Section by Section Summary 2013 HB 1

advertisement

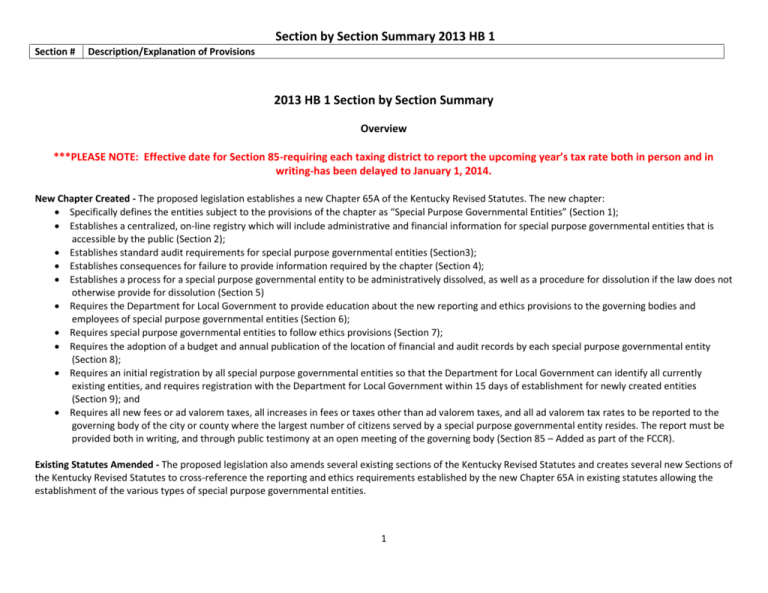

Section by Section Summary 2013 HB 1 Section # Description/Explanation of Provisions 2013 HB 1 Section by Section Summary Overview ***PLEASE NOTE: Effective date for Section 85-requiring each taxing district to report the upcoming year’s tax rate both in person and in writing-has been delayed to January 1, 2014. New Chapter Created - The proposed legislation establishes a new Chapter 65A of the Kentucky Revised Statutes. The new chapter: Specifically defines the entities subject to the provisions of the chapter as “Special Purpose Governmental Entities” (Section 1); Establishes a centralized, on-line registry which will include administrative and financial information for special purpose governmental entities that is accessible by the public (Section 2); Establishes standard audit requirements for special purpose governmental entities (Section3); Establishes consequences for failure to provide information required by the chapter (Section 4); Establishes a process for a special purpose governmental entity to be administratively dissolved, as well as a procedure for dissolution if the law does not otherwise provide for dissolution (Section 5) Requires the Department for Local Government to provide education about the new reporting and ethics provisions to the governing bodies and employees of special purpose governmental entities (Section 6); Requires special purpose governmental entities to follow ethics provisions (Section 7); Requires the adoption of a budget and annual publication of the location of financial and audit records by each special purpose governmental entity (Section 8); Requires an initial registration by all special purpose governmental entities so that the Department for Local Government can identify all currently existing entities, and requires registration with the Department for Local Government within 15 days of establishment for newly created entities (Section 9); and Requires all new fees or ad valorem taxes, all increases in fees or taxes other than ad valorem taxes, and all ad valorem tax rates to be reported to the governing body of the city or county where the largest number of citizens served by a special purpose governmental entity resides. The report must be provided both in writing, and through public testimony at an open meeting of the governing body (Section 85 – Added as part of the FCCR). Existing Statutes Amended - The proposed legislation also amends several existing sections of the Kentucky Revised Statutes and creates several new Sections of the Kentucky Revised Statutes to cross-reference the reporting and ethics requirements established by the new Chapter 65A in existing statutes allowing the establishment of the various types of special purpose governmental entities. 1 Section by Section Summary 2013 HB 1 Section # Description/Explanation of Provisions Location of Public Hearing for Special Purpose Governmental Entities Subject to KRS 132.023 – KRS 132.010, 132.023, and 132.024 are amended to require that any public hearing required by KRS 312.023 must be held on the same day, at the same place, and immediately prior to a regularly scheduled meeting of the governing body of the city or county where a majority of the population served by the special purpose governmental entity resides (Sections 86, 87, and 88 – Added as part of the FCCR). Fiscal Provisions – The proposed legislation: Annual Registration Fee - Provides for an annual registration fee to be paid by all special purpose governmental entities with the fee increasing based on the revenues of the special purpose governmental entity. The fee will offset the costs of the DLG and the Auditor of Public Accounts in administering the provisions of Chapter 65A, and may be amended one timeas those costs increase or decrease (Section 2) Current Fiscal Biennium Appropriation – Appropriations are made to the Auditor and DLG to offset start up costs. 