market analysis and strategic recommendation: analysing the cider

advertisement

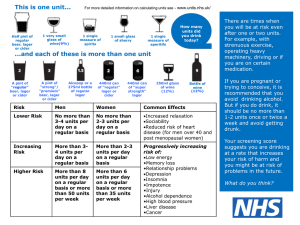

+ Bristol Business School Academic Year: 09/10 Assessment Period: August Assessment Type: Referral Open book exam Module Leader: Module Number: Module Name: Word Limit: Jenny Lloyd UMKCPD-20-1 Introduction to Marketing Coursework Submission Date and Time: Open book exam in which you are allowed to bring your prepared case into the exam with you. The time and date of the test will become available when the exam timetable is published. UNIVERSITY OF THE WEST OF ENGLAND, BRISTOL LEVEL 1 Introduction to Marketing Component B: Referral Assessment Module No UMPCPD-20-1 2009 / 2010 BRIEFING DOCUMENT MARKET ANALYSIS AND STRATEGIC RECOMMENDATION: ANALYSING THE CIDER INDUSTRY ASSIGNMENT TYPE: ASSIGNMENT ISSUE DATE: ASSIGNMENT SUBMISSION: Individual report written in controlled conditions Week commencing Assessment under controlled conditions in the referral assessment period MODULE LEADER: Dr Jenny Lloyd Assessment Overview This assessment will test your ability to undertake an environmental analysis of a given market sector. Attached to this brief, you will find a broad market overview of the cider market. You are expected to supplement the material in this case by researching this market sector to a level where you are able to undertake a ‘macro’ analysis. In ‘controlled conditions’ (exam-style), you will be given additional information that relates to a company and its ‘micro’ environment and you will be expected to undertake further analysis using appropriate frameworks and answer a series of questions on the basis of both your macro and micro analysis. You are allowed to take the basic case study ‘Industry Overview: The Cider Industry’ into the exam with you annotated (by hand). No other notes may be brought in. The annotated case study should then be handed to the examiner with your written script at the end of the examination period. Learning Outcomes Upon completion of this assignment students will have demonstrated their ability to: apply marketing analysis frameworks to strategic marketing planning decisions; to identify the needs of stakeholders in a given market and their role as potential drivers of innovation identify the potential threats and opportunities within a given market sector; analyse a given organization to identify the strengths and weaknesses that it possesses within that market segment; critically appraise the ability of that chosen organization to address the threats and exploit the opportunities that exist within their sector; generate clear, rational and reasoned recommendations, supported by theory, as to a preferred course of action taking into account the short, medium and long term future of the organization. Assignment Format This assignment comprises of two stages: ‘preparatory research and analysis’ and ‘execution’. In the preparatory stage, you will be given a ’brief’ and are expected to research the specified market, analysing it as far as possible using established marketing frameworks. You should make full use of all of the services the University Library has to offer; for example: Mintel market reports Marketline Emerald and Business Source Premiere databases Nexis WARC (World Advertising Research Centre) In addition, the Government publish a wealth of statistics online (http://www.statistics.gov.uk) that offer real insight into social trends The ‘execution’ element will take place in the referral assessment period under exam-style ‘controlled conditions’. Whilst this assessment is technically the ‘coursework’ component of this course (known as ‘Component B’) the fact that the ‘execution’ element will be undertaken in examination conditions means that it will be scheduled as an examination in the referral assessment period. Under exam-style conditions you will be given information pertaining to a company and its micro environment. You will then be asked to respond to a series of questions that will test your ability to undertake an effective analysis of a marketing environment. You are allowed to bring your copy of the basic case study into the exam with you, annotated with hand-written notes only. No additional notes will be allowed. The Brief Within the context of this assessment, you are expected to assume the role of a marketing consultant. Your Managing Director has been approached by a potential new client, the owner of a medium sized cider manufacturer who is seeking advice as to the best options to develop his business. In preparation for a meeting with this client, he has asked you to undertake a macro analysis of the cider sector so that you can demonstrate a clear understanding of the opportunities and threats that exist for all clubs in the cider industry. He has provided you with a basic case study that details a limited number of salient facts but as the information is relatively superficial, it is necessary for you to undertake further research in order to be able to complete the task satisfactorily. Under controlled conditions, you will then be presented with a report that contains details of the company and its micro environment. You will be required to analyse the report and, on the basis of your prior research and the information in the company report, answer questions that will test your ability to generate or demonstrate any or all of the following: An effective market analysis that contains elements of both macro and micro environment. An understanding of the relevant stakeholder groups and their varying needs. A correctly executed SWOT/TOWS matrix with components correctly identified. The ability to generate critical (key) success factors on the basis of macro and micro analysis undertaken. Strategic recommendations (based upon the analysis undertaken). Assessment Criteria Your work will be assessed on your ability to: 1. Demonstrate a clear, detailed and insightful understanding of the UK cider industry the needs of its stakeholders and the markets that it serves. 