Electric Vehicles

advertisement

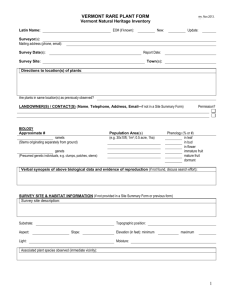

U.S. DEPARTMENT OF ENERGY SOLAR MARKET PATHWAYS PROGRAM VERMONT SOLAR DEPLOYMENT PLAN FOCUS AREA BRIEF ELECTRIC VEHICLES May 2015 INTRODUCTION Electric Vehicles. Synergies exist among plug-in vehicle and solar PV consumers, including overlapping consumer purchase preferences for both technologies, use of solar PV power for vehicle charging, and use of plug-in vehicles for distributed storage and grid reliability assets to respond to fluctuating renewable energy production. EVs in the Vermont Comprehensive Energy Plan Vermont’s transportation sector is currently fueled 95% by petroleum. To transform the transportation sector, the 2011 Vermont Comprehensive Energy Plan (CEP) identified two primary strategies: 1. Reduce Petroleum Consumption (Vol 2, 9.6.2, p. 280) 2. Reduce Energy Use in the Transportation Sector (Vol 2, 9.6.3, p. 284) Because transportation accounts for the highest share of energy use in Vermont, policies that address this sector have a proportionately larger impact on the state’s overall energy consumption. Most current transportation sector consumption is in gasoline and diesel fuels, both petroleum-based sources of energy. The shift to renewable energy sources for the transportation sector will likely occur at a slower pace than in other sectors. This is due in part to the limited control the state has over vehicle technology and regulations. States are preempted by the federal government from setting their own fuel economy standards, for example. Higher upfront costs for plug-in vehicles and shifting technology are also sources of hesitation among consumers considering a switch. In order to make significant progress toward the state’s target of 90% renewable energy by 2050, the Vermont Agency of Transportation has set a goal that 25% of all vehicles registered in Vermont be powered by renewable energy sources by 2030. Business-as-usual projections for plug-in electric vehicles (EVs) are modest. However, there are a number of reasons to believe that the next 20 years will be different from business as usual. Technological innovation in vehicle engineering, particularly as it relates to batteries, is occurring at a rapid pace. The CEP includes an interim 2030 goal to reach a benchmark of 25% of the vehicle fleet powered by renewable energy. This will require more than 140,000 EVs or other renewably powered vehicles registered in VT based on the current fleet size. Biofuels already significantly contribute to renewably powered transportation in Vermont through the US EPA’s Renewable Fuel Standard (RFS) which creates the requirement for ethanol blends. However, as the charts below indicate, travel powered by electricity is much more cost effective than gasoline or other alternative fuels. While these savings are decreased by the higher initial cost of EVs, they can be significant today and will provide additional benefits as the technology matures. Figure 1. Alternative Fuel Prices US DOT Beyond Traffic, 2015 The Vermont Public Service Department’s 2014 Total Energy Study identified technology and policy pathways to achieve the CEP goal of 90% renewable by 2050 and continued to recognize electric vehicle technology as a critical strategy to meet the state’s energy goals. Surveys of current and potential EV owners provide evidence of the strong correlation between EVs and solar PV consumers. For example, the California EV rebate program has queried over 16,000 rebate recipients and found nearly 30% already have solar PV or are planning to install it. A total of 63% have expressed consideration of future PV installation1. The development of an advanced solar market in Vermont will provide significant opportunities to increase the number of renewably powered vehicles in the state. The benefits of renewably powered 1 Center for Sustainable Energy (2015). California Air Resources Board Clean Vehicle Rebate Project, EV Consumer Survey Dashboard. Retrieved 5 May 2015 from http://energycenter.org/clean-vehicle-rebateproject/survey-dashboard 2 transportation include reduced greenhouse gas and other harmful pollutant emissions, reduced cost and volatility in transportation energy expenditures and support for economic development activities by reaping fuel expenditure savings to provide capital for investment. Conversely, EVs are capable of providing grid support services, including demand side management (DSM) through controlled charging and distributed energy storage using EV batteries – both of which can be used to respond to short term fluctuations in power generation that may occur with a higher share of solar PV generation. TECHNOLOGY AND MARKET DESCRIPTION There are two basic types of plug-in electric vehicles (EVs): All Electric Vehicles (AEV) – powered solely by electricity with range from 60-100 miles for vehicles under $40,000. Up to 270 miles for Tesla vehicles which start at $70,000. Currently 