2 Section by Section Summary 2013 HB 1 Section # 1 2 3 4 Description/Explanation of Provisions Establishes new KRS Chapter 65A Definitions - Defines terms used in the chapter, including “Special Purpose Governmental Entity” which incorporates entities that are defined in existing law as “districts”, “special districts”, “taxing districts”, and “nontaxing districts” , as well as entities that have similar characteristics but were not previously included. Also defines “fees”. Central Registry Establishment and Reporting Requirements Requires the DLG to: o Create forms for reporting and make those forms available by March 1, 2014; o Establish an on-line central registry, which shall be available to the public on or before October 1, 2014; o Establish, via regulation, reporting requirements and timelines Requires special purpose governmental entities to report administrative and financial information for publication on the registry Imposes a registration fee to support administration of the system. The DLG may amend the fee one time as costs change. The fee also covers expenses incurred by the Auditor of Public Accounts. Audit Requirements Applies for fiscal periods beginning on or after July 1, 2014 Establishes a tiered set of requirements depending on the greater of annual receipts or expenditures, with smaller entities being subject to agreed upon procedures every 4 years, and the largest entities being subject to annual audits Reduces the level at which annual audits are required to $500,000 of annual receipts or expenditures (for those entities subject to the current law, the level is set at $750,000, so this change increases the number of entities that will be subject to annual audit) Allows 12 months for completion of the audit or agreed upon procedures Requires the audit or special procedures to be vailable on the registry If existing law requires more stringent audit provisions, the more stringent provisions will apply. Compliance Provisions If a SPGE fails to submit information in a timely manner or submits noncompliant information the following occurs: The DLG notifies the SPGE and the establishing entity in writing that the SPGE has failed to submit the required information and provides 30 days for the SPGE to comply. The notice will also identify the consequences for failing to comply; If the information is not submitted, the DLG shall: o Notify the Auditor, who shall then inform the SPGE that it will be subject to an audit at its expense at the SPGE’s expense; o Notify the governing body or bodies in the county or counties in which the SPGE operates of the noncompliance o Notify any state level entity to which the SPGE reports of the noncompliance; o Notify the Finance and Administration Cabinet, which shall notify all state agencies and entities to withhold all funds otherwise due the SPGE; and o Publish a notice of noncompliance in the newspaper of general circulation in the area where the SPGE operates A private right of action is also provided for citizens owning property or living within the area served by the SPGE 3 Section by Section Summary 2013 HB 1 Section # Description/Explanation of Provisions 5 Dissolution Provisions - This section establishes two types of dissolution procedures – administrative dissolution for entities that have discontinued operations, or that are chronically noncompliant with reporting requirements, and general dissolution for entities for which no dissolution provisions currently exist in the statutes. Administrative Dissolution Can be initiated by the DLG, by the governing body of the establishing entity, if there is no establishing entity, by the county in which the SPGE is located, or by the governing body of the SPGE; Process requires publication of notice of dissolution on the registry, and in most cases in the newspaper, as well as the mailing of a copy of the notice; If the entity for which dissolution is sought is providing services, has outstanding liabilities or owns assets, the entity seeking dissolution must develop a dissolution plan; After passage of 30 days with no objection and satisfaction of outstanding obligations, the entity shall be deemed dissolved If objections are received, the administrative process shall be aborted, and instead the process established for other general dissolutions shall be followed. General Dissolution May be initiated by the governing board of the SPGE with approval of the governing body of the establishing entity, or the establishing entity; Requires the development of a dissolution plan, publication of the intent to dissolve, and a public meeting Education Provisions – Requires the DLG to provide or to arrange for the provision of education for the governing bodies of SPGEs and their employees. Ethics Provisions – Requires SPGEs to