Project Name

advertisement

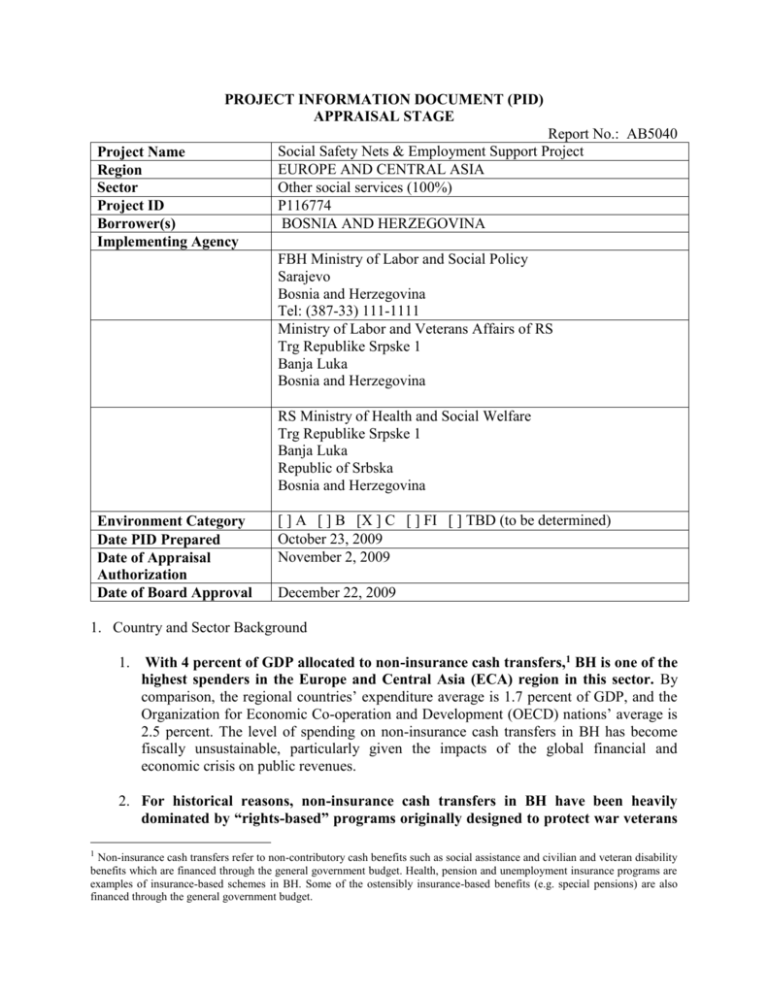

PROJECT INFORMATION DOCUMENT (PID) APPRAISAL STAGE Project Name Region Sector Project ID Borrower(s) Implementing Agency Report No.: AB5040 Social Safety Nets & Employment Support Project EUROPE AND CENTRAL ASIA Other social services (100%) P116774 BOSNIA AND HERZEGOVINA FBH Ministry of Labor and Social Policy Sarajevo Bosnia and Herzegovina Tel: (387-33) 111-1111 Ministry of Labor and Veterans Affairs of RS Trg Republike Srpske 1 Banja Luka Bosnia and Herzegovina RS Ministry of Health and Social Welfare Trg Republike Srpske 1 Banja Luka Republic of Srbska Bosnia and Herzegovina Environment Category Date PID Prepared Date of Appraisal Authorization Date of Board Approval [ ] A [ ] B [X ] C [ ] FI [ ] TBD (to be determined) October 23, 2009 November 2, 2009 December 22, 2009 1. Country and Sector Background 1. With 4 percent of GDP allocated to non-insurance cash transfers,1 BH is one of the highest spenders in the Europe and Central Asia (ECA) region in this sector. By comparison, the regional countries’ expenditure average is 1.7 percent of GDP, and the Organization for Economic Co-operation and Development (OECD) nations’ average is 2.5 percent. The level of spending on non-insurance cash transfers in BH has become fiscally unsustainable, particularly given the impacts of the global financial and economic crisis on public revenues. 2. For historical reasons, non-insurance cash transfers in BH have been heavily dominated by “rights-based” programs originally designed to protect war veterans 1 Non-insurance cash transfers refer to non-contributory cash benefits such as social assistance and civilian and veteran disability benefits which are financed through the general government budget. Health, pension and unemployment insurance programs are examples of insurance-based schemes in BH. Some of the ostensibly insurance-based benefits (e.g. special pensions) are also financed through the general government budget. or their surviving dependents (“veteran-related benefits”). Veteran-related benefits absorb about three-quarters of total spending on non-insurance cash transfers in BH. The share is slightly lower in the Federation of Bosnia and Herzegovina (FBH) than in Republika Srpska (RS) – the two Entities that make up BH. Both Entities also operate a number of civilian benefits that account for about one-quarter of total spending on noninsurance social protection cash transfers. The “big ticket” item for these civilian benefits is disability benefits in the FBH (for Non-War Invalids and Civilian Victims of War), which have increased significantly over time. Civilian benefits also include means-tested programs such as Social Assistance Benefits and the Child Protection Allowance. 3. Despite significant fiscal outlays on non-insurance cash transfers, their coverage of the poor is low; and, in aggregate, they tend to be regressive in nature. In terms of coverage, about 15 percent of those in the bottom quintile report receiving veteran or civilian benefits. In terms of targeting accuracy, benefits are generally regressive since those in the poorest quintile receive only 18 percent of total non-insurance social protection cash transfers in BH – a smaller proportion than their share of the total population of BH. A similar share of these benefits goes to those in the richest quintile. Given those patterns, it is not surprising that poverty-reduction impact is negligible. Indeed, the poverty headcount rate is estimated in the 2007 Household Budget Survey (HBS) at about 18 percent of the population with the transfers counted in total consumption (incomes). Without the transfers, the poverty headcount would increase only slightly to 19.2 percent of the population (so transfers reduced poverty by only 1.2 percentage points). By way of contrast, the poverty impact of social insurance benefits (pensions) is much higher: without these transfers poverty would increase to 25.8 percent of the population. 