Community council training 2015

advertisement

Association of Community Councils Together (ACCT) Training

For Community Council Members, January 17, 2015

Janet Geyser, ACCT Parliamentarian, kicked off the training and introduced Rep. Jim Dunnigan (now House

Majority Leader, from Taylorsville) who told us about his history of getting involved: initially he was just a

citizen/complainer (re potholes, unsynchronized lights, etc.); next he served on the Taylorsville/Bennion

Community Council, then on the Taylorsville City Council. He has served for the last 12 years as a state

legislator.

He described several major issues that will come before the legislature during this session. A possible increase

in gas taxes will be discussed to fund road improvements, as our roads haven’t been getting adequately

maintained in recent years. This could take the form of a straight increase from the current 24¢/gal. to 34¢, or

be reflected in increased registration charges, mileage charges (this coming from those who hate Priuses and

their ilk), or other possibilities.

Public education needs increased funding. One way to better fund education is to increase the state income

tax from 5% to 6%. Governor Herbert would prefer to take some transportation funding to use for education.

Prison relocation. Rep. D characterized this as a great project to encourage community activism and there are

varying viewpoints in the legislature on this subject (with those of Draper and legislators who happen to be

developers being most strongly in favor).

Although he was not totally familiar with the Community Preservation Bill, Sen. Mayne had given him an

outline with bullet points about the bill and asked him to speak to it and he did his best to answer questions

about it. It is still in draft form, i.e., fluid. He covered the main points that we’ve already seen from Salt Lake

County (SLCo). The election in Nov. 2015 for unincorporated non-township residents is still planned to offer

only the options of remaining with the status quo (being annexed into cities gradually) or annexing into

adjacent cities en masse. Sen. Mayne stressed to him that the bill is still very much fluid.

Pam Roberts, Exec. Dir. Of the Wasatch Front Waste and Recycling District (WFWRD), then talked trash with

us. She noted that if the Municipal Services District happens, WFWRD will continue to stay intact, namely if

residents annex into other cities, we will still fall under WFWRD services. They have achieved a 96% customer

satisfaction rate. The handout she provided showed the glass drop-off sites, box collection program, Christmas

tree collection (if yours hasn’t been picked up already, call 385-468-6325, and they’ll be sure to pick it up next

week), and other programs. See their website: www.wasatchfrontwaste.org for this info. They achieved many

goals (including world class customer services, environmental stewardship, employee satisfaction, and

financial stewardship) in 2014 and have many more goals targeted for 2015, including establishing an online

payment system that is more effective and other fiscal goals.1

Pam noted that they have to pay $31/ton to dump garbage but are PAID $16/ton

for recycled waste, so if you’re not recycling now (or recycling enough), please

reconsider. It’ll help all of our bills go down and help the planet!

1

I picked up 3 extra packets of handouts and the thumb-drives provided, which have all the ACCT training materials from

2008 through 2015, and will bring them to the next meeting for council members who may want them. Please advise if

you want a packet before the Feb. meeting & I’ll make copies of additional handouts.

1

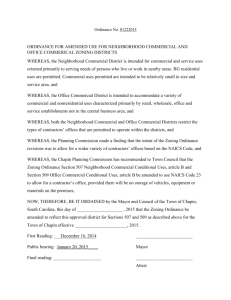

Rolen Yoshinaga, Division Director of Development Services, talked to attendees about the services that they

provide residents and the community councils. Their responsibilities to the community councils are covered in

County Ordinance 2.56.100 (see at

https://www.municode.com/library/ut/salt_lake_county/codes/code_of_ordinances?nodeId=TIT2ADPE_CH2.

56CODICOCO). They are required to advise community councils about Planning Commission (PC) agendas for

upcoming meetings. Community councils (CC’s) are allowed to make recommendations re certain zoning

applications. Our recommendation is included in the staff report to the Planning Commission [usually,

although not always in Granite’s recent experience]. The CC can request that the PC delay consideration of the

issue for 4 weeks (this is a continuance) in case, e.g., we need further information or discussion.

