X1 thinking is only the start, however. Brian

advertisement

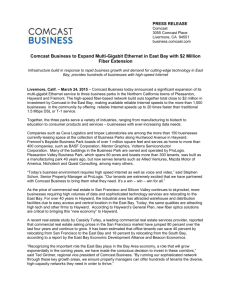

The Sunday Brief: Comcast – In Search of Legacy Greatness 17 February 2013 Happy President’s Day weekend from 8,700 feet! Many of you are enjoying this weekend away from the stress hustle and bustle of the office, as am I. Many of you enjoy The Sunday Brief for the pictures, and for those who are skiers, this is a picture that should bring back memories. Well, it’s been another busy week in telecom. CenturyLink (I am a shareholder) cut their dividend by 26%, sending their stock price down 23% in one day (there’s a lot in the CTL announcement and we will revisit in a March SB). Research firm NPD announced that the Xbox continued their 25 month reign at the video game hardware leaderboard (this was offset by reports of parts shortages of the Surface Pro). LTE chipmaker leader Sequans (I’m on their Board of Directors) defied conventional wisdom and successfully completed a secondary share offering (their shares closed Friday more than 10% above the offering price). And Clearwire shareholders received no additional insights on their direction from this week’s earnings call (and only a few of us were surprised). The big news, however, was Comcast’s quarterly earnings call and surrounding announcements. Acquiring the remaining stake in NBC Universal is a milestone event, as it combines content creation with customer experience control. There are limitations to the extent of that combination, but, as Comcast mentioned on the earnings call, there are new frontiers for theatrical and broadcast releases that make content more attractive to customers. What’s unique about NBCU is that it allows a former cable executive (Steve Burke) to ask questions about content delivery that his peers at TWE and Viacom do not have the experience and insight to posit. In turn, it allows the cable business an opportunity to test the limits of content delivery and, through that process, deliver a substantially improved (and better connected) content experience (e.g., “The Voice” at 18ms latency to your Wi-Fi device). This week’s Sunday Brief will focus on Comcast’s earnings from a cable perspective and will highlight the areas where the combined company might consider improving their value proposition. The chart to the left shows the performance of Comcast and Time Warner Cable’s stocks over the past year. Both companies have seasoned leadership, and both companies face significant competition from AT&T U-Verse and Verizon FiOS products (Comcast in Atlanta, San Francisco, Chicago and Miami with U-Verse, and Washington DC with FiOS; TWC with New York City for FiOS, and Los Angeles, Dallas, Ohio, and the Carolinas for U-Verse). Both companies have made significant capital and sales force investments in Business Services (Comcast’s $2.4 billion in annualized revenue is now ahead of TWC’s $1.9 billion but over a larger footprint). While the source of revenues is fundamentally different (cable is deriving 80+% of revenues from accounts with less than 20 employees), the combined TWC/ Comcast business services revenues will likely be larger than that of infrastructure provider Level3 by 2014 ($6.4 billion revenue in the last four quarters). Comcast is depending on business services for at least $800 million in revenue growth in 2013 – that’s a little over 2% growth for the entire cable business unit. If both Time Warner Cable and Comcast are growing their Business Services markets, and High Speed Internet penetration (primarily through DSL conversion but some product growth as well) continues to grow, why the large gap in recent stock performance? Where has Comcast found wind to fill investors’ sails? Fourth quarter earnings provide several clues. First, Comcast views video differently than Time Warner Cable (and other cable providers). To Comcast, video is not a cash cow, a rinse and repeat formula of retransmission agreements followed by rate hikes (or, to use the snappy Verizon term “price ups”). Video is the means to deliver new and innovative content to 21+ million digital and 11.5 million advanced video customers. This sounds subtle, but Comcast has backed up this commitment with billions of dollars of video platform investment over the past two decades. They want to drive a new and different video experience. This sounds small, but with a better remote control (Electronic Programming Guide) product, channel organization (which filters out channels most customers never watch), and on-screen search customer engagement improves. The X1 results described on the earnings call clearly show that small changes are yielding big results. X1 thinking is only the start, however. Brian Roberts hinted at the need to think differently in