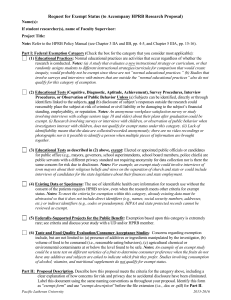

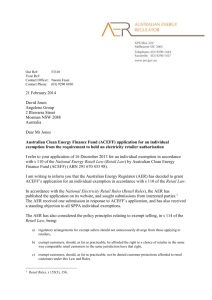

AER (Retail) Exempt Selling Guideline

advertisement