View/Open - DukeSpace

advertisement

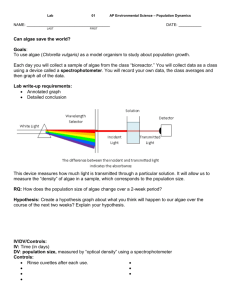

Algae and Coal: Turning Pollution into Prosperity By Patrick McNamara Dr. Timothy L. Johnson, Advisor May 2010 Submitted in partial fulfillment of the Requirements for the Master of Environmental Management degree in The Nicholas School of the Environment of Duke University 2010 Table of Contents Abstract……………………………………………………………………………3 Introduction……………………………………………………………………….4 Background………………………………………………………………………..7 Coal…………………………………………………………………………………7 GHG Mitigation Options…………………………………………………..……….9 Algae………………………………………………………………………………11 Methods…………………………………………………………………………..19 Variables…………………………………………………………………………..21 Equations………………………………………………………………………….30 Results…………………………………………………………………………….32 Discussion………………………………………………………………………...37 Conclusions……………………………………………………………………….39 2 Abstract Algae have long been researched as a potential source of biodiesel and biofuel because of their quick growth rate, simple inputs and ability to grow under environments unsuitable for many other plants. Using a Monte Carlo simulation, this analysis examines the circumstances under which an algae farm might become profitable now and in the future. The use of CO2 from fossil fuels, specifically coal-fired power plants, is potentially valuable for both the utility and the algae farm because algae require large amounts of CO2 for their high growth rates. My results show that the success of algae farms in the United States is currently unprofitable in the short and mid-term (five to ten years). Moreover their long term profitability is heavily dependent on the system design, fuel prices, location, the existence and increase of prices being placed on air pollutants such as CO2 and NOX, as well as successive scientific breakthroughs under reasonable assumptions. 3 Introduction The earth is continuously bombarded with energy from the sun during the day, approximately .1-.5%1 of which plants utilize via photosynthesis, driving most living systems on the planet. That energy is used to capture carbon dioxide (CO2) and ultimately increase earthen biomass. These Ppants emit oxygen during photosynthesis, approximately 70%2 of which algae are responsible for, making it arguably the world’s most important plant. Algae can grow almost anywhere as long as there is adequate moisture, sunlight and nutrients (phosphorous, nitrogen, potassium, iron and chloride). There are tens of thousands of species of algae, many of which have the ability to double in growth multiple times a day, making them very efficient photosynthesizers. Not only do they use solar energy to increase biomass, they have a potentially valuable byproduct in the form of oils and lipids. These oils can be converted into biodiesel even more easily3 than conventional crude oil, and contain no sulfur; the oils can even be used for bioplastics, although that market is nascent at best4. The starch in the biomass can also be converted into biofuel, making them a potentially renewable substitute for both gasoline and petroleum diesel. These characteristics make algae a very attractive source of fuel, and there has been a large amount of research in this area including at the U.S. Department of Energy5. A very similar area of study is the use of CO2 from the flue gas of our coal-fired power plants for algae growth facilities. This concept was introduced only in the last decade at MIT, but 1 Rabinowitch, E., 1961. Photochemical utilization of light energy. Proc. Natl. Acad. Sci. USA 47, 1296–1303. <http://www.mckinsey.com/clientservice/ccsi/pdf/low_carbon_economy.pdf>.Nick Hoffman and James. 2009. Profiting from the Low-Carbon Economy. McKinsey London Office. 2 Hall, Dr. Jack. "Ecology.com | Algae; The Most Important Organism?" The Ecology Global Network | Ecology News and Information for Residents of Planet Earth. Web. 22 Mar. 2010. 3 "HowStuffWorks "How Oil Refining Works"" HowStuffWorks - Learn How Everything Works! Web. 22 Mar. 2010. <http://www.howstuffworks.com/oil-refining4.htm>. 4 Williams, Andrew. "US Company Transforms Algae into Bioplastic: Could Slash Petroleum Use by 50% : CleanTechnica." CleanTechnica - The Future of Clean Energy Technology. Web. 22 Mar. 2010. 5 United States. Department of Energy. National Renewable Energy Laboratory. A Look Back at the US DOE Aquatic Species Program - Biodiesel from Algae. By John Sheehan. 4 commercial algae farming is an established industry with over 50 years experience6. Many parties are showing a great deal of interest in the idea of algae-based carbon capture, with test facilities in the United States and China, both coal-rich countries7,8. The flue gas contains other regulated and priced pollutants in SO2 and NOX, as well as unregulated ones like mercury, which algae can absorb in their growth process9. The potential exists for algae to add to the options of mitigating regulated pollutants if it can absorb emissions at a lower cost. By acquiring CO2 more easily, and taking advantage of a future price on CO2, the economics for algae growth facilities can improve. The potential for this type of facility is significant: we could use a cheap, abundant domestic natural resource to generate electricity in a carbon-constrained market and grow transportation fuel in the process. That potential, along with a pending climate change crisis, makes research into the biophysical processes, engineering and economic aspects of this type of facility both crucial and lucrative. To help eliminate the climate change problem, the greenhouse gases (GHGs) from coalfired power plants must either be reduced, or there must be a large-scale shift away from coal to less GHG-intensive forms of electricity, like natural gas, wind or solar. A wide variety of clean coal technologies are under development and testing10, including carbon-capture and 6 Clayton, Mark. " Algae like a Breath Mint for Smokestacks." News, Travel, Weather, Entertainment, Sports, Technology, U.S. & World - USATODAY.com. 10 Jan. 2006. Web. 21 Nov. 2009. <http://www.usatoday.com/tech/science/2006-01-10-algae-powerplants_x.htm>. 7 Lever, Robert. "Algae Blooms Into Promising Biofuel." World Business Council for Sustainable Development, 26 July 2009. Web. 14 Sept. 2009. <http://www.wbcsd.org/Plugins/DocSearch/details.asp?ObjectId=MzUxNTQ>. 8 Khan, Shakeel, and Rashmi. "Algae: A Nover Source of Renwable Energy and Carbon Sequestration." Renewable Energy. 21 May 2009. Web. 15 Sept. 2009. <http://www.scribd.com/doc/15688667/Algae-a-novel-source-ofrenewable-energy-and-carbon-sequestration>. 9 E. M. Sunderland, D. P. Krabbenhoft, J. W. Moreau, S. A. Strode, and W. M. Landing. "Mercury Sources, Distribution, and Bioavailability in the North Pacific Ocean: Insights from Data and Models." Global Biogeochemical Cycles 23 (2009): 1-14. American Geophysical Union. 1 May 2009. Web. 10 Apr. 2010. <http://proxy.lib.duke.edu:3170/journals/gb/gb0902/2008GB003425/>. 10 Hoffman, Nick, and James Twining. Profiting from the Low Carbon Economy. Publication. McKinsey and Company, 2009. Web. 17 Sept. 2009. <http://www.mckinsey.com/clientservice/ccsi/pdf/low_carbon_economy.pdf>.Nick Hoffman and James. 2009. Profiting from the Low-Carbon Economy. McKinsey London Office. 