abstract - Music Business Research

advertisement

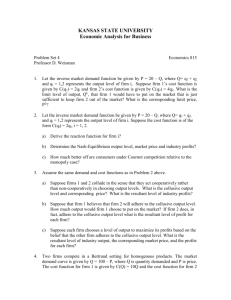

Title: The Determinants of Profits in the Recorded Music Sector Author: Juan D. Montoro-Pons, Departament D’Economia Aplicada, Universitat de València. Email: Juan.D.Montoro@uv.es Goals: While many empirical studies on recorded music have analyzed consumers and their motivations, fewer have a focus on the supply side of the market. From an empirical standpoint this is a relevant issue as one could link supply behavior to some industry traits such as the creativity and innovation in the sector and the adherence of firms to specific business models to mention two. One reason for that could be that data are scarce and scattered, and those that are available (available public information about record labels is usually restricted to the officially filed and audited accounts) are only weakly linked to the relevant questions about the recorded music industry. However it can be argued that a combination of quantitative and qualitative analysis can be useful for a better understanding of the sector. The goal of this paper is to identify the determinants of returns in the recorded music industry and link them to managerial and structural characteristics of the industry. In so doing a relative measure of profitability is explained in terms of observed covariates. Nevertheless, the nature of the dataset also allows us to include non-observed effects at the firm and country level. This research analyzes the performance of 467 record labels in 8 European countries for which data were widely available (Austria, Belgium, France, Italy, Norway, Spain, Sweden and UK) over a period of 10 years (2003-2012). Research questions Four main research with respect to profits are put forward. H1. The extent of country level effects on profits. The performance of the recorded music sector can be affected by several features that are domestic by their nature. These could be traits such as the share of domestic repertoire, its variety and innovativeness, the country legal framework and the enforcement of property rights, and economic conditions to mention some. While the work does not aim at singling out the specifies of such country effects, it does aim at measuring its relative relevance, specifically compared to between and within firms total profits variability. H2. Effect on profits of the two-tier (majors/independents) structure of the recording industry. This specific arrangement is not only about the size of the firms but also (and most important) about the innovation and assumption of risks of each actor within it. It has been argued that innovations takes place at the independents level and once these catch on they are exploited by majors that have the financial and managerial resources to market them in a profitable way. If this were the case a greater risk (and hence variability of profits) could be observed for independents. Moreover a premium in performance for majors could point out to the profitable exploitation of innovations by these firms taking place in the sector. H3. Impact of the size of the firms in the market. The two-tier structure has a correlate on size with most majors being significantly larger than independents. However to reduce size to a major/independents dummy variable would be misleading. While most independent firms are small and medium-sized enterprises there are big differences between them as measured by the value of total assets in their balance sheets. Hence a precise estimation of the effect of total assets on performance will help to understand the role of size and whether the consolidation led by the majors in the past is rooted on sound grounds. H4. Degree of persistence of abnormal profits (or losses). These have been related to barriers to entry (to exit) in the sector. As an alternative to the between industries analysis, time persistence can help to understand the inertia in profits and hence the degree of competition within a sector. Methodology: Given the clustered structure of the data, the assumption of independence between observations is violated, hence the need to account for the structure in the data (observations nested into firms nested into countries). To this end a three levels random effects model is used as the baseline econometric specification that links returns to the control variables. Data were obtained from Amadeus, a database compiled by Bureau van Dijk of comparable financial information for public and private companies across Europe. For this paper data were gathered (based on its availability) for record labels in eight European countries (Austria, Belgium, France, Italy, Norway, Spain, Sweden and the UK) representing 34% of the recorded music business in the European region, as reported by IFPI. Preliminary results: 1) There is a strong firm effect, i.e. most of the variance of profits is due to specific features of the firm or firm-level specific resources. These could account for specific business models, creativity and innovativeness, a catalogue of established artists among other. 2) Contrary to intuition (and yet being a preliminary results) country effects seem not to play a strong role in the performance of record labels. 3) Major record labels show an advantage in performance that should be further investigated. 4) Size matters but in a nonlinear fashion: the performance of a record label cannot be indefinitely increased by increasing its size. Conclusions: The structure of the recorded music industry (composed of an oligopoly plus a competitive segment) and the role of innovation on the performance of record labels has been tested using a econometric framework. Based on these, the main conclusion is expected to be linked to the success or failure of specific business models in the industry. A detailed inspection of firm-level effects combined with a qualitative analysis is to be undertaken as a next step in this research. Keywords: phonographic industry, return on total assets, multilevel model, firm performance References J.C. Bou and A. Satorra , 2007. The persistence of abnormal returns at industry and firm levels: evidence from Spain. Strategic Management Journal, 28: 707--722. M. Bourreau and M. Gensollen and F. Moreau, F., 2012. The impact of a radical innovation on business models: incremental adjustments or big bang? Industry and Innovation, 19 (5): 415--435. R.A.K. Cox and J.M. Felton and K.H. Chung, 1995. The concentration of commercial success in popular music: an analysis of the distribution of gold records. Journal of Cultural Economics, 19(4): 333--340. J. Gander and A. Rieple, 2004. How relevant is transaction cost economics to interfirm relationships in the music industry? Journal of Cultural Economics, 28 (1):57-79. D.E. Giles, 2007. Increasing returns to information in the US popular music industry. Applied Economics Letters, 14 (4-6):327--331. J. Goddard and M. Tavakoli and J.O.S. Wilson, 2005. Determinants of profitability in european manufacturing and services: evidence from a dynamic panel model. Applied Financial Economics, 15(18):1269--1282. J. Goddard and M. Tavakoli and J.O.S. Wilson , 2009. Sources of variation in forms profitability and growth. Journal of Business Research, 62: 495--508. A.M. Mcgahan , 1999. The Performance of US Corporations: 1981-1994. Journal of Industrial Economics, 47 (4): 373--398. A.M. Mcgahan and M.E. Porter, 1999. The Persistence of Shocks to Profitability. Review of Economics and Statistics, 81(1):143--153. A.J. Scott, 1999. The US recorded music industry: on the relations between organization, location, and creativity in the cultural economy. Environment and Planning A, 31(11): 1965--1984. P. Tschmuck, 2012. Creativity and innovation in the music industry. 2nd edn. Springer.