critical_transitions_markets - ARAN

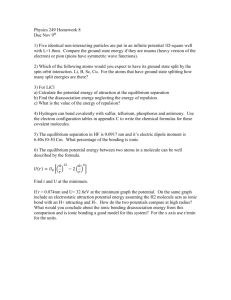

advertisement

Critical transitions in Eurozone sovereign bond markets N. Metadjera,* and S. Raghavendrab a J.E. Cairnes School of Business and Economics, National University of Ireland Galway, University rd., Galway, Ireland. b J.E. Cairnes School of Business and Economics, National University of Ireland Galway, University rd., Galway, Ireland. JEL codes: C22, C61, C62, G12, G15, G17 Keywords: Financial crises, bond interest rate, bifurcation, domain of attraction, early-warning signals, critical slowing down, multiple equilibria. Abstract: In this paper we present empirical evidence that the sovereign bond markets may have undergone a catastrophic transition during the Eurozone debt crisis. We find evidence of a phenomenon called ‘critical slowing down’ that theory predicts should precede such transitions. Two alternate approaches are used to detect critical slowing down. Firstly we estimate the domain of attraction, a methodology that has been used to detect critical transitions in ecological systems, which examines the rate at which a system returns to equilibrium following a stochastic shock. Secondly, we examine the statistical properties of sovereign bond yield data for trends which have been shown to precede catastrophic regime shifts between alternate steady states in many real world dynamical systems. Our results indicate that critical transitions approach provides an alternative method to study financial market crashes and the phenomenon of critical slowing down estimated from the statistical properties of the financial data may act as useful early warning signal in predicting the crashes. * Corresponding author. E-mail: n.metadjer1@nuigalway.ie I. Introduction The financial history of the last century unequivocally points to the stylized fact that the financial markets undergo large and abrupt transition following a prolonged phase of bullish growth. The abruptness of the collapse makes it difficult to predict crashes. The stock market crash of 2007 and the Eurozone sovereign debt market crisis of 2009 provide examples in recent times. In the literature there has been a renewed interest on the issue of predicting such crashes. Broadly, there are two alternative approaches in the literature on the subject. One stems from the economics literature1, predominantly an equilibrium approach, and examines the issue by looking at the deviations from the steady state (i.e. “normal times”) following a stochastic shock. The other approach stems from statistical physics and ecology, proposes the possibility of multiple steady states, analyses the evolution of the financial markets using the concepts of regime shifts and studies the dynamics of transition from one equilibrium to the other.2 In this paper, we follow the second approach taking the cue from the recent literature on the catastrophic regime shifts in ecological systems. There exists a large body of literature in ecology that provides direct empirical evidence that ecosystems and climactic systems undergo abrupt and catastrophic regime shifts (Scheffer et al., 2009; Brock and Carpenter, 2006; Dakos et al. 2008). The abrupt and catastrophic regime shifts are then modelled using the method of bifurcations (or phase transition) in dynamical systems, where the system undergoes qualitative structural changes when an underlying parameter reaches a threshold (or a critical point). For instance, a system could suddenly give rise to new equilibria or the state of the system could switch abruptly from one equilibrium to the alternate equilibrium when the parameter in question reaches the threshold. It is well documented in the dynamical systems theory that these catastrophic changes may be unpredictable as they are usually preceded by gradual or smooth evolution of the system. Wissel (1984) found that a universal property of systems approaching a critical transition is the phenomenon of ‘critical slowing down’. This means that the rate at which a system recovers back to its equilibrium following a small shock goes asymptotically to zero as the critical 1 2 See Colander et al (2009) for a recent review of the literature. See Sornette (2002; 2003) for the popularizing this approach. threshold is approached. The recent ecological literature provides us with methods and tools to detect the phenomenon of critical slowing down from the statistical properties