5 sequestration systems which would remove CO2 from flue gas after combustion and sequester it underground before it enters the atmosphere. Algae-based carbon capture is among many clean coal technologies, but algae do not technically sequester CO2; algae merely get more energy from that same unit of CO2 and displace crude oil-based transportation fuels in the process. A reliable and comprehensive investigation into the long-term economic feasibility of these systems may help promote the development of this new industry, which may possibly offer more cost-effective options to reduce carbon emissions. The following analysis adds to the literature in this area by exploring the facts that drive the net present value (NPV) of an algae growth facility using flue gas CO2 based on real data and under specific assumptions such as the price of carbon dioxide, biodiesel and biofuel subsidies, and related factors. This information will be used to compare the potential of algal-based carbon capture and reusing (CCR) with the more familiar carbon capture and sequestration (CCS) method. It will begin with a review of the relevant literature; providing background information as well as summarizing the political and non-political benefits, potential markets and similar analyses previously conducted. The next section will discuss the methods and variables, including a Monte Carlo simulation, a covariance estimation to minimize the uncertainty present in fuel prices, absorption and abatement potential, facility costs, and will ultimately provide a range of NPVs to analyze under given assumptions. The third section contains the results and analysis, in which the basic statistics on the NPVs under each set of assumptions will be analyzed and interpreted, with a discussion of the most important costs and revenues. The final section will discuss the limitations of this analysis and outline where further research is needed. 6 Background Coal The use of coal-fired electricity has spurred decades of strong economic growth in the United States. Coal mining is an industry contributing over $20 billion to US GDP annually11. More importantly for economic growth, it has provided a cheap, reliable, domestic source of electricity to American factories and businesses for over a century. Coal continues to maintain its near majority hold in the electricity industry at approximately 49 percent in 200912. Even though 19 percent of new generating capacity is expected to be coal in the year 2030, only a modest decrease to 47 percent of overall generating capacity is predicted for 2030 in the Department of Energy’s 2009 Annual Energy Outlook; these numbers do not assume carbon-constrained economy, but do illustrate the magnitude of the invested infrastructure. Given that we have enough proven domestic reserves (271 million short tons) to maintain our current annual consumption increase of 2.4% per year until 208413, we know that coal can be securely utilized well into the future. The emissions from coal-fired power plants contribute significantly to increasing atmospheric concentrations of greenhouse gases (GHGs), specifically CO2. Carbon dioxide emissions are the leading contributor to global climate change, making technologies with the potential to reduce CO2 from coal-fired power plants important from an environmental standpoint and attractive from a business standpoint in a carbon-constrained economy. Another pollutant from coal-fired power plants is nitrogen oxides. Although they are a pollutant most 11 Jorgenson, Dale W., and Kevin J. Stiroh. Raising the Speed Limit: U.S. Economic Growth in the Information Age. Rep. National Research Council. Web. 21 Jan. 2010. <http://muse.jhu.edu/journals/brookings_papers_on_economic_activity/v2000/2000.1jorgenson_comment.pdf>. 12 United States. Department of Energy. Energy Information Administration. U. Mar. 2009. Web. 14 Sept. 2009. <http://www.eia.doe.gov/oiaf/aeo/index.html>. 13 United States. Department of Energy. Energy Information Administration. US Coal Supply and Demand:2008 Review. Web. 18 Jan. 2009. <http://www.eia.doe.gov/fuelcoal.html>. 7 commonly from motor vehicles, the third leading source is coal-fired power plants. More specifically, nitrogen dioxide (NO2) is a criteria pollutant, requiring the EPA to set national standards for its emission. This is in large part because NO2 is a precursor to ozone (O3) formation, which has been shown to exacerbate asthma problems for those who come into shortterm contact with it. It also contributes to emphysema and bronchitis in urban areas, along with other respiratory ailments14. Nitrous Oxide (N2O) is a GHG with global warming intensity approximately 298 times that of CO2 per unit weight15 and is present in very small quantities in the flue gas from coal-fired power plants (~10ppm). There is no known distinction in the absorption potential amongst nitrogen oxides by algae42, so they will fall together under NOX absorption rather than being accounted for separately. However the pollution does not stop there; two other major pollutants in the flue gas of coal-fired power plants are sulfur dioxide (SO2) and mercury (Hg). SO2 is not a major GHG, but is a leading contributor to acid rain in the United States, as well as emphysema, bronchitis, and asthma in urban areas. After the creation of the Acid Rain Program in Clean Air Act of 1990, the level of SO2 has been reduced significantly mostly via the burning of low-sulfur coal and flue gas scrubbers. This reduction was achieved through a pollution permits program, allowing the use of any method to reduce SO2 emissions levels as long as the goal was reached. This method stands in stark contrast to the Best Available Control Technology (BACT) standards instituted in many EPA regulations in years past, which did not allow the use of any technology besides those prescribed by the EPA. The BACT approach is widely believed to be less efficient than a market-based approach such as pollution permits markets. Mercury is not an EPA criteria 14 "Health | Nitrogen Dioxide | US EPA." U.S. Environmental Protection Agency. Web. 11 Nov. 2009. <http://www.epa.gov/air/nitrogenoxides/health.html>. 15 IPCC. Climate Change 2007: Synthesis Report. Rep. Intergovernmental Panel on Climate Change, 2008. Web. 2 Apr. 2010. <http://www.ipcc.ch/publications_and_data/ar4/syr/en/contents.html>. 8 pollutant, but is a well known toxin because “exposure at high levels can harm the brain, heart, kidneys, lungs, and immune system of people of all ages” 16. Coal-fired power plants are also the leading cause of mercury emissions to the air in the US, accounting for over 40% of all domestic emissions5. While algae can absorb mercury in the growth process9, reliable data on their absorption potential in a controlled system is not available, and they are consequently excluded from this analysis. GHG Mitigation Options These pollutants are important because while CO2 from the electricity generation sector must be reduced in the long term, coal-fired electricity causes much more damage to the environment than just through its emission of GHGs. Reducing these is an added benefit of an algae-based sequestration method versus large-scale post-combustion sequestration. The current methods of choice for carbon mitigation from coal-fired power plants is large-scale CCS, more demand being met by natural gas, renewable energy and even nuclear power. Oxyfuel and IGCC are forms of electricity generation that would significantly reduce the aforementioned pollutants from coal-fired power generation. These methods make the flue gas suitable for sequestration without the use of chemical scrubbers by significantly reducing many other pollutants in it, including CO2 by around 10% because of their increased combustion efficiency17, 18, but the levels of CO2 would still be high enough to require underground sequestration19. Moreover, 16 "Basic Information | Mercury | US EPA." U.S. Environmental Protection Agency. Web. 19 Jan. 2010. <http://www.epa.gov/hg/about.htm>. 17 United States. Department of Energy. Office of Fossil Energy. Oxy-Fuel Combustion. By Madhava Syamlal, George Richards, and Sean Plasynski. National Energy Technology Laboratory, Aug. 2008. Web. 26 Jan. 2010. <http://www.netl.doe.gov/publications/factsheets/rd/R&D127.pdf>. 