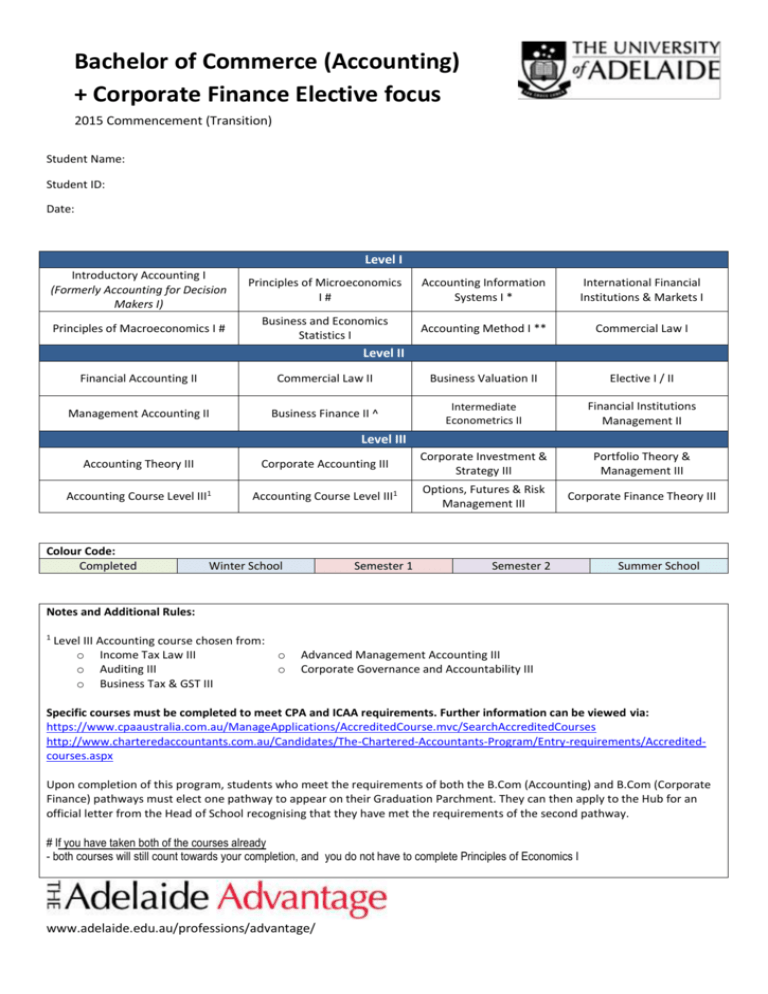

(Accounting) + Corporate Finance Elective Focus

advertisement

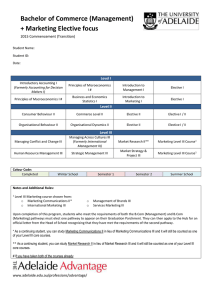

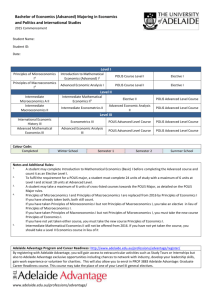

Bachelor of Commerce (Accounting) + Corporate Finance Elective focus 2015 Commencement (Transition) Student Name: Student ID: Date: Level I Introductory Accounting I (Formerly Accounting for Decision Makers I) Principles of Microeconomics I# Accounting Information Systems I * International Financial Institutions & Markets I Principles of Macroeconomics I # Business and Economics Statistics I Accounting Method I ** Commercial Law I Level II Financial Accounting II Commercial Law II Business Valuation II Elective I / II Management Accounting II Business Finance II ^ Intermediate Econometrics II Financial Institutions Management II Level III Accounting Theory III Corporate Accounting III Corporate Investment & Strategy III Portfolio Theory & Management III Accounting Course Level III1 Accounting Course Level III1 Options, Futures & Risk Management III Corporate Finance Theory III Colour Code: Completed Winter School Semester 1 Semester 2 Summer School Notes and Additional Rules: 1 Level III Accounting course chosen from: o Income Tax Law III o o Auditing III o o Business Tax & GST III Advanced Management Accounting III Corporate Governance and Accountability III Specific courses must be completed to meet CPA and ICAA requirements. Further information can be viewed via: https://www.cpaaustralia.com.au/ManageApplications/AccreditedCourse.mvc/SearchAccreditedCourses http://www.charteredaccountants.com.au/Candidates/The-Chartered-Accountants-Program/Entry-requirements/Accreditedcourses.aspx Upon completion of this program, students who meet the requirements of both the B.Com (Accounting) and B.Com (Corporate Finance) pathways must elect one pathway to appear on their Graduation Parchment. They can then apply to the Hub for an official letter from the Head of School recognising that they have met the requirements of the second pathway. # If you have taken both of the courses already - both courses will still count towards your completion, and you do not have to complete Principles of Economics I www.adelaide.edu.au/professions/advantage/ If you have taken Principles of Microeconomics I, but not Principles of Macroeconomics I - Principles of Microeconomics I will still count towards your completion, and you should undertake the course International Financial Institutions and Markets I in place of Principles of Macroeconomics I. You should not take Intermediate Macroeconomics II until you have done this. If you have taken Principles of Macroeconomics I, but not Principles of Microeconomics I - Principles of Macroeconomics I will still count towards your completion, and you must take the new course Principles of Economics I If you have not yet taken either course - You must take the new course Principles of Economics I. * As a continuing student, if you have not completed Accounting Information Systems I you will need to take Accounting Information Systems II. This will be counted as a level II Commerce course and you will be permitted to take an additional Level I elective. ** As a continuing student, if you have not completed Accounting Method I it is strongly advised that you enrol in this semester 1. ^ As a continuing student, you can study Business Finance I in lieu of Business Finance II and it will still be counted as one of your level II core courses. Adelaide Advantage Program and Career Readiness: http://www.adelaide.edu.au/professions/advantage/register/ By registering with Adelaide Advantage, you will gain access to extracurricular activities such as Study Tours or Internships but also to Adelaide Advantage exclusive opportunities including chances to network with industry, develop your leadership skills, gain work experience or volunteer for charities. This will also allow you to enrol in PROF 3883 Adelaide Advantage: Graduate Career Readiness course. This course may take the place of one of your Level III general electives. Program Adviser Notes: