Issue: Investment Classification Review

advertisement

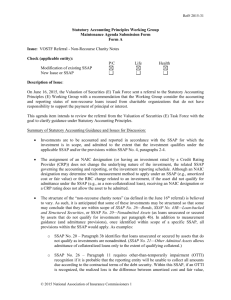

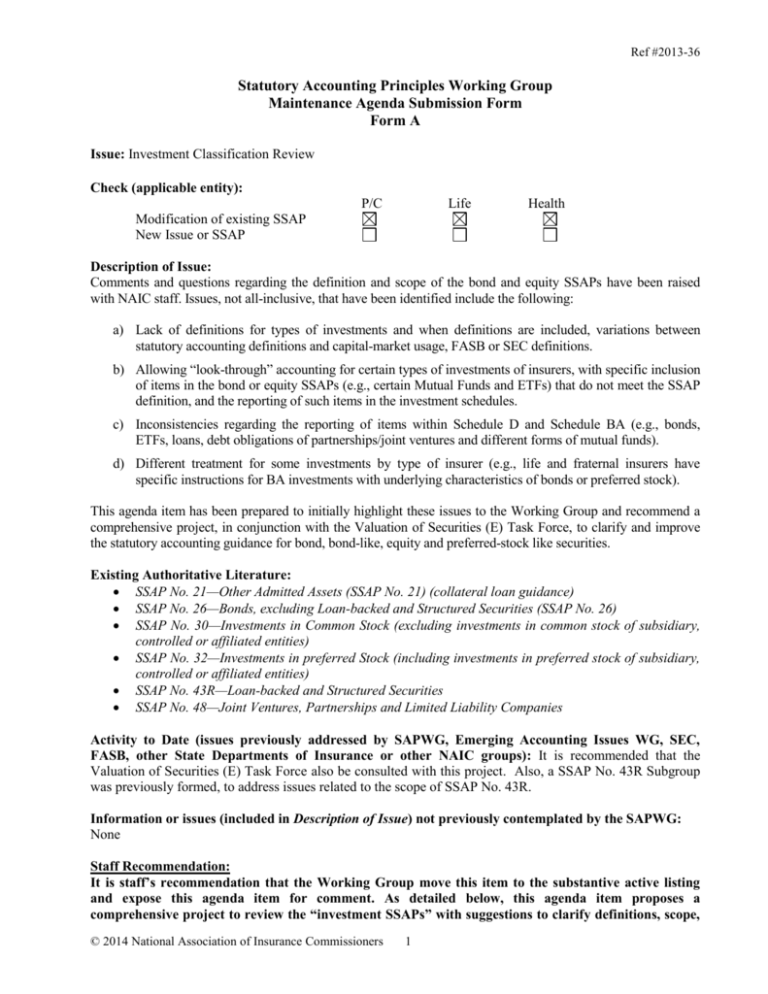

Ref #2013-36 Statutory Accounting Principles Working Group Maintenance Agenda Submission Form Form A Issue: Investment Classification Review Check (applicable entity): P/C Life Health Modification of existing SSAP New Issue or SSAP Description of Issue: Comments and questions regarding the definition and scope of the bond and equity SSAPs have been raised with NAIC staff. Issues, not all-inclusive, that have been identified include the following: a) Lack of definitions for types of investments and when definitions are included, variations between statutory accounting definitions and capital-market usage, FASB or SEC definitions. b) Allowing “look-through” accounting for certain types of investments of insurers, with specific inclusion of items in the bond or equity SSAPs (e.g., certain Mutual Funds and ETFs) that do not meet the SSAP definition, and the reporting of such items in the investment schedules. c) Inconsistencies regarding the reporting of items within Schedule D and Schedule BA (e.g., bonds, ETFs, loans, debt obligations of partnerships/joint ventures and different forms of mutual funds). d) Different treatment for some investments by type of insurer (e.g., life and fraternal insurers have specific instructions for BA investments with underlying characteristics of bonds or preferred stock). This agenda item has been prepared to initially highlight these issues to the Working Group and recommend a comprehensive project, in conjunction with the Valuation of Securities (E) Task Force, to clarify and improve the statutory accounting guidance for bond, bond-like, equity and preferred-stock like securities. Existing Authoritative Literature: SSAP No. 21—Other Admitted Assets (SSAP No. 21) (collateral loan guidance) SSAP No. 26—Bonds, excluding Loan-backed and Structured Securities (SSAP No. 26) SSAP No. 30—Investments in Common Stock (excluding investments in common stock of subsidiary, controlled or affiliated entities) SSAP No. 32—Investments in preferred Stock (including investments in preferred stock of subsidiary, controlled or affiliated entities) SSAP No. 43R—Loan-backed and Structured Securities SSAP No. 48—Joint Ventures, Partnerships and Limited Liability Companies Activity to Date (issues previously addressed by SAPWG, Emerging Accounting Issues WG, SEC, FASB, other State Departments of Insurance or other NAIC groups): It is recommended that the Valuation of Securities (E) Task Force also be consulted with this project. Also, a SSAP No. 43R Subgroup was previously formed, to address issues related to the scope of SSAP No. 43R. Information or issues (included in Description of Issue) not previously contemplated by the SAPWG: None Staff Recommendation: It is staff’s recommendation that the Working Group move this item to the substantive active listing and expose this agenda item for comment. As detailed below, this agenda item proposes a comprehensive project to review the “investment SSAPs” with suggestions to clarify definitions, scope, © 2014 National Association of Insurance Commissioners 1 Ref #2013-36 and the accounting method / related reporting. This project suggests the development of a new SSAP to capture investments that are outside of specific “investment-type” definitions and consider the elimination of “exceptions” within specific SSAPs and address specific characteristics of those investments to ensure consistent and appropriate valuation and reporting. (Due to the potential movement of investments within different SSAPs or reporting schedules, staff has proposed for this to be a substantive change.) As part of an initial exposure, comments are requested on the overall proposal, as well as the key elements and possible actions identified below. Comments are requested to provide information regarding the identified items as well as additional elements/possible actions that should be considered. Staff Review Completed by: Julie Gann, NAIC staff – November 2013 Original Overview of SSAP Guidance and Reporting Process with Identified Elements and Proposals: Note: The following was completed in the original drafting of the agenda item. It has been retained for historical purposes. Please see the reference to subsequent memorandums / documents noted in the status section for the most current exposure/discussion items. SSAP No. 26 - Bonds Any securities representing a creditor relationship, whereby there is a fixed