18 Brown, Jay A.R., Lynn M. Manfredo, Jeff W. Hoffmann, Massood Ramezan, and Gary J. Stiegel. An Environmental Assessment of IGCC Power Systems. Nineteenth Annual Pittsburgh Coal Conference, 28 Sept. 2002. Web. 22 Jan. 2010. 19 United States. Department of Energy. Naitonal Energy Technology Laboratory. By Julianne M. Klara and John G. Wimer. May 2007. Web. 2 Feb. 2010. <http://www.netl.doe.gov/energyanalyses/pubs/deskreference/B_IG_GEE_CCS_051507.pdf>. 9 IGCC and Oxyfuel would require entirely new power generation infrastructure, while traditional pulverized coal power is already in place. Public understanding or even knowledge about the existence of CCS is very low20; however this is not just because of an information dissemination problem. CCS systems are simple to understand in theory: the CO2 would be separated from the flue gas, compressed into liquid form and transported to appropriate underground storage sites. It is the true costs and abatement potential of CCS that are very uncertain and confusing, even amongst well known organizations like the IPCC, which estimates a range of $20-270 CO2 sequestered21, or the IEA which predicts costs ranging from $20-8022, at an 80-90% capture rate. This cost includes a 10-40% parasitic load, the additional electricity required to be generated to run the entire CCS system, with the weight of the probability on the upper end for older plants. The National Energy Technology Laboratory (NETL) at the Department of Energy (DOE) says that “water consumption by thermoelectric plants is predicted to grow… 35.7%” by 2030 (approximately 10- 15% of which will be from CCS) 23. CCS therefore requires the continued mitigation or continued pollution for the currently unregulated ones, or the investment into new power infrastructure. Finally, the risk of CO2 leakage into the air or water formations, albeit small13, is one that could potentially nullify the capital expenditures and climate savings of its employment, or acidify a large water table. These flaws lead one to look more closely at cleaner electricity generation options, such as renewable energy or even nuclear power. Renewable generation such as solar or wind power 20 Curry, Thomas E. A Survey of Public Attitudes towards Climate Change and Climate Change Mitigation Technologies in the United States. Massachusetts Institute of Technology, Apr. 2007. Web. 3 Jan. 2010. <http://sequestration.mit.edu/pdf/LFEE_2007_01_WP.pdf>. 21 Simbolotti, Giorgio. IEA Energy Technology Essentials. Rep. CO2 Capture and Storage, Dec. 2006. 4 Dec. 2009. 22 United Nations Intergovernmental Panel on Climate Change. 2006. “Special Report on Carbon Capture and Storage” Jan. 2007. 4 Dec. 2009. 23 National Energy Technology Laboratory. Department of Energy. DOE Estimates Future Water Needs for Thermoelectric Power Plants. 6 Dec. 2007. Web. 4 Feb. 2010. <http://www.netl.doe.gov/publications/press/2007/07083-Water_Use_Analysis_Updated.html>. 10 is outside the scope of this analysis, and not for the sake of simplification. First, while the economics for each are continually improving, solar is still cost prohibitive on a large scale24. Wind presents its own set of challenges in that it is nearly on par with coal economically, but only in certain regions; relative to coal, the areas with the most wind potential are either small and far away (North Central U.S.) from the heaviest areas of consumption (east and west coasts, south) or currently cost prohibitive (offshore)25. Additionally, wind power generates most of its electricity at night, when demand is usually at its lowest26. Nuclear power has the most complications of all three, including waste management, permitting costs and political reticence, which make it challenging to assess or predict US deployment of nuclear power in the near or long term. While the author does not argue that the aforementioned energy technologies will not be a significant part of our power infrastructure in the future, they are outside the scope of a pulverized coal-CCS vs. algal CCR comparison. Algae Before describing the details of algal CCR research or its significant potential, the design of the two main competing system designs must be discussed; open pond and photobioreactor. The open pond system will be discussed simultaneously with the open raceway pond as the designs are very similar27. The open pond system more closely simulates algae’s natural growth environment, and is relatively cheaper than a photobioreactor to build and operate. These cost savings come with many drawbacks, including the inability to control the growth environment, 24 Wiser, Ryan, Galen Barbose, and Carla Peterman. The Installed Costs of Photovoltaics in the US from 1998-2007. Rep. Lawrence Berkeley National Laboratory, Feb. 2009. Web. 5 Feb. 2010. <http://eetd.lbl.gov/ea/emp/reports/lbnl-1516e.pdf>. 25 United States. Department of Energy. Increasing Wind Energy's Contribution to US Electricity Supply. Dec. 2008. Web. 5 Feb. 2010. <http://www.nrel.gov/docs/fy08osti/41869.pdf>. 26 Wald, Matthew L. "Utility Will Use Batteries to Store Wind Power." The New York Times. 11 Sept. 2007. Web. 2 Feb. 2010. <http://www.nytimes.com/2007/09/11/business/11battery.html>. 27 "Cultivation of Algae - Open Pond - Oilgae - Oil from Algae." Biodiesel from Algae Oil - Oilgae.com. Web. 22 Mar. 2010. 11 the risk of contamination, evaporation, gas leakage, and most importantly, relatively low algae production on surface areas. The raceway pond model increases costs and energy usage but does so to increase growth and extraction efficiency over the same land area. These drawbacks, and the obvious limitation on space for shallow, open pond systems, have lead to research and investment into using photobioreactors. These allow for nearly complete environmental control, significantly reduce the risk of gas leakage or evaporation, and have much greater productivity, which reduces land requirements and can lower per-unit harvesting costs, since algal density can be much greater in the photobioreactor than the shallow pond28. Largely because of the ability to manage important factors like gas accumulation, temperature and species, the costs of a photobioreactor system are much higher. The dynamics of these two designs will be compared in the final analysis. With an idea of the system designs, the specifics of the system’s pollution absorption and byproducts can be discussed. What makes algae valuable as a pollutant mitigator is that it can reduce CO2, SO2, NOX and mercury at potentially high levels. The absorption efficiency can be up to 90% for carbon oxide and up to 96% for nitrogen oxides29. The effects of different pollutant levels vary by strain, however generally the more NOX in the gas stream the more biomass produced relative to lipids for oil production, and vice versa30. While we cannot believe these levels are achievable with every strain, the potential for high levels in one species exists with hybridization or genetic modification. Mercury absorption is a nascent area of research for 28 J. Benemann, 5th Annual World Congress on Industrial Biotechnology, Chicago, April 30, 2008 Nagase et al. "Improvement of Microalgal NOx Removal in Bubble Column and Airlift Reactors." Journal of Fermentation and Bioengineering 86.4 (1998): 421-23. Print. 30 Schenk et al. "Second Generation Biofuels: High-Efficiency Microalgae for Biodiesel Production." Bioenergy Research 1 (2008): 20-43. Print. 29 12 microalgae, but studies to date have shown volatilization levels in the 90% range31, but the lack of validating studies and variety in the original study justifies its exclusion from this cost analysis. Finally, sulfur dioxide emissions are already restricted pollutants with an established market and two compliance methods in the form of low-sulfur coal or a chemical scrubber. The potential exists for algae to replace one or both of these options if it can reduce emissions at a lower cost than either current remediation method. However, research up to this point has only identified levels of tolerability for algae species, not absorption potential. The continuance of existing SO2 mitigation methods is recommended32, because algae cultivation slows and eventually stops at untreated (treated is defined as “scrubbed” or the burning of low-sulfur coal) levels33. In addition, the recent reduction of sulfur requirements in diesel fuel from 500ppm to 15ppm34 makes the potential revenue stream from biodiesel, which contains no sulfur, very small. Assuming 7.34lbs per gallon of diesel, over 18,000,000 gallons of algae biodiesel would need to be consumed in place of petroleum diesel to eliminate one ton of SO2 emissions after the institution of the ULSD requirement. This is outside the realm of currently reasonable algae production possibilities. Therefore the use of algae as a mitigator for SO2 emissions is excluded from this analysis, but its potential is acknowledged. Most research surrounding algae has centered on the use of its lipids and starch for conversion to transportation fuels. With current average estimates varying widely from 5,000- 31 Kelly. "Biotransformation of Mercury in pH-stat Cultures of Eukaryotic Freshwater Algae." Microbiology 187 (2007): 45-53. Springer Link, 10 Oct. 2006. Web. 6 Feb. 2010. <http://proxy.lib.duke.edu:2461/content/y5363252032k1370/fulltext.pdf>. 32 Kadam, Kiran L. "Power Plant Flue Gas as a Source of CO2 for Microalgae Cultivation: Economic Impact of Different Process Options." Energy Management 38 (1997): 505-10. Print. 33 Matsumoto et al. 1997. Influence of CO2, SO2 and NO in flue gas on microalgae productivity. J.Chem. Eng. Jpn. 30, 620–624. 34 "Biodiesel Performance, Costs, and Use." Energy Information Administration - EIA - Official Energy Statistics from the U.S. Government. 4 June 2004. Web. 2 Feb. 2010. <http://www.eia.doe.gov/oiaf/analysispaper/biodiesel/>. 13 20,000 gallons/acre/year of biodiesel35, it is much more productive than other energy crops such as wheat, palm and soy36. The variety of the claims leads one to natural skepticism, as many are taken from laboratory experiments, not taken full scale operations. Nevertheless the potential is widely recognized22, so a range of values for gal/acre/yr will be used each year and over time. The potential benefits for this type of abatement system do not stop with pollution reductions; politically speaking this system is very palatable. First, by growing fuel, a country can reduce the need to import oil from parties in the Middle East, such as Saudi Arabia, and increase our economic and energy security by not being subject to supply constraints outside their immediate control37. Secondly, the growth method uses non-arable land, which reduces food price spikes and avoids global ‘food-instead-of-fuel’ issues. Third, the use of biofuel/biodiesel does not require the enormous infrastructure changeover that electric automobiles require. While electric or hydrogen vehicles may be part of our long-term transportation future, they have their own environmental, engineering and cost downsides, and are excluded from this analysis38, 39. Fourth, by continuing the use of domestic coal, a political battle with a strong lobby is avoided, the jobs in poor coal states can not only be maintained but expanded, and subsidies for CCS in a climate change or energy bill may be unnecessary. Finally, the use of coal as a relatively cheap source of electricity can help economic growth in a carbonconstrained world. Contrastingly, the continued use of coal does nothing to address the upstream 35 "Algenol Biofuels - The Science - The Biology." Algenol Biofuels - Harnessing the Sun to Fuel the World. Web. 09 Feb. 2010. <http://www.algenolbiofuels.com/thescience-biology.html>. 36 Haag, Amanda L. "Algae Bloom Again." Nature Magazine. 31 May 2007. Web. 13 Sept. 2009. <http://www.nature.com/nature/journal/v447/n7144/full/447520a.html>. 37 Blomberg, Brock, Gregory Hess, and Hunter Jackson. "Terrorism and the Returns to Oil." Economics & Politics 21.3 (2009): 409-32. 19 Aug. 2009. Web. 4 Feb. 2010. <http://proxy.lib.duke.edu:2333/cgibin/fulltext/122563663/HTMLSTART>. 38 Wise, Marshall, Kyle G. Page, James J. Dooley, and Son H. Kim. "The Impact of Electric Passenger Transport Technology Under an Economy-Wide Climate Policy in the United States." International Journal of Greenhouse Gas Control 4 (2010): 301-08. Print. 39 "Hydrogen-Fueled Cars Call for Stricter Safety Requirements for the Fueling System." Chemical Business 23.12 (2009): 45. Web. 2 Feb. 2010. 14 damage of coal mining and production like those from mountaintops mining with valley fills. A recent study found that that even after reclamation, groundwater still has higher levels of minederived chemicals than un-mined sites, and that even those who live around the mines have higher levels of mortality, lung cancer, hypertension, and heart, kidney and lung disease40. This analysis aims to understand the circumstances under which the use of algae as a carbon dioxide mitigation tool can be profitable, taking both an optimistic and pessimistic approach in the short, medium and long term in the hopes of better quantifying the potential of this system. There have been two valuable analyses done on the subject, which will be discussed here. First, EniTechnologie from Spain conducted a comparable analysis in 2006 where they set parameters for worst case, median case and best case scenarios and analyzed the results41. Their worst case scenario produced a loss of €410/hectare (ha)/yr, while their best case scenario achieved a profit of €210/ha/yr. Their median case assumption had a net profit of €0, but their most likely assumptions were all leaning towards those of their best-case scenario. However this analysis is limited because it looks at the European market, not the United States. The carbon market in Europe is mandatory and therefore has a more reliable price structure, whereas the US market is only voluntary and operates at much lower prices. The authors conclude that the system has economic viability in the mid to long-term, but remains unlikely to be viable in the short term because of capital costs and technological uncertainty. A similar analysis by the British Columbia Innovation Council takes a slightly different approach and tries to determine the cost of production for open ponds, photobioreactors and 40 Palmer, M. A. "Mountaintop Mining Consequences." Science 327.5962 (2010): 148-49. Print. Harmelen, Toon V., and Hans Oonk. Microalgae Biofixation Process: Applications and Potential Contributions to Greenhouse Gas Mitigation Options. Tech. 2006. 