Internal Control for Schools - Department of Education and Early

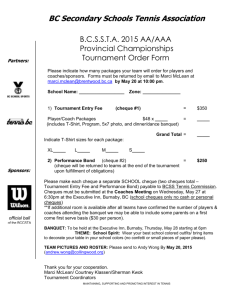

advertisement