schedule Definition: for one or more future payments. Noted Inclusions: US Treasury Securities, US Government Agency Securities, Municipal Securities, Corporate Bonds, Bank Participations, Convertible Debt, Certificates of Deposit in excess of one year, Commercial Paper, ETFs that qualify per the P&P Manual, Class 1 Bond Mutual Funds identified in the P&P Manual. Reporting: Schedule D - Part 1, Long-Term Bonds Valuation: Amortized Cost or Lower of Amortized Cost of Fair Value (depends on designation and whether the holder maintains AVR) Key Elements: 1. Definition of a bond is very broad. This has led to confusion regarding the items within scope of SSAP No. 26, and whether items should be reported on Schedule D or BA. This includes questions raised on the difference between a bond, a loan (SSAP No. 21, paragraph 3) and a secured borrowing (SSAP No. 103), as well as investments in debt obligations of a partnership, LLC or joint venture. 2. Noted inclusions identify specific items that are outside of the bond definition (e.g., ETFs and Mutual Funds). These specific items meet the definition of stock but have been included within SSAP No. 26 as a “look-through” approach has determined the underlying assets to be fixed-income. Although included in SSAP No. 26, the aspects of these items do not mirror components of standard bonds; therefore the reporting of such items on Schedule D – Part 1 has been inconsistent or confusing. Also, as “exceptions” to the bond definition have recently expanded, consideration may be needed on whether more items should be permitted a look-through approach. 3. Inclusion of Commercial Paper in paragraph 2h, without any reference to the term, is confusing as these instruments often do not extend beyond 270 days. (SEC registration is required if term extends beyond 270 days.) Commercial Paper that is short-term © 2014 National Association of Insurance Commissioners 2 Ref #2013-36 (less than one-year) is captured by SSAP No. 2—Cash, Drafts and Short-Term Investments and included in Schedule DA. Possible Options: A. Incorporate a definition for a bond that utilizes the existing terms (creditor/debtor relationship with a fixed schedule for future payments) and also defines a “security” as this is often the key difference between a “bond” and a “loan”. Proposal suggests incorporating the FASB “security” definition, as it is used in FASB Codification Topics 320 (Investments – Debt and Equity Securities) and 860 (Transfers and Servicing): FASB Security Definition: A share, participation, or other interest in property or in an entity of the issuer or an obligation of the issuer that has all of the following characteristics: a. It is either represented by an instrument issued in bearer or registered form or, if not represented by an instrument, is registered in books maintained to record transfers by or on behalf of the issuer. b. It is of a type commonly dealt in on securities exchanges or markets or, when represented by an instrument, is commonly recognized in any area in which it is issued or dealt in as a medium for investment. c. It either is one of a class or series or by its terms is divisible into a class or series of shares, participations, interests, or obligations. B. Eliminate “exceptions” for items that are not “bonds” per the stated proposed definition from SSAP No. 26. This would include the Mutual Funds and ETFs currently included in SSAP No. 26, paragraphs 2i and 2j. (These items are proposed to be addressed in a separate SSAP with specific accounting and reporting guidance as they may have “bond-like characteristics” but they are not “bonds” and they do not have the same reporting elements of bonds (e.g., par value, amortized cost, maturity, NAIC designations, etc.). This also complicates the application of the accounting guidance. C. Clarify the guidance for Commercial Paper so that SSAP No. 26 is more explicit that it only includes commercial paper with terms that exceed one year. (Based on the SEC provisions it is speculated that such items may not be common.) The FASB or SEC do not include a definition of Commercial Paper, the following was found on an investor website: Short-term, unsecured, discounted, and negotiable notes sold by one company to another in order to satisfy immediate cash needs. D. Clarify the scope to explicitly include reference to debt obligations issued by joint ventures/partnerships as SSAP No. 48 should only provide accounting and reporting requirements for equity interests in these organizations. SSAP No. 30—Common