Agenda - Research Service Office

advertisement

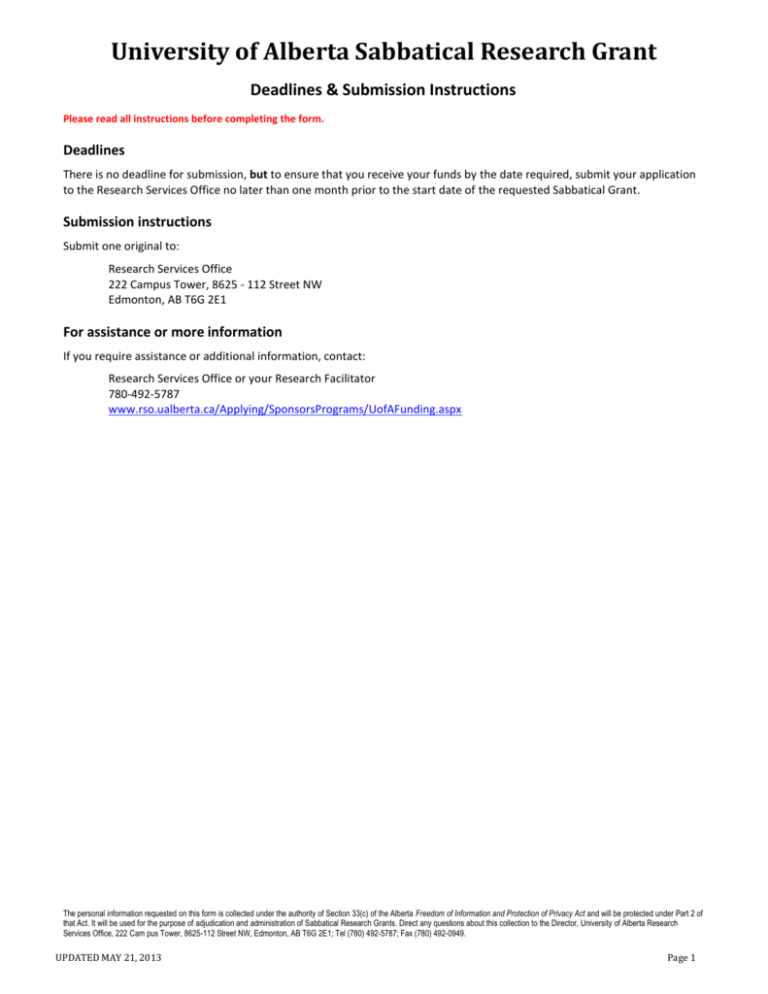

University of Alberta Sabbatical Research Grant Deadlines & Submission Instructions Please read all instructions before completing the form. Deadlines There is no deadline for submission, but to ensure that you receive your funds by the date required, submit your application to the Research Services Office no later than one month prior to the start date of the requested Sabbatical Grant. Submission instructions Submit one original to: Research Services Office 222 Campus Tower, 8625 - 112 Street NW Edmonton, AB T6G 2E1 For assistance or more information If you require assistance or additional information, contact: Research Services Office or your Research Facilitator 780-492-5787 www.rso.ualberta.ca/Applying/SponsorsPrograms/UofAFunding.aspx The personal information requested on this form is collected under the authority of Section 33(c) of the Alberta Freedom of Information and Protection of Privacy Act and will be protected under Part 2 of that Act. It will be used for the purpose of adjudication and administration of Sabbatical Research Grants. Direct any questions about this collection to the Director, University of Alberta Research Services Office, 222 Cam pus Tower, 8625-112 Street NW, Edmonton, AB T6G 2E1; Tel (780) 492-5787; Fax (780) 492-0949. UPDATED MAY 21, 2013 Page 1 UNIVERSITY OF ALBERTA SABBATICAL RESEARCH GRANT – TERMS OF REFERENCE Terms of Reference Overview A Sabbatical Research Grant is a special form of self-funded grant that provides tax relief. No additional funds are forwarded. This program permits a researcher to receive a research grant in lieu of salary. The grant may be used for all the same purposes of a grant-in-aid of research. This program covers only research activities and is not for projects directed at teaching or the development of teaching-related skills. A continuing faculty member who has been granted a sabbatical leave has, in the process, also satisfied the adjudication requirements to receive a Sabbatical Research Grant. Once the grant has been awarded, the funds are no longer considered to be sabbatical stipend, but constitute a research grant which is subject to the regulations of the program and the researchrelated policies of the University. The amount of the grant should be reasonable and commensurate with the proportion of time to be spent on the research project. Grants may not exceed the sabbatical stipend less employee benefits. The grant payment will be treated as T4A income for tax purposes, and accordingly, no income tax will be deducted by the University. The grant is self-administered. The award recipient is responsible for reporting the income to Canada Revenue Agency (“CRA”) and declaring the eligible expenditures against it. Application procedures Provide one hard copy of the application (completed electronically) ensuring to complete all sections of the application form and include the required attachments. Supplement each application with the Summary of Sabbatical Program taken from the Application for Sabbatical, approved by the Chair of the Department, the Director of the Institute or Centre, or the Dean of the Faculty responsible for the payment of salary to the researcher. Grant period The program uses the calendar year (the normal taxation year) as its base. According to the CRA under Income Tax Folio, S1F2-C3, Scholarships, Research Grants and Other Education Assistance, research grant-related expenses must be incurred in the same calendar year in which the research grant is received in order to be claimed against the grant. In some cases, research expenses may be incurred in the year immediately preceding or immediately following the year in which the grant is received. Please see Section 3.77 for further details. Grant level The value of the research grant request should be reasonable and commensurate with the proportion of time to be spent on the research project. Grants may not exceed the remaining sabbatical stipend for each calendar year less employee-paid benefits deductions. To determine the employee-paid benefits deductions, please see the applicant’s cheque stub. If there are further questions about this calculation, contact the department or faculty administrator. Payment of research personnel Grantees should be aware of their responsibilities concerning statutory deductions (CPP and UIC) when hiring assistants or other employees on a grant. Consult Sections 3.33 and 3.62 and 3.63 and 3.7 for further information. The department or faculty administrator will have further information on these statutory deductions. Travel and related costs Travel costs are allowable for purposes essential to the research outlined. According to the CRA guidelines, researchers may claim only their own expenses of travelling between their home and the place at which they sojourn (temporarily reside) while engaged in research work, providing that such travel is essential to the research. Travelling expenses of spouses and children may not be claimed. Researchers are not permitted