25% of currently registered EVs in Vermont. Plug-in Hybrid Vehicles (PHEV) – 10-75 miles of electric range on a battery and then the vehicles switch seamlessly to gasoline for extended range operation. These are 75% of the currently registered EVs. EVs travel about 3 miles per kWh of energy, resulting in an annual consumption of about 2 MWh for the average Vermont Vehicle. Energy is delivered to the vehicles through Electric Vehicle Supply Equipment (EVSE), commonly referred to as “charging stations”. There are three basic types of EVSE as shown in the figure below. Figure 2. EV Charging Levels Level 1 Level 2 DC Fast Charging • Uses EVSE provided by vehicle manufacturers plugged into standard 120V outlets. • Charges at approximately 1.5 kW, so this typically happens overnight. • Uses dedicated EVSE hardwired or plugged into a 208/240V outlet. • Charging power is 3.3 kW to 7.2 kW for most EVs. Tesla’s charge at up to 20 kW. Typically 3-6 hours for a charge. • Up to 100 kW for vehicles equipped with this capability, usually limited to All Electric models. • Approximately 30 minutes to reach an 80% state of charge, after which charging slows considerably. Most EV owners charge at home overnight. Several Vermont electric utilities have optional residential Time of Use (TOU) rate programs which provide lower costs during overnight hours. Workplace charging is the second most common option when available to drivers and provides a helpful “second showroom” with the US Dept of Energy estimating employees with access to charging are twenty times more likely to own an EV. Public charging stations are necessary to increase the confidence of consumers considering an EV purchase, particularly for all electric vehicles. Vermont currently has 60 public 3 charging stations, 13 of which include DC Fast Charging for EVs equipped with this capability. The number of charging stations has more than doubled over the past 2 years. Table 1. Vermont Utility Time of Use Rates Utility2 Residential Standard Rate Customer Charge $0.43 / day (approx. $12.90/ month) Standard kWh Charge Residential TOU On-Peak TOU per kWh Customer Charge $0.147 / kWh $16.26 / month Vermont Electric Cooperative $17.22 / Month $17.22 / Month Burlington Electric Department $8.21 / month $0.087 / kWh up to 100kWh $0.176 / kWh In excess of 100kWh $0.1088 per kWh up to 100kWh $0.148 per kWh Green Mountain Power $13.86 / month $0.257 4 consecutive hours between 7:00 a.m. and noon and 3 consecutive hours between 4:00 and 10:00 p.m. $0.19789 per kWh 6:00 a.m.-10:00 p.m. M-F $0.108 / kWh up to 100 kWh $0.23 / kWh above 100 kWh June 1st to September 30th, Mon-Fri, 12:01 P.M. to 6:00 P.M. and December 1st to March 31st, Mon-Fri, 6:01 A.M. to 10:00 P.M TOU Off Peak per kWh $0.114 $0.142 $0.108 EVs are available at approximately 28 dealers across the state out of 112 total new car dealers. There are no current state incentives for EVs, but there is a federal tax credit up to $7,500 for first 200,000 EVs by manufacturer. The exact amount varies depending on the size of the battery. Current cumulative sales for market leaders GM and Nissan are around 70,000 vehicles each, so the incentives are anticipated to remain for several more years and could be renewed in the future. 2 Other Vermont utilities including municipal utilities offer Time-Of-Use rates. 4 Vermont is one of 10 states participating in the California Zero Emission Vehicle (ZEV) program which requires automakers to sell increasing numbers of plug-ins and hydrogen fuel cell vehicles over next 10 years – up to about 15% of sales by Figure 3 - Vermont Electric Vehicle Registrations 2025. EVs are registered in over 60% of Vermont communities and Figure 1 - Vermont EV Registrations comprise about 0.1% of the total Vermont fleet of registered vehicles. EV sales over the past year have reached approximately 1% of new light duty vehicle sales in the state. As the chart to the right illustrates, significant growth has occurred over the past few years with just over 890 plug-in vehicles now registered in the state as of April 2015. Per capita rates of EV ownership are highest in Lamoille County, indicating plug-in vehicles do work in rural areas. Annual increases in new EV registrations are shown in the table below. The slowdown in new registrations in 2014 was likely due to decreased inventory available at local dealerships and bridging from early adopter enthusiasm with latent demand to more mainstream consumers. EV market volatility is anticipated to continue in the near term as new models come into the market and are general economic conditions impact new vehicle purchases. Table 2. Annual Vermont EV Sales by Type Annual EV Sales 2013 2014 Plug-in Hybrid Vehicle All Electric Vehicle Total 326 204 82 67 408 271 The current estimate of electric usage related to EVs in Vermont is approximately 1,900 MWh annually. This is approximately 0.03% of Vermont’s retail electric sales, so