Recommendations may be made on: 1) text changes to ordinances in Title 19 of County ordinances (Zoning,

see https://www.municode.com/library/ut/salt_lake_county/codes/code_of_ordinances?nodeId=TIT19ZO), 2)

conditional use permits, 3) applications for extraordinary relief (see code 19.71.050 and 2.56), or 4) exceptions

to zoning ordinances.2

Uses on a property may be either conditional uses (which the CC weighs in on) or permitted uses (which are

just approved by staff). Conditional use “shall be approved subject to reasonable conditions.” An example of

a permitted use is that the staff allows for new treatment facilities [e.g., like the new one for teens with

problems that will soon open up at the old Millsap home down the street from the Youngs’ residence]. This

doesn’t even come to the CC’s for discussion because its use is protected by both state and federal law.

If you want to open up a preschool in your home, however, that’s a conditional use and needs to go to the CC

and PC, where they need to discuss and determine reasonable mitigation of impacts on residents, such as the

hours of operation, which may impact neighborhood traffic.

Rolen stressed that there must be a reasonable connection between the planned use and the condition that

we might apply to it.

Rolen advised that his office is working on rewriting the Foothill Canyon Overlay Zone (FCOZ) ordinance and

he expects a version to be available for review by March. They’re also establishing new zones, a mountain

resort zone—village and a mountain resort zone—recreation. There will also be a revised planned unit

development (PUD) ordinance out in a few weeks.

If anyone (council member or resident) thinks we need changes to what’s permitted vs. conditional, any citizen

can change a law. They have to work through their SLCo Council representative to initiate such changes.

Rolen explained some of the differences between subdivisions and PUD’s. With PUD’s, the homeowners are

responsible for the road vs. the County (they are private roads, with snow removal, maintenance paid for by

the homeowners association). Common areas with various amenities are required and the yards are smaller.

Basically, the developer wants to increase housing density and is willing to run their own roads. The CC’s

concern is usually housing density which impacts traffic (and home values).

If anyone might have questions for Rolen, you can contact him at 385-468-6675.

2

Rolen’s words about advising CC’s about PC agendas vs. what we can recommend on, leads one to a natural discussion

of an issue that impacted Big Cottonwood Canyon recently, where the PC agenda dealt with a zoning request that did not

have to go to the Council. Therefore, it didn’t. However, if CC’s watch the PC’s online agendas, we can maybe catch items

that might impact our residents, as this did, and call to offer comments. Or, perhaps the ordinance can be rewritten to

explicitly require that the Planning staff at least inform the CC. This should be discussed at a future CC & ACCT meeting.

2

Ralph Chamness, Chief Deputy for the SLCo District Attorney’s office, works in their civil division, and he spoke

about the rights and responsibilities of community councils. He represents the County, so he can tell us what

the statutes say, but he can’t be our council attorney. He recommended reviewing Chap. 2.56, COMMUNITY

DISTRICTS AND COMMUNITY COUNCILS.

The CC’s must be private corporations, not a part of the County. We must be registered with the Dept. of

Commerce. It’s better also that we are recognized as a 501(c)(3), particularly with regard to receiving County

funding for events, etc. {The Granite CC is not, but, like the rest of the CC’s, are covered under Utah

Neighborhood’s 501(c)(3) status.]

The County protects CC’s as a group and as individuals (with respect to our duties on the CC) under the

Governmental Immunity Act (this is when they do get to act as our lawyers), if we were sued, e.g., for

recommendations that we might make on a zoning issue. Our bylaws can and should be reviewed by Ralph to

ensure that they comply with ordinance [I’ll be happy to submit these again; previously we were told they

didn’t have to review/approve them, after a lengthy delay in trying to get them reviewed. Discuss at next CC

meeting.]

Some of our responsibilities: We need to stay within the boundaries of what ordinance and our bylaws say we

can do. We don’t get paid—we must be strictly volunteers. We must conduct open and public meetings,

although the Open and Public Meetings ACT does not apply to CC’s. He recommends following it to the extent

possible, although we may not want to publish our agendas in the newspapers and demand that no subjects

be discussed at meetings that were not on the agenda. We should attend ACCT training. We are also required

within 90 days of the close of our fiscal year (end December) to submit our detailed financial report to the

County.