41 15 fermenters42. The fermentation option is where the algae are fed sugars and nutrients in a heated, sealed environment and the yeast does not rest. The costs for this type of system are similarly high relative to open pond systems, but provide an entirely oil-oriented growth, producing double or more the lipids of even either photosynthesis-based system43. This option is excluded from this analysis because relatively little research has been done on the subject relative to open ponds and photobioreactors. Nonetheless, the authors find that the fermentation method currently produces a kilogram of algae at the lowest cost at laboratory scale, $1.54/kg, while open ponds produce at $2.66/kg and photobioreactors at $7.32/kg. This analysis brings in another option for algae growth, and competition can only help this burgeoning industry. The authors conduct a cost-benefit analysis, listing the lipid content under each system and accounting for the value of the oils and other byproducts sold under different scenarios. The lack of a long-term approach limits the usefulness of these numbers, as they are based on current production capabilities, while photobioreactors are being heavily researched precisely because they have such significant potential. In addition to using algae to grow fuel from the emissions of coal-fired power plants, algae can also provide substantial nutritional benefits. It has the potential to be grown cheaply enough that it was a central tenet of Mark Reynolds’ book “Green Algae Strategy: End Oil Imports and Engineer Sustainable Food and Fuel”44. In it Reynolds outlines his proposal for growing algae biodiesel from the flue gas of coal-fired power and selling the resulting biomass as a cheap, sustainable source of food even in a changing climate. Similar to tofu, algae can 42 Alabi, Abayomi, Martin Tampier, and Eric Bibeau. Microalgae Technologies and Processes for Biofuels/Bioenergy Production in British Columbia: Current Technology, Suitability and Barriers to Implementation. Rep. 2009. Print. 43 "Fermentation or Photosynthesis: The Debate in Algae Fuel | Green Tech - CNET News." Technology News CNET News. Web. 21 Mar. 2010. <http://news.cnet.com/8301-11128_3-9859455-54.html>. 44 Edwards, Mark R. Green Algae Strategy: End Oil Imports and Engineer Sustainable Food and Fuel. [S.l.: CreateSpace], 2008. Print. 16 provide many vitamins including A, B1, B2, B6, C, niacin and are rich in iodine, potassium, iron, magnesium, calcium and even omega-3 fatty acids. The dry algae biomass sells for around $200/tonne, but the tofu market is much more valuable and widespread, selling for roughly $4000/tonne42. The current market for algae as a food source is relegated to Asia, especially China and Japan, where over 90 species are eaten regularly. A discussion on how to expand the currently market is absent, limiting the books prescriptive usefulness. The life cycle energy usage of an algae farm is important to discuss even in an economic analysis because producing algae for biofuels is not a renewable fuel if it does not produce more energy than it takes in (excluding the sun). The first energy analysis, “Life-Cycle Assessment of Biodiesel Production from Microalgae”45 analyzes just what its title says it will; however it should be noted that the numbers were based on laboratory results, since no algae-for-biodiesel commercial facility existed to their knowledge at the time of writing, and are therefore merely approximations. While the energy balance for the facility is significantly negative, the authors note that 90% of the energy consumed by the facility is dedicated to dry lipid extraction (70% if the cake is wet), making it a crucial area for future efficiency research. The authors excluded the use of co-firing biomass for electricity generation, which could only have lessened the impacts relative to merely excluding it. Moreover, many of the systems and studies reviewed use technology from ten years ago, much of which is likely no longer relevant given the large amount of research into the area since. 45 Bernard et al. "Life-Cycle Assessment of Biodiesel Production from Microalgae." Environmental Science and Technology 43.17 (2009): 6475-481. 27 July 2009. Web. 15 Oct. 2009. <http://pubs.acs.org/doi/abs/10.1021/es900705j>. 17 The second life cycle study to discuss is “Environmental Life Cycle Comparison of Algae to Other Bioenergy Feedstocks”46. This analysis looked to quantify the upstream environmental impacts of algae, corn, canola and switchgrass, also excluding the conversion to liquid or solid fuel. The authors find that the other three crops have lower impacts than algae on energy use, greenhouse gas emissions and water consumption, while algae are most favorable with respect to eutrophication potential and total land use. However, when including the use of flue gas and/or wastewater treatment as substitutes for water and fertilizer inputs47, the impacts of algae are reduced significantly. Algae became more environmentally friendly than the rest when source-separated urine was employed as a fertilizer source. The authors find that algae growth in their model was “largely insensitive to inputs widely associated with algae productivity such as water and sunlight availability” while nutrient supplies dominated the environmental impacts. Recycling fertilizer would make these impacts much smaller, although energy inputs would have to go up. A life cycle assessment is useful, but should only be part of the decision making process when trying to reduce the greenhouse gas concentrations in the atmosphere. Since this system will be used to absorb or remove pollutants, a positive energy or resource balance is not necessarily a requirement. We should merely desire that it be more environmentally friendly than the next best alternative to the mitigation of that pollutant: CCS, solar power, wind farms, geothermal and others. 46 Clarens et al. "Environmental Life Cycle Comparison of Algae to Other Bioenergy Feedstocks." Environmental Science and Technology 44.5 (2010): 1813-819. 19 Jan. 2010. Web. 26 Jan. 2010. <http://pubs.acs.org/doi/abs/10.1021/es902838n>. 47 Howell, Katie. "NASA Bags Algae, Wastewater in Bid for Aviation Fuel - NYTimes.com." The New York Times Breaking News, World News & Multimedia. 13 Nov. 2010. Web. 29 Apr. 2010. <http://www.nytimes.com/gwire/2009/05/12/12greenwire-nasa-bags-algae-wastewater-in-bid-for-aviation12208.html>. 18 Methods Whereas previous analyses looked at the one-time profitability of an algae farm under a given set of assumptions, none have explored the long-term potential of algae farms in a statistically meaningful way41, 42. The long term impact of fuel subsidies on the viability of these systems has also not been studied, in large part because the subsidies have to be renewed almost annually48, 49. Third, recent legislation such as the Waxman-Markey bill gives us an idea of what a U.S. carbon market might look like in the United States, allowing us to have a much more reliable estimate of the potential an algae farm has. Additionally, the European Trading Scheme (ETS) for greenhouse gases has been in place for over three years, giving valuable information as to the price fluctuations we may be able to expect in a U.S. carbon market. Finally, the prospect of algae becoming a sustainable, nutritious food source like tofu holds a great deal of potential for the algae market. Tofu currently sells for about twenty times algae on the open market39, and the use of algae as a substitute good for tofu has been mentioned42 but has not been quantified up to this point. This analysis will be exploring the aforementioned areas through the use of a Monte Carlo simulation (MCS). An MCS is a non-deterministic method that uses independent, randomly generated numbers to reduce the uncertainty and increase the understanding of future outcomes. The randomly generated numbers are from distributions chosen to represent the probability spectrum of a given variable (i.e. a normal distribution for the heights of men in the United States). The use of an MCS makes sense when exploring these aspects of a future algae farm because there is a lot of uncertainty as to how productive they will be or what fuel prices will be like; this allows the range of possible outcomes to be explored. 48 Abuelsamid, Sam. "Expiration of Biodiesel Subsidy Ends Bad Year for Industry Autoblog Green." Web. 23 Mar. 2010. <http://green.autoblog.com/2010/01/03/expiration-of-biodiesel-subsidy-ends-bad-year-for-industry/>. 