follow ethics provisions. Allows a SPGE to adopt more stringent ethics provisions and requires those to be filed with the DLG if adopted. Budget Adoption and Publication Requirements – Requires adoption of a budget by all SPGEs before money can be spent and requires annual publication of the location where SPGE fiscal documents can be reviewed. Initial Registration Requirements – Requires all SPGEs to register with the DLG on or before December 31, 2012. Requires ADDs, KACO, the League of Cities and the Auditor of Public Accounts to assist the DLG in publicizing the requirements. Prohibits any entity failing to register from expending any funds and establishes a private right of action to enforce the provisions. 6 7 8 9 SECTIONS 10 – 84 ARE CONFORMING AMENDMENTS 10 11 12 13 Amend KRS 65.003 – Existing ethics provisions – to incorporate the provisions of Section 7 of the Act relating to SPGEs. Amend KRS 65.005 – Existing requirements for reporting to the County Clerk – New language transitions the reporting requirements from this section to the provisions of Sections 1-9 of the Act Amend KRS 65.065 – Existing budget requirements and audit requirements for some but not all SPGEs – New language transitions the reporting requirements from this section to the provisions of Sections 1-9 of the Act Amend KRS 65.070 – Existing administrative filing requirements for some but not all SPGEs - New language transitions the reporting requirements 4 Section by Section Summary 2013 HB 1 Section # 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 Description/Explanation of Provisions from this section to the provisions of Sections 1-9 of the Act Amend KRS 65.117 – DLG provision relating to financing obligations – the language is amended to apply to special purpose governmental entities. Amend KRS 65.900 – Definition of entities subject to the UFIR filing requirements, which under existing law includes only those districts with the authority to levy ad valorem taxes. Language is included to transition all special districts to the SPGE reporting requirements established by Sections 1-8 of the Act. Amend KRS 65.905 – UFIR requirements – amend to transition all special districts to the SPGE reporting requirements established by Sections 1-8 of the Act. Amend KRS 39F.160 – Rescue Squad Taxing Districts – Amend to require compliance with Sections 1-9 of the Act Amend KRS 43.070 – Powers and Duties of the Auditor of Public Accounts to clarify the authority of the Auditor to audit the accounts of SPGEs at the expense of the SPGE. Amend KRS 43.075 to conform with the changes made in Section 18 of the Act Create a new section of KRS 65.180 to 65.192 – General Provisions for the Creation of Taxing Districts to require compliance with Sections 1-9 of the Act Create a new section of KRS 65.350 to 65.375 relating to Land Bank Authorities to require compliance with Sections 1-9 of the Act Amend KRS 65.530 relating to Riverport Authorities to require compliance with Sections 1-9 of the Act Create a new section of KRS 65.660 to 65.679 relating to Emergency Services Boards to require compliance with Sections 1-9 of the Act Amend KRS 65.8925 relating to Regional Waste Water Commissions to conform existing web publication requirements with the new provisions required by Section 2 of the Act, and to require compliance with the provisions of Sections 1-9 of the Act. Create a new section of KRS 68.600 to 68.606 relating to Industrial Taxing Districts to require compliance with Sections 1-9 of the Act Amend KRS 74.070 relating to water districts to require compliance with Sections 1-9 of the Act Amend KRS 75.430 relating to fire departments created under KRS Chapter 273 to require compliance with Sections 1-9 of the Act, and to delete the provisions requiring filing of the annual filing with the SOS with the state fire commission. Note fire protection districts and volunteer fire departments are required by KRS 65.255 to follow the audit and reporting requirements of KRS 65.065. Since that section is amended as Section 12 of this Act, these entities will be subject to the provisions of Sections 1-8 of this Act by those amendments and therefore KRS 65.255 does not need to be amended in this Act Create a new provision of KRS 76.005 to 76.230 relating to metropolitan sewer districts to require compliance with Sections 1-9 of the Act Create a new section of KRS 76.213 