to claim their own personal and living expenses, including meals, while engaged in research. However, researchers are entitled to claim expenses for meals and lodging while on brief field trips (certainly fewer than 30 days in any single location) in connection with their research. Personal moving expenses are not allowable under the program. Note particularly Section 3.75. UNIVERSITY OF ALBERTA RESEARCH SERVICES OFFICE Page 2 UNIVERSITY OF ALBERTA SABBATICAL RESEARCH GRANT – TERMS OF REFERENCE Adjudication Adjudication of the preceding Application for Sabbatical constitutes the principal adjudication for a sabbatical research grant. The Research Services Office will, however, initiate a further review of the budget in relation to the research proposal, and may require further clarification of any budget item before approving a sabbatical research grant. Incomplete applications will be returned to the applicants. Grant payment Once the sabbatical grant is approved, a notice to the researcher and to Human Resources will initiate the changes to your payroll for the requested payment periods. The amount of the research grant is to be reported on an Income Tax T4A slip. A sabbatical grant may be paid in one of two different ways: either as a single payment or in equal monthly installments included with the regular monthly sabbatical stipend payment. Thus, in relation to this program, the total payment to the researcher will be divided into two components: (1) stipend and (2) research grant. The gross amount of the grant and stipend (before deductions) will not exceed the normal gross monthly stipend. Successful applicants under this program do not have the option of opting out of the University of Alberta pension plan. This program does not affect the awardee’s pension. Equipment All equipment purchased with the awarded funds is the property and responsibility of the awardee. Tax information Although the University approves a research grant, deductibility of expenses for income tax purposes must be in accordance with the Canada Revenue Agency regulations, and these deductions should be claimed when the researcher files his or her personal income tax return. Any questions with respect to the eligibility of expense deductions must be resolved between the researcher and the CRA. The researcher is solely responsible for any additional income tax which may become payable as a result thereof. The researcher is not required to submit an accounting for these funds to the University; but since it is the responsibility of the researcher to support claims for deductions to the CRA, researchers should keep detailed records of research expenditures. The University is not in a position to offer any more detailed tax information than that which is contained in the CRA, nor will the University assist the faculty member in the presentation of a case to the CRA. Any questions about taxation regulations should be referred directly to the CRA or to an external tax advisor. Leaving the University of Alberta If at any time during the term for which the grant has been made, the grantee ceases to be a member of the University and his or her stipend ceases, the grant arrangement will terminate, and the stipend and grant amounts are to be reconciled between the investigator and the University. Eligible items relating to the research project • • • • • • • • • • • Direct costs of research (as allowed by Federal granting councils) Conference registration fees and travel to conference Service contracts on equipment Shipping (if justified) Publication costs Research assistance (fact checking, research, translation) Honoraria for external experts, but not for principal investigator Books, journals (if directly related to project and unavailable in the library) Car rental, where reasonable when other modes of transport are not available Ground transportation (airport-hotel, etc.) Research equipment (e.g., computer hardware /software, as justified by the research UNIVERSITY OF ALBERTA RESEARCH SERVICES OFFICE Page 3 UNIVERSITY OF ALBERTA SABBATICAL RESEARCH GRANT – TERMS OF REFERENCE Ineligible items relating to the research project • • • • • • • • • • • • Assistant attending conference Course fees Membership in professional societies Visas Medical insurance Travel/cancellation insurance Office rental Percent mortgage for in-home office Copy editing, proofing, stylistic editing, substantive editing to be done by PI or publisher Currency exchange Sojourning expenses (temporary residence of more than 30 days, in a place other than your home while engaged in research work) Consultant fees Link: Income Tax Folio S1-F2-C#: Scholarships, Research Grants and Other Education Assistance: http://www.cra-arc.gc.ca/tx/tchncl/ncmtx/fls/s1/f2/s1-f2-c3-eng.html. UNIVERSITY OF ALBERTA RESEARCH SERVICES OFFICE Page 4 University of Alberta Sabbatical Research Grant Application Form Complete electronically. 