Stock Definition: Securities which represent a residual ownership in a corporation. Noted Inclusions: Publicly traded common stocks, master limited partnerships trading as common stocks and American deposit receipts only if the security is traded on the New York, American, or NASDAQ exchanges, publicly traded common stock warrants, shares of © 2014 National Association of Insurance Commissioners 3 Ref #2013-36 Reporting: Valuation: mutual funds (except Class 1 bond funds and ETFs, which qualify for bond treatment), common stocks that are not publicly traded, and common stocks that are restricted as to transfer of ownership. Schedule D- Part 2 – Section 2, Common Stocks Owned Initially at cost, but at fair value on the balance sheet. Fluctuations in fair value are recorded as unrealized gains/losses until realized. Key Elements: 1. Although not widely different, the definition of “stock and common stock” is not consistent with the SEC: Stocks are a type of security that gives stockholders a share of ownership in a company. Stocks also are called “equities.” A common stock that is subordinate to all other stock of the issuer. 2. The inclusion of “mutual funds” within the “common stock” definition is overly broad and allows inclusion of all “investment company” investments, and the characteristics of some of these investments may warrant separate accounting and reporting consideration (e.g., look-through). Per the SEC, an "investment company" is a company (corporation, business trust, partnership, or limited liability company) that issues securities and is primarily engaged in the business of investing in securities. An investment company invests the money it receives from investors on a collective basis, and each investor shares in the profits and losses in proportion to the investor's interest in the investment company. The performance of the investment company will be based on (but it won't be identical to) the performance of the securities and other assets that the investment company owns. The federal securities laws categorize investment companies into three basic types: Mutual funds (legally known as open-end companies); Closed-end funds (legally known as closed-end companies); UITs (legally known as unit investment trusts). Each type has its own unique features. For example, mutual fund and UIT shares are "redeemable" (meaning that when investors want to sell their shares, they sell them back to the fund or trust, or to a broker acting for the fund or trust, at their approximate net asset value). Closed-end fund shares, on the other hand, generally are not redeemable. Instead, when closed-end fund investors want to sell their shares, they generally sell them to other investors on the secondary market, at a price determined by the market. In addition, there are variations within each type of investment company, such as stock funds, bond funds, money market funds, index funds, interval funds, and exchange-traded funds (ETFs). Consideration should also occur on whether registered and unregistered investments should be treated differently. Possible Options: A. Incorporate a definition for “common stock” that mirrors the SEC definition: Stocks are a type of security that gives stockholders a share of ownership in a company. Stocks also are called “equities.” A common stock is subordinate to all other stock of © 2014 National Association of Insurance Commissioners 4 Ref #2013-36 the issuer. B. Conduct a review of the various types of “investment company” investments and determine explicit guidance for these investments – including whether the investments warrant “common stock” (SSAP No. 30) accounting and reporting treatment or whether they need separate accounting and reporting guidance. This proposal suggests the potential development of a new SSAP to capture various investments that do not fit within the current SSAPs. (For example “mutual funds” and UITs are redeemable at “Net Asset Value” (NAV), which is calculated at the investment company’s total assets minus its total liabilities. This amount is calculated daily, and the price that investors receive on redemptions is the approximate per share NAV at redemption, minus any fees that the fund deducts at that time (such as deferred sales loads or redemption fees). C. The current reporting schedule (D -2-2) does not include information regarding NAIC designation. Although such information is not provided for a distinct “common stock” there may be items that could be subject to NAIC designation that may be determined to