the impacts of EVs on the grid are negligible at this point, although in some rare cases upgrades to local distribution networks are required due to high power draw (20 kW or more) associated with certain vehicles and charging equipment.. While the ongoing growth in EV adoption is encouraging, much more work is needed to meet the state’s energy transformation goals of achieving 140,000 renewably powered vehicles over the next 15 years – this will require an average of over 9,000 additional EVs a year. 5 The Drive Electric Vermont program is working on a multitude of fronts to support these goals. The consumer decision funnel in the figure below illustrates the process of consumer engagement from initial product awareness, leading to familiarity, consideration, purchase and continuing into loyalty. While social media and other technological changes now give consumers greater ability to skip these discrete stages, the funnel still provides a helpful framework for the typical consumer EV purchase process. The Drive Electric Vermont program seeks to engage with consumers at each stage of this process. Figure 4. Consumer Decision Funnel McKinsey, 2009 In 2014, VEIC contracted with a nationally recognized market research specialist - MSR Group - to perform a statistically valid survey of 495 Vermont consumers regarding their awareness and attitudes toward electric vehicles in the spring of 2014. The results of the survey have informed priorities for Drive Electric Vermont. The research found general awareness of electric vehicles was over 90% of the population surveyed, but many potential consumers need greater familiarity with the options available. Vehicle cost was the most common barrier to considering EV purchases, followed by concerns over limited vehicle range and charging infrastructure. Purchase cost was also cited as the most important issue to motivate consumers to purchase or lease an EV, as shown in the chart below. Figure 5. Vermonter Motivating Factors to Purchase an Electric Vehicle 6 MSR Group, 2014 The above material demonstrates electric vehicles are a clear priority for Vermont to meet our energy and environmental goals. Ongoing research and Drive Electric Vermont program development has highlighted a number of critical areas to speed market transformation of EV technology, including increased consumer familiarity, dealer education to better inform customers considering new vehicle purchases and consumer incentives to reduce barriers and increase motivation to move forward with an EV lease or purchase. MARKET CONDITIONS — OPPORTUNITIES AND CHALLENGES Growth. What is the scope of the growth of this market over the scenario planning horizons? What would constitute high growth, low growth forecasts? Business as Usual Scenario The Vermont ZEV action plan includes detailed information on activities underway in the state of Vermont to support automakers in complying with ZEV program requirements. The chart below illustrates the anticipated continued growth in the market, particularly in 2017 and beyond once the existing travel provision expires which allows manufacturers to meet their requirements by only selling EVs in California. The ZEV program requirements have a variety of credits for different vehicle technologies, so actual experience of sales could differ from the scenario presented below. A relatively conservative estimate under existing policies would be approximately 10,000 EVs in Vermont by 2023, or nearing about 2% of the fleet of registered vehicles. Figure 6. Vermont ZEV Program Compliance Scenario3 3 From the Vermont ZEV Action Plan - http://www.anr.state.vt.us/anr/climatechange/ZeroEmissionVehicles.html 7 NESCAUM, 2014 90by50 and Solar Development Pathways Scenario As stated above, the Vermont Comprehensive Energy plan includes goals for 25% of vehicles to be powered by renewable energy in 2030 and 90% by 2050. These values translate to approximately 143,000 EVs in 2030 and 515,000 EVs by 2050. Achieving this rate of growth will depend on vehicle availability at competitive pricing and sustained programs to transform the new and used vehicle markets. VEIC is investigating various growth curves considering current adoption rates and long term prospects [TBD]. Technical Advances. Vehicle advancements bringing additional range at same / reduced cost MARKET CONDITIONS — CHALLENGES Barriers. What are the barriers to this growth? (for example, existing business or system infrastructure, market awareness, financing…) While EV sales in Vermont have grown 10 fold in the last three years, they still make up a very small segment of the automobile market. Plug in vehicles still represent less than 1% of new vehicle sales in Vermont which, when aligned with Rogers innovation adoption bell curve, assigns innovator status to plug in EV purchasers and leasors. Sales of hybrid vehicles (the non-plug-in variety) has pregressed along this continuum to the level where purchasers fall into the early adopter category. 