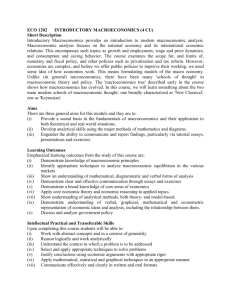

Exercises for basic macroeconomics

advertisement

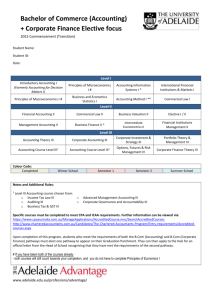

Preparatory work for EC201 Macroeconomics 2 Most of the undergraduate students taking Macroeconomics 2 have done a full year of macro before. You will find it greatly beneficial to read key chapters of an introductory textbook to familiarise yourself with key concepts. We suggest you read about the following topics: Measuring macroeconomic data Aggregate production Saving and investment Money and inflation. Suggested Reading It is likely (but not certain) that your EC201 module will reference as its main textbook "Macroeconomics” by Nils Gottfries (2013), Palgrave Macmillan. This is an advancedintermediate book. Without prior preparation, we judge this book too difficult for students who have done no macroeconomics before. The best preparation would be to study an introductory macroeconomics text, and it makes sense to study the same introductory macroeconomics material that Warwick first year undergraduates will have studied. This will put you on a similar footing to the rest of your cohort in EC201. Any of the following texts would be suitable to borrow for the purposes of preparation prior to arrival in Warwick: Mankiw (2012), Macroeconomics (8th edition); Burda and Wyplosz (2012), Macroeconomics: A European Text (6th edition); Mankiw and Taylor (2008), Macroeconomics (European Edition, 6th edition); Blanchard and Johnson (2013), Macroeconomics (6th Edition) – try to borrow the most recent edition possible in all cases. If possible, DO NOT BUY any of these introductory macroeconomics texts but instead borrow one of them for a few days or weeks. NONE OF THEM will be used in EC201 (they are too elementary) so the only time you would use them is in your own preparatory work before arrival in Warwick. If you cannot get hold of any of the listed textbook, you can use any other introductory macroeconomics text from a reputable publisher that includes relevant material. Exercises Please complete the following exercises, which are similar to those undertaken in the Warwick EC108 Macroeconomics 1 module that most of the students who join you in EC201 will have done. The Pre-Reading for each Exercise lists chapters in various textbooks that are most relevant. These readings are intended as alternatives: you are not expected to read more than one textbook. Alternative textbooks, including those not listed here, have similar material on these topics and can be used instead. Occasionally, Further Reading is given for the exercises. At this stage this Further Reading is for general interest and is not compulsory. PLEASE BRING YOUR SOLUTIONS TO YOUR PRE-SESSIONAL CLASSES AT THE START OF THE COURSE. 1 Exercise 1: The Data of Macroeconomics Pre–Reading Mankiw (2012), Macroeconomics, , Chapters 1, 2 and 3 Mankiw and Taylor (2008), Macroeconomics, Chapters 1, 2 and 3 Burda and Wyplosz (2012), Macroeconomics, Chapters 1 and 2 Question 1 Assume that the equation for demand for bread at a small bakery is Qd = 60 - 10Pb + 3Y, where Qd is the quantity of bread demanded in loaves, Pb is the price of bread in euros per loaf, and Y is the average income in the town in thousands of euros. Assume also that the equation for supply of bread is Qs = 30 + 20Pb - 30 Pf, where Qs is the quantity supplied and Pf is the price of flour in euros per kilogram. Assume finally that markets clear, so that Qd = Qs. a) If Y is 10 and Pf is €1, solve mathematically for equilibrium Q and Pb. b) If the average income in the town increases to 15, solve for the new equilibrium Q and Pb. Question 2 A small scale French farmer sells 800 litres of milk to a French intermediary for €200. The intermediary puts the milk in fancy containers and sells it to Danone for €350. Danone uses the milk to produce yogurt in its plant in Seville, Spain, selling the yogurt produced for €575. How will this string of transactions affect French GDP? How will it affect French GNP? How will it affect Spanish GNP and GDP? 2 Exercise 2: National Income Pre–Reading Mankiw (2012), Macroeconomics, , Chapters 1, 2 and 3 Mankiw and Taylor (2008), Macroeconomics, Chapters 1, 2 and 3 Burda and Wyplosz (2009), Macroeconomics, Chapters 1 and 2 Further Reading Oswald, A.J. (1997), “Happiness and Economic Performance”, Economic Journal, 107 Carol Graham, C. (2011) “Happiness economics: Can we have an economy of wellbeing?” http://www.voxeu.org/index.php?q=node/6819 Question 1 Suppose a car manufacturer is choosing between two production options. It can produce 100 cars with 200 workers and 50 machines, or it can produce 166 cars with 300 workers and 75 machines. Would you describe the manufacturer’s production function as exhibiting decreasing, constant, or