Mr. Maurer Name: AP Economics Chapter 23, Problem Set 1 Perfect

advertisement

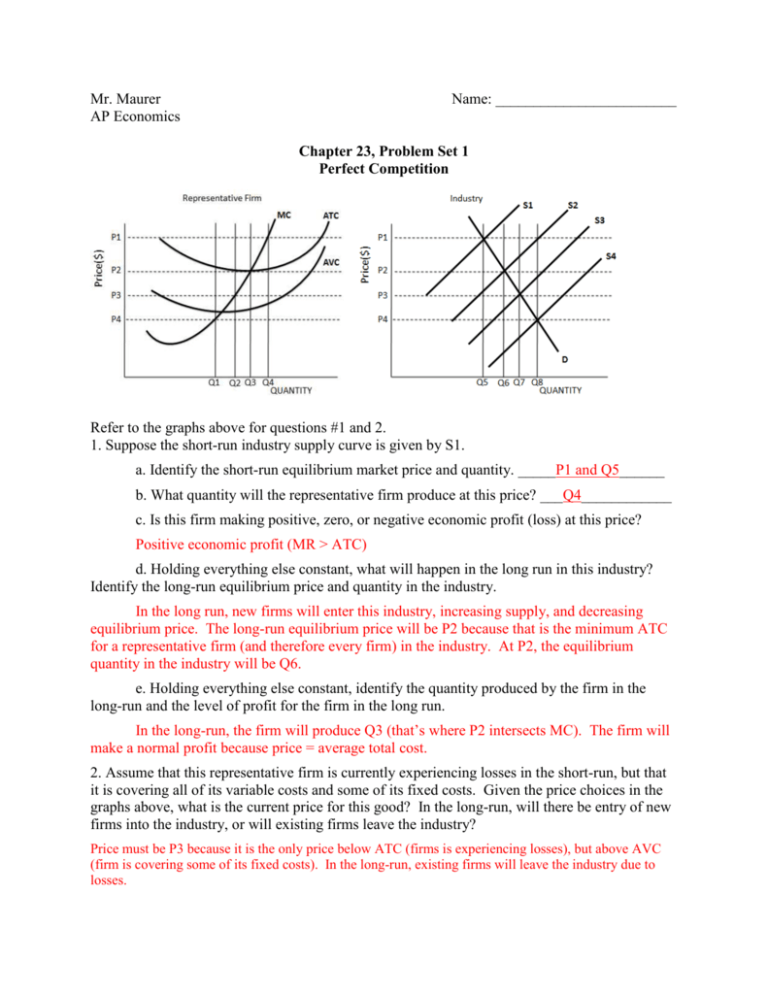

Mr. Maurer AP Economics Name: ________________________ Chapter 23, Problem Set 1 Perfect Competition Refer to the graphs above for questions #1 and 2. 1. Suppose the short-run industry supply curve is given by S1. a. Identify the short-run equilibrium market price and quantity. _____P1 and Q5______ b. What quantity will the representative firm produce at this price? ___Q4____________ c. Is this firm making positive, zero, or negative economic profit (loss) at this price? Positive economic profit (MR > ATC) d. Holding everything else constant, what will happen in the long run in this industry? Identify the long-run equilibrium price and quantity in the industry. In the long run, new firms will enter this industry, increasing supply, and decreasing equilibrium price. The long-run equilibrium price will be P2 because that is the minimum ATC for a representative firm (and therefore every firm) in the industry. At P2, the equilibrium quantity in the industry will be Q6. e. Holding everything else constant, identify the quantity produced by the firm in the long-run and the level of profit for the firm in the long run. In the long-run, the firm will produce Q3 (that’s where P2 intersects MC). The firm will make a normal profit because price = average total cost. 2. Assume that this representative firm is currently experiencing losses in the short-run, but that it is covering all of its variable costs and some of its fixed costs. Given the price choices in the graphs above, what is the current price for this good? In the long-run, will there be entry of new firms into the industry, or will existing firms leave the industry? Price must be P3 because it is the only price below ATC (firms is experiencing losses), but above AVC (firm is covering some of its fixed costs). In the long-run, existing firms will leave the industry due to losses. 3. A.P. Milk is a typical profit-maximizing company in a perfectly competitive industry that is in long-run equilibrium. a. At the bottom of this page, draw correctly labeled side-by-side graphs for the dairy market and for A.P. Milk and show each of the following: (See Figure 23.7 on p. 426 and 23.8 on p. 428) i. Price and output for the industry. ii. Price and output for A.P. Milk. b. Assume that milk is a normal good and that consumer income falls. Assume that A.P. Milk continues to produce. On your graphs, show the effect of the decrease in consumer income on each of the following in the short-run. i. Price and output for the industry. ii. Price and output for A.P. Milk. iii. Area of loss or profit for A.P. Milk. c. Following the decrease in consumer income, what must be true if A.P. milk is to continue to produce in the short-run? The new price (P2) must be greater than AVC at the new quantity (Q3). d. Assume that the industry adjusts to a new long-run equilibrium. Compare the following between the initial and the new long-run equilibrium. i. Price in the industry. Will return to the old equilibrium (Pe). ii. Output for