of the system. In this paper, our aim is to empirically verify whether the European bonds markets undergo the critical transition in this crisis by testing the phenomenon of critical slowing down prior to the crash. We examine 10 year sovereign bond yields for Greece, Ireland and Portugal for the evidence of critical slowing down in the lead up to the Eurozone sovereign debt crisis. The presence of critical slowing down prior to the sovereign debt crisis would not only augment our understanding of the dynamics of the crisis but it might also provide us with early warning signals in the context of financial markets. II. Empirical methodology In the literature there are number of methodologies to detect impending critical transition or regime shifts3. In this paper, we use two separate approaches to test critical transition in the European bond markets. The first approach is concerned with the empirical estimation of the domain of attraction and the second approach studies the statistical properties of the system prior to the crash to establish whether or not it underwent critical transition. We provide a brief discussion of these methods in the following. Approach I: Estimating the domain of attraction In simple terms, the domain of attraction is the area of influence of the equilibrium point. In technical terms, the equilibrium point is called as an “attractor”, which literally means that any perturbation around the equilibrium will dampen and the system will return back to its original position of equilibrium. For example, in our case we can think of the equilibrium price as the price at which the bond markets clear, 3 For a summary of these methods see Dakos et al (2012) i.e. demand equals supply at that price. Hence, we would say that the bond market is in equilibrium when there is no excess demand or excess supply, or in other words if the bond market is perturbed around its equilibrium due to some shock it would return back to the its equilibrium level of price. However, the crucial question is after a perturbation from the equilibrium point, how long the system will take to return back to the equilibrium. The return time very much depends on the shape of the domain of attraction, or the curvature of the domain of attraction. Imagine a well, where the walls are steep. If we place a ball anywhere other than its deepest point, the ball will quickly roll down to the deepest point (or global minimum) of the well. However, if the walls are relatively flat, the ball will take relatively more time to reach the minimum of the well. This is analogous to physical systems where we know that the potential energy of the well is instrumental in bringing the ball back to the minimum point in the well – the steeper the well, higher is the potential energy and the ball would roll back at an exponential speed to the minimum. Hence, in order to estimate the domain of attraction we need to calculate its depth over the range of probable values of the state of the system. Let the variable 𝑈 to denote the depth of the domain of attraction and 𝑥 denote the state of the system over which 𝑈 is evaluated. If we go back to the well analogy, as the depth of the well decreases the forces driving the ball back to the bottom of the well increase. Therefore we have that, 𝑑𝑥 𝑑𝑈 =− 𝑑𝑡 𝑑𝑥 Put simply, if a stochastic shock moves the bond market away from its equilibrium price, it will move to a shallower point on the domain of attraction and market forces (supply and demand) will increase, driving the market back to equilibrium. By plotting 𝑈 over a range of probable bond yield values we can determine the number and location of fixed points (equilibria) in the system, where the local minima indicates a stable fixed point and local maxima unstable fixed point. The critical transition literature has developed empirical methods to directly estimate the domain of attraction from the empirical data. The method estimates the depth of the domain of attraction at and around the equilibrium. In other words, the method directly estimates the steepness of the walls of the domain of attraction. Suppose we have two minimum points in the sytem. If the walls of the domain of attraction are steep at and around the equilibrium points as in Fig. 1a, then the system would quickly settle down in the minimum following a stochastic shock. However, for some reason if the domain of attraction flattens at the left hand side