Charlie Munger

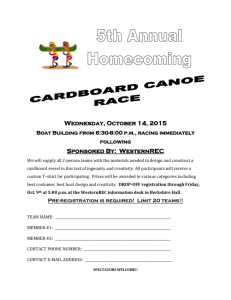

advertisement