Comments and Introduction of arguments according to a bailiff

advertisement

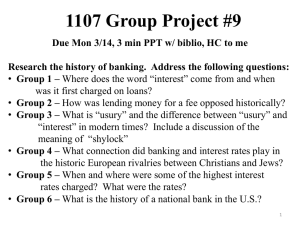

REPUBLIC OF ALBANIA NATIONAL CHAMBER OF PRIVATE BAILIFFS Nr 77 Prot. Tirana, on 06.05.2015 Data:___________Ora:____ Subject: Comments and Introduction of arguments according to a bailiff lawyer point of view/ 11 main points related to “bad loans” issue in Albania. Directed to: For knowledge: Governor of Bank of Albania Mr. Gent Sejko Minister of Finance Mr. Shkelqim Cani Financial Surveillance Authority Mr. Pajtim Melani In attention of: Prime Minister of Albania Mr. Edi Rama Dear Mr. Governor! Let me at first congratulate for your new and important duty, not only for the importance but also for its degree of difficulty considering the actual and economic context of our country. At the same time, benefiting from our first correspondence, let me express my personal consideration and the faith that you will accomplish your duty successfully considering your experience in bank sector. Adresa: Nikolla Jorgo” Ndërtesa 9, Kati 2, Tiranë, Mobile: +355676089890 e-mail: kontakt@nchb.al, web: www.nchb.al Being the representative of an important structure, as the group of bailiffs, I strongly believe that your challenging duty seeks our contribution and collaboration for enhancing the rule of law state. The development of the democracy is a goal that can be achieved only through collaboration. Albanian private bailiffs, despite being a new organization, created 4.6 years ago, have a key duty, in representing the faith that people have on justice system, but also the commercial and economic relationships they represent. Being the ones who materialize the justice, we are the ultimate protective measure against the injustice and the bridge of communication between Law and Economics. Please, allow me, despite your specialized and complete information, to make a brief and necessary introduction for the enforced execution system in Albania. 1. Introduction of Enforced Execution System in Albania. In Albania this system is mixed being composed on Private and State Bailiffs. This means that the public functions of a Bailiff can be performed even by the private operators through respecting the main procedural and legal provisions of Civil Procedure Code, being the fundamental legal document. This system that is similar even in many other democratic countries has as main advantage that it gives to different creditors the freedom of choice between private and state bailiffs. In this context both services now are considered as integral parts of the trial process and are the most important part of it considering even the difficulties that public needs have for obtaining real justice. Through the numerical summery, I will introduce as below, I am making you aware of the structural capacity of both services that operate in Albania. Public Bailiff Service that functions since 2001 (with 58 active bailiffs now) and Private Bailiff System that functions since 2010 (230 licenses/150 active today) differs from one another in the point that Private Bailiffs have territorial jurisdiction in all the territory of Albania and is organized Adresa: Nikolla Jorgo” Ndërtesa 9, Kati 2, Tiranë, Mobile: +355676089890 e-mail: kontakt@nchb.al, web: www.nchb.al through National Chamber of Private Bailiffs while the State Bailiffs have local competencies and are dependent on the Ministry of Justice and the General Directorate of Bailiffs. Mixed model of bailiffs Total number of bailiffs (state & private) Technical and administrative staff (Lawers, economists) State Service 58 ( nominated bailiffs) Private Service 230 llicenses (150-active) 165 (employees) 13 ( employees) Private bailiff system Natural person Legal person 71 (Private Bailiffs) 48 (bailiff companies) Structural organization of the system according to the mixed model Like you can clearly distinguish, the advantage of Private Bailiff System is evident not only in terms of the organization structure, but even in terms of its empowerment by the state. For more than 4 years, the evolution of the private bailiff service has been fast and today can be seen as the main partner and the first choice of the creditors, including the 100% bank creditors that use our service for the execution of “bad loans”. In order to fully understand this service, despite numbers we should analyze the following: 1.1 The special features of Private Bailiff Service. In the last decade, the ongoing efforts toward the development of market economy have been increasing but the goal of improving the economy is permanent. The liberalization of Private Bailiff Service through Law No. 10031 of 11.12.2008 (in the framework of integration with EU legislation) is an added contributing factor toward economic growth because “a progressive economy should be characterized by an efficient debt execution in order to directly influence the free flow of money”. The liberalization and well-functioning of bailiff service system directly influence the following variables: Adresa: Nikolla Jorgo” Ndërtesa 9, Kati 2, Tiranë, Mobile: +355676089890 e-mail: kontakt@nchb.al, web: www.nchb.al bailiff service liberalization rapid and efficient execution of court decisions or bank contracts free movement of money as a factor toward economic growth and business climate improvements The bailiff service element clearly has a multiple effect on the economic and legal indicators. Being between economy and law, this service has this special feature characteristic. It directly influence in the materialization of justice, and on the other hand is an economic intermediary that channels the unused funds into other economic agents, giving an energetic injection to the economic system as a whole. Law No. 10031 “For the Private Bailiff Service” makes clear the “public” nature that this service has because it represents a public function: the execution and real fulfillment of the justice. The special features are distinguished even in the article No. 32 of the Law No. 10031 in which are specified the obligations of a bailiff through them b) should strictly comply with the articles of Civil Procedure code and other normative acts g) to take all measures for the execution of the title, through respecting human dignity and through putting into balance the debtor needs and creditor interests. This expresses also the legislator aim to provide bailiffs with sacred legal duties like the balance of interests and being as an executive judge beside the liberalization and the creation of the bailiff market. We consider this informative part as necessary, in order to support the following arguments related to many problems. Dear Mr. Governor! You are the first authority having the adequate and complete information for the level of bad loans and the measures against them. Is not new the fact that Albania is ranked as the second state (after Adresa: Nikolla Jorgo” Ndërtesa 9, Kati 2, Tiranë, Mobile: +355676089890 e-mail: kontakt@nchb.al, web: www.nchb.al Kazakhstan) among developing countries of Europe and Asia for the level of “bad loans” by many international organizations? International Monetary Fund has specified the deterioration of bad credits as one of the greatest dangers for the economic stability. Even World Bank and BERZH agreed in terms of consequences that bad loans bring to the economy. Nearly one month ago, the head of IMF mission Mr. Nadeem Ilahi on 17th of March 2015 for a media statement that had a large public impact stated “there is something in the system that is not allowing bad loans to decrease. We are asking ourselves what it is. Why is the problem of bad loans still permanent despite the undertaken measures?” Further he suggested: “We agreed with Government to see in broader terms the problem, not only as a bank problem but in everything, how are the contracts executed, how is the collateral functioning and how are the court decisions taken”. The head of the IMF mission addressed the question “Where can we seek the bad” by non-only putting into focus only banks or justice, but also all the context of factors in a logical way. At the same day, for a press conference , where even You as the representative of Bank of Albania and government representatives participated, head of IMF emphasized the request “institutions should establish a strategy for the solution of this problem that is damaging the credit process” by associating it with “the problem of high level of bad loans with the difficulties of contract execution” and suggested “we welcome the authorities for establishing an inclusive strategy for the bad loans aiming the improvement of credit climate”. Even Finance Minister and You have been committed “To undertake an immediate strategy, and concrete measures plan for creating an over institutional work group in cooperation with bank industry and other country authorities for addressing and quickly solving this problem”. Adresa: Nikolla Jorgo” Ndërtesa 9, Kati 2, Tiranë, Mobile: +355676089890 e-mail: kontakt@nchb.al, web: www.nchb.al Dear Mr. Governor, Despite your as-above mentioned commitment toward this problem, Please take my analysis and suggestions as the representative of Private Bailiffs Structure. Considering the fact that “The starting point of any solution is the clear and strict reference of the real problem and of its generating source” we all together can understand the position of all “players” in this process including A) justice sector B) Bank Sector C) economic Sector D) political sector for establishing the strategic scenario of improvement of credit climate. 