increasing returns to scale? Explain. Question 2 “The Cobb-Douglas production function can have constant, increasing or decreasing returns to scale.” Show mathematically whether or not the above statement is correct. Question 3 Assume that GDP (Y) is 5,000. Consumption (C) is given by the equation C = 1,000 + 0.3(Y - T). Investment (I) is given by the equation I = 1,500 - 50r, where r is the real interest rate in percent. Taxes (T) are 1,000 and government spending (G) is 1,500. a) What are the equilibrium values of C, I, and r? b) What are the values of private saving, public saving, and national saving? c) Now assume there is a technological innovation that makes business want to invest more. It raises the investment equation to I = 2,000 - 50r. What are the new equilibrium values of C, I, and r? d) What are the new values of private saving, public saving, and national saving? 3 Exercise 3: The Open Economy Pre–Reading Mankiw (2012), Macroeconomics, Chapter 5 Mankiw and Taylor (2008), Macroeconomics, Chapter 5 Burda and Wyplosz (2012), Macroeconomics, Chapter 6 Further Reading Blanchard and Johnson (2013), Macroeconomics, Chapter 18 (6th ed.) Froot, K., and Rogoff, K. (1995), “Perspectives on PPP and Long Run Real Exchange Rates”, in G. M. Grossman and K. Rogoff, eds, Handbook of International Economics, 3. Mann, C. (2002), “Perspectives on the US Current Account Deficit and Sustainability”, Journal of Economic Perspectives, 16 (3). Question 1 Consider an economy described by the following equations: Y = C + I + G + NX Y = 5,000 G = 1,000 T = 1,000 C = 250 + 0.75 (Y – T) I = 1,000 – 50 r NX = 500- 500ɛ r = r* = 5 a) In this economy, solve for national saving, investment, the trade balance and the equilibrium exchange rate. b) Suppose now that G rises to 1,250. Solve for national saving, investment, the trade balance and the equilibrium exchange rate. Explain what you find. c) Now suppose that the world interest rate rises from 5 to 10 percent (G is again 1,000). Solve for national saving, investment, the trade balance and the equilibrium exchange rate. Explain what you find. 4 Exercise 4: Economic Growth Pre–Reading Mankiw (2012), Macroeconomics, Chapters 7 and 8 Mankiw and Taylor (2008), Macroeconomics, Chapters 7 and 8 Burda and Wyplosz (2012), Macroeconomics, Chapters 3 and 4 Question 1 Consider an economy described by the production function: Y = F (K , L) = K 0.3 L 0.7 a) What is the per-worker production function? b) Assuming no population growth or technological progress, find the steady-state capital stock per worker, output per-worker and consumption per-worker as function of the saving rate and the depreciation rate. c) Assume that the depreciation rate is 10 percent per year. Show how the steady-state capital per-worker, output per-worker and consumption per-worker differs for increasing saving rates (construct a table.) What saving rate maximises output per worker? What saving rate maximises consumption per worker? d) Find the marginal product of capital. Add to your table the marginal product of capital net of depreciation for each of your saving rates. What does your table show? Question 2 a) Provide a diagrammatic exposition of the Golden Rule for the Solow growth model. b) Find a saving rate that can increase consumption more than the corresponding to the Golden Rule. c) Suppose that the depreciation rate increases. Explain using a graph what will happen to the Golden Rule capital stock? d) The Solow model uses a production function which has diminishing returns to capital. Find the Golden Rule capital stock for a linear production function of the type Y=AK, using a graph. 5 Exercise 5: AD & AS Pre–Reading Mankiw (2012), Macroeconomics, Chapters 9, 10 and 11 Mankiw and Taylor (2008), Macroeconomics, Chapter 10 Further Reading Blanchard (2005), Macroeconomics, Chapters 5, 7 and 8 Oswald, Andrew, “Can the ‘New Economy’ Really Survive Expensive Oil?” (January 2001): http://www2.warwick.ac.uk/fac/soc/economics/staff/academic/oswald/accountancyoil200 1.pdf Advanced Reading Hicks, J.R. (1937), “Mr. Keynes and the ‘Classics’: a Suggested Interpretation”, Econometrica, 5 for the original formulation of what is now called IS–LM, reprinted in Hicks, J.R. (1982), Money, Interest, and Wages: Collected Essays in Economic Theory, vol. 2. Question 1 Why is it easier for the monetary authorities to deal with demand shocks than with supply shocks? Illustrate your answer. Question 2 Suppose that an adverse supply shock occurs. Explain diagrammatically its effects on output and the price level in both the short and the long run. What actions can the government take so as to stabilize the economy? Do you think that these actions will affect both the long and the short run equilibrium? 6