fit best within this schedule. As such, revisions are proposed to capture this information (as well as other pertinent info as deemed through review of this project) for appropriate accounting and reporting considerations (e.g., RBC). D. Clarify the guidance within SSAP No. 30 to differentiate between the “equity” interests captured within that schedule, and “equity” investments captured within SSAP No. 48 (Schedule BA). SSAP No. 32—Preferred Stock Definition: Preferred stock may or may not be publicly traded is defined as any class or series of shares the holders of which have any preference, either as to payment of dividends or distribution of assets on liquidation over the holder of common stock. Noted Inclusions: Redeemable preferred stock (including mandatory sinking fund preferred stock, payment in kind stock and preferred stock redeemable at option of the holder), perpetual preferred stock (including nonredeemable preferred stock and preferred stock redeemable at the option of the issuer) and exchange traded funds that qualify for preferred stock treatment as determined by the SVO. Reporting: Schedule D- Part 2 – Section 1, Preferred Stocks Owned Valuation: Initially at cost, including brokerage and other related fees. Balance sheet reporting varies based on whether the stock is high-quality, redeemable or perpetual (characteristics of debt or equity), and whether the reporting entity maintains an AVR. Based on these characteristics, preferred stock can be reported at cost, amortized cost, or fair value, or the lower of cost, amortized cost or fair value. Key Elements: 1. For consistency purposes, definitions of preferred stock, redeemable preferred stock, and perpetual preferred stock should be consistent with definitions available under US GAAP or SEC. 2. Noted inclusions identify specific items that are generally outside of the preferred stock definition (e.g., ETFs). Possible Options: A. Incorporate definitions that mirror the FASB or SEC definitions. © 2014 National Association of Insurance Commissioners 5 Ref #2013-36 B. Conduct a review of the entire standard to assess the scope of inclusions (e.g., ETFs) as well as the measurement method for the different preferred stock investments. SSAP No. 43R—Loan-backed and Structured Securities Loan-backed securities are securitized assets for which the payment of interest and principle is directly proportional to the payments received by the issuer from the underlying assets, including but not limited to pass-through securities, lease-backed securities, and equipment trust certificates. Definition: Structured securities are loan-backed securities which have been divided into two or more classes for which the payment of interest and/or principal of any class of securities has been allocated in a manner which is not proportional to payments received by the issuer from the underlying assets. Noted Inclusions: Includes beneficial interests in securitization transactions that are accounted for as sales under SSAP No. 103 and purchased beneficial interests in securitized financial assets. Also includes commercial mortgage-backed securities, residential mortgage-backed securities, equipment trust certificates, credit tenant loans (CTL), 5*/6* securities, interest only (IO) securities, and loan-backed and structured securities, Beneficial Interest Definition: Rights to receive all or portions of specified cash inflows received by a trust or other entity, including, but not limited to, senior and subordinated shares of interest, principal, or other cash inflows to be “passed-through”, or “paid through”, premiums due to grantors, commercial paper obligations, and residual interests, whether in the form of debt or equity. Reporting: Schedule D - Part 1, Long-Term Bonds Valuation: Entities with AVR – Reported at amortized cost, except for those with an NAIC designation of 6, which is reported at the lower of amortized cost or fair value. Entities without AVR – Items with NAIC designation 1-2, reported at amortized cost. Items with NAIC designation 3-6, reported at lower of amortized cost or fair value. Designation of items within SSAP No. 43R follows the Purposes and Procedures Manual of the NAIC SVO: 1) Financial Modeling, 2) Modified Filing Exempt, or 3) All other Securities. Items within SSAP No. 43R also have potential for “bifurcated impairment” based on whether the entity intends sell, or if the entity has the intent and ability to hold the investment to recover the amortized cost basis. Key Elements: 1. The cash flow assessments required within SSAP No. 43R have been misinterpreted for single-payer investments (e.g., equipment-trust certificates, credit tenant loans). 