49 American Workers, State, and Business Relief Act of 2010, S. 4213, 111th Cong. (2010). Print. 19 Here I will outline the steps in the model, followed by a description of the variables included, their units and the assumptions for each. With the goal of finding the annual profit for the system, an MCS was run in which 1000 simulations are run in Excel for every year from 2010 to 2040 using key variables and inputs outlined in the sections below. A Monte Carlo simulation makes sense for a few reasons. First, these systems have a variety of outputs with uncertain prices, and a Monte Carlo simulation can provide information as to their effects. Second, these uncertainties also occur over time with different price characteristics for each market. The prices of pollutants are expected to rise steadily over time, but the price of CO2 will likely vary less widely than N2O. Fuel prices are expected to increase in the long-term, but the year-to-year variation between prices is high relative to pollutant prices. The risk surrounding the investment into algae farms can be quantified with an MCS and allow for more intelligent, targeted investment into increasing the economic viability of algae farms. In each year from 2010 to 2040, the profit for that year is calculated by subtracting the capital costs, operating costs (labor, electricity, fertilizer, water, maintenance, and flocculation), taxes, waste and insurance from the revenues of gas and diesel fuel, CO2, NOX and biomass. The annual profits are used to find an NPV under given market assumptions, growth rates and farm types using Microsoft Excel’s “=NPV()” function. Because of the thirty year time horizon, a 4% discount rate will be used to find the NPV. This is a realistic assumption for a mid-term investment of this magnitude given that historical averages for discount rates are around 4%50. However the discount rate could be higher or lower over the next thirty years, making this an important simplifying assumption. 50 "Historical Changes of the Target Federal Funds and Discount Rates - Federal Reserve Bank of New York." FEDERAL RESERVE BANK of NEW YORK. 19 Feb. 2010. Web. 28 Feb. 2010. <http://www.newyorkfed.org/markets/statistics/dlyrates/fedrate.html>. 20 Variables For each revenue variable, a random number will be drawn from a chosen distribution with the mean and standard deviation based in historical data where possible, and academic literature or legislation otherwise. For regulated pollution prices and biomass, a normal distribution will be used to reflect the fact that there is a great deal of uncertainty as to what the exact prices will be, that they will be relatively more stable under government regulation than market prices, but that there is also only a small chance for very high and very low prices. Since these market prices cannot be negative but numbers drawn from a normal distribution can be, price “collars” will be used for CO2 and NOX, discussed below. The mean and standard deviation are those of the annual permits prices since inception for NOX. The specifics of CO2 prices are discussed below. For fuel prices I used the statistical program R to create a covariance matrix of historical prices from the Energy Information Administration (EIA) dating back to 1991 for gasoline and 1995 for diesel fuel51. Academic literature will be used for biomass prices, as information on the market is not easily available. For CO2, the yearly averages will be based on H.R. 2454, otherwise the Waxman-Markey legislation. These prices are preferable to academic projections because the bill gives us a reasonable indication of what a US GHG market might look like52. Secondly, while the European Union (EU) market for GHGs is a mandatory one, but there are failures in the EU market that are likely to be learned from when implementing the U.S. market, as well as the general differences between the U.S. and EU economies that will not necessarily make the results comparable. 51 "U.S. Retail Gasoline Historical Prices." Energy Information Administration - EIA - Official Energy Statistics from the U.S. Government. Web. 20 Jan. 2010. <http://www.eia.doe.gov/oil_gas/petroleum/data_publications/wrgp/mogas_history.html>. 52 "H.R. 2454: American Clean Energy and Security Act of 2009 (GovTrack.us)." GovTrack.us: Tracking the U.S. Congress. Web. 22 Mar. 2010. <http://www.govtrack.us/congress/bill.xpd?bill=h111-2454>. 21 Finally we must consider the global effects of a CO2 market in the U.S.; not only will the U.S. be limiting its GHG emissions, but the effect of limiting its own emissions will greatly increase the likelihood of a global treaty to limit GHG emissions. However, to keep prices both consistent and reliable, we will use domestic (U.S.) prices for all pollutants. The EPA analysis of the Waxman-Markey bill finds that CO2 permits will be worth $11 to $15 in 2012 and $22 to $28 in 202547. Consequently, the prices of CO2 for 2012 in this analysis will be $13/ton in 2012, increasing $1/year to 2040. For 2010 and 2011, Chicago Climate Exchange averages are used (~$2/ton) 53. A price “collar” is included in the Waxman-Markey legislation to prevent price shocks to the market, and they will be used in this analysis as well. The bottom bracket will be 50% of the expected yearly average, while the upper bracket will be 150% of the yearly average. The Waxman-Markey legislation uses the minimum reserve auction price for the previous year plus 5%, plus the rate of inflation (as measured by the Consumer Price Index). This is sufficient for the legislation as they will have those numbers available in that given year, but they are not available now, so the price collar here is a simplified assumption. The standard deviation for CO2 prices will be based on the data obtained from the European Climate Exchange’s historical price database54. Over the life of the European climate accord, future spot prices have averaged approximately $20.95/ton with a standard deviation of $4.93/ton for a standard deviation that is 23.5% of the average price. This will be used as the standard deviation for carbon prices in this analysis, as it is the most representative of the fluctuations we might experience in a U.S. market. The price of NOx is likely more volatile than CO2 because it is less studied, the spot prices have ranged from $350-$5000 since its inception in 2003, and the specifics of the 53 "Privately Negotiated Transactions." Chicago Climate Exchange. 20 Apr. 2010. Web. 29 Apr. 2010. <http://www.chicagoclimatex.com/content.jsf?id=1813>. 54 "ECX Historical Data." Welcome to the European Climate Exchange - Home. 20 Apr. 2010. Web. 29 Apr. 2010. <http://www.ecx.eu/ECX-Historical-Data>. 22 domestic market for NOx are uncertain. The current National Ambient Air Quality Standard (NAAQS) is 0.053ppm, however we can expect them to continue to be regulated under the Clean Air Act, and we will make that assumption in this analysis. Prices dropped after the Clean Air Interstate Rule (CAIR) was vacated on July 11th, 2008 in North Carolina v. EPA because polluters were no longer certain when the EPA would issue a new rule, though they are legally required to and say it may take over two years55. As an exploratory analysis, it is assumed that NOx can be used as fertilizer, even though it has not been conclusively proven56. The Alabi et al. paper assumes nitrogen as 5.5% of the dry mass by weight, and an estimate of 1% NOx is assumed here. For NOX the average annual permit prices found at the EPA database are used57. The price for NOX in 2010 will be the same as 2009 (~$350), but the average for 2011 will be the average of prices from 2003-2009 ($2028.57), under the assumption that it will be regulated, and it will increase 2% per year to 2040. The same price collar as used for CO2 is used here, as it is plausible that any future national NOX would incorporate such a measure. These assumptions significantly affects the viability of an algae farm, and therefore this analysis, because the potential for the nitrogen oxides to be absorbed in the growth process or used as fertilizer has much greater value in a regulated market. As discussed above, dry algae biomass currently sells for around $200/tonne42 on the open market, a slight premium over its competitor market in distillers grain and corn starch42. There is the possibility of making algae biomass a substitute for the tofu market, so both prices will be used in the model to examine their effects on the viability of the system. Total biomass 55 "EPA: Clean Air Interstate Rule - Basic Information." U.S. Environmental Protection Agency. Web. 23 Mar. 2010. <http://epa.gov/interstateairquality/basic.html>. 