2. Undertake a market analysis correctly and thoroughly at both a ‘micro’ and ‘macro’ level. 3. Correctly identify the components of a TOWS/ SWOT analysis on the basis of macro and micro analyses undertaken 4. Generate critical (key) success factors on the basis of the opportunities, threats, strengths and weaknesses identified 5. Draw logical conclusions from the analysis undertaken and, in conjunction with theoretical constructs, generate strategic recommendations. 6. Use of up-to-date market information in combination with appropriate theoretical frameworks as a basis of the analytical process throughout. INDUSTRY OVERVIEW: THE CIDER INDUSTRY INTRODUCTION Cider is a beverage made from apple juice whose heritage can be traced back many centuries. Traditionally it was made in both alcoholic and non-alcoholic form; the latter known as ‘apple cider’ in the US. Earliest mentions of cider are visible in writings dating back to early Roman, Greek and Egyptian civilisations which noted the consumption of fermented apple juice as a beverage. However, over recent centuries, cider production has largely been located in Europe; most specifically the UK, France and Spain. The UK boasts the highest consumption of cider by volume and, unlike sales of other types of alcoholic beverage, it appears to be a growing market (see Figure 1). Figure 1 Sales of Cider and Perry (Source: Mintel 2008) 2003 2004 2005 2006 2007* 2008* (est) m litres index £m Index £m at Index €m 2003 prices Index 481 495 523 565 665 726 100 103 109 117 138 151 100 104 111 123 146 161 100 106 112 124 148 152 1,170 1,213 1,296 1,435 1,710 1,888 1,170 1,189 1,246 1,347 1,558 1,646 100 102 106 115 133 141 1,691 1,788 1,896 2,105 2,500 2,568 TYPES OF CIDER There are a number of different types of cider. At the most basic level, ciders can be divided into those that are ‘still’ and those that are ‘sparkling’. ‘Sparkling’ ciders are those that contain carbon dioxide (a gas that is produced during the fermentation process) and are usually stored under pressure in a similar fashion to beers and soft drinks. In contrast, ’still’ ciders are simply a form of fermented apple juice that contains no carbonation. Cider types are also distinguished by their production method and alcohol content. For example, it has already been noted that, in the US, ‘apple cider’ is a non-alcoholic refreshing apple juice drink. In contrast, ‘French style’ cider contains alcohol but is manufactured using a process that halts fermentation so that the alcohol content of the liquid is limited to between 2% and 5% ABV1. ‘Draft’ cider, which may or may not be served from a keg is generally limited to 6% ABV and ‘farmhouse style’ ciders (often called ‘real cider’) can have an ABV that ranges from between 5% and 12%). ‘Farmhouse style’ cider is often mistakenly labelled as ‘scrumpy’. However, a cider can only be regarded as ‘scrumpy’ if it has been made with cider apples using traditional methods, has not added yeast to support the fermentation process and does not contain additives of any form. There are also a number of cider variants. ‘Perry’, in particular, has experienced a resurgence of interest in recent years. Made in a similar fashion to cider, it is made from a mixture of apple and pear juice. In contrast, apple juice can be fermented to a point at which the ABV exceeds 12% when it is considered ‘apple wine’. Finally, ‘cyser’ is an form of mead traditionally thought to have been made by ancient monks. It is a sweet liquid produced by fermeningt a mixture of apple juice and honey with yeast to a point at which the ABV can reach up to 13.5%. 1 ABV is an abbreviation for Alcohol By Volume and simply represents what proportion of the total volume of liquid is alcohol. The higher the percentage, the stronger the alcoholic beverage THE COMPETITIVE CONTEXT Cider competes in what is known as the ‘long drink’ market2. The market is divided into five types of ‘long drink’: cider/perry, ales/stouts, lagers and liquids known as ‘flavoured alcoholic beverages’ (FABs) in the trade but more commonly by consumers and the media as ‘alcopops’. Whilst cider may well be the only ‘long’ alcoholic drink to be experiencing growth over past years, it still commands a relatively small proportion of the overall ‘long drink’ market. However, despite its recent growth, the market for lager is still worth five times as much as that for cider (See Figures 2 and 3). Cider is sold through what are known as ‘on trade’ and the ‘off trade outlets’. In the UK, retailers selling alcohol to the public are required to get a license and the ‘on’ and ‘off’ element relates to the type of license