2. Brief Overview, statistics of the ongoing process of bad loans in Albania Our country as a new democracy has experienced the primary stage of recognition with institutions that collect people saving-commercial banks. In the beginning of 2000 credits were provided aggressively, even when the market conditions were disoriented and bankers lack of experience. The ongoing process of providing credits were increasing neglecting its feedback or its payment. Until the end of 2007, before the crisis, Albania was a model in terms of loan payments. According to official source, the level was only 3.3%. At the beginning of 2008 until January 2009 this level increased up to 6.8%. It was the time when we heard the strange statement that “Albania was not affected by the global crisis and was a kind of Balkan locomotive” in fact it was “a locomotive that charged a large level of bad loans”. On May 2010 the level increased up to 12% of bad loans related to total loan portfolio and on 2011 reached the level of 18.8% and on December 2012 was 22.76% or converted in 1 milliard and 260 million of USD of all portfolio referred always to official sources. On 2013 the level reached 24.4% and in the recent data published for 2014 is supposed that this level is nearly 23%. Adresa: Nikolla Jorgo” Ndërtesa 9, Kati 2, Tiranë, Mobile: +355676089890 e-mail: kontakt@nchb.al, web: www.nchb.al 30 PROGRESSION OF BAD LOANS 25 22.76 23 18.8 20 15 12 10 5 24.4 6.8 3.3 0 2007 2008-2009 2010 2011 2012 2013 2014 As is mentioned above, all data classify Albania as the country with the highest level of bad credits in Europe and Asia after Kazakhstan with nearly 23% of bad loans related to total loan portfolio. What is clearly distinguished is the negative position we have in the Region, Macedonia that has the lowest level of bad credits nearly 0.9%, Bosnia Herzegovina- 5%, Serbia and Montenegro- 6% and Kosovo even a lower level. Bad loans level in some countries of our Region Montenegro Serbia Bosnia Herzegovina Macedonia albania 0 5 10 15 20 25 Adresa: Nikolla Jorgo” Ndërtesa 9, Kati 2, Tiranë, Mobile: +355676089890 e-mail: kontakt@nchb.al, web: www.nchb.al Dear Mr. Governor, The head of IMF mission Mr. Nadeem Ilhai made a question and represented a concern: 3. Why is the level of bad loans still permanent despite the undertaken measure for their decrease? Trying to give a modest contribution related to this concern, we want to introduce you the following arguments: Referring to the significant statistics that show that in the latest 4 years the level of bad loans was alarming for our economy and influenced people revenue while on the other hand to commercial banks they did not cause any trouble. (Some of the main indicators of bank performance for 2008-2013) Indicators 2008 2009 2010 2011 2012 2013 Assets (%GDP) 76,7 77,5 79,7 84,6 89,4 91,1 Total Deposits 59,3 60,7 65,7 69,8 73,3 75,7 36,5 39,3 39,5 42,5 42,7 41,8 7,34 3,54 6,7 0,8 3,8 6,6 (%GDP) Credit to economy(%GDP) Profit (milliard of ALL) Source: Annual Reports of Albanian Association of Banks We still don’t have the annual report of 2014, but even this year is supposed to express an increasing bank performance. From the “Declaration of Financial Stability for second half of 2014” is supposed that the value of bad loans is nearly 23%. From the official data published by AAB easily is distinguished an increasing tendency of credit and an increasing of credit portfolio. So is the probability of bad loans. Adresa: Nikolla Jorgo” Ndërtesa 9, Kati 2, Tiranë, Mobile: +355676089890 e-mail: kontakt@nchb.al, web: www.nchb.al We can see an increasing tendency of deposits that influence the degree of liquidity and sometimes they have overcome the limit required by the Supervisory Authority. Even the profit followed the same tendency. Bank performance is significantly positive. Following in the table we have expressed data in relative terms (related to GDP) in order to easily distinguish the impact on economy. Credit on execution (related to loan portfolio) Amount of obligation (TOTAL, milliard of ALL) The debt amount of private subjects (as part of whole debt) The debt amount of individuals(as part of whole debt) Collected debt amount (related to the debt expressed in the order ) june 2014 19,2% march 2014 june 2013 26,4% 19,6% 107,9 74% 26% 27,4% ALBANIA REGION 23% 5%-10% Bad Loans Still the value of bad loans is high and as consequence the provisioning expenses are high, the net profit of the bank is at satisfied level amounts. 4. How is this possible? Where are the costs of bad loans transferred? Banks transfer their losses within their systems in to their customers by charging to them higher interest rates. Adresa: Nikolla Jorgo” Ndërtesa 9, Kati 2, Tiranë, Mobile: +355676089890 e-mail: kontakt@nchb.al, web: www.nchb.al It seems the most logical and economical explanation considering the fact that banks operate in a complete freedom regarding to the changing interest rates of loan contracts. The practice of fluctuating interest rates is applied in all banks in the same way despite the different forms in which they are expressed. An interesting fact is their investment on Treasury Bonds, beings 100% safe investments in front of the economy needs for generating funds by the bank investments. Clearly, in the recent years, banks choose the lowest risk investment, that on T-bonds causing in this way the permanent risk attributed to economic growth. Dear Mr. Governor, The findings of this simple statistical analysis, for sure you can elaborate them more, and you can probably find many orientations for this problem and you may find its origin. Performing the duty of bailiff officer, put us in front of many bank problems, lack of proper guarantees, insolvent corporations, fictive collaterals etc. Lack of proper guarantees associated with lack of proper information, and the confusion caused by the legal and economical terminology, often unclear, have been made visible in many of enforced execution cases. 