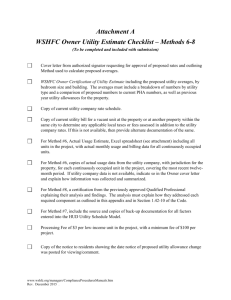

07362-15_15-0535.ord - Public Service Commission

advertisement