1. Applicant Applicant’s Name: Application Date: Surname Given Name(s) E-mail: Telephone: ext. Department: Faculty: Academic Rank: Personal Employee Number: 2. Sabbatical Information Title of Research Project: Sabbatical Start Date: Sabbatical End Date: Proposed sabbatical research grant schedule (see Program Guidelines on “Grant Period” for more details). Select one or both. CURRENT Calendar Year 20 Total value of grant requested for the current calendar year: $ How many installments should this grant be paid in? Equal monthly installment with regular stipend payments: Starting in (payroll month) and ending in (December or earlier); or In equal payments. OR A single payment in (month). Payment will be made with your regular stipend payroll at the end of the month(s) noted above. NEXT Calendar Year 20 Total value of grant requested for the current calendar year: $ How many installments should this grant be paid in? Equal monthly installment with regular stipend payments: Starting in (payroll month) and ending in (December or earlier); or In equal payments. OR A single payment in (month). Payment will be made with your regular stipend payroll at the end of the month(s) noted above. 3. Employee Authorization Applicant: Print Name For Staff and Student Payments use only Date: Signature Payment processed (#1 above): Stipend reduction effected: $ $ -500011 (Code 305/310) -500011 (Code 315) Payment processed (#2 above): Stipend reduction effected: $ $ -500011 (Code 305/310) -500011 (Code 315) UNIVERSITY OF ALBERTA RESEARCH SERVICES OFFICE – Updated June 27, 2013 Page 5 UNIVERSITY OF ALBERTA SABBATICAL RESEARCH GRANT – APPLICATION FORM 4. Budget The purpose and objectives of the proposed expenditures must be warranted in the context of the research project. Please enter budget items below, providing as much detail as possible. Append additional pages if necessary. Applications that do not provide sufficient detail will be returned. Please review the Program Guidelines and relevant excerpts of Canada Revenue Agency (“CRA”) for information regarding allowable expenses and restrictions on the total funds that can be requested: Income Tax Folio S1-F2-C#: Scholarships, Research Grants and Other Education Assistance at http://www.cra-arc.gc.ca/tx/tchncl/ncmtx/fls/s1/f2/s1-f2-c3-eng.html. Salaries of technical and professional assistants $ Stipends to graduate students and postdoctoral fellows $ Purchase or rental of equipment under $5,000 $ Purchase or rental of equipment over $5,000 (submit equipment quotations for these items) $ Materials, supplies and incidentals $ Travel and subsistence $ Computing and statistical consulting costs $ Others (specify) $ AMOUNT REQUESTED $ Explain the contribution to the research project of all travel, detailing all locations, institutions and individuals to be visited and the reasons for and duration of each visit, and the breakdown of travel and subsistence for each visit. Justify each budget item (including computer hardware and software) by clarifying how it will help to achieve the project goal. Attach an additional page if necessary. UNIVERSITY OF ALBERTA RESEARCH SERVICES OFFICE – Updated June 27, 2013 Page 6 UNIVERSITY OF ALBERTA SABBATICAL RESEARCH GRANT – APPLICATION FORM 5. Attachments 1. “Summary of Sabbatical Program” (part 6 of your approved Application for Sabbatical). 2. Forms for human ethics certification, animal care, and/or biohazards containment (must be attached if applicable). 6. Certification of Applicants 3. I have read and understand the terms of reference applicable to this Sabbatical Research Grant and attached to this application (pgs 1-4). 4. This application is made in compliance with the Application Guidelines and Conditions of the Grant, and the University’s policies. In the event that an award is made, I will use any funds awarded in compliance with these conditions. 5. I do not currently have funding from any other source for the expenses outlined in this application. I understand that if reimbursed from another source, the expenses cannot also be claimed against this Sabbatical Research Grant. 6. I understand that the Sabbatical Research Grant is subject to the regulations of CRA-Taxation, as they may from time to time be interpreted by that Agency or by the courts and I will hold the University harmless against any claims which may arise as a result of such regulations or interpretations. 7. Applicant Signature Applicant: Print Name Date: Signature 8. Certification of Dean, Director and/or Chair I have reviewed this Sabbatical Research Grant carefully, and I am satisfied that: • The University will benefit from this research activity; • The activity is timely and appropriate for the field of interest of the researcher; • The amounts requested in the budget are reasonable and justifiable; and • The amount of the research grant requested is reasonable and commensurate with the proportion of time to be spent on the research project. This proposal has my support and approval, and I support the payment of a corresponding Sabbatical Research Grant. 9. Dean, Director and/or Chair Signatures Department Chair: Print Name Date: Signature Dean: Print Name Date: Signature UNIVERSITY OF ALBERTA RESEARCH SERVICES OFFICE – Updated June 27, 2013 Page 7