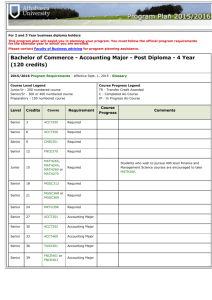

Wayne Cushing, SLCo Treasurer, next spoke on Governmental Mechanisms for Financing Services. He

provided a handout that showed the 2014 recommended budget revenues by source (37%--general property

tax, 20%--sales and other tax, 19%--intergovt grants (e.g., feds) & contracts, 12%--fees for services, 1%-licenses & permits, 2%--rental income, 9%--other). Property taxes are very stable, while sales tax can fluctuate.

He noted that ‘people in Utah actually pay their property taxes’ [what do people in other states do?]. Property

taxes collected by SLCo are allocated as follows: 44.2%--school districts, 6.7% community

development/redevelopment, 4.1%--libraries, 16.9%--countywide, 20.5%--municipalities, and 7.6%--other. He

noted that Utah has many separate tax districts that have different property tax rates [see these by year at

http://propertytax.utah.gov/property-tax-rates/2012-10-22-20-17-01/approved-taxing-entities]. He noted that

if one doesn’t bother to pay one’s fees, such as Unified Police Dept (UPD) or WFWRD’s, they will show up on

one’s property tax bill.

Patrick Leary, Township Executive, spoke about the Municipal Services District (MSD), which resolution was

passed last week by the SLCo Council. Patrick provided copies of the resolution, which sets up a service area to

provide the same services that we get now through sales tax revenue (street and sidewalk maintenance, storm

drain, animal services). Public hearings will be set up to discuss this soon (dates will be provided soon; they are

being changed since the Trib published an article on this Sunday3). This action, the establishment of the MSD,

is a precursor to the Community Preservation Bill’s Metro-Township passage. If the bill passes and townships

elect to become part of the Metro-Township, and unincorporated non-township areas are later annexed into

cities, those areas will be withdrawn from the MSD and receive those services from the cities.

3

See http://www.sltrib.com/news/2039594-155/salt-lake-county-looking-to-create

3

Mayor Ben McAdams next spoke a bit about changes in our county and his theme of The Future We Choose.

Although the future will be very different from the past and present, we want to be able to retain our unique

identities. We want our kids to be able to go outside at recess, because the air is safe to breathe. We want our

kids to get good educations here as well as jobs, and be able to live near us, so we must accept some growth,

but we still want our community parades and other events to remain intact. The Community Preservation

Proposal goes to the heart of this problem. ACCT has been very involved in creating this bill.

He noted that the League of Cities and Towns has discussed with him their proposal to get rid of townships

entirely; he managed to politely tell them no. The Community Preservation Bill is still a protected draft (not

available on legislative website), which he hasn’t seen yet. The County lawyers are reviewing the latest draft to

ensure that it matches up with the principles that have been developed and circulated; once that’s done, it’ll

be circulated for ACCT and CC review.

County Councilman Richard Snelgrove, new chair of the County Council, spoke about community service.

What we do makes our communities a better place for all.

County Councilwoman Aimee Winder Newton spoke and thanked all of us for our sacrifice in giving up our

Saturday morning to help us serve the communities better.

County Councilman Sam Granato also spoke and expressed his thanks. He noted that the people who help out

each councilperson, such as Leslie Reberg, in his case, are now titled Senior Policy Advisors. They can be

counted on to help get answers to our questions.

Kevin Jacobs, the SLCo Assessor, advised us that the real estate market here is strong (but not hot), which is

good. He expects to see 3-4.5% increases in property values this year. He and his staff are willing to visit with

us to help answer questions we may have about assessments [we’ll discuss at our Feb. meeting whether we

want to have him visit to answer questions, e.g., about appeals]. They plan to work more with repeat

appealers to property taxes to try to get at some of the root causes of appeals.

The County Recorder’s and Surveyor’s offices were also represented.

Nearly all of these public servants ate lunch with ACCT members and answered more questions for us. We

thank them all for providing some really excellent training.

4