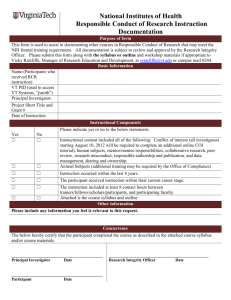

Exhibit A: Administrative Services

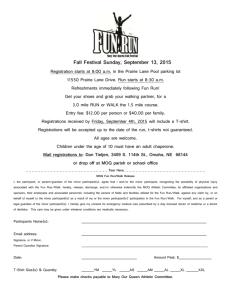

advertisement