8 Price is still a major barrier to plug in EV sales. As is evident in the chart of motivating factors [Figure 5] 91 percent of Vermonters answering the survey indicated that the purchase price of a vehicle is somewhat or very important. Even with incentives, EVs typically cost more up front than conventional vehicles. While affordable lease options are becoming more common, these are not always welladvertised and cost is still perceived to be a major barrier. As a rural, mountainous, northern state, Vermont is known for its winter driving conditions. Compared to the national average, Vermont has over 3 times the all-wheel drive auto inventory per capita of the national average (https://www.cars.com/articles/2014/02/winter-weather-sends-all-wheel-drive-inventoryup-20-percent/) http://www.prnewswire.com/news-releases/sales-surge-for-all-wheel-drive-vehicles246882411.html While there are limited hybrid AWD vehicles currently on the market, there is currently only one commercially available plug-in electric AWD vehicle available in VT (it retails at $75,000)4. Another major barrier to EV adoption in Vermont is battery range. Because of Vermont’s low population density, commutes tend to be longer and development less concentrated. Limited battery range is definitely an issue. Also current EV technology performs at its highest efficiency in stop and go traffic (with regenerative braking) and on flat terrain. Vermont has an abundance of neither of these. Exacerbating the barrier of limited battery range is the lack of a comprehensive EV charging network. Vermont currently has (?) public EV charging stations. Growing this network will definitely facilitate EV adoption in Vermont. Finally, auto dealer engagement is a powerful tool in selling electric vehicles. Many Vermont dealers do not offer electric vehicles at all. The dealers that do frequently are not actively promoting the vehicles. Dealer staff are often not well informed about the products and will sometimes actively steer people away from electric vehicle options. 4 TESLA Model S (now available) and Model X (available in 2016) Toyota RAV4 EV has been discontinued. 9 Overcoming barriers. How can those barriers be overcome? Identify strategies that can be used to help reduce barriers. As with any new technology incentives and disincentives are powerful policy tools. Incentives include cash incentives, dealer incentives, and tax incentives. Several states offer EV incentives including California, Colorado, Georgia, Louisiana, Massachusetts, Utah and (most recently) Texas. Some states offer registration fee exemptions or travel incentives in the form of free tolls or high occupancy vehicle (HOV) lane access. Incentives could also be offered in the electric sector. Electric rate structures for EV charging can provide significant benefits to Vermont’s electric grid by encouraging EV owners to charge at night during off-peak hours. Distribution Utilities can charge rates that make EV charging extremely cost-effective for EV owners. ConEdison in New York offers on-peak delivery rates of 19.4 cents/kWh and off peak rates of 1.36 cents/kWh5. On the other side of the equation, disincentives can also be a powerful tool. An increase in the State gas tax or the implementation of a Carbon Tax in Vermont would provide an economic disincentive to drive vehicles that consume fossil fuels and steer drivers toward EVs. Aside from economic incentives and disincentives, other ways to overcome market barriers to EVs include the broader introduction of All Wheel Drive EVs into the Vermont marketplace, particularly at a price point that can be combined with economic incentives to be comparable to the purchase price of a modest conventional vehicle. Charging infrastructure development is one way in which Vermont regulators can promote the adoption of electric vehicles. Allowing Distribution Utilities to rate base spending on electric vehicle charging stations would incentivize Vermont’s DU’s to install charging stations and receive a guaranteed rate of 5 A customer/basic-service charge of $19.87 per month applies, along with any applicable delivery charges and adjustments as specified in general rule 26 of the Con Edison electric tariff. http://www.coned.com/electricvehicles/rates.asp 10 return while building their sales base. Alternately, public-private partnerships could promote the retail sale of electricity in places like conventional gas stations through DC fast charging or at highway rest areas to promote tourism and long-distance travel by EV owners. To address the lack of dealer initiative related to EV sales, additional sales commissions orspiffs could be offered for dealer sales staff. Educational outreach programs directed at dealers and sales staff could build greater familiarity with the vehicles and their benefits. Innovative marketing strategies such as packaging together an electric vehicle with rooftop solar PV and an attractive financing option may potentially promote the vehicle to building technology in the future. Electric vehicle sales continue to grow as EVs are seen as a viable alternative to fossil fuel consumption through conventional vehicles. As the EV markets continue to grow, economies of scale will contribute to less expensive batteries and better technology options. This combination of declining costs and maturing technologies will be instrumental in overcoming market barriers. 