56 Zeiler, K.G. Biological Trapping of Carbon Dioxide: Draft Milestone Report. National Renewable Energy Laboratory, Golden, CO. February. 1994. 57 "Annual Auction | Allowance Trading | Clean Air Markets | Air & Radiation Home | US EPA." US Environmental Protection Agency. 23 Mar. 2010. Web. 28 Apr. 2010. <http://www.epa.gov/airmarkt/trading/auction.html>. 23 productivity is measured in tonnes of dry biomass per hectare per year and is based on realized growth rates in the Alabi et al. study42, extrapolated to the southwest United States’ solar radiation levels of about 6.5 kWh/m2/day58 instead of the 3.1 kWh/m2/day42. The growth rates in the Alabi et al. study are used as the 2010 baseline (11.4 g/m2/day for open ponds and 15.3 g/m2/day for photobioreactors) and converted to tonne/ha/yr. These productivity levels are used for 2010, with optimistic, moderate and pessimistic annual growth rates (2%, 3.5% and 5%, respectively) used to account for different possibilities. There is also chance applied to each year for a significant scientific breakthrough in the algae industry. Since there is no reliable way to predict a scientific breakthrough, a random number from log-normal distribution is drawn. This makes sense because we expect more steady growth in new technologies to be combined with a significant one time breakthroughs more heavily in the early years of emerging technologies than in later years. For the log-normal distribution’s x-value a random number from 0 to 1 was generated, with a mean of 1 and a step-scaled standard deviation. The standard deviation was 1 for 2010, 0.985 for 2011, 0.97 for 2012 and so forth. This is done because greater productivity gains are expected in the early years when the technology is just emerging. A Monte Carlo simulation of 5000 iterations was conducted on these random numbers for each year, and the average was used as the scientific breakthrough component for the given year. Photobioreactor systems receive an additional .05 added to the standard deviation of the random number generated so as to account for the more nascent nature of the technology and therefore greater likelihood of more significant scientific breakthroughs. To further account for the likelihood of significant breakthroughs early in the life of algae farms, the resulting Monte Carlo average will be multiplied by 2 in the first decade (2010-2019) and 1.5 in the second decade (2020-2029). 58 "U.S. Solar Radiation Resource Maps." Renewable Resource Data Center (RReDC) Home Page. Web. 21 Mar. 2010. <http://rredc.nrel.gov/solar/old_data/nsrdb/redbook/atlas/>. 24 To come up with revenues for each byproduct, productivities from various species of the academic literature were averaged to come up with 5% and 15% carbohydrate productivity for open ponds and photobioreactors, respectively42. The carbohydrates are processed to form cellulosic ethanol, very similarly to other cellulosic ethanol stocks. For lipids to be processed into biodiesel, a 15% productivity rate is used as the base case for raceway ponds and 25% for photobioreactors42, indicating that photobioreactors produce more fuel and less biomass59. The output for biomass is a simple multiplication of 0.01 by the productivity, which is the same as is used in the Alabi et al. study42. These productivities are multiplied by the total productivity for that year in tonnes/ha, and then converted to gallons using 7.34 pounds per gallon for biodiesel and 6.58 pounds per gallon for biofuel to give a number in gallons/ha/yr. There is no reliable information available on whether the learning gains and increases in technical efficiency will outweigh the use of more technologically advanced equipment in such a new market, so a simplifying assumption is made that real capital and operating costs are assumed to stay constant over time. Real dollars will be used as both costs and revenues are discounted in the NPV calculation. For gasoline and diesel fuel markets, historical prices will make up the average and standard deviations for future prices in the MCS. The prices of biofuel and biodiesel will exhibit significant levels of uncertainty60 as the prices of crop inputs, food prices, subsidies, substitutes (petroleum) and renewable mandates changes. There are also a number of other markets for algae-based byproducts to be sold in, including animal feed and plastics. However, those two markets are very different in their uncertainties, as algae has been grown and sold for decades in 59 Kim, D.D. 1990. Outdoor Mass Culture of Spirulina platensis in Vietnam. Journal of Applied Phycology, 2(2), 179-181. 60 "Biodiesel Market Marked by Uncertainty: EIA | Articles & Archives |." NPN. Web. 22 Mar. 2010. <http://www.npnweb.com/ME2>. 25 the pharmaceutical industry61, but the market for the use of algae in plastics and bioplastics is new or non-existent, so it comes with a great deal of uncertainty. Data on both markets is not readily available, so they are excluded from this analysis. Secondly, the prospect exists for the use of algae as a vegetarian substitute for tofu, which sells at roughly $4000/tonne42, so one analysis will use this price point as a value for algae biomass. The effects of renewable fuel subsidies and mandates are integral to the success of many renewable fuels, and algae are no exception. Biodiesel receives a $.01 per gallon tax credit for every percent of biodiesel blended with regular diesel, and it is approximately the same for biofuels45, 46. Biofuel from algae does not currently receive a specific subsidy, but it is assumed the same as other biofuels because the subsidy is for biofuels in general. Since transportation fuel will be arguably the most important byproduct, reliable prices are necessary. Annual average pump prices for gasoline and diesel are used back to 1991 and 1995, respectively50. Using those prices, and the statistical program R, a variance- covariance matrix was created to account for the relationship between the prices. The R output table that of that matrix is shown in Table 1 below. Table1 var(fuelprices) Annual.Gas.Prices Annual.Diesel.Prices Annual.Gas.Prices Annual.Diesel.Prices 5724.79 6578.99 6578.99 7644.02 By incorporating the historical relationship between gasoline and diesel prices, this method of price estimation significantly increases the reliability of the 1000 simulations in R that form the basis for gasoline and diesel (and therefore biofuel and biodiesel) prices into the future. 61 "Algae Use in Pharmaceuticals - Definition, Glossary, Details - Oilgae." Biodiesel from Algae Oil Web. 22 Mar. 2010. <http://www.oilgae.com/ref/glos/algae_use_in_pharmaceuticals.html>. 