they possess. An ‘on trade’ license permits sellers to sell alcohol for consumption on the premises, for example, in bars, pubs and restaurants. In contrast, an ‘off trade’ license permits the sale of alcohol but does not permit consumption on the premises. Typical ‘off trade’ retailers are supermarkets such as Sainsbury’s and off-licences such as Oddbins. Figure 2: UK volume sales of alcoholic drinks, by type, on and off trade 200608 (Source: Mintel 2008) 2006 m litres % 2007 m litres Ales stouts Lager Wine FABs Total % 2008 (est) m litres % %change 2006-08 1,645 23 1,544 22 1,443 21 -12.3 4,087 1,242 200 57 17 3 3,954 1,259 165 57 18 2 3890 1,270 151 58 19 2 -4.8 2.3 -24.5 7,174 100 6,922 100 6,754 100 -5.9 A ‘long drink’ is one that is of relatively and usually relates to beers, ciders and spirits consumed in dilution with mixers (ie a gin and tonic). In contrast ‘shorts’ are usually spirits which are served undiluted in short measure (sometimes described as ‘shots’). 2 FIGURE 3: UK retail value sales of alcoholic drinks, by type, 2006-08 (Source: Mintel 2008) 2006 2007 2008 £m % £m % £m % % change 2006-08 Ales and stouts Lager Wine FABs 5,908 19.6 5,711 19.1 5,503 18.4 -6.9 10,994 12,135 1,082 36.5 40.3 3.6 10,874 12,468 893 36.3 41.6 3.0 10,948 12,675 830 36.5 42.3 2.8 -0.4 4.4 -23.3 Total 30,119 100 29,946 100 29,956 100 -0.5 Lager, ales and stouts There appears to be some decline in the sector overall, some of which may be attributable to the decline in the number of pubs and the smoking ban. However some products and brands appear to be bucking the trend; particularly specialist ales and imported lagers which appear to be successful in both in the on and off-trade. In contrast, lager, which enjoyed an unprecedented boom in the 1990s early 2000s, has experienced a fall in demand. Whilst it is difficult to attribute the decline to a single reason, there are those in the industry who believe that its association with the binge drinking and ‘lager lout’ culture negatively affected its image. In addition, consumers have begun to display preferences for less bland alternatives to lager and appear to be increasingly drawn to drinks that possess authenticity, provenance or a distinct flavour. However, lager brands do benefit from higher levels of brand loyalty than cider brands and sales of lager appear to be far less seasonal than those of cider. Wine Sales of wine appear to be increasingly slowly if steadily in terms of both volume and value sales. This may be because, as a sector, it is less vulnerable to the challenges generated by the decline in pub numbers and is well positioned to respond to the new smoke-free restaurant focussed pubs. Another reason for its continued growth is its strong appeal across both male and female drinkers of all age-groups. Flavoured alcoholic beverages (FABs) As a sector, flavoured alcoholic beverages (FABs) are in decline. Over recent years, the sector has become closely associated with underage and binge drinking cultures and such negative connotations appear to have directly impacted upon its sales. Young drinkers who were once the target market for the FAB sector appear to have turned to cider and this boom in cider sales has helped to banish the similarly negative associations that were once linked to cider. THE BROADER MARKET ENVIRONMENT Within the context of the cider market, there are a number of broad issues that have a potential impact upon organisations, customers and consumers within the long drinks market. Impact of the Recession One of the most obvious factors affecting all organisations within the alcoholic drinks industry over is that of the recession. In a time of economic uncertainty, increased unemployment and concerns over impending increases in levels of taxation to cover the budget deficit, consumers have altered their spending patterns in terms of both what they buy and where they spend their money. ‘Budget’ retailers such as Aldi and Lidl have seen a growth in sales of up to 21%i, whilst more upmarket retailers such as Waitrose introduced basic or ‘Essentials’ ranges to cater for increasingly price conscious customers. Changes in Consumption Patterns A recent report by the Office for National Statistics highlighted a more tragic side to changes in consumption; in 2008 9,031 alcohol-related deaths were recorded in the UK; an increase of 307 upon the previous year. It was also noted that the number of drink-related fatalities has more than doubled since the early 1990s; the majority of which involved people aged over 35. However, 11 of those deaths related to alcohol consumption recorded in 2008 involved individuals aged between 15 and 34 years of age. In a separate survey, the Office for National Statistics suggested that middleclass professionals were more likely to be heavy drinkers than people from less-privileged backgrounds. The study, ‘Smoking and Drinking Among Adults’, showed a clear class division in drinking habits. Professionals admitted consuming 13.8 units of alcohol a week, compared with 10.6 units in the households of manual workers. It was also noted that middle-class drinkers also tended to drink more frequently, with almost one in five admitting drinking alcohol on five or more days a week, compared to just 11 per cent of manual workers. The Demise of the Pub Whilst the recent economic