4. The opportunity costs of public spending on generally regressive transfers are high. Public expenditures on non-insurance cash transfers absorb a huge share of the Entities’ respective budgets (about 40 percent in FBH and 14 percent in RS). This level of spending requires buoyant public revenues. However, public revenues will be under continuing pressure in view of the global economic crisis. Moreover, devoting a large proportion of public funds to social transfers has the effect of crowding out resources that could be devoted to public investments – which will be increasingly needed to stimulate growth as the economy continues to sag under the impact of the economic crisis. 5. In addition, besides doing little to ameliorate poverty, there is evidence that some rights-based programs create disincentives for employment. This is partly by virtue of a design flaw: In BH, applicants for all non-insurance cash transfers (except war veterans’ benefits) are required to register as unemployed to qualify for benefits (in addition to their “rights based” categorical qualifications). This requirement has not helped better “target” benefits to those in need; rather it has had the effect of distorting labor markets as people register as unemployed simply to qualify for benefits. 2. Objectives 6. The Project Development Objectives are (i) to support non-insurance cash transfers in reaching the eligible poor and disabled; (ii) to improve the efficiency and transparency of benefit administration; (iii) to support job brokerage services for those active job seekers who become ineligible to receive cash transfers or who are vulnerable (e.g., poor, disabled but able work, hard-to-serve, demobilized soldiers, etc.). 3. Rationale for Bank Involvement 7. With a more than a decade-long record, the Bank’s involvement in this sector in BH has been steady with some significant results. It has largely involved a mix of investment and technical assistance operations in labor and social protection areas, which mostly achieved the desired results. In addition to operations, a substantial amount of analytical work has been produced by the Bank in recent years – the latest piece being the Policy Note on Social Transfers in Bosnia and Herzegovina: Moving Towards a More Sustainable and Better Targeted Safety Net (April 2009), which underpins this operation. 8. The Bank has accumulated substantial experience internationally and in ECA in helping countries develop and apply effective targeting tools to strengthen the effectiveness of social safety nets. Moreover, in the foregoing two year period 20072009, the Bank team had acquired in-depth knowledge of and access to key BH-related data in this area. Over the same period, the Bank team has maintained an active and productive policy dialogue with the Entity Governments. In this respect the chief interlocutors have been, in FBH: the Ministry of Labor and Social Policy and the Ministry of Veterans’ Affairs; and, in RS: the Ministry of Labor and Veterans’ Affairs and the Ministry of Health and Social Welfare. Contacts with the respective Ministries of Finance and Employment Bureaux have also been maintained. Hence, the Bank has both practical country-related experience as well as analytical expertise to provide BH policymakers with advice as ongoing dialogue on a strategy to rationalize the country’s spending on non-insurance cash transfer programs and, possibly, finance implementation of such reforms. 9. The authorities in FBH and RS had expressed interest for Bank’s support in this area even before the country’s macroeconomic problems became glaringly evident. The Bank team has used a programmatic approach in engaging with the Government and a broad range of other key stakeholders through viable "entry points" to engage technically and to promote dialogue, awareness, and press interactions, which led to a perceptible change in the official discourse in this sector. 