5. Is it a continuation of legal amendments or is it a specific attention for the well management of credit portfolio? Considering the proper statistical references the bad loans is increasing and so it represents a serious threat. Causes may be identified with the crisis of private entrepreneurship and the mismanagement of loan portfolio by commercial banks. There are many cases when loan is provided without the proper guarantees, mortgages, sureties and banks have shown neglect for the problematic cases and turning them into bad loans. Adresa: Nikolla Jorgo” Ndërtesa 9, Kati 2, Tiranë, Mobile: +355676089890 e-mail: kontakt@nchb.al, web: www.nchb.al Dear Mr. Governor, In the recent years, many amendments of Civil Procedure Code and other normative acts took place. The amendments tried to create a more efficient mean for helping the efficient enforced execution. In order to decrease the level of bad loans. But still this was not possible. The expected success was in fact a failure. According to many lawyers point of view this failure came as a consequence of the amendments that were suggested only by banks. 5.1 Legal amendments have not recovered the bank system, they have vitalized bad loans Below, there is a list of amendments asked by banks and the generous positive answer for their requests by the legislator, providing them with legal means and despite them the bad credits were increased. Even nowadays is asked the same strategy: Amendments Proposals and according to their request lawmaking! The following are the amendments as asked by bank operators represented by AAB: The additions and changes on Civil Procedure Code were approved in Parliament with the Law No. 10052 of 29.12.2008 giving to banks the opportunity to be part of the enforced execution with low costs. Law has provided direct possibility for decreasing the level of risk in general, associated with loan contracts, and the risk factor of interest rates. On October-December 2010, it is shown the lack of capability of government for intervening in to the Law No. 8438 “For the tax on Revenue”, in which in the article no. 25 “legal reserves for banks and insurance companies” the provisions for lost credits according to SNFR were not deductible expenses. AAB after strongly lobbying against this proposal avoided the initiative of Ministry of Finance. it is influenced the Law “For the registration of immovable properties” because the proposals related to the guarantee fund, the procedure of suspension, and legal mortgage were taken into consideration and on 21th of March 2012, Albanian Parliament has Adresa: Nikolla Jorgo” Ndërtesa 9, Kati 2, Tiranë, Mobile: +355676089890 e-mail: kontakt@nchb.al, web: www.nchb.al approved the new law and improved the functionality of Immovable Properties Registration Office in the benefit of banks. The changes done on March 2011 and 2012 in the Law “For some changes in the Law No. 9917 of 19th of May 2008 “for the prevention of money laundering and terrorism financing” were also influenced by AAB. Despite the fact that the main aim of Law No. 9917 was not to punish the subjects but to make them partners in the battle against money laundering and terrorism financing, the interventions for decreasing the penalties of banks were evident. Banks asked to not apply the percentage value related to unreported transactions in the framework of extended vigilance that banks should have shown as asked by this law. On 18th of April 2013, Albanian Parliament has approved the Law no 122/2013 “for some changes in Civil Procedure Code”. AAB was again included in proposing, consulting the proposed changes by lobbying in the predecessor ministry of Justice. The articles 511/1, 517, 564, 577, 609, 610, 611 and 615 of Civil Procedure Code were changed. Above all is changed the article No. 517 stating “under debtor request, the court considering the financial position of the debtor and after asking the creditor, could postpone the time term of the execution of the debt, except the case when this debt comes as a result of a bank contract”. So, the court cannot in any of cases, even when there is complete lack of capability of payment, judge on Albanian loan takers because is not allowed by law. On 28th of December 2013, Albanian Parliament has approved the Law No. 177/2013 “For some changes on the law no. 8438 for the tax on revenue”. An important change on this law that influenced directly the bank performance was the statement of recognizing the provisions for bad loans as expenses according to SNRF/SNA. As we can state, is amended an important quantity of material and procedural law under one proposing initiative of AAB. Nearly 90 % of proposals of AAB have been approved. The same culture of proposal-changes has functioned even for the normative acts as the Guideline of the Minister of Finance and Minister of Justice No. 1665/1 of 5th of March 2014 “For the establishment of the bailiff fees and other services approved” that has stagnated for 4 months the functionality principle of private bailiff service turning it into a collection service that is not legally known in Albania and the bailiff fee tended to be turned into a success fee. Adresa: Nikolla Jorgo” Ndërtesa 9, Kati 2, Tiranë, Mobile: +355676089890 e-mail: kontakt@nchb.al, web: www.nchb.al This guideline has been considered illegal by the Administrative Appeal Court on 18th of June 2014. 