Community Empowerment (Scotland) Act 2015 Part 5: Asset

advertisement

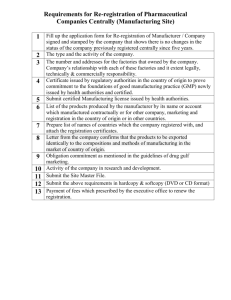

Community Empowerment (Scotland) Act 2015 Part 5: Asset Transfer Requests Implementation Discussion Paper 5 Assessment of benefits and valuation The price to be paid for an asset, or the level of rent, is a key issue for both relevant authorities and community bodies. The Act does not say how much should be paid, whether it should be at “market value” or at a discount. All relevant authorities have a duty to secure best value for the public money they receive. They have the ability to dispose of property at less than market value in certain circumstances, but there is limited guidance on adopting such an approach. Guidance will be needed on how a valuation of the property should be obtained, how any proposed discount on market value might be considered, and how the relevant authority can ensure that any benefits assessed as supporting the grant of a discount are actually realised. Funding organisations also need to be involved, as their grants may be subject to conditions about the valuation or any restrictions on title. We propose to establish an expert group to look at the issues covered by this paper. Non-financial benefit In reaching a decision on an asset transfer request (s.82) the relevant authority must consider whether agreeing to it would be likely to: promote or improve o economic development o regeneration o public health o social wellbeing o environmental wellbeing reduce inequalities of outcome which result from socio-economic disadvantage The authority must also make the decision in a manner which encourages equal opportunities and the observance of the equal opportunities requirements. It must also consider any other benefits that might arise if the request were agreed to, and compare these to the benefits of any other proposal. The request must be agreed to unless there are reasonable grounds for refusal. 1 We recognise that the assessment of non-financial benefits is a difficult area for relevant authorities. This is not a new issue, and there is a range of guidance and research available which could be drawn on. We will need to identify the most helpful approaches, and give relevant authorities comfort that they can clearly show how any discount achieves Best Value. This guidance will also need to be accessible to community bodies, so that they can clearly set out the benefits of their proposals. Some relevant authorities, such as local authorities, are likely to have a broad understanding of the whole range of public benefits. Other relevant authorities which have more limited functions may need assistance in this process from other bodies. Questions: How can we help public bodies in this task? Can Community Planning Partnerships help? What about those relevant authorities which are not CP Partners? Price The price obtained for the transfer will be part of the assessment of benefits, in terms of the outcomes which could be achieved by the use of those funds. It is recognised that public authorities need capital returns or rental income to fund new building or other services, and this is a legitimate consideration in the process. Community organisations can access a range of grant funding and have various options for income generation, including initiatives such as community renewables and community shares, as well as more traditional business like hire of premises and retail. However, relevant authorities should also take into account the benefits that may be gained from the community body’s proposals, such as improved health and wellbeing, economic regeneration and reduced demand for services. They should consider the community body’s circumstances and whether a discount may be justified in order to enable the asset transfer to go ahead and to realise those benefits to the community. Local authorities can dispose of land at less than market value, under the Disposal of Land by Local Authorities (Scotland) Regulations 2010. The regulations require them to consider whether the disposal is likely to promote or improve economic development or regeneration, health, social wellbeing or environmental wellbeing. These matters are also to be considered in deciding whether to agree to or refuse an asset transfer request. Other relevant authorities are subject to the Scottish Public Finance Manual. This states that “Where there are wider public benefits, consistent with the principles of Best Value, to be gained from a transaction, disposing bodies should consider 2 disposal of assets at less than Market Value. This includes supporting the acquisition of assets by community bodies, where appropriate.” Any disposal of property at less than market value must also take into account the rules on State Aid (see http://www.gov.scot/Topics/Government/State-Aid). There may also be other issues relating to competition or procurement to be considered. Where a discount is granted in recognition of other benefits to be achieved from the transfer, relevant authorities may wish to protect that funding, in case the expected benefits are not delivered. Mechanisms such as “clawback” may be used, requiring a percentage of the discount to be repaid if the property is sold, usually reducing over a number of years. Guidance will address how this can be implemented in a proportionate way, that is acceptable to funders and to regulators. 3