ITEM NO. 07 (L-05) - New Delhi Municipal Council

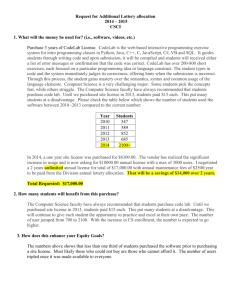

advertisement