recession is not the only cause of the closure of a large number of pubs in the UK, in recent times it can certainly be seen as a contributory factor. According to CAMRA3, thirty six pubs are closing every week. The smoking ban coupled with supermarket promotions that sell alcohol as a loss leader have both been cited as major contributing factors to the decline in pub numbers. Those pubs that are managing to successfully weather the current storm tend to be those that serve food and the sector has seen major growth in the number of ‘gastropubs’. Unfortunately for the cider sector, however, it is often the case that wine is chosen as an accompaniment to the food or, in cases where diners have had to drive their cars to the pub, soft drinks become the beverage of choice. Associations with Underage Drinking, Binge Drinking and Anti-Social Behaviour One of the biggest challenges that faces the cider industry is its association with under-age drinking, binge drinking and anti-social behaviour. Significant concern has been voiced by both health agencies and the Government about the increasing incidence of binge drinking and anti-social behaviour that is directly attributable to the consumption of alcohol. The concept of binge drinking is not clearly defined, however, it is generally seen to occur when individuals drink large quantities within a short period of time with the primary aim of getting drunk. In defining ‘binging’ the Government-backed ‘Drink Aware’ campaign cites the marker used by the NHS and National Office of Statistics which suggests that ‘binging’ is drinking more than double the daily recommended units of alcohol in one session. The Government guidelines state that men should not regularly drink more than three to four units a day, and women should not regularly exceed more than two to three units daily .Binge drinking for men, therefore, is drinking more than eight units of alcohol – or about three pints of strong beer. For women, it’s drinking more than six units of alcohol, equivalent to two large glasses of wine. Because of its sweetness and the availability of high strength liquids, cider, FABs or spirits diluted with squash or juice are often the drink of choice of under-age consumers. However, the consequences are potential dire. Every day, 15 children under the age of 16 are admitted to A&E in hospitals because of alcohol abuse with some having consumed more than a bottle of vodka in one session. Of the 11-13 year-olds who state that they drink regularly, the majority claim to consume more than 10 units of alcohol a week with the result that now children as young as 12 are being diagnosed as alcoholics. Scientists have recently warned that teenagers who drink heavily are risking permanent brain damage, in particular to their brain function as alcohol has been shown to cause significant memory loss in youngsters; a condition that has been proved to extend to adulthood. The Crime and Disorder Act 1998 defined antisocial behaviour as acting in a ‘manner that caused or was likely to cause harassment, alarm or distress to 3 CAMRA – The Campaign for Real Ale one or more persons not of the same household’. This can take a variety of forms including such acts as behaving in a drunk and disorderly, creating a public nuisance, graffiti and defacement of public property, harassment and, more seriously, assault and rape. Findings from the 2004 Home Office Crime and Justice survey found that youths who indulged in underage consumption of alcohol were more likely to offend or suffer an offence. It was reported that who drank alcohol once a week or more committed a disproportionate volume of crime, particularly amongst the young as alcohol-fuelled crime accounted for 37% of all offences reported by 10- to 17-year-olds. The Potential for Government Intervention In response to both changes in consumption and a public desire for action on antisocial behaviour the Government has sought to address the issue through budgetary measures. In the 2010 Budget, Chancellor Alastair Darling increased duty on cider by 10 per cent above the level of inflation with the result that the price of a litre of cider increased by 5p. By comparison, a 1 per cent increase in duty was made on beer, wine and spirits, adding 2p to a pint, 10p on a bottle of wine and 36p to a bottle of spirits. He also stated his intention to raise alcohol duties by 2 per cent above the rate of inflation for two more years from 2013. In targeted attempt to reduce the consumption of the very strongest ciders, it was also announced in the Budget that the very definition of cider will be changed so that higher-strength versions can be taxed more. Alistair Darling, the Chancellor at the time, suggested that the increase in cider duty would reduce the number of people abusing high-strength alcoholic drinks, but cider producers said that it could damage the industry. In a report in the Times newspaper on March 25th 2010, Henry Chevallier, chairman of the National Association of Cider Makers, stated: “We are at saturation point on the duty on alcohol — even for a success story like cider. This dramatic increase could well reverse the growth we have generated in recent years. “Depending on how retailers deal with the duty it will add significantly to what consumers pay for a pint of cider. We have no