to 76.240 relating to metropolitan sewer districts to require compliance with Sections 1-9 of the Act. Create a new provision of KRS 76.274 to 76.279 to relating to metropolitan sewer districts to require compliance with Sections 1-9 of the Act Create a new provision of KRS 76.295 to 76.420 relating to metropolitan sewer districts to require compliance with Sections 1-9 of the Act Amend KRS 77.135 relating to Air Pollution Control Districts to require compliance with Sections 1-9 of the Act Amend KRS 77.140 relating to Air Pollution Control Districts to reference audit or agreed upon procedures established by Section 3 of the Act Create a new provision of KRS 80.262 to 80.300 relating to City County Housing Authorities to require compliance with Sections 1-9 of the Act Create a new provision of KRS 80.310 to 80.610 relating to County and Regional Housing Authorities to require compliance with Sections 1-9 of 5 Section by Section Summary 2013 HB 1 Section # Description/Explanation of Provisions the Act 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 Amend KRS 91.758 relating to management districts in cities of the first class and urban county governments to require compliance with Sections 1-9 of the Act Amend KRS 91.760 relating to management districts in cities of the first class and urban county governments to require compliance with Sections 1-9 of the Act Amend KRS 91A.360 relating to Tourist and Convention Commissions to require compliance with Sections 1-9 of the Act Amend KRS 91A.370 relating to Tourist and Convention Commissions to require compliance with Sections 1-9 of the Act Amend KRS 91A.372 relating to Tourist and Convention Commissions in urban-county governments to require compliance with Sections 1-9 of the Act Amend KRS 91A.380 relating to Tourist and Convention Commissions in multiple counties to require compliance with Sections 1-9 of the Act Amend KRS 91A.570 relating to management districts in cities of the 2nd to 6th Classes to require compliance with the budget provisions of Sections 1-9 of the Act Amend KRS 91A.575 relating to management districts in cities of the 2nd to 6th Classes to require compliance with Sections 1-9 of the Act Amend KRS 96A.190 relating to Mass Transit Authorities to require compliance with Sections 1-9 of the Act Amend KRS 97.095 relating to Regional Parks Authorities to require compliance with Sections 1-9 of the Act Amend KRS 97.120 relating to City Recreational Commissions to require compliance with Sections 1-9 of the Act Amend KRS 97.600 relating to City Park Boards to require compliance with Sections 1-9 of the Act Amend KRS 97.720 relating to War Memorial Commissions to require compliance with Sections 1-9 of the Act Amend KRS 104.610 relating to Flood Control Districts to require compliance with Sections 1-9 of the Act Amend KRS 107.380 relating to Community Improvement Districts to require compliance with Sections 1-9 of the Act Create a new provision of KRS 108.010 to 108.075 relating to Urban Service Districts to require compliance with Sections 1-9 of the Act Create a new provision of KRS 108.080 to 108.180 relating to Ambulance Services Districts to require compliance with Sections 1-9 of the Act Create a new provision of KRS Chapter 109 relating to Solid Waste Management Districts to require compliance with Sections 1-9 of the Act Amend KRS 147.635 relating to Area Planning Districts to require compliance with Sections 1-9 of the Act Amend KRS 147A.021 relating to the Department for Local Government to add administering the provisions of Sections 1 to 9 of the Act to the duties of the DLG Amend KRS 147A.090 relating to Area Development Districts to require compliance with Sections 1-9 of the Act Create a new provision of Subtitle 50 of KRS Chapter 154 relating to Industrial Development Authorities to require compliance with Sections 1-9 of the Act Amend KRS 164.655 relating to Cooperative Extension Service Districts to require compliance with Sections 1-9 of the Act and to delete existing publication and notice requirements. Create a new provision of KRS Chapter 173 relating to library districts created by cities to require compliance with Sections 1-9 of the Act Amend KRS 173.570 relating to Library districts to require compliance with Sections 1-9 of the Act and to delete existing filing requirements with 6 Section by Section Summary 2013 HB 1 Section # Description/Explanation of Provisions the county clerk. 