10. The outcomes achieved as a result of this approach included: (i) a change in the nature of the public debate from a rights-based approach to a needs-based benefits; (ii) transferring knowledge to Government officials on the topic of targeting mechanisms including proxy means targeting; (iii) creating a common understanding on the linkages between rights-based benefits and employment; and, (iv) building a level of policy consensus in key institutions. Thus, the authorities in both Entities have increasingly begun to realize the importance of undertaking benefit reform measures in a timely manner, before circumstances cause them to adopt alternative crude cash-saving measures that could leave behind the most vulnerable members of society and generate pent up demand for benefits, once the economy picks up. While the total weight of noninsurance benefits in RS has not overwhelmed the public finances as yet, the authorities in the RS are determined to modernize the benefit administration system and to tighten controls over expenditures in this area. Therefore the programmatic approach to client engagement outlined above led BH authorities to call for World Bank support for reforms and improvements in capacity and effectiveness in this area even before the country’s deteriorating fiscal situation made it imperative. 4. Description 11. These objectives would be achieved by supporting policy, technical and systems reforms and investments in the areas of (i) targeting (enhancing safety net design, Component 1); (ii) benefits administration monitoring and oversight (Component 2); (iii) job brokerage services (Component 3); and (iv) communications (Component 4). Ultimately, the project seeks to support a comprehensive and integrated safety net that is efficient, transparent, and effective in reaching the poor and vulnerable groups. This implies that the targeting and benefits administration improvements introduced by the project could apply to all benefits civilian and war veteran benefits - even if the roll-out of these improvements is carried out in a phased and gradual manner due to political and administrative feasibility considerations The following five components will be supported under the project: Component 1: Enhancing Safety Net Design (Eligibility Processes): This component would improve the transparency and effectiveness of non-insurance cash transfers to reach eligible poor, disabled; and vulnerable through introduction of improved targeting mechanisms. Component 2: Strengthening Benefits Administration and Oversight: This Component would improve transparency and efficiency of benefits administration through development and improvement of functional registries, capacity building, oversight and controls, and monitoring of benefits. Component 3: Job Brokerage and Employment Support This component would support job brokerage services for those active job seekers who become ineligible to receive cash transfers or who are vulnerable (e.g., poor, disabled but able work, hard-toserve, demobilized soldiers, etc.). Component 4: Communication: This component would support transparency, public awareness, and a Government communication strategy to foster understanding of the need for improved benefits targeting and other safety net reforms. Component 5: Project Management: Support to Government for management and implementation oversight of Project. 5. Financing Source: IDA Borrower International Development Association Total ($15.0 m.) 0 15 15 6. Implementation 12. The proposed Project would be implemented over a four-year period. This four-year time period is based on: (a) technical considerations for designing, piloting, and implementing the proposed systems improvements; (b) inevitable time requirements for procurement processes; and (c) the sensitivity of some aspects of safety net reforms and the need to phase-in certain improvements as a result of those sensitivities. In the Federation, the FBiH Ministry of Labor and Social Policy (FBH MoLSP) through its unit for project implementation (PIU SESER) will be responsible for the implementation of the proposed Project. In Republika Srpska, the RS Ministry of Labor and Veterans’ Affairs (RS MoLVA)/ and the RS Ministry of Health and Social Welfare (RS MoHSW) will jointly be responsible for project implementation. Both Ministries will provide technical staff for the project management team which will be housed in the Ministry of Health and Social Welfare of the RS. 7. Sustainability 13. The project seeks to reform social benefits so that they are fiscally and administratively sustainable and ensure that the benefits reach those who need them the most. Supporting improvements in targeting mechanisms; the benefits administration system, and job brokerage services for active job seekers in vulnerable groups ultimately contribute to: (a) improved governance, quality and effectiveness of public spending in achieving development objectives; (b) stronger fiscal discipline with respect to the management and containment of non-insurance benefits; and (c) a social safety net that is better able to protect and improve the living standards of needy groups, such as the poor, vulnerable and disabled. 