6. The supervisory role of Bank of Albania in order to prevent the delays in execution of the lost loans. Dear Mr. Governor, The protection of common interests of bank customer is and should be an active aim of the state authority because is the one who is the ultimate guarantor of the legal state of its citizens. Under periods of high level of bank loans, this supervision should be more strict and toward the strengthening of the legal infrastructure through enhancing the regulatory framework for prevention and management of bad loans risks. The only guideline operating is the Guideline No. 62 “For Risk Administration by banks and branches of foreign banks”. Article No. 11 refers to the maximum level of 180 days for classifying the loans as “lost”. In point 4 of Article 17 is prescribed the delete of the lost loans by the balance sheet, without specifying any time term, but only by specifying the 3 year period within which the delete should be completed. 6.1 What is happening today while following the lost loans and the changeable value amount of the debt during an enforced execution case? Why is the initial of such procedure seeking large amount of time? Case A. Sula vs Raiffeisen Bank is a symbol case for the concern that changeable amounts of values represents. Hundreds of debtors are in front of this problem due to the charge of penalties and interests from the time of noncompliance with the debt up to the initial of executive procedures. There are even more problematic cases such as: Adresa: Nikolla Jorgo” Ndërtesa 9, Kati 2, Tiranë, Mobile: +355676089890 e-mail: kontakt@nchb.al, web: www.nchb.al a) When keeping suspended the executive title for years from the period of stating the noncompliance of the debt to the initial of enforced execution or, b) When the orders of executions are kept without passing into the phase of enforced execution 6.2 A typical case is of the debtor A. Sula vs Raiffeisen Bank, whose debt is doubled Amount benefited through Loan Contract, 866,424.9 LEK date 25.09.2009 1,152,041.83 ALL (total) The amount in delay of debtor on 25.04.2011, 827,710.32 ALL (Principal) according to Raiffeisen Bank confirmation as shown in the Order of Execution No. 3202 of 247,621.2 ALL (Interesa) + 76,710.31 ALL (Kamatëvonesa) Act, Date 09.06.2011 1,964,833.19 ALL (total) Value of Debt confirmed by the first creditor 827,710.32 ALL (Principal) on 05.07.2013 through “notice for loan 554,138.26 ALL (Interests) + 571,204.61 transfer in to “Tranzit” sha ALL (Penalties)+ 11,780 ALL (legal expenses) Value of the debt required by “Tranzit: sha 2,211,927 ALL (total) according to “request for putting into execution of 2.12.2014 protocoled by Bailiff Company “Corrector” shpk with No. 02 of prot, date 3.12.2014 Adresa: Nikolla Jorgo” Ndërtesa 9, Kati 2, Tiranë, Mobile: +355676089890 e-mail: kontakt@nchb.al, web: www.nchb.al value of the debt 2,500,000.00 2,000,000.00 1,500,000.00 1,000,000.00 500,000.00 0.00 value of the debt value from the credit the delayd amount obligation,25.04.2 011 the confirmed value when the loan is transferred 05.07.2013 the required value by "Tranzit" when is put into execution 02.12.2014 866,424.90 1,152,041.83 1,964,833.19 2,211,927 For a period of 3 years is distinguished the doubling of the debt amount for the period from the delayed payment up to the moment of putting into execution. While if we refer to the period from obtaining the loan the debt amount is tripled, within 5 years. A contributing factor toward this increase was the factoring operator that has received the attributes of the substitute creditor that has turned the case Sula into the phenomenon” Sula”. 6.3 Phenomenon “Sula” is distinguished in many bailiff cases and this should be under your attention and supervision. Damaging the position of Albanian debtor causes the breach of his fundamental rights and makes the cases hopeless. This phenomenon should not be continuing to happen due to unrecoverable consequences it brings, where the loan givers turn into debtors and they experience a vicious circle causing the hard social punishment. Meanwhile the image of a bank system deteriorates. Even the message that the case “Sula” conveys is important. When the politics of bank interests are established, the social element should be taken into consideration. These interests should be acceptable, reliable as shown in the bank advertisements. The high and speculative interests of banks that are artificially increasing will deteriorate the faith on bank sector, considering again Sula Case. There are many other questions that this case represents Adresa: Nikolla Jorgo” Ndërtesa 9, Kati 2, Tiranë, Mobile: +355676089890 e-mail: kontakt@nchb.al, web: www.nchb.al considering the principle that “each creditor has under his own decision to start or not an enforced execution case”. Bailiff Service is the testimony and the collaborator of cases when these possibilities are by intention or by carelessness neglected by bank or non-banks financial institutions and these delays are in months and years that the supervision of Bank of Albania should supervise under the aim of the Guideline “For Credit Risk Administration by banks and foreign branches”. Dear Mr. Governor, Now is the moment to provide you with the information about the contradiction between AAB and NCHB related to the changeable value amount of the debt during the enforced execution procedure? 