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 Amend KRS 173.770 relating to library districts formed by petition to require compliance with Sections 1-9 of the Act and to delete existing filing requirements with the county clerk. Create a new provision of KRS 183.132 to 183.165 relating to Local Air Boards to require compliance with Sections 1-9 of the Act Amend KRS 184.080 relating to Public Road Districts to require compliance with Sections 1-9 of the Act Amend KRS 210.400 relating to Community Mental Health Boards to require compliance with Sections 1-9 of the Act Amend KRS 212.500 relating to Public Health Commissions in Cities of the 1st Class to require compliance with Sections 1-9 of the Act Amend KRS 212.639 relating to Public Health Commissions in Urban-county governments to require compliance with Sections 1-9 of the Act Create a new provision of KRS 212.720 to 212.760 relating to Public Health Taxing Districts to require compliance with Sections 1-9 of the Act Amend KRS 212.794 relating to Independent Health Districts to require compliance with Sections 1-9 of the Act Amend KRS 216.343 relating to Hospital Districts to require compliance with Sections 1-9 of the Act Amend KRS 220.544 relating to Sanitation Districts to require registration under Section 9 of the Act, compliance under Sections 1 to 8 of the Act, and coordination of publication requirements Amend KRS 262.097 relating to Soil Conservation Districts to require compliance with Sections 1-9 of the Act Amend KRS 262.280 relating to Soil Conservation districts to amend audit provisions to comply with the provisions of Section 3 of the Act Amend KRS 262.760 relating to watershed conservancy districts to require budgets to be submitted under Section 2 of the Act Amend KRS 262.763 related to watershed conservancy districts to require compliance with Sections 1-9 of the Act Amend KRS 266.120 relating to Levee Districts to require compliance with Sections 1-9 of the Act Create a new provision of KRS Chapter 267 relating to Drainage Districts to require compliance with Sections 1-9 of the Act Create a new provision of IRS Chapter 268 relating to Drainage and Levy Reclamation Districts to require compliance with Sections 1-9 of the Act Amend KRS 268.170 relating to Drainage Levy and Reclamation Districts to require budgets to be submitted as required by Section 2 rather than publication. Create a new provision of KRS Chpater 269 relating to Drainage Taxing Districts to require compliance with Sections 1-9 of the Act Amend KRS 273.441 relating to Community Action Agencies to require compliance with Sections 1-9 of the Act Amend KRS 6.764 relating to legislative appointments to reference definition of Special Purpose Governmental Entity Amend KRS 64.012 relating to county clerk fees to amend reference to KRS 65.070 Amend KRS 136.602 relating to local utilities taxes to amend reference to KRS 65.005 Amend KRS 65.009 relating to ex officio members of taxing districts to provide that the section does not apply to a district established by a city or cities. Creates a new section of KRS Chapter 65A to require all new fees or ad valorem taxes, all increases in fees or taxes other than ad valorem taxes, and all ad valorem tax rates to be reported to the governing body of the city or county where the largest number of citizens served by a special purpose governmental entity resides. The report must be provided both in writing, and through public testimony at an open meeting of the 7 Section by Section Summary 2013 HB 1 Section # Description/Explanation of Provisions governing body (Added as part of the FCCR). ***EFFECTIVE DATE HAS BEEN DELAYED TO JANUARY 1, 2014. 86 87 88 89 90 Amend KRS 132.010 to add definitions for “taxing district” and “special purpose governmental entity” and to amend the definitions for “county”, “Fiscal court” and “county judge executive. Amend KRS 132.023 to require any public hearing to be held on the same day and in the same place, immediately before a regularly scheduled meeting of the governing body of the city or county. Amend KRS 132.024 to conform. Current Biennium Expenditure Appropriation to DLG and the Auditor EMERGENCY – Declare an emergency so that the proposed legislation will become effective upon its passage and approval by the Governor or upon its otherwise becoming law 8