Donor Guidelines - Department of Health

advertisement

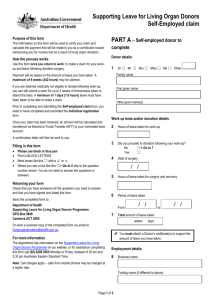

Supporting Leave for Living Organ Donors Donor Guidelines 1. What is the Supporting Leave for Living Organ Donors Programme? The aim of the Supporting Leave for Living Organ Donors Programme (the Programme) is to reduce financial stress associated with being a living organ donor, raise the profile of living organ donors and encourage employers to support employees who have chosen to donate an organ. The Programme provides a financial contribution to employers who have paid an employee for leave to attend medical appointments to assess their suitability to become a living organ donor (kidney or partial liver) and/or undergo and recover from living donor surgery in the form of paid leave, or an exgratia payment in lieu of paid leave. Payments are calculated for up to nine weeks of leave, based on a 38-hour week, at up to the National Minimum Wage. The payment to employers is to either replenish an employee's leave or contribute towards reimbursing the employer, where they have made a payment to their employee in place of income lost due to organ donation. 2. Why do we have the Programme? Living organ donation is major surgery and is not without risk to the donor. Prospective donors are required to undergo extensive testing to ensure they are physically and mentally able to donate. If surgery proceeds, the donor will require a significant amount of time off work to recover. Some donors may be required to take this period as leave without pay, or they may exhaust their paid leave entitlements. This can lead to financial stress with some donors feeling compelled to return to work against medical advice. The Programme is not an incentive to donate. It is designed to help support those people who wish to donate but cannot afford to due to loss of income and the financial stress it would cause for them and their family. Page | 1 3. Who can apply? To be eligible for the Supporting Leave for Living Organ Donors Programme you, the donor, must be: a) an Australian citizen or permanent resident with a valid Medicare card; b) 18 years of age or older; c) intending to donate a kidney or partial liver between 1 July 2015 and 30 June 2017; d) employed by: i. a registered Australian business; ii. the same employer (or self-employed) for at least 28 days prior (56 days prior for casual employees) to either signing the Individual Registration Form or the date of surgery (whichever was first); and iii. an employer willing to participate in the Programme and pay you for your time-off. The Department of Health will assess an applicant’s eligibility based on the information and evidence supplied on the Individual Registration Form. 4. What is acceptable evidence for eligibility? You must provide acceptable evidence with the Individual Registration Form to confirm you meet the eligibility requirements, including: a) Australian Citizenship/Residency A copy of your Medicare card should be provided so we can confirm your Australian citizenship or residency. b) Age You must provide your age on the Individual Claim Form and we will confirm this through your Medicare record. c) Intention to donate You must provide your proposed date of surgery on the Individual Claim Form. It must fall between 1 July 2015 and 30 June 2017. d) Employer Your employer’s ABN will be used to confirm you are employed by a registered Australian business. e) Length of time employed You must be employed by the same employer for at least 28 days (56 days for casual employees) prior to signing the Individual Registration Form or the surgery date (whichever was first). Suitable evidence includes payslips or a letter on your employer’s letterhead signed by a suitable office holder. f) Self-employed If self-employed, you must have been selfemployed for at least 28 days prior to signing the Individual Registration Form or the surgery date (whichever was first). Suitable evidence would be a business activity statement, tax return or profit and loss statement that includes advice on your period of self-employment. g) Income Suitable evidence is required to confirm the income you earned for the 28 days (56 days for casual employees) prior to signing the Individual Registration Form or the surgery date (whichever was first). Evidence can include payslips or a letter on your employer’s letterhead signed by a suitable office holder. 5. How can I register for the Programme? You should submit your registration for eligibility assessment and supporting documents prior to commencing leave for donation (but no more than 28 days prior to your surgery date). If the application is incomplete, the Department of Health will contact your for more information. 5.1 Full-time/part-time employees If you would like to register for the Programme, you must: discuss the initiative with your employer and ensure they agree to take part; download and complete the Individual Registration Form and get the form signed by your employer; attach suitable evidence (i.e. payslips) to your Individual Registration Form, that verify your employment status, average weekly hours and average weekly wage; and submit your form to the Department of Health by email or post. 5.2 Self employed If you are self-employed, in order for the Department of Health to assess your eligibility, as part of your Individual Registration Form you must include appropriate evidence of: the average number of hours you work per week; the average income you earn per week; and the length of time that you have been selfemployed. Appropriate evidence may include a business activity statement, or a tax return or profit/loss statement for the previous financial year. 5.3 Casual Employees If you are in casual employment, your Individual Claim Form must include details about the ex-gratia payment paid by your employer, broken down into work-up and donation / recovery. You can calculate your average weekly hours and ‘regular’ weekly income by averaging the weekly hours you worked and income you earned over the 8 weeks, or 56 days, prior to signing the Individual Registration Form or the surgery date (whichever was first). You should provide suitable evidence, such as payslips, to verify this information. 