1. Case Law of the Relationship Bank – bailiff in the framework of changeable value amount National Chamber of Private Bailiffs issued a directive in which is stated that “Bailiff Officer cannot execute newest values of debts, but only the definitive value amount for the one is issued the order of execution”, against the bank attitude for bringing newer debt values. Calculation of penalties and interests after the issuance of the order of execution has not found any solution by law, but this absence cannot be used in the advantage of one party through damaging the interests of debtors. Article No. 510/d of Civil Procedure Code prescribes the act of credit giving as an Executive Titles. This means that the law has make a difference by considering them as specific subjects by treating them in a favorable way. Despite recognizing the special feature of the bank system by qualifying its acts of credits as Executive Titles, through the court process filter, prescribes the issuance of the Order of Execution. It passes through a judicial investigation, through written and other proofs after stating: A definitive obligation and a full, clear, exact, identified one. Adresa: Nikolla Jorgo” Ndërtesa 9, Kati 2, Tiranë, Mobile: +355676089890 e-mail: kontakt@nchb.al, web: www.nchb.al In this moment bailiffs through creditor request have the right to initiate the executive procedure for the appliance of the order of execution that is the key mechanism of the executive procedure. The constitutional jurisprudence has emphasized the fact that “the provision by law of the loan contract as executive title aimed the balance between public interest on one side and the respect of human rights by the other side”. Creditors have the right to be referred on the principles of Civil Procedure Code, in which the lack of payment of penalties is considered as an essential failure of the debt amount. Our civil Code has not provided with a maximum limit of penalties like the other countries Codes do, our Code has accepted the contractual freedom, but always respecting the rules of the game. Since we do not have any specific article for the level of penalties, we should refer to the general provisions, in the article no. 422 of Civil Code “Creditor and Debtor should behave with correctness, impartiality, and according to reasonable requests”. The contractual freedom is not absolute, it can be limited through some moral and economic factors that through ignoring them, a disproportional damage of the interests of debtor might happen, meaning that the will of this party is not so free. These are the reasons why we have issued the unified directive for the unchangeable value of the debt amount not only for the reason of the contractual moral, but also for fulfilling the legal principles. 2. Private Bailiff Service as a factor that influence the decrease of bad loans in Albania Dear Governor, The official data show that during the 4 year period of the existence of Private Bailiff System in Albania, is done a huge work and a lot of success, by finalizing many cases within a brief time. Even bank creditors have appreciated the success achieved by bailiffs that beside evaluated as successful, was considered an innovation. Adresa: Nikolla Jorgo” Ndërtesa 9, Kati 2, Tiranë, Mobile: +355676089890 e-mail: kontakt@nchb.al, web: www.nchb.al 8.1. Which are the factors contributing directly for the increase of bad loans in Albania and is Bailiff System a contributing factor? The obligations arising from Loan Agreements are well guaranteed and are recognized as executive titles. This enable the creditor to direct to the court for the issuance of the Order of Execution and to initiate the procedure of enforced execution as soon as possible. This is the aim of the legislator as prescribed in law No. 10031 “For the Private Bailiff Service” and guarantees the consequences as below: 1. Better opportunities for complete and rapid execution of the obligations arising from the executive title. 2. The diminishing of the possibility that the debtor could avoid or hide his possessions. 