FinStmt Shell - Brainerd HRA

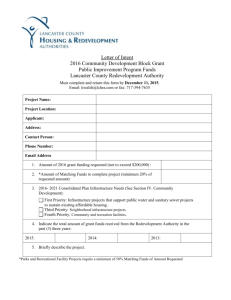

advertisement