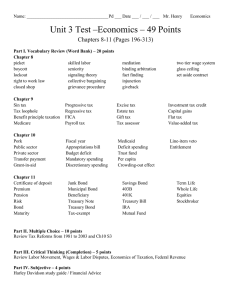

Name: Pd ___ Date ___ / ___ / ___ Mr. Henry Honors Econ Unit 3

advertisement

Name: ____________________________________ Pd ___ Date ___ / ___ / ___ Mr. Henry Honors Econ Unit 3 Test – Honors Economics – 59 Points Chapters 8-11 (Pages 196-313) Part I. Vocabulary Review (Word Bank) – 25 points Chapter 8 picket skilled labor boycott seniority lockout signaling theory right to work law collective bargaining closed shop grievance procedure mediation binding arbitration fact finding injunction giveback Chapter 9 Sin tax Tax loophole Benefit principle taxation Medicare Progressive tax Regressive tax FICA Payroll tax Excise tax Estate tax Gift tax Tax assessor Chapter 10 Pork Public sector Private sector Transfer payment Grant-in-aid Fiscal year Appropriations bill Budget deficit Mandatory spending Discretionary spending Medicaid Deficit spending Trust fund Per capita Crowding-out effect Chapter 11 Certificate of deposit Premium Pension Risk Bond Maturity Junk Bond Municipal Bond Beneficiary Treasury Note Treasury Bond Tax-exempt Savings Bond 403B 401K Treasury Bill IRA Mutual Fund two tier wage system glass ceiling set aside contract Investment tax credit Capital gains Flat tax Value-added tax Line-item veto Entitlement Term Life Whole Life Equities Stockbroker Part II. Critical Thinking (Completion) – 8 points Review Labor Movement, Wages & Labor Disputes, Economics of Taxation, Federal Revenue Part III. Multiple Choice – 12 points In addition to above, be sure to review Tax Reforms from 1981 to 2003, Ch10 S3 #10, & PA State Universities Part IV. Subjective – 4 points Review Tom Coburn’s Wastebook Part V. Essay – 5 points each (10) 47-51 and 52-56 Essay #1: Describe the importance of early investment opportunities and the different considerations that one should make to have sound Financial Fitness for the Future Essay #2: Describe 4 examples of items that are Tax-Exempt in Pennsylvania and one item that you feel should be tax exempt but is not in our state and why. Essay #3: Describe an example of how Behavioral Adjustment taxes entice consumer purchases and 4 examples that reduce consumer purchases. Essay #4: Describe the ways in which the Federal Government generates revenue for our Federal Budget. Essay #5: Describe how our Federal Budget works and describe examples of expenditures within our Budget. Essay #6: Describe how deficits, surpluses, and the National Debt impact our economy today.