Litigation MEMO - NTEU Chapter 46

advertisement

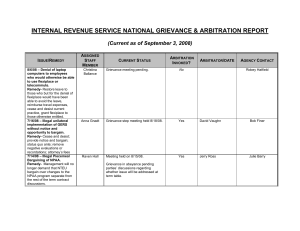

Litigation Update The following are highlights from some of our important (past) litigation incidents. 14. NTEU and IRS NTEU File No. 5464 Forum: Grievance Attorneys: O’Duden/Atkin/Bialczak ISSUES: Whether IRS is violating the Fair Labor Standards Act by failing to compensate Revenue Officers properly for all of the overtime hours they work. STATUS: NTEU filed a national grievance and information request on April 7, 2011. 21. NTEU and IRS (Bothelo, Grievant) NTEU File No. 5457 Forum: Arbitration Attorneys: O’Duden/Adkins/Bialczak ISSUE: Whether an adverse action imposed by IRS upon a seasonal employee for call-back issues and retention of non-employee benefits was justified. STATUS: NTEU’s Office of General Counsel was asked to assist in this case. The parties held grievance meetings, and the IRS denied the grievance at each step. NTEU has invoked arbitration. A hearing has been scheduled for July 29, 2011. 22. NTEU and IRS NTEU File No. 5455 Forum: Grievance Attorneys: O’Duden/Atkin/Lawrimore ISSUE: Whether IRS violated applicable laws, regulations, and contractual provisions, under Art. 42, Sec. 4.A.2., of the National Agreement II, by failing to compensate properly Fuel Compliance Officers and Fuel Compliance Agents for hours worked in excess of their established tours of duty. STATUS: National grievance filed on October 5, 2010. A grievance meeting was held on December 13, 2010. IRS denied grievance and remedy on March 17, 2011. Arbitration was invoked on March 24, 2011. A hearing has been scheduled for July 7 and 8, 2011. NTEU L I T I G AT I O N UP DAT E APRI L 2 0 1 1 23. NTEU and IRS (Whitmer, Grievant) NTEU File No. 5453 Forum: Arbitration Attorneys: O’Duden/Atkin/Bialczak ISSUE: Whether IRS violated the National Agreement, the Veterans Employment Opportunities Act and/or the Uniformed Services Employment and Reemployment Rights Act by filling certain Revenue Agent vacancies in Bowling Green, Kentucky, exclusively through the FCIP. STATUS: NTEU filed a grievance on behalf of an IRS employee, who is a veteran, over his non selection for a Revenue Agent vacancy that the IRS filled through the FCIP. Consistent with Article 41, the parties held grievance meetings, and the IRS denied the grievance at each step. NTEU has invoked arbitration. A hearing has been scheduled for June 16, 2011. 24. IRS and NTEU NTEU File No. 5440 Forum: Grievance Attorneys: O’Duden/Atkin/Lawrimore ISSUE: Whether the IRS has acted contrary to law by denying current and former part-time employees Sunday premium pay. STATUS: NTEU filed a national grievance on March 2, 2010. A settlement agreement was signed on March 18, 2011. Affected employees will receive a notice and a calculation of estimated back pay by the end of June. 28. NTEU and IRS NTEU File No. 5437 Forum: Arbitration Attorneys: O’Duden/Atkin/Bialczak ISSUE: Whether IRS violated the federal labor statute and negotiated agreements by denying official time to NTEU representatives attempting to represent bargaining unit employees in background investigation interviews. Whether IRS acts unlawfully and contrary to negotiated agreements in failing to take steps to assure that OPM investigators afford employees their right to union representation, if requested, in such interviews. STATUS: NTEU filed a national grievance on November 17, 2009. A grievance meeting was held on December 17, 2009, followed by a conference call on January 26, 2010. IRS denied the grievance on March 30, 2010, and NTEU invoked arbitration on April 26. An arbitration hearing was held on November 30, 2010. Opening post-hearing briefs were filed on April 13, 2011, and reply briefs will be filed on May 4, 2011. This case was consolidated with an earlier, similar grievance. (See #33.) 29. NTEU and IRS NTEU File No. 5432 Forum: Arbitration Attorneys: O’Duden/Atkin/Bialczak ISSUE: Whether IRS violated the Fair Labor Standards Act by failing to compensate Case Advocates in the Taxpayer Advocate Service (TAS) for overtime worked before and after their shifts and on weekends, holidays, and days off, due to excessively high inventories and tight deadlines. STATUS: NTEU filed a national grievance and information request on April 17, 2009. IRS has now produced information responsive to the request. A grievance meeting was held on October 22, and a conference call was held on December 9. We provided IRS further information on February 4, 2010. Case advocates participated in an on-line survey to collect more evidence for NTEU. NTEU invoked arbitration on October 27, 2010. 30. NTEU and IRS NTEU File No. 5425, 5425-2 Forum: Grievance Attorneys: O’Duden/Atkin ISSUE: Whether the IRS violated the Fair Labor Standards Act by improperly exempting Series 343 positions including program analyst, management analyst, management and program analyst at grades 12 and below from coverage of the FLSA and by failing to properly compensate them for hours worked under the Act. Whether IRS committed an unfair labor practice by repudiating its 1999 settlement agreement with NTEU when it exempted those positions without notifying NTEU of its intent to exempt the positions from coverage under the FLSA. STATUS: NTEU filed a national grievance and information request on November 10, 2008. The parties settled the grievance on June 3, 2010. Affected employees received a joint NTEU-IRS notice; they should have received back pay by October 1, 2010. Employees had until October 31, 2010, to dispute any computations with IRS. NTEU successfully resolved the two disputes submitted to it, but discovered other errors in IRS’ computations of back pay. On March 14, 2011, NTEU filed a new grievance alleging that IRS had breached the 2010 settlement agreement. A grievance meeting was held on April 22, at which time IRS indicated an intent to comply fully with the settlement. 31. NTEU and IRS NTEU File No. 5428 Forum: Arbitration Attorneys: O’Duden/Adkins/Bialczak ISSUE: Whether the IRS violated the law, the contract, and a prior settlement agreement between the parties by not paying night differential to employees who are redeeming time off awards and by counting time off awards and religious compensatory time off toward the 8-hour-per-pay period limit on night differential pay for employees in leave status. STATUS: NTEU filed a national grievance on January 30, 2009. IRS produced information relevant to the grievance, and a grievance meeting was held on June 10, 2009. A meeting was held on January 25, 2010, to discuss updated data. Arbitration was invoked on November 15, 2010. 33. NTEU and IRS NTEU File No. 5412 Forum: Arbitration Attorneys: O’Duden/Atkin/Bialczak ISSUE: Whether IRS committed unfair labor practices and breached its agreements with NTEU by failing to ensure that OPM investigators conducting background investigations of IRS employees honored employees’ statutory and contractual rights to union representation in background investigation interviews. STATUS: A national grievance was filed on January 23, 2008, and arbitration was simultaneously invoked. NTEU filed an information request on January 30, 2008. Subsequent factual developments, including the transfer of investigatory authority to OPM, delayed the processing of this grievance. NTEU filed a second grievance, with additional allegations, on November 17, 2009. (See #28.) IRS denied that grievance and this one on March 30, 2010. The two matters were consolidated and an arbitration hearing was held on November 30, 2010. Initial briefs were filed on April 13, 2011, and reply briefs on May 4, 2011.