equilibrium, as in Fig. 1b, and suppose the initial point of the ball is near the left equilibrium point. Two things would happen: First, the flatness of the domain of attraction of the left equilibrium will slow down the system (or the ball) for any perturbation around that equilibrium, this phenomenon is called as the “critical slowing down”. Secondly, further flattening of the domain of attraction will tip the system over the edge and make the system crash to the global minimum, which is the right hand side equilibrium point. This phenomenon is known as “critical transition” or “catastrophic regime shifts”, and the flattening of the domain of attraction that leads to the slow down in the system is known as “critical slowing down”, which is considered as an early warning signal for any critical transition in the system. Fig. 1 Domain of attraction for a bond market: A) far from a critical transition and B) close to a critical transition. (Dakos et al, 2012; Guttal and Jayaprakash, 2008) Method of estimation Assuming a stochastic model for the bond yields where the rate of change in bond yields (𝑑𝑥) follow a 𝑑𝑈 simple model with drift rate − 𝑑𝑥 and diffusion parameter 𝜎 2 , 𝑑𝑥 = − 𝑑𝑈 𝑑𝑡 + 𝜎𝑑𝑊 𝑑𝑥 (1) and W is a Weiner process with mean 0 and variance of 1, which is the stochastic component of the bond yield. From Eq. (1) we can estimate and plot the domain of attraction for each of the bond markets and track changes over time. Following Livina et al. (2010), derive a relationship between the empirical probability density function of a stochastic process of bond yields (Eq. 1) and its domain of attraction. The first step is to define the Fokker-Planck Equation (FPE) for the above model. The FPE describes the time evolution of the probability density function of the bond yield (𝑥).4 𝜕𝑝(𝑥, 𝑡) 𝜕 𝑑𝑈 1 𝜕2 = [ 𝑝(𝑥, 𝑡)] + 𝜎 2 2 [𝑝(𝑥, 𝑡)] 𝜕𝑡 𝜕𝑥 𝑑𝑥 2 𝜕𝑥 (2) This differential equation can be solved for a stationary solution to the probability density function 𝑝(𝑥) given by 𝑝(𝑥)~𝑒 −2𝑈(𝑥) 𝜎 (3) We can therefore obtain the relationship between the depth of the domain of attraction and the stationary probability density function as 𝑈=− 4 𝜎2 𝑙𝑜𝑔𝑝𝑑 2 For definition, derivation and solution of the FPE see Gardiner (1985). (4) Where 𝑝𝑑 , the empirical probability density function can be estimated using a standard Gaussian kernel estimator.5 Approach II: Estimating the statistical indicators of critical transitions Our second approach uses indicators outlined in the critical transitions literature to detect critical slowing down. In the critical transition literature it is well documented that the phenomenon of critical slowing down is related to the increase in the correlation in the system. We examine changes in the AutoRegression lag 1 (AR1) coefficient, Auto-Correlation Function at lag 1 (ACF1) (Dakos et al., 2008), SD (Brock and Carpenter, 2006), Skewness (Guttal and Jayaprakash, 2008) and Kurtosis (Biggs et al. 2009). Note that from the AR(1) coefficient we can calculate the recovery rate of the system for any perturbation from the equilibrium point, which is simply the reciprocal of the AR(1) coefficient. So, we should expect the recovery rate to tend to zero as the system approaches the critical threshold. The existing literature states that these indicators, also called early warning signals, should increase in a continuous manner as a critical transition is approached due to critical slowing down. Dakos et al. (2012) outline a procedure for testing for indicators of impending critical transitions in time series data. The bond yield data is detrended by first log differencing to remove unit roots and secondly using a Gaussian kernel smoother to remove any remaining non stationarities, which may lead to spurious results. We follow the methodology of Dakos et al. (2008; 2012) and choose a bandwidth of the Kernel smoother equal to 10% of the sample size for our baseline analysis. The indicators are calculated on the detrended residuals of the bond yields, in overlapping rolling windows equal to 50% of the sample size. In order to 5 See Silverman (1986). test the strength of the trend in the indicators we use Kendall’s tau correlation coefficient. Surrogate data methods are used to determine the significance of our results6. III. Results Approach I: Estimating the domain of attraction We estimate and plot the domain of attraction of the Greek, Irish and Portuguese bond markets over 6 