3. Avoidance of the increasing of the debt amount due to the passing of the time from the first delay up to the issuance of the Executive Order. If an enforced execution case will start soon, even the probabilities of a bailiff for success are increasing. Naturally, when the case is represented in delay, even the procedures to be undertaken are difficult and complex considering the contact address etc. and the chances for this loan to be transformed into a bad loan will be also increasing. Otherwise, the debtor will have the possibility to hide his possessions or to transfer it in to other people. Despite the fact that these actions are considered illegal, a very time consuming processes could take place, fact that will damage the enforced execution. Since the main subject responsible for starting an enforced execution procedure is the bank creditor, delaying the procedure, logically the consequence is that the bank itself is contributing in the increase of the bad loans. Bailiffs proceed under a well specified framework of actions, have no way to avoid the time terms so they have not any possibility to contribute in the increase of bad loans, they have only had the positive impact of improving the situation through hundreds of executed cases totally completed. Adresa: Nikolla Jorgo” Ndërtesa 9, Kati 2, Tiranë, Mobile: +355676089890 e-mail: kontakt@nchb.al, web: www.nchb.al The increased level of bad loans cannot be the common responsibility of bank and bailiffs because each of them have a separated level of responsibility that can be easily proved by many evidences. It is also distinguished the monopolistic selection by bank creditors. On 2013-2014 in Albania from 300 bailiff subjects, only 5% of this capacity was contracted by banks, fact that should be further elaborated and should be found the necessary strategy. An immediate collaborative strategy between banks and bailiffs should be implemented as the most adequate solution and this should be even under your attention. 3. Collection and Factoring as alternative solution of bank creditors. Legal framework, efficiency, and their contribution toward the bad loans. Dear Mr. Governor, At the beginning there was a high level of collaboration between Private Bailiff Service and Bank creditors, collaboration that is diminished despite the increasing level of the bad loans. 3.1 Collection Bank and Non-bank Creditors recently make agreements with some collection companies that are not licensed or based in a well specified legal framework to better provide the collection, recovery or debt execution. There are many proved cases where these companies make “calls or perform some bailiff behaviors” making debtors doubtful. So, is very important to investigate the legal framework, tariffs, type of contracts that the collection companies use as a parallel reality. Some hard problems come as the result of this extra procedural collaboration as following: Bank and Non-Bank Creditors when state a bad loan, are directed to the court for the issuance of the order of execution. In this moment the creditor make contractual agreements with a collection company instead of choosing a bailiff. This company under doubtful ways make contacts with the debtor. Lacking the minimal legal information, the Adresa: Nikolla Jorgo” Ndërtesa 9, Kati 2, Tiranë, Mobile: +355676089890 e-mail: kontakt@nchb.al, web: www.nchb.al debtor rights and guarantees as prescribed in the article 609,610 of Civil Procedure Code are denied. Another important element is the time term that the bad loan follows under the administration of the collection company. Each day influences the increasing of the level of penalties in charge of the debtor. The debt execution through these collection companies has not any legal protection by exposing too many risks. Tariffs used are not approved or verified by any authority, they are established through uncontrolled contracts. This is an abusing fact since these values are established in an unfair way and charged to the debtor. This has hardly damaged the bailiffs market and increased the level of bad loans, so we suggest that banks and non-banks financial institutions should resign from these illegal practices that are emerged through the absence of a precise legal framework. 9.2 Factoring The same problematic emerges under factoring. These are some licensed activities by Supervisory Authority of Bank of Albania as financial services. Factoring institute is based on the transferring of the credit agreement prescribed by Civil Code “creditor can transfer the loan in to another person without the approval of the debtor with the condition that the credit is not related to personal features and is allowed by law”. The factor should at least perform 2 of these functions: the financing of the seller, keeping the accounts, debt collection, and the protection of the seller by the debtor lack of possibility of payment, the main condition is that the factor and the seller are not the same, but the factor should be a third party. If the seller enters into more than one contractual relationships for the same loans, for the same debtor, this is absolutely invalid, being a prohibition of law. Adresa: Nikolla Jorgo” Ndërtesa 9, Kati 2, Tiranë, Mobile: +355676089890 e-mail: kontakt@nchb.al, web: www.nchb.al Very important is the notification of the debtor within the time frame prescribed by the factoring contract, notification that is considered to be complete when the debtor receives