2. The definition of beneficial interests includes items that may be in the form of debt and equity. Items that resemble equity-interests do not fit in the definition of a loan-backed and structured security, but they are included in SSAP No. 43R. © 2014 National Association of Insurance Commissioners 6 Ref #2013-36 3. Additional securities may be eligible to be financially modeled, but the determination of NAIC designation as a result of financial modeling is only addressed for loanbacked and structured securities. Possible Options: A. Incorporate guidance to clarify the scope of SSAP No. 43R. B. Consider accounting and reporting guidance in accordance with the review of other investments conducted as part of this project. SSAP No. 48—Joint Ventures, Partnerships and Limited Liability Companies Definition: Includes investments in corporate joint ventures and unincorporated joint ventures, investments in general partnership interests and limited partnership interests. Noted Inclusions: Includes investments in certain state low income housing tax credit property investments that do not fall within SSAP No. 93. Investments in scope that do not reflect a “minority” interest are captured under SSAP No. 97—Investments In Subsidiary, Controlled and Affiliated Entities Reporting: Schedule BA – Other Long-Term Invested Assets Valuation: SSAP No. 48 (Minority Interest) – Audited US GAAP Equity. (If audited US GAAP equity is not available, provisions allow for use of audited foreign GAAP, audited IFRS, or tax basis if criteria/reconciliations are met.) SSAP No. 97 (Non-Minority Interest) – Either Market Valuation, Audited Statutory Equity, or Audited GAAP Equity Key Elements: 1. The term “investments” is overly broad and seemingly includes all investments, however, the perceived intent is to only include equity investments, and not debt investments held by the reporting entity. 2. Schedule BA has different reporting guidelines for life and fraternal insurers some of this is an intentional differentiation by risk-based capital. Possible Options: A. Incorporate clarification guidance to clarify the scope of “investments” within scope of SSAP No. 48. B. Review and understand current accounting and reporting processes and the extent to which different reporting should exist based on the type of reporting entity. Status: On December 15, 2013, the Statutory Accounting Principles (E) Working Group moved this item to the substantive active listing and exposed the comprehensive project to review the investment SSAPs. As part of the exposure, comments are requested to provide information regarding the identified items as well as additional elements/possible actions that should be considered. The Working Group also directed staff to revise the name of this agenda item from “Definition of Mutual Funds and Bond Equity” as the scope would expand between bonds and stocks. Staff updated the name to “Investment Classification Review.” © 2014 National Association of Insurance Commissioners 7 Ref #2013-36 On March 29, 2014, the Statutory Accounting Principles (E) Working Group received comments from interested parties and directed NAIC staff to begin developing an issue paper for this project, as well as sending referrals to Valuation of Securities (E) Task Force, the Capital Adequacy (E) Task Force and the Blanks (E) Working Group to request collaboration. On April 17, 2014 the Statutory Accounting Principles (E) Working Group conducted an e-vote to expose a draft investment matrix. This matrix was developed in response to the chair request during the 2014 Spring National Meeting to assist in the identification of issues that should be discussed as part of this agenda item. During the National Meeting, it was noted that the matrix would be publicly distributed to gather information from regulators and interested parties on the investment issues that should be discussed. Pursuant to the evote, the investment matrix was exposed for a public comment period ending June 7. On August 16, 2014, the Statutory Accounting Principles (E) Working Group considered comments on the investment matrix and exposed a memorandum with proposed discussion topics, and suggested prioritization. G:\DATA\Stat Acctg\3. National Meetings\A. National Meeting Materials\2014\Summer\NM Exposures\13-36 - Investment Classification.docx © 2014 National Association of Insurance Commissioners 8