CITY OF ST CLAIR, MICHIGAN CITY COUNCIL 2013

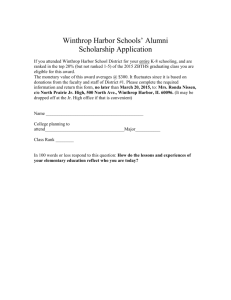

advertisement

CITY OF ST CLAIR, MICHIGAN CITY COUNCIL 2013-2014 BUDGET WORKSHOP MONDAY, APRIL 29, 2013 MUNICIPAL BUILDING, 547 N CARNEY DRIVE Mayor Pro Tem LaPorte called the second 2013-2014 Budget Workshop to order in the Council Chambers of the Municipal Building, 547 North Carney Drive, St Clair MI 48079 at 6:05 pm, for the purpose of giving a brief overview of portions of the proposed Fiscal Year 2013-14 budget, including enterprise funds, and discussion of critical funds and other concerns. PRESENT: Members Burns, Foley, Kindsvater, Krebs, LaPorte, McCartney. ABSENT: Mayor Cedar. ADMINISTRATION: Mike Booth, City Superintendent; Lynne Houston, City Assessor; Stephanie Schriner, Harbormaster; DJ Boulier, Building Inspector; Janice Winn, City Clerk. ALSO PRESENT: Bill Klieman. McCartney moved, Krebs seconded, CARRIED, to record the absence of Mayor Cedar as excused. City Assessor Housing gave a history of tax revenue over the past five years and other fund projections that would impact the tax structure for 2013-14. Property Values - Since 2008, the City has lost $65 million dollars (26%) of taxable value, which represents $800,000 in tax revenue. Projections are that another $89,000 will be lost this year. The majority of the loss is in personal property taxes. Real property values are starting to gain gradually, but are still expected to decrease another 4.5% this year. Member McCartney questioned property value trends and foreclosures. There is a good trend that values are starting to come up and foreclosures are decreasing, and bank-held homes are selling for more than before. Residential sales values seem to be increasing, commercial properties held steady, and industrial property values were down. Personal Property Taxes - Members Burns questioned elimination of the personal property tax at the state level and replacement options. No final decisions have been made, but originally it was the state’s intent to phase-in elimination of the tax for any industrial properties with $40,000 or less in personal property. Currently those properties generate $17,000 annually in revenue. Taxes would continue to be assessed on any property with personal property above $40,000. The city will need to decide whether to mail personal property tax statements prior to August 1 st with the summer tax bills and await final instructions from the state. If all personal property taxes were eliminated at once, the city could lose as much as $418,000 in tax revenue. DDA – The DDA tax capture table was based on 2002 property values which were increasing at a rate of 2.5% per year. Values have consistently decreased since then and in addition, this year two large MI Tax Tribunal cases are in the DDA district which could result in additional losses. Most of the loss is in personal property. The city is still capturing $978,000 in taxable value in the DDA district, which equates to just over $20,218 in revenue. However, the DDA has a $38,000 commitment to pay the city back for a $165,000 loan for the Clinton Ave streetscape project, which has a current balance of $85,600. Annual payments may need to be reduced and spread out over a longer term because of this negative fund balance. Budget numbers will be updated to reflect those changes. Member Kindsvater asked administration to explore the requirements and benefits to temporarily suspend the DDA until the economy improves, and also discussed their expenses and funding sources. MI Tax Tribunal Cases – Of the six Tax Tribunal appeals outstanding, three were stipulated and settled, and the other three are pending. The city needs to look at what it stands to lose in a worse-case scenario and project the budget revenues accordingly. Industrial Properties – Industrial property tax revenue is still decreasing but the rate of decline is not as great, and may even turn positive next year. Once-vacant industrial properties are starting to fill up and other companies are constructing additions. The renewable energy credit for the former Blue Water Plastics Co site on Whiting St was revoked because the recipient did not fulfill obligations. The City Assessor left following this portion of the agenda (6:31 pm) Harbor Fund – Operations produced positive cash flow of $86,722 in 2011-12, but overall cash decreased $73,151 as a result of the floating dock project. Since the beginning of the year, $76,898 has been received from the state grant for the floating docks project, and the DDA contributed $82,906, which made the project possible. Without the contribution, the fund would have been negative This reverses an overall decrease in fund balance in 2011-12. The current budget proposal should produce positive cash flow of $25,000. The ramp extension funds will be taken from the 2012-13 budget year. Overall, the harbor staff is practicing good financial management with the stability of harbor operations and income. City Superintendent reviewed harbor operating expenses and explained depreciation logic and its application to operations. Depreciation is a tool used to offset the useful life of the asset with the goal of continually adding to cash balance to avoid having to borrow money when the life of the asset is expended and it needs to be replaced. Bill Klieman, 1374 S Riverside Ave, questioned how depreciation is accounted for in both the expense side and the debt side of the budget. The current budget proposal does not include any funds for dredging if a grant requiring match money were to become available. City Superintendent may have to ask for budget adjustments if that opportunity arises. Harbormaster Schriner indicated that approximately $200,000 $250,000 is needed to dredge all areas adequately, and the city is not eligible to receive