a typical firm. Will return to original quantity (Qe) iii. The number of firms in the dairy industry. There will be fewer firms in the industry due to the exit of firms because of losses. Therefore, fewer firms will each produce the same quantity per firm, but the total output for the industry will go down. 4. Mr. Maurer finally left teaching to open his own business. He produces DVD movies for sale, which requires only a building and a machine that copies the original movie onto a DVD. Mr. Maurer rents a building for $10,000 per month and rents a machine for $10,000 a month. Those are his fixed costs. His variable cost is given in the accompanying table. (You can ignore any implicit or opportunity costs not given). Assume that the market for DVDs is perfectly competitive, is in long-run equilibrium, and that the market price of a DVD is currently $14.83. Quantity of DVDs 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 Total Fixed Cost Total Variable Cost 20,000 20,000 20,000 20,000 20,000 20,000 20,000 20,000 20,000 Total Cost 0 10,000 18,000 25,000 34,000 48,000 68,000 96,000 133,000 Average Variable Cost 20,000 30,000 38,000 45,000 54,000 68,000 88,000 116,000 153,000 10.00 9.00 8.33 8.50 9.60 11.33 13.71 16.63 Average Total Cost Marginal Cost 30.00 19.00 15.00 13.50 13.60 14.67 16.57 19.13 10.00 8.00 7.00 9.00 14.00 20.00 28.00 37.00 a. In the space below, draw side-by-side diagrams for Mr. Maurer’s firm and for the entire industry. Illustrate on the appropriate diagram: i. the industry supply curve, demand curve, and market price ii. Mr. Maurer’s marginal revenue curve, short-run supply curve, average total cost curve and average variable cost curve. Note: you do not need to graph these perfectly with the numbers above. Just put in the proper shapes and maintain the proper relationships between them. Then you just need to identify a few key points on your graphs. b. At the current market price, what is Mr. Maurer’s profit-maximizing output? Indicate on the diagram. 5000 units – see diagram. c. What is Mr. Maurer’s shut-down price in the short run? Indicate this on the diagram. $8.33 – See diagram. d. At the current market price, how much economic profit is Mr. Maurer making? Profit = (Price – ATC) x Quantity = (14.83 – 13.60) x 5000 = $6150. Mr. Maurer 20.50 DVD Industry 20.50 14.83 13.50 14.83 13.50 8.33 6000 S2 5. Now assume that consumer incomes rise and DVDs are a normal good, causing the price of DVDs to rise to $20.50. a. Indicate the effect of this change on your graph of the industry. See Diagram b. What is Mr. Maurer’s new profit-maximizing quantity? Indicate on the diagram. 6000 units c. What is Mr. Maurer’s new economic profit? Show your computations. (20.50 – 14.67) x 6000 = $34,980 d. In the long-run, how will the industry respond to this change? Explain and indicate this response on your diagram of the industry. New firms will enter the industry because economic profits are possible because price is higher than ATC for the typical firm. This will shift the supply curve to the right. e. What will be the long-run equilibrium price for DVDs? $13.50