11 MARKET CONDITIONS — COSTS Costs. What cost projections are available? What are plausible high- and low-cost projections? Are cost projections highly dependent on volume ? Are there identifiable market share or scale thresholds for cost reductions? Battery cost predictions National Academy of Science report on long term cost forecast Reducing Costs. What strategies have been identified to reduce costs? What strategies have been identified to reduce barriers to market growth? Volume of sales Manufacturing improvements to reduce most costly materials Recycling programs Time of Use / Demand management programs for EV charging (some could provide payments back to consumer) SCENARIO INPUTS Inputs for Scenario Analyses. Using the Current Accounts / Historic Data as starting points, what are the plausible, initial inputs for the Reference (business as usual), Long-Range Target (assume 2050 as the end point), and Solar Development Pathways α (the alpha scenario)? These will be starting points for review and possible revision. Table 1. Scenario data structure table for electric vehicles Current Account / Historic Data Reference (Business as Usual) Long-range Target (LRT) SDPα Applicable market segments Number of units Light-duty vehicles Light-duty vehicles Light-duty vehicles Light-duty vehicles 891 10,000 by 2023 Same as LRT Total annual energy consumption Type of growth Changes in performance characteristics 1,900 MWh TBD 23,000 by 2023 143,000 by 2030 515,000 by 2050 TBD Logistic Logistic NA Exponential 2% increase in range annually until vehicles reach 200 12 TBD Current Account / Historic Data Costs Note that costs will be addressed in a subsequent draft. However, documenting and collecting cost data and references as appropriate are recommended. Reference (Business as Usual) Long-range Target (LRT) SDPα miles of range $35,000 for 200 mile range vehicle in 2020 $25,000 for 200 mile range vehicle in 2020 $25,000 for 200 mile range vehicle in 2020 UNMET NEEDS More information needed. Please describe areas for more research or collaboration with other jurisdictions or experts. Potential for Grid Interactive Vehicle technology to provide income back to EV owners and increase their payback period. ++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++ APPENDIX FOR REFERENCE (TO FOCUS AREA BRIEF AUTHORS) The following paragraphs are general statements about the other focus areas, for your information and reference, as needed. Heat Pumps. Solar provides one of the non-carbon electric sources capable of fuel switching for space heating. Control of heat pumps (cooling and heating) provides potential for active load management that can be matched with intermittent variable output of PV systems. Energy Storage. Storage enables higher saturation of intermittent renewables such as solar and wind, on the grid. Storage can improve resiliency and operational efficiency of the grid (providing required ancillary services). With advanced inverters, storage provides potential for systems to provide back-up power when the grid is down. Storage supplements the potential value proposition from highsaturation solar. High-Performance Modular Homes. High-saturation solar can reduce operating expenses for these homes when it is combined with other efficiency and control strategies. Solar energy, either site based or at the community level, can be part of an affordable solution that reduces overall energy burdens and provides higher-quality construction and living environments. Incentives. Tax credits and other direct incentives have been essential to the growth of solar PV markets. With declining costs, and the possibility that future federal tax credits will decline, it is essential 13 to examine if incentives are still required to promote market development. As the market continues to grow, it is also important to consider if particular market segments (for example, low-income or lowwealth) require ongoing incentive support. Incentives can also affect the type of system (rooftop versus ground mounted) and the technical operations (for example, western versus southern exposure) of systems that are deployed. Net metering. Net metering is one of the incentives that has contributed to significant market growth. Looking forward, an advanced solar market might require modifications and / or alternatives to net metering. This focus area will receive a more in-depth treatment than the other focus areas. 14