month, non-overlapping windows. For comparison purposes the plots are scaled by their standard deviations. Portugal and Ireland are examined from 1 July 2008 to 31 June 2011 whereas for Greece we examine the period 1 January 2008 to 31 December 2010. The time periods are chosen based on a visual examination of the raw data; the choice of time period is based upon when the bond yields begin to rise across our sample countries. An earlier time period is chosen for Greece due to the fact that the country’s sovereign bond yields appear to increase sooner than those of Ireland and Portugal. We use daily bond yield data which is not log differenced or otherwise detrended. The results are displayed in Figs 2, 3 and 4 below. The Greek plots display some behaviour consistent with critical slowing down. Initially the domain of attraction is very narrowly distributed around a bond yield of approximately 5%, with steep walls indicating a stable equilibrium with a high recovery rate. From the first half of 2009 onwards there appears to be an increase in the spread and asymmetry of the domain of attraction. This is consistent with increasing variance and skewness. A flattening of the wall of the domain of attraction occurs in the first half of 2010 followed by a sharp increase from a global minimum of approximately 5-6% in the period ended 30 June 2010 to approximately 11-12% in the period ended 31 December 2010. However the later 6 1000 surrogate data sets are constructed with the same best fit ARMA structure as the detrended bond yield data. Pvalues are were derived from the estimated Kendall-𝜏 statistics, calculated on the statistical indicators of critical slowing down for each of the 1000 surrogate time series. time periods exhibit irregular behaviour with numerous local maxima and minima, making it difficult to observe behaviour predicted by critical transitions theory. Both the Irish and Portuguese bond data display behaviour consistent with the hypothesis of critical slowing down occurring in the markets. In both cases we observe an increase in spread and asymmetry as well as a gradual flattening of the right hand side of the wall of the domain of attraction, culminating in a situation with two distinct local minima (or two distinct equilibria) in the period ended 30 June 2011. In both cases the lower minimum (equilibrium) is at approximately 6% and the higher minimum (equilibrium) corresponds to a yield of approximately 12%. Our results provide some evidence of behaviour consistent with the critical transitions literature, with abrupt transitions between alternate equilibria in all three sovereign bond markets preceded by a flattening of the domain of attraction. Fig. 2 Estimated domain of attraction for Greek bond yield data in 6 month non overlapping windows plotted over a range of bond yield to maturity on the 𝒙-axis Fig. Estimated domain of attraction for Irish bond yield data in 6 month non overlapping windows plotted over a range of bond yield to maturity on the 𝒙-axis Fig.4 Estimated domain of attraction for Portuguese bond yield data in 6 month non overlapping windows plotted over a range of bond yield to maturity on the 𝒙-axis Approach II : Estimating the statistical indicators of critical transitions Figs 5, 6 and 7 display the results of the indicators of critical slowing down. The first pane displays the detrended bond yield data. In the following panes we have the rolling window AR1, ACF1, SD, skewness and kurtosis. The results displayed are for the baseline case of 50% rolling window size and 10% bandwidth for the Gaussian kernel smoother. The Kendall-𝜏 value is also provided for each indicator. The Kendall-𝜏 values alongside their p-values based on surrogate significance testing are summarised in Table 3.1. Based on the results of the potential analysis we choose a critical threshold of 30 June 2010 for Greece and 31 December 2010 for Ireland and Portugal. Table 1. Kendall’s Tau and p-values for indicators of critical transitions Greece Ireland Portugal Kendall p- Kendall p- Kendall p- tau value tau value tau value ACF1 0.532 0.186 0.718* 0.061 0.69* 0.071 SD 0.957*** 0.001 0.987*** 0.001 0.986*** .001 Skewness 0.347 0.32 0.578 0.161 0.692* 0.08 Kurtosis 0.664* 0.096 0.576 0.131 0.672* 0.077 Notes: * indicates 10% significance based on surrogate data testing, ** =5%, and ***=1%. p-value are calculated using surrogate data sets Please note that since the AR(1) coefficients