and confirm it, regardless of the change made on the creditor subject. Case “Sula” is also a case that shows this element, and this should be also under your attention and supervision because as the debtor pretends the notification is not completed neither by the first, nor by the second creditor. There are many risks related to this financial service like following: The level of operational risk of conflicts possibly arising is high. The risk might be transferred into the debtor party and not only to the seller. The low possibility provided by law for obtaining information is possible and goes toward the high level of operational risk. High probability of money laundering through this transaction is a risk to be taken into priority and attention. And according to the official data of Bank of Albania, bad loans in this sector is still high and has increasing tendencies as shown below: Problematic Loans in Non Bank Financial Institutions 16 14 12 10 8 6 4 2 0 14.1 8.9 6M-2012 15.1 13.2 8.3 Fund 2012 6M-2013 Fund 2013 6M-2014 Adresa: Nikolla Jorgo” Ndërtesa 9, Kati 2, Tiranë, Mobile: +355676089890 e-mail: kontakt@nchb.al, web: www.nchb.al 4. Guidelines for well-functioning of banks. Dear Mr. Governor, Bank activities cannot be considered as a closed commercial activity of some subjects acting in confidentiality and individuality. Is true that bank is a business, but the collection of savings has also a public interest. Despite that our Constitution provides many principles of market economy, the protection of private and public properties, it has not any provisions for the main principle of the functioning of credit institutions etc. Is the state responsible for protection of people savings in order to contribute into productive savings for the economy of the state? All the economic activity should be oriented into social aims and goals and this is a basic principle for the market economy, and has found protection by many other Constitutions of different states. This is again the reason why we suggest you to see this point of view instead of unilateral amendments or choosing other than bailiff’s subjects for execution in order to avoid the risk caused by the increase of bad loans in Albania. This system should strictly respect the principles of loan provision in 2 main directions: The negotiations between banks and customers to be focused on the interest rate and imperative should be the clear information provided to the debtor. Hundreds of debtors are non-informed for this purpose. Loan to be provided under strict purposes and the maturity time to be well specified. There are hundreds of cases where some thousands or millions of Euro loans are provided under some fictive and even ridiculous collaterals as guarantees. Adresa: Nikolla Jorgo” Ndërtesa 9, Kati 2, Tiranë, Mobile: +355676089890 e-mail: kontakt@nchb.al, web: www.nchb.al This cause not only the increase of the bad loans, but also affects the financial aspect in terms of liquidity of the bank. Since credit is provided through deposits, the loss of a loan puts the bank into huge difficulties for turning back to the depositors their savings and interests. 5. The proper strategy as one of the surest premises for successfully solving the bad loan problem. Dear Mr. Governor, Personally, you and the institution you are in head of, have all the strategic instruments for the recovery of bad loans and of their negative effect on the economy. controlled bank aims increasing the credit owner bank has established strict rules and procedures related to risk management Bank of Albania business, liquidity and secondary markets stem slowing the economic growth and creating the depressive state of the economy creation of the informal credit as a parallel bank reality Under the illustrative graph, we are expressing the cramp recently created as a result of bad loans. It has a closed shape, like a vicious circle in which is clear a lack of energetic injection that the economy should receive from the process of crediting. Bank of Albania is located at the center having the role of the promoter through strategies, monetary politics or other known instruments. At the center of the responsibility, but also at the center of golden professional opportunities you are enabled with all the legal tools and means to exploit the circle shown symbolically as above. Adresa: Nikolla Jorgo” Ndërtesa 9, Kati 2, Tiranë, Mobile: +355676089890 e-mail: kontakt@nchb.al, web: www.nchb.al Due to your experience, you know well the directions of the problem, in macroeconomics term, fiscal and legal one and I am sure that you will follow the right steps for the proper solutions. We, National Chamber of Private Bailiffs together with other actors, want to make you aware that we are ready to practically contribute in pursuing the following strategic steps being not only a state commitment, but a vital public interest. Thank You for your attention and for your comprehension toward this material! Respectfully, HEAD OF THE CHAMBER Tedi MALAVECI Adresa: Nikolla Jorgo” Ndërtesa 9, Kati 2, Tiranë, Mobile: +355676089890 e-mail: kontakt@nchb.al, web: www.nchb.al