14. In practice, project sustainability will largely depend, but not be limited to, the following: (i) political will and the authorities’ ability and willingness to undertake the reforms needed to improve transparency and effectiveness of benefit schemes; (ii) the authorities’ ability to improve the functionality and use of the IT systems/ registries and accomplish the requisite capacity building, set up effective systems of oversight and control of benefit schemes that are to be tackled under the Project; (iii) the extent to which the job brokerage services are effectively implemented in terms of providing the biggest number of intended beneficiaries with sustainable employment at the most efficient per capita cost; and, (iv) the extent to which the authorities are able to articulate and communicate the benefits of the envisaged reforms in an effective manner. Some of the above shall be subject to factors and circumstances which the project preparation has aimed to identify and/ or foresee. 8. Lessons Learned from Past Operations in the Country/Sector 15. The design of the SSNESP takes into account the lessons learned from (a) international experience in reforming and modernizing social safety nets (technical aspects); (b) experience in BH and other post-conflict countries and (c) experience with previous social protection-related Projects in BH (SOTAC, SITAP, PELRP, SESP, SOSAC and SOSAC II) regarding the importance of managing political sensitivities surrounding the issue of civilian and war veterans benefits. 9. Safeguard Policies (including public consultation) Safeguard Policies Triggered by the Project Environmental Assessment (OP/BP 4.01) Natural Habitats (OP/BP 4.04) Pest Management (OP 4.09) Physical Cultural Resources (OP/BP 4.11) Involuntary Resettlement (OP/BP 4.12) Indigenous Peoples (OP/BP 4.10) Forests (OP/BP 4.36) Safety of Dams (OP/BP 4.37) Projects in Disputed Areas (OP/BP 7.60)* Projects on International Waterways (OP/BP 7.50) Yes [] [] [] [] [] [] [] [] [] [] No [ x] [x ] [ x] [ x] [ x] [ x] [x ] [ x] [ x] [x ] 10. List of Factual Technical Documents Report No. AAA33 – BA: Bosnia and Herzegovina Social Assistance Transfers in Bosnia and Herzegovina: Moving Toward a More Sustainable and Better-Targeted Safety Net Policy Note. Maniza Naqvi, Vedad Ramljak, Anna Gueorguieva, Emil Tesliuc, Erwin Tiongson, Michele Gragnolati. Report on Administrative and Institutional Aspects of the Institute of Medical Examinations of FBH. Vedad Ramljak Administrative and Institutional Aspects of the Civilian Benefits System in Federation of Bosnia and Herzegovina (FBH). Vedad Ramljak Administrative and Institutional Aspects of the Veterans Benefits System in Federation of Bosnia and Herzegovina (FBH). Vedad Ramljak Matrix of Benefits in FBH coasted. Vedad Ramljak Summary of Social Protection Schemes in FBH. Vedad Ramljak * By supporting the proposed project, the Bank does not intend to prejudice the final determination of the parties' claims on the disputed areas The Implementation completion reports for the Second Employment Support Project. Zorica Lesic The Implementation completion report for the Pilot Emergency Labor Redeployment Project. Ufuk Guven Mapping, Distribution, Amounts, Category of Rights Based Benefits in FBH 11. Contact point Contact: Maniza B. Naqvi Title: Sr Social Protection Specialist Tel: (202) 458-1938 Fax: Email: Mnaqvi@worldbank.org 12. For more information contact: The InfoShop The World Bank 1818 H Street, NW Washington, D.C. 20433 Telephone: (202) 458-4500 Fax: (202) 522-1500 Email: pic@worldbank.org Web: http://www.worldbank.org/infoshop