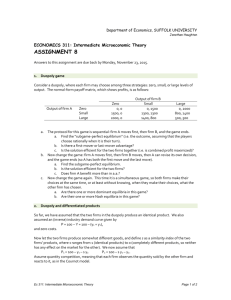

The Right Speed And Its Value

advertisement