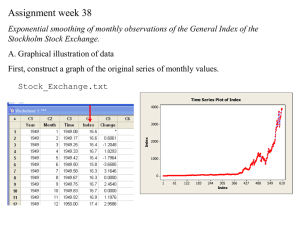

Page 135 number 12 General American Investors Co., a closed

advertisement

Page 135 number 12 General American Investors Co., a closed-end regulated investment management company, invest primarily in medium-and high-quality stocks. Jim Campbell is studying the asset value per share for this company and would like to forecast this variable for the remaining quarters of 1996. The data are presented in Table P-12. Evaluate the ability to forecast the asset value per share variable using the following forecasting methods: naïve, moving averages and exponential smoothing. When you compare this tecsniques, take into consideration that the actual asset value per share for the second quarter of 1996 was 26.47. write a report for Jim indicating which method he should use and why. Answer: Plot Time Series Plot of yt 32.5 30.0 27.5 yt 25.0 22.5 20.0 17.5 15.0 4 8 12 16 20 24 Index 28 32 36 40 44 1. With NAÏVE Method t naive1 yt (stationary ) 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 naive2 naive3 (trend) (seasonal) e1 e2 e3 16.98 - - - - - - 18.47 16.98 - - 1.49 - - 17.63 18.47 19.96 20.09075 -0.84 -2.33 -2.46075 20.65 17.63 16.79 16.8282 3.02 3.86 3.821798 21.95 20.65 23.67 24.18732 1.3 -1.72 -2.23732 23.85 21.95 23.25 23.33184 1.9 0.6 0.51816 20.44 23.85 25.75 25.91446 -3.41 -5.31 -5.47446 19.29 20.44 17.03 17.51755 -1.15 2.26 1.772449 22.75 19.29 18.14 18.2047 3.46 4.61 4.545298 23.94 22.75 26.21 26.83061 1.19 -2.27 -2.89061 24.84 23.94 25.13 25.19225 0.9 -0.29 -0.35225 16.7 24.84 25.74 25.77383 -8.14 -9.04 -9.07383 18.04 16.7 8.56 11.22746 1.34 9.48 6.812544 19.19 18.04 19.38 19.48752 1.15 -0.19 -0.29752 18.97 19.19 20.34 20.41331 -0.22 -1.37 -1.44331 17.03 18.97 18.75 18.75252 -1.94 -1.72 -1.72252 18.23 17.03 15.09 15.2884 1.2 3.14 2.941603 19.8 18.23 19.43 19.51456 1.57 0.37 0.285443 22.89 19.8 21.37 21.50521 3.09 1.52 1.384789 21.41 22.89 25.98 26.46223 -1.48 -4.57 -5.05223 21.5 21.41 19.93 20.02569 0.09 1.57 1.474308 25.05 21.5 21.59 21.59038 3.55 3.46 3.459622 20.33 25.05 28.6 29.18616 -4.72 -8.27 -8.85616 20.6 20.33 15.61 16.49936 0.27 4.99 4.100643 25.33 20.6 20.87 20.87359 4.73 4.46 4.456414 26.06 25.33 30.06 31.14606 0.73 -4 -5.08606 28.89 26.06 26.79 26.81104 2.83 2.1 2.078962 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 forecas t 30.6 28.89 31.72 32.02733 1.71 -1.12 -1.42733 27.44 30.6 32.31 32.41121 -3.16 -4.87 -4.97121 26.69 27.44 24.28 24.60633 -0.75 2.41 2.083673 28.71 26.69 25.94 25.9605 2.02 2.77 2.749501 28.56 28.71 30.73 30.88288 -0.15 -2.17 -2.32288 25.87 28.56 28.41 28.41078 -2.69 -2.54 -2.54078 24.96 25.87 23.18 23.43336 -0.91 1.78 1.526635 27.61 24.96 24.05 24.08201 2.65 3.56 3.52799 24.75 27.61 30.26 30.54135 -2.86 -5.51 -5.79135 23.32 24.75 21.89 22.18625 -1.43 1.43 1.133745 22.61 23.32 21.89 21.97262 -0.71 0.72 0.637378 24.08 22.61 21.9 21.92162 1.47 2.18 2.158383 22.31 24.08 25.55 25.64557 -1.77 -3.24 -3.33557 22.67 22.31 20.54 20.6701 0.36 2.13 1.999896 23.52 22.67 23.03 23.03581 0.85 0.49 0.484191 25.41 23.52 24.37 24.40187 1.89 1.04 1.00813 23.94 25.41 27.3 27.45188 -1.47 -3.36 -3.51188 25.68 23.94 22.47 22.55504 1.74 3.21 3.124959 26.47 25.68 27.42 27.54647 0.79 Best Naive -0.95 -1.07647 Autocorrelation Function for naive1 (with 5% significance limits for the autocorrelations) 