Job Description for CFO Organizational Information: Budget $13

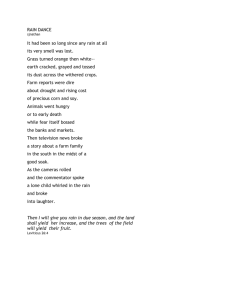

advertisement

Job Description for CFO Organizational Information: Budget $13 million plus Website: www.raininc.org Mission Statement: Our mission is to deter the institutionalization of the elderly by providing services and supports that will enable them to live in their homes with dignity and respect. Currently, R.A.I.N. is the largest provider of social services for seniors in the Bronx. We have 21 service sites throughout the Bronx and one in upper Manhattan through which we offer a comprehensive continuum of services to help seniors live safely and independently in their homes. With over 1,800 employees, R.A.I.N. serves an estimated 30,000 individuals annually through its programs. We have one of the largest home attendant and personal care services for homebound persons in the City, in addition to a home‐delivered meal program, 13 senior centers, case management services, transportation services, elder abuse services and two housing developments with over 156 units for low‐income seniors. We work closely with the leaders and residents of the neighborhoods we serve, and with other community organizations and government agencies. R.A.I.N. has strong partnerships with elected and public officials within the communities in which we are located. We are wellknown, respected and highly regarded for our provision of excellent, quality programs and services for the elderly and their families. Position Details/Job Description: RAIN Finance Department seeks a CFO, who will have overall responsibility for the RAIN Finance Department. This position will report to the Executive Director and the RAIN Board of Directors. Responsibilities: Direct and manage the accounting and financial operations of RAIN, Inc.; Direct, manage and oversee the staff accountants in the performance of their duties; Prepare annual budget for Board approval Oversee accounts payable, billing and receivables; Ensure correctness of general ledger and financial reports; Account for RAIN investment activities; Coordinate year-end audits, including preparation of schedules and other documents pertaining to audits; Ensure timely submission of annual tax forms; Coordinate the monthly general ledger closing schedule; Ensure the preparation of bank reconciliation; Prepare monthly financial statements for the Board of Directors; Monitor payroll activities; and Review transaction data for accuracy, adequateness of documentation and conformity to the charts of accounts. Benefits: Salary: low 100’s Health Insurance Dental Insurance Vision Pension Plan Generous Vacation and Sick Time Qualifications: 5 Years+ of experience on a supervisory level CPA or Masters level in accounting and finance Non-profit accounting experience required Ability to work in a hands-on fast-pace environment Strong organizational, problem solving, and analytical skills Strong communication and H.R. skills 2