6. How will I know if I am eligible? Following the assessment of eligibility, you will be sent a letter to advise you of the outcome. If you are found to be eligible, your letter will include an Individual Claim Form for you to complete after you have completed your time-off. Your employer will also receive a letter to confirm your eligibility which will include an Employer Payment Form. If you are found not eligible, you and your employer will receive letters to advise you of this outcome. 7. Can I request a review on the decision of my eligibility? If you're not satisfied with the decision about your eligibility, you can ask for a review. After receiving the eligibility decision letter, you have 28 days to request a review. Page | 2 You can contact the Department of Health and request a review by telephone or in writing (contact details are at the end of the Guidelines). The request must state the reasons why you are asking for the decision to be reviewed. Your eligibility will be reviewed by a departmental officer who was not involved in the original decision and you will be advised of the outcome within 21 days. 7.1 What if I am not happy with the review outcome? The Commonwealth Ombudsman can investigate complaints about the actions and decisions of Australian Government agencies to see if they are wrong, unjust, unlawful, discriminatory or unfair. If you are not satisfied with the outcome of the review of your eligibility, you can contact the Ombudsman’s office through the Commonwealth Ombudsman website or by phoning 1300 362 072. 8. How can I make a claim? Following completion of your time away from work, if you have previously submitted an Individual Registration Form (and had your eligibility confirmed by the Department of Health), you can submit your Individual Claim Form. You can make a claim for leave taken to undergo work-up tests, donation and recovery or both. a) Work-up tests – time claimed must be a minimum of 1 day (7.6 hours) and a maximum of 2 weeks (76 hours). Claims can be made when donation does not proceed due to medical ineligibility. b) Donation – time claimed cannot exceed 9 weeks (342 hours). c) Work-up and donation – these can be claimed together, as long as the total period of leave does not exceed 9 weeks (342 hours) and is in accordance with (a) and (b) above. Note: Work-up only can only be claimed where donation did not proceed due to medical ineligibility. Where work-up testing occurred prior to 1 July 2015 and donation occurred on or after 1 July 2015, workup is not claimable. A person is only eligible to claim once for the Programme. The total claim cannot be more than nine weeks (342 hours) in a lifetime. Page | 3 You cannot submit a claim until you have completed all leave related to the donation and your employer has paid you for this time off work. The Department of Health cannot process your claim until we received all relevant information. If your claim is incomplete, we will contact you for the necessary information. All forms and evidence must be submitted by 30 September 2017 to be eligible for reimbursement under the Programme. 8.1 What if I cannot return to work after 9 weeks? In this situation, the donor and their employer can submit the claim after a period of 9 weeks leave is completed but before the donor returns to work. However, the employer must have paid the donor as per the requirements of the Programme. Payments under the Programme are limited to a maximum leave period of 9 weeks. 8.2 Steps in the Claim Process To submit a claim under the Programme, you must complete the Individual Claim Form that was mailed to you with the confirmation of your eligibility (or available for download on the Department of Health’s website). To complete this form, you must: arrange for relevant sections to be completed/signed by a donation professional; attach supporting documentation to verify the amount of leave taken (medical certificate); and submit your form to the Department of Health by email or post. 9. How is the payment calculated and when is it made? The payment will be calculated based on the average number of weekly hours you work and the hourly rate of pay (up to the National Minimum Wage) and the amount of time you took off work for the purpose of living organ donation (up to nine weeks). Your average weekly hours and rate of pay will be determined by the evidence you provided in your Individual Registration Form. No payments will be made directly to donors, with the exception of self-employed donors. The payment will be made to your employer when we have received your completed Individual Claim Form and the Employer Payment Form from your employer. You and your employer will be advised when we have made the payment and finalised your claim. Page | 4 Definitions Donor employee An employee who has undergone surgery for the purpose of donating a kidney or partial liver. Prospective donor Someone who has made a fully informed decision to undergo medical evaluation to be a living organ donor. Donation professional An employee of the hospital that is involved in the donation process eg. social worker, nurse, donation coordinator or clinician. Work-up Tests of physical and mental health that are taken to ensure the donor is medically suitable to proceed to donation Regular (hours) Casual employees should calculate their ‘regular’ hours by averaging their weekly hours worked over the 8 weeks, or 56 days, prior to submitting the Individual Registration Form. Ex-gratia payment For the purposes of this Programme, an ex-gratia payment is a sum of money provided as a favour (i.e. without there being any legal obligation or legal liability to do so) by an employer to an employee and at the discretion of the employer where the employee has no entitlement to paid leave. Living organ donor A person who donates a kidney or partial liver to someone with end stage kidney disease or liver failure. Page | 5 Where can I get more information? For further information about the Supporting Leave for Living Organ Donors Programme: Visit The Department of Health website Email livingorgandonation@health.gov.au Mail Department of Health Supporting Living Organ Donors Leave Programme GPO Box 9848 CANBERRA ACT 2601 Call Department of Health – (02) 6289 5055 Page | 6