1.0 0.8 Autocorrelation 0.6 0.4 0.2 0.0 -0.2 -0.4 -0.6 -0.8 -1.0 1 2 3 4 5 6 Lag 7 8 9 10 11 9 10 11 Autocorrelation Function for n2 (with 5% significance limits for the autocorrelations) 1.0 0.8 Autocorrelation 0.6 0.4 0.2 0.0 -0.2 -0.4 -0.6 -0.8 -1.0 1 2 3 4 5 6 Lag 7 8 Autocorrelation Function for n3 (with 5% significance limits for the autocorrelations) 1.0 0.8 Autocorrelation 0.6 0.4 0.2 0.0 -0.2 -0.4 -0.6 -0.8 -1.0 1 2 3 4 5 6 Lag 7 8 9 10 11 But from the ACF plot we see that the seasonal naïve give the good forecast, all of the first six tome lags into the confidence interval. 2. With Moving averages method we use 4 quarter in length Moving Average Plot for yt 32.5 Variable Actual Fits Forecasts 95.0% PI 30.0 27.5 Mov ing A v erage Length 4 25.0 yt A ccuracy MAPE MAD MSD 22.5 20.0 17.5 15.0 1 5 Moving Average for yt Data Length NMissing yt 45 0 Moving Average Length 4 Accuracy Measures MAPE MAD MSD 9.31334 2.12848 6.92939 Moving Average Plot for yt MTB > MA 'yt' 4; SUBC> Forecasts 1. Moving Average for yt Data Length NMissing yt 45 0 Moving Average 10 15 20 25 Index 30 35 40 45 Measures 9.31334 2.12848 6.92939 Length 4 Accuracy Measures MAPE MAD MSD 9.31334 2.12848 6.92939 Forecasts Period 46 Forecast 24.6375 Lower 19.4781 Upper 29.7969 3. With single exponential smoothing Smoothing Plot for yt Single Exponential Method 32.5 Variable Actual Fits Forecasts 95.0% PI 30.0 27.5 Smoothing Constant Alpha 0.696098 25.0 yt Accuracy MAPE MAD MSD 22.5 20.0 17.5 15.0 1 5 10 15 Single Exponential Smoothing for yt Data Length yt 45 Smoothing Constant Alpha 0.696098 Accuracy Measures MAPE MAD MSD 8.42548 1.89435 5.46249 20 25 Index 30 35 40 45 Measures 8.42548 1.89435 5.46249 Forecasts Period 46 Forecast 25.2269 Lower 20.5858 Upper 29.8679 4. With Double Exponential Smoothing Smoothing Plot for yt Double Exponential Method 32.5 Variable Actual Fits Forecasts 95.0% PI 30.0 27.5 Smoothing Constants Alpha (lev el) 0.951666 Gamma (trend) 0.037978 yt 25.0 Accuracy MAPE MAD MSD 22.5 20.0 17.5 15.0 1 5 10 15 20 25 Index Double Exponential Smoothing for yt Data Length yt 45 Smoothing Constants Alpha (level) Gamma (trend) 0.951666 0.037978 Accuracy Measures MAPE MAD MSD 8.50550 1.87142 5.94963 Forecasts Period 46 Forecast 25.8330 Lower 21.2481 Upper 30.4178 30 35 40 45 Measures 8.50550 1.87142 5.94963 5. With Winter’s Method (multiplikatif) Winters' Method Plot for yt Multiplicative Method 32.5 Variable Actual Fits Forecasts 95.0% PI 30.0 27.5 Smoothing C onstants A lpha (lev el) 0.2 Gamma (trend) 0.2 Delta (seasonal) 0.2 yt 25.0 22.5 Accuracy Measures MA PE 11.6253 MA D 2.5842 MSD 10.2970 20.0 17.5 15.0 1 5 10 15 20 Winters' Method for yt Multiplicative Method Data Length yt 45 Smoothing Constants Alpha (level) Gamma (trend) Delta (seasonal) 0.2 0.2 0.2 Accuracy Measures MAPE MAD MSD 11.6253 2.5842 10.2970 Forecasts Period 46 Forecast 23.5163 Lower 17.1851 Upper 29.8474 25 Index 30 35 40 45 Moving average MSD 6.92939 MAPE 9.31334 MAD 2.12848 Forecast 24.6375 Single Exponential 5.46249 8.42548 1.89435 25.2269 Hol’t Method 5.94963 8.50550 1.87142 25.8330 Winter’s Method 10.2970 11.6253 2.5842 23.5163 Conclusion : according to the result of error and value of forecast we can see that the best method is Double exponential smoothing with forecast 25.83. Error = 26.47 – 25.83 = 0.64