one of his responses to a question when he said he wanted to make Comcast “the absolute home for where a young person coming out of school or somebody with their career says this is a company at the crosshairs of media and technology, and all parts of this company make it where I want to spend my career.” Sounds like an ambitious Silicon Valley CEO, not a button-downed East Coast business executive. To Comcast, video is going through a new adoption curve, one that is enabled by remote access to content through multiple devices. To continue to fend off innovation from Apple, Microsoft (Xbox), and others, they will need to simplify and redesign the customer experience. X1 is only the start. Second, Comcast is reinvesting in their data platform to drive growth and faster speeds. Today, when you order High Speed Internet service from Comcast, the default (baseline) speed is 20 Mbps. In most locations, customers can order up to 105 Mbps (which enables a faster work-at-home connection than most offices offer today). Comcast is going to increase baseline speeds in 2013 and also incorporate a better modem/ Wi-Fi router experience. With more devices (automatically) connecting to the home router, this will not only be an excellent retention tool, but also accelerate adoption. Couple this with the continued cooperation with Cox, Time Warner Cable, and Brighthouse to create a national Wi-Fi network, and Comcast has the makings of a truly unique consumer and small business Internet experience. (Note: If Comcast wants to take a page out of the Amazon playbook, they should offer their new router at slightly above cost (or even free) to customers who take advanced data packages). Comcast’s investment extends beyond the home, however. Network nodes, routers, and optical equipment need to be installed. This investment, in turn, brings faster speeds closer to the local office building, making the investment for “last mile” of fiber easier to justify. But the investment starts with the home (or apartment). When the economy recovers, Comcast will be ready with both business and consumer High Speed Internet reaping the benefits. Finally, Comcast is reinventing the operations that generate nearly $40 billion in revenues. Neil Smit discussed these at length during the earnings call: … We remain very focused and believe we can continue to gain further efficiencies in our customer service and technical operations. In 2012, we reduced our activity levels by more than 4.5 million truck rolls and by 16 million agent calls handled in our call centers, even as we added 1.5 million total new customers. Our service is improving and customers continue to elect self-installations, which accounted for 36% of our total installations at year-end 2012 compared to 21% at year-end 2011. In addition, we now have 27% of customers managing their accounts online. All these improvements reflect the innovative efforts we are making to increase customer satisfaction by giving our customers more choice and control, which results in lower activity levels for our cable operations. Comcast continues to suffer from an acknowledgement gap. ACSI rates them the fourth worst company in the country for customer service. J.D. Power has consistently rated Comcast (now called XFINITY) at the bottom of the pack for years (latest TV survey results can be found by clicking here and Internet results by clicking here). Without a doubt, new services like X1 will improve Comcast’s brand image, but will this be enough? Can Comcast remove the need for 50% of all service calls with help from the Silicon Valley (or from my friends at Step One in Austin, TX who would be an interesting showcase of the Comcast/ Verizon product set)? Comcast’s long-term approach to video, High Speed Internet, and Business Services separates them from their peers. Investors are just beginning to realize the effects of their multi-year plan. But without an improved brand image acknowledged by millions of customers to back up their innovations, they will remain a good company and not break into an Apple, Amazon, or Google level of greatness. Something to think about as we celebrate Michael Jordan’s birthday today, and President’s Day tomorrow. For more on Comcast, their earnings release, trending schedule, webcast, and transcript can be found here (registration required). More on the CenturyLink announcement along with other earnings release analysis next week. If you have friends who would like to be added to this email blog, please have them drop a quick note to sundaybrief@gmail.com and we’ll add them to the following week’s issue. Have a terrific week! Jim Patterson Patterson Advisory Group www.pattersonadvice.com jim@pattersonadvice.com (816) 210-0296 mobile Twitter: @pattersonadvice