federal funds in 2013 because St Clair is not designated as an at-risk harbor or in danger of closing. The harbor completed a dredging project at a cost of $120,000 two years ago. Council discussed the affects of dredging on pilings and structural concerns that could arise if the river bottom continues to be repeatedly dredged, or if the harbor of refuge designation could be lost if the city did not dredge. Debris in the harbor is now being cleaned out of the harbor by volunteers at significant cost savings. Bill Klieman questioned whether the harbor seeks competitive bids for fuel. A current fuel supply agreement is in place and once it expires in one to two years, the city will seek bids. The gasoline supply contract covers wholesale price plus a hauling fee. Member Foley discussed kayaking and the use of kayaks by inexperienced boaters. It was suggested that kayaks only be allowed in the Pine River and a policy and enforcement practice be set up to decrease exposure to liability. Sewer Fund - Rates were not increased in 2012-13, but are scheduled to be adjusted in 201314. Repayment of the $1.8 million SRF loan for open-cut and sewer lining improvements begins in 2013, with interest and debt payments amounting to $115,000 per year. City Superintendent will look at adjusting rates after looking at available cash, but it is possible that rates will not increase in 2013-14. Member Kindsvater questioned the sewer use contract with St Clair Township and inconsistency in sales. A rate adjustment is made yearly in May following a review of the usage. The contract is based on cost and a calculated percentage of payment. In order to be fair, it was suggested that the township should contribute to any large improvement costs or any costs associated with operating the system. Member Kindsvater questioned sewer plant capital improvements. A pump station on N Riverside Ave needs to be replaced ($65,000-$70,000), as well as an air conditioning/heating/cooling system at the plant. Council discussed advantages and costs associated with creating a sewer authority with East China Twp, a concept which was talked about several times over the years but no action was ever taken. Six to ten homes at the south end of the city are already serviced by East China, and council felt that it makes sense longterm to pursue this option. City Superintendent was asked to investigate how much of the plant maintenance costs or sewer infrastructure could be eliminated if a cooperative effort between municipalities was undertaken to determine whether the concept is cost effective enough to proceed. City Superintendent responded to an inquiry from Bill Klieman about accounting for employee retirement/pension expenses. Mr Klieman felt that the one mill collected should cover the full cost and any additional should be collected from employee contributions. City Superintendent explained that pension expenses need to be reflected in each department where they actually occur. Water Fund – The rate study suggested a 3.2% increase in 2013-14 but no rate increases are included in the proposed budget. 2011-12 operations produced positive cash flow of $65,000 at year-end, up from $15,000 and moving in the right direction. There are no current debt obligations. The retirement of two operators in this fiscal year will generate $120,000 in cash. There is cash available and the goal is to build additional cash because of the aging infrastructure in the plant. Council discussed privatizing meter reading services. City Superintendent is looking at the final budget numbers but it looks like the fund is moving in the right direction. Member Burns questioned water production not reflected in sales in the rate study report conducted by The Spicer Group. Over 20% of the amount generated is unbilled. The source of this loss needs to be analyzed to see if there are leaks in the system, illegal taps, line breaks from aging infrastructure, unmetered fire lines, or other causes for the lost revenue. Rubbish Fund – The fund ended 2011-12 with positive cash of $129,000. Beginning in June and alternating with the billings of the three water sections, the city will be issuing a one-time rebate of $38.00 per household, which will still leave a 15% balance in the fund. Currently the city has a five year contract with Waste Management for rubbish and garbage collection services. Equipment Pool – Operations produced positive cash flow of $28,500, with the cash balance in the fund of $984,000. Plans are to replace a cemetery trailer, wood chipper, two pick-up trucks, and a dump truck (grant with match money). City Superintendent reported that the estimated cost of a new street sweeper is $166,000, with used equipment ranging from $80,000 - $125,000. Member McCartney and DJ Boulier, 1110 Oakwood, commented that street cleaning should be performed more frequently for maintenance and aesthetic purposes, and suggested that the city should purchase or rent equipment, or contract the service. Contracting the mowing of residential lawns issued blight violations should also be explored to see if it is more cost effective than having city employees perform the services. Purchase of a crack sealer at $18,000 may be more achievable given the available funds. It was suggested that work sessions on repairs, maintenance, and financing of road improvements, and on finding the best ways to utilize city labor be held after the budget is approved. A quick update was given on the harbor launch ramp extension project. The concrete has been ordered and the city is waiting on DEQ permits. The preliminary budget will be presented to Council at the May 6, 2013 meeting, with a public hearing scheduled for May 20, 2013 at 7:00 pm at the City Hall Council Chambers. Adjournment at 7:37 pm. Janice Winn, City Clerk Mike LaPorte, Mayor Pro Tem