control over the retail price of cider, but it could mean up to 10p a pint. What makes this so serious is that cider makers have invested millions to plant thousands of acres of new orchards in the last decade. Orchards take years to yield a return and the loss to the rural economy and the environment will be enormous if sales decline sufficiently and the demand for English apples falls.” THE OUTLOOK FOR THE FUTURE According to Mintel (2008), the outlook for the cider industry is challenging. In the past, increases in cider consumption such as those seen in recent years have been the result of short-term fads and are likely to be unsustainable. This, compounded with a difficult economic climate and Government initiatives to encourage the public to adopt more healthy modes of behaviour is likely to see sales of cider flatten or potentially tail off in years to come. In addition, the tough economic climate and the UK Government’s desire to reduce its budget deficit is likely to generate its own problems for the cider industry. Sharp increases in taxation on alcoholic drinks, including cider, offer the potential for multiple benefits. Not only would it generate valuable income, it might also dissuade binge drinking and with it reduce the estimated £3 billion that it costs the NHS to treat drink-related injuries and illnesses every year. However, all is not totally bleak for the cider industry. Over recent years the there has been strong growth in ‘artisan’-style products across all sectors. ‘Artisan’ products are those that are crafted using traditional methods and materials and this is an area in which many traditional cider makers have great expertise. In addition, sales in both the premium and the organic sectors have continued to grow albeit at a slightly reduced rate. Marking Guide First Class. 70%+ Distinctive submissions that demonstrate exceptional learning in ALL the following criteria: - Tasks in assessment brief are comprehensively addressed and of a consistently high standard; - Clear integration and substantiation of relevant marketing tools; - Submission has practical feasibility within industry context; - Conclusions drawn at various stages are sustainable and appropriate; - Effective and concise communication of ideas and written quality of report format and writing - Evidence of wider reading - Clear acknowledgement of ALL relevant academic sources using the HARVARD Referencing system where appropriate; - Outstanding presentation quality, structuring and written in language appropriate to a business environment Upper Second Class 60-69% Above average submissions that demonstrate substantial learning in ALL the following criteria: - Tasks in assessment brief are comprehensively addressed and of a consistently high standard; - Integration and substantiation of relevant marketing tools demonstrated; - Conclusions drawn at various stages are sustainable and appropriate, though the comprehensiveness of the coverage may not be clear; - Effective and concise communication of ideas and written quality of report format and writing; - Some evidence of wider reading - Clear acknowledgement of ALL relevant academic sources using the HARVARD Referencing system; - Strong presentation quality, structuring and appropriate business language. Lower Second Class 50-59% Average submissions that demonstrate broad learning across the assessment but with no outstanding areas: - Tasks in assessment brief are addressed and of an acceptable standard; - Integration and support of relevant marketing tools with no major omissions; - Effective and concise communication of ideas and written quality of report format and writing; - Minimal evidence of further reading having been undertaken; - Acknowledgement of majority of relevant academic sources using HARVARD Referencing system; Acceptable quality of presentation, structuring and minimal spelling/ grammatical errors. Third Class 40-49% Submissions indicate poor but adequate learning in the module: - Tasks in assessment brief are superficially covered, lacking in detail, with minimal supporting explanation given; - Main marketing tools are utilised but coverage and discussion weak; - Conclusions drawn at various stages are weak and without academic underpinning; - Sufficient communication of ideas and written quality of report format and writing, albeit weakly evidenced; - No evidence of wider reading; - Few academic sources cited and incorrect referencing system used; - Adequate level of presentation some structural, spelling and grammatical issues; Referred < 40% Submissions indicate minimal learning in the module: - Inability to address the tasks set out in the brief, coverage of material sparse; - Fails to answer the tasks set; - Minimal application of relevant marketing tools and misses key points; - Minimal / no indication that the student is aware of and can use module material; - Conclusions drawn at various stages are sustainable and appropriate; - Ideas and written quality of report format and writing not supported with appropriate evidence; - No evidence of wider reading - Inaccurate citing of academic sources; - Poor level of presentation, lacking structure, some structural, spelling and grammatical issues. Thompson, James (2008) ‘Lidl and Aldi see sales soar amid economic downturn’, The Independent, Weds, 25th June i