HW-7 Solution

advertisement

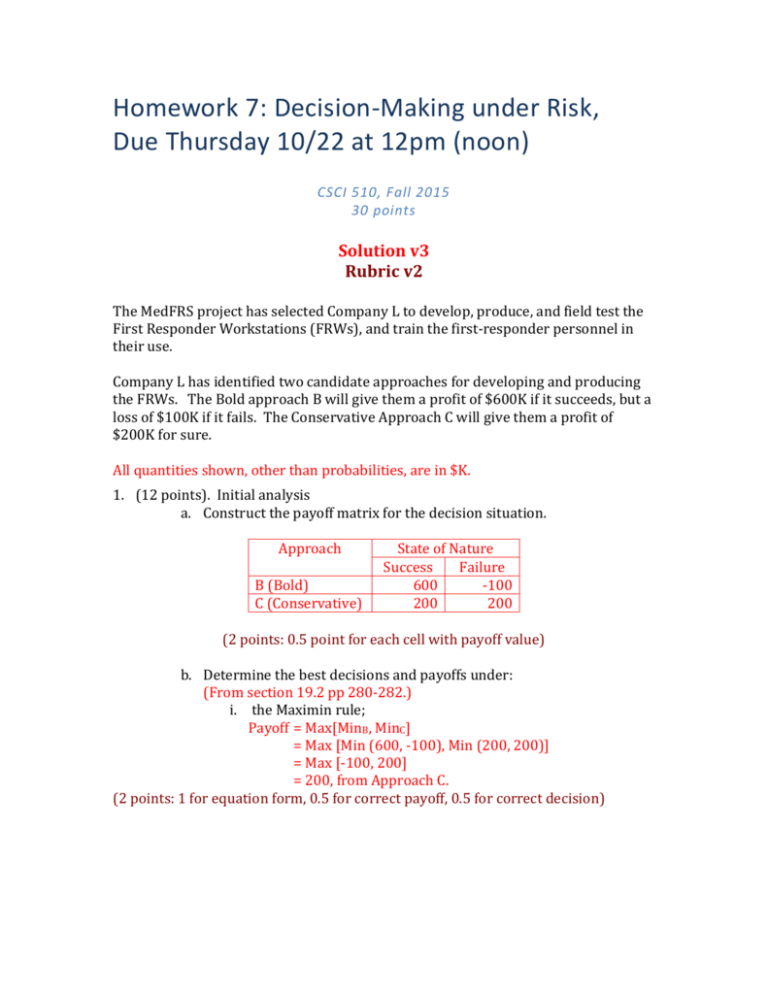

Homework 7: Decision-Making under Risk, Due Thursday 10/22 at 12pm (noon) CSCI 510, Fall 2015 30 points Solution v3 Rubric v2 The MedFRS project has selected Company L to develop, produce, and field test the First Responder Workstations (FRWs), and train the first-responder personnel in their use. Company L has identified two candidate approaches for developing and producing the FRWs. The Bold approach B will give them a profit of $600K if it succeeds, but a loss of $100K if it fails. The Conservative Approach C will give them a profit of $200K for sure. All quantities shown, other than probabilities, are in $K. 1. (12 points). Initial analysis a. Construct the payoff matrix for the decision situation. Approach B (Bold) C (Conservative) State of Nature Success Failure 600 -100 200 200 (2 points: 0.5 point for each cell with payoff value) b. Determine the best decisions and payoffs under: (From section 19.2 pp 280-282.) i. the Maximin rule; Payoff = Max[MinB, MinC] = Max [Min (600, -100), Min (200, 200)] = Max [-100, 200] = 200, from Approach C. (2 points: 1 for equation form, 0.5 for correct payoff, 0.5 for correct decision) ii. the Maximax rule; and Payoff = Max[MaxB, MaxC] = Max [Max (600, -100), Max (200, 200)] = Max [600, 200] = 600, from Approach B. (2 points: 1 for equation form, 0.5 for correct payoff, 0.5 for correct decision) iii. the Laplace rule. EVLaplace (Approach) = 0.5 * Success_Payoff (Appproach) + 0.5 * Failure_Payoff (Approach). EVLaplace (B) = 0.5 * 600 + 0.5 * (-100) = 300 – 50 = 250. EVLaplace (C) = 0.5 * 200 + 0.5 * 200 = 200. Decision = B with payoff 250, because 250 > 200. (3 points: 1 for equation form, 1 for correct payoff, 1 for correct decision) c. Determine the breakpoint probability of Bold approach success above which the Bold approach will be preferable. (From section 19.3 pp 282-283.) Let PSuc = the probability of success; then Payoff (B) = PSuc * 600 + (1 - PSuc) * (-100) = PSuc * 700 - 100, and Payoff (C) = PSuc * 200 + (1 - PSuc) * 200 = 200. The breakeven probability is the value of PSuc where Payoff (B) = Payoff (C). Solving: PSuc * 700 - 100 = 200; PSuc = 300 / 700 = 0.428571 approximately. (3 points: 2 for equation form/method (multiple methods possible), 1 for correct answer) 2. (12 points). Value of perfect information (From section 20.7 pp 294-295.) a. Determine the Expected Value of Perfect Information (EV)perfect info: the payoff if Company L had perfect information about the success or failure of the Bold approach. Assume that the original success or failure probabilities were equally likely at 0.5 each. (From equation 20-7.) (EV)perfect info = P(Success) * max (values of Success outcomes) + P(Failure) * max (values of Failure outcomes) = 0.5 * max (600, 200) + 0.5 * max (-100, 200) = 0.5 * 600 + 0.5 * 200 = 400. (5 points: 3 for equation form, 2 for correct answer) b. Determine the Expected Value of No Information (EV)no info: the payoff if Company L had no information about the success or failure of the Bold approach. Assume that the original success or failure probabilities were equally likely at 0.5 each. (From equation 20-6.) (EV)no info = max (EV(B), EV(C)) = max (0.5 * 600 + 0.5 * (-100), 200) = max (250, 200) = 250. (5 points: 3 for equation form, 2 for correct answer) c. Determine the Expected Value of Acquiring Perfect Information (EVPI): the maximum investment in acquiring information on the success of the Bold approach that would be worth doing. (From equation 20-8.) EVPI = (EV)perfect info - (EV)no info = 400 - 250 = 150. (2 points: 1 for correct answer according to student numbers, 1 for numerically correct answer) 3. (6 points). RRL for prototypes Company L also identifies two levels of prototyping that would buy information to reduce the risk of proceeding with no information. Prototype X would cost $20K and reduce the risk of B failing from $100K to $50K. Prototype Y would cost $40K and reduce the risk from $100K to $20K. (From Risk Analysis lecture (EC-11) slide 40.) a. Compute the Risk Reduction Leverage (RRL) for Prototypes X and Y. RRL = Risk Reduction Leverage; RE = Risk Exposure. RRL = (REBefore – REAfter) / Risk Reduction Cost. REBefore = 100. RRL(X) = (100 – 50) / 20 = 2.5. RRL(Y) = (100 – 20) / 40 = 2.0. (2 points: 1 for equation form, 1 for correct answer) b. Identify which is the better investment. Since RRL(X) > RRL(Y), Prototype X is the better investment. (2 points: 1 for correct answer according to student numbers, 1 for numerically correct answer)