are identical to ACF(1) coefficients for all sample countries, we did not report them separately. All the indicators increase over time across all our sample countries as evidenced by positive Kendall tau values. For Greece the ACF1 coefficient and the skewness are insignificant. However the SD and kurtosis have positive significant trends. In Ireland the ACF1 coefficient and the SD are significant but the skewness and kurtosis are insignificant. However, both the skewness and kurtosis are quite close to the 10% significance level. The Portuguese results indicate significant positive trends across all indicators. Fig. 5 Indicators of critical transitions Greece 01/01/2004-30/06/2010. On the 𝒙axis is the observation number and on the 𝒚-axis is the indicator value. Fig. 6 Indicators of critical transitions Ireland 01/01/2004-31/12/2010. On the 𝒙axis is the observation number and on the 𝒚-axis is the indicator value. Fig. 7 Indicators of critical transitions Portugal 01/01/2004-31/12/2010. On the 𝒙axis is the observation number and on the 𝒚-axis is the indicator value. IV. Conclusion Our results provide some evidence that the sovereign debt markets of Greece, Ireland and Portugal exhibited critical transitions in this crisis. Potential analysis indicates a flattening of the wall of the domain of attraction prior to transitions between alternate equilibria for Greece in the mid to late 2010 and for Portugal and Ireland in early to mid-2011, which is a sign of critical slowing down in those markets. Further evidence is found in the positive trends exhibited in many of the statistical indicators of critical transition of the bond yield data of countries in our sample. For instance, the Kendall statistic for Autocorrelation (ACF1) is significant for Ireland and Portugal, and the Kendall statistic for Standard Deviation is significant for Greece, Ireland and Portugal at the highest level of significance. Even though, further analysis with larger datasets and higher frequency is needed to establish that financial markets undergo catastrophic regime shifts, our results indicate that critical transitions approach provides an alternative method to study financial market crashes and the phenomenon of critical slowing down estimated from the statistical properties of the financial data may act as useful early warning signal in predicting the crashes. V. Acknowledgements Naoise Metadjer would like to acknowledge research funding received from the Irish Research Council for the Humanities and Social Sciences and from the Hardiman Research Scholarships. VI. Bibliography Brock, W. A. and Carpenter, S. R. 2006. Variance as a Leading Indicator of Regime Shift in Ecosystem Services. Ecology and Society, 11, 1-15. Dakos, V., Carpenter, S. R., Brock, W. A., Ellison, A. M., Guttal, V., Ives, A. R., Kefi, S., Livina, V., Seekell, D. A., Van Nes, E. H. & Scheffer, M. 2012. Methods for Detecting Early Warnings of Critical Transitions in Time Series Illustrated Using Simulated Ecological Data. PLoS ONE, 7, e41010. Dakos, V., Scheffer, M., Van Nes, E. H., Brovkin, V., Petoukhov, V. & Held, H. 2008. Slowing down as an early warning signal for abrupt climate change. Proceedings of the National Academy of Sciences, 105, 14308-14312. Gardiner, C. W. 1985. Handbook of stochastic methods for physics, chemistry, and the natural sciences, Springer, Berlin. Guttal, V. & Jayaprakash, C. 2008. Changing skewness: an early warning signal of regime shifts in ecosystems. Ecology Letters, 11, 450-460. Livina, V., Kwasniok, F. & Lenton, T. 2010. Potential analysis reveals changing number of climate states during the last 60kr. Climate Past, 6, 77-82. Scheffer, M., Bascompte, J., Brock, W. A., Brovkin, V., Carpenter, S. R., Dakos, V., Held, H., Van Nes, E. H., Rietkerk, M. & Sugihara, G. 2009. Early-warning signals for critical transitions. Nature, 461, 5359. Silverman, B. W. 1986. Density Estimation for Statistics and Data Analysis, Chapman and Hall, London. Sornette, D. 2002. Predictability of catastrophic events: Material rupture, earthquakes, turbulence, financial crashes, and human birth. Proceedings of the National Academy of Sciences of the United States of America, 99, 2522-2529. Sornette, D. 2003. Why stock markets crash: critical events in complex financial systems, Princeton University Press, New Jersey. Wissel, C. 1984. A Universal Law of the Characteristic Return Time near Thresholds. Oecologia, 65, 101-107.