart 4 of Part 2 to re-enact the current section 72. Clause 11 amends section 26(3) to clarify that an adjudicator must terminate adjudication proceedings whenever the dispute is determined (before the adjudicator makes a determination) under another dispute resolution procedure. Clause 12 inserts a new section 28(3) to require that all adjudication notices (not just those served on residential occupiers) contain a statement of the respondent's rights and obligations and a brief explanation of the adjudication process. The provision replaces the current section 62(1), which is being repealed. Clause 13 replaces section 31 with new sections 31 and 31A. New section 31 relates to charging orders in respect of dwellinghouses. Section 10 of the Act prohibits charging orders where the construction site is the owner's residence. New section 31 will also prohibit charging orders where a construction site is owned by a family trust and occupied by a beneficiary of the trust. New section 31A re-enacts section 64. Clause 14 amends section 35 to define notice of acceptance, which is referred to in sections 35to37. Clause 15 inserts a new section 36A,which requires an adjudicator to hold a preadjudication conference to answer questions about the adjudication process. Clause 16 amends section 37 to require adjudicators to give a respondent additional time to serve a written response on the claimant if additional time is necessary owing to the size or complexity of the claim. Clause 17 re-enacts sections 63 and 67 as new sections 38A and 38B. Clause 18 amends section 47 to require an adjudicator to advise a defendant of the consequences of not taking steps to oppose an application by a plaintiff to enforce an adjudicator's determinations about rights and obligations. Clause 19 repeals sections 52to55 (which are being re-enacted as new sections 71A to 71D). Clause 20 amends section 58 to make adjudicators' determinations about rights and obligations under a construction contract enforceable. Page 10 Clause 21 inserts a new section 59A, allowing a party in whose favour a determination is made regarding rights and obligations to enforce the determination by entry as a judgment. Clause 22 makes a minor amendment to section 60 to reflect the amendment to section 58. Clause 23 repeals section 61. Clause 24 repeals sections 62to64 and 67. (Sections 63, 64, and 67 are being re-enacted as new sections 31A, 38A, and 38B.) Clause 25 amends the Part 4 heading. Clause 26 inserts a new subpart 1AA in Part 4, re-enacting the existing sections 52to55 as new sections 71A to 71D. Clause 27 repeals subpart 1 of Part 4. Clause 28 amends section 73 to allow all adjudicators' determinations to be enforced by entry as a judgment, not just determinations regarding payment. Clause 29 amends section 74 to— • shorten, from 15 to 5 working days, the period in which a defendant can apply to the District Court to oppose a plaintiff's application for a determination to be enforced by entry as a judgment; and • allow a defendant to oppose entry of a determination as a judgment if the time allowed by the adjudicator for compliance has not elapsed. Clause 30 amends section 75 to shorten, from 15 to 5 working days, the period after which the court must enter a determination as a judgment if the defendant takes no steps to oppose an application for entry as a judgment. Part 3 Amendments to miscellaneous provisions Clause 31 inserts a new section 83 to allow the Chief Executive of the Ministry of Business, Innovation, and Employment to collect information on adjudications for statistical or research purposes. Page 11