26 For 2010 and 2011, EIA projected prices will be used, while future prices will be based on last year’s price plus the average increase in known prices over the span of current EIA data. Since I am assuming this facility will not be doing its own refining, pump prices are discounted by 30% to account for wholesaler profits and refining costs. The two main facility types in use for algae growth algae growth largely determine the output of the aforementioned byproducts. The open pond systems are characterized by relatively low costs and low efficiencies, but are currently the most cost-efficient means of algae growth. Photobioreactors are more complex systems, with algae in tubes or bags and in a highly controlled environment; they are more costly to build and operate, but hold a higher growth potential than the open pond systems. The productivity will have a high degree of uncertainty, so these values will be based on current academic literature from the few known results, based on maximum daily yield in tonnes/ha/year. While discussing the byproduct orientation of growth methods, a discussion on species must be had. There is an enormous variety of algae species in existence, each with its own tolerance for SO2, and CO2 and NOX absorption abilities. With that in mind, an individual species is not used in this analysis. The species characteristics used are from Alabi et al.42 and are discussed on an individual basis. This is especially helpful because many companies are looking to create a hybrid species with the best characteristics of various strains in the growth process. Capital costs for each system vary dramatically, with ranges from $100,000 (lab scale) to $1.5million (large-scale) per hectare for the photobioreactors, and $60,000 to $260,000 for open pond systems (all at 30 year time spans from 13-14% interest)42. The capital and operating costs from the Alabi et al. study will be used, making annualized capital costs $36,497/ha/yr for open pond systems and $210,000/ha/yr for photobioreactor 27 systems. The costs for maintenance, taxes, waste disposal and insurance are $13,455/ha/yr for open ponds because of greater simplicity compared to photobioreactors, costing $75,846/ha/yr. The final set of variables includes electricity, labor, fertilizer and water use, which can obviously be very high in a temperature controlled environment growing the most efficient plants on Earth. The price for electricity is important for an algae facility from both an input and output perspective. As an input, the facility obviously requires some electricity to run and maintain, with significantly higher requirements for closed bioreactor systems as compared to the open pond systems32. However, the dry algal biomass that is leftover after oil extraction can also be co-fired in the power plants to generate electricity. This option will not be considered though, as there is little data on the concept. This analysis separates the harvesting and energy intensive drying process from all other power uses, as it is currently an area of intense research and is therefore more likely to change over time. As such, $1600/ha/yr is assumed for the open pond system, while $5257/ha/yr is assumed for the photobioreactor system, with the higher cost largely because of the complications of the system. For labor, it is assumed that an employee will cost about $40,000 per year to employ, using on employee for every two hectares for the open ponds, one employee per hectare for photobioreactors33. This is a roughly optimistic assumption because the photobioreactor systems will be more productive than open pond systems, but they may require relatively better trained employees to operate. Finally, for fertilizer there are many estimates of use, but a conservative, average estimate is $3,000/ha for open pond systems and $5,106/ha for photobioreactor systems due to their much higher productivity42. There is the possibility of recycling the nutrients to keep costs down, or even using wastewater, since algae do not require treated water. This possibility will be looked at by eliminating the cost of water and fertilizer, which assumes a deal between the wastewater treatment and algae growth facilities 28 in which it is cheaper to pump untreated water to the growth facility than treat it at the plant. When this deal is not in place, we use $500/ha in annual water costs for the open pond system and $1000/ha for photobioreactors42. Table 1 below shows the variables that formed the basis for the cost and revenue streams. For the variables that were randomly generated, normal distributions were used. In some cases upper and lower bounds were utilized, as discussed above for CO2 and NOX. A lower bound was placed on fuel prices because it is less likely that fuel prices will bottom out lower than a dollar per gallon that spikes will be experienced due to their relationship with oil prices62. The standard deviations for both biomass and productivity were arbitrarily large at 25% to reflect the fact that it is not plausible to make a reasonable assumption about either value. This assumption adds a significant level of uncertainty to the model. In the case of biomass, there is too little data available on the algae biomass market42. Nearly all of the data on productivity changes over the past decade, when scaled systems were initially tested and designed, is not publicly available or is no longer relevant because of the time frame differences. GAS DIESEL Distribution Normal Normal Standard Deviation Historical Prices Historical Prices CO2 Normal 23.5% of average NOX BIOMASS CAPITAL COSTS OPERATING COSTS PRODUCTIVITY Normal Normal Constant Constant Normal Historical Prices 25% of average 0 0 25% of average Table 1 62 Upper Bound N/A N/A 50% annual average 50% annual average N/A N/A N/A N/A Lower Bound $1/gal $1/gal 150% annual average 150% annual average 0 N/A N/A N/A Source EIA (#51) EIA ECX (#54) EIA Alabi et al. (#42) Alabi et al. Alabi et al. Alabi et al. Borenstein, Severin, Colin A. Cameron, and Richard Gilbert. "Do Gasoline Prices Respond Asymmetrically to Crude Oil Price Changes." The Quarterly Journal of Economics (1997). MIT Press Journals. Feb. 1997. Web. 21 Apr. 2010. <http://www.mitpressjournals.org/doi/pdf/10.1162/003355397555118>. 29 Equations Below is the list of equations to be considered in this analysis. ‘Y’ is the year in which the investment in the algae farm is made, ‘O’ indicates an open pond design, ‘P’ indicates a photobioreactor design, ‘D’ is the discount rate applied to both benefits in costs (4%), GR is the growth rate for that analysis, where ‘R’ indicates the growth rate percentage (2, 3.5 or 5%) and SBy is the additional scientific breakthrough component for that year. ‘NX’ is equal to the tons of NOX mitigated in any given iteration, ‘CO’ is equal to the tons of CO2 mitigated, and ‘BM’ is equal to the tons of dry biomass left over after drying and oil extraction. ‘BD’ is equal to the gallons of biodiesel sold at producer prices and ‘BF’ is equal to the gallons of biofuel sold at producer prices. ‘W’ is the price of the water usage and ‘F’ is the price of fertilizer usage for a given system. ‘334.845’ is the number of gallons of biofuel per tonne based on biofuel weighing 6.58lbs/gallon and ‘300.357’ is the number of gallons of biodiesel per tonne based on biodiesel weighing 7.34lbs/gallon. NOX and biomass are considered mutually exclusive revenue sources because the sale of the biomass leads to its consumption and therefore release of the NOX into the atmosphere. However they will be addressed together in this analysis to determine which is the most valuable market under a given circumstances. The price of each byproduct is shown βX where ‘X’ is used in place of the indicator symbol for each byproduct (NX, CO, BD, BF, BM and ‘T’ for tofu). Case 1: Base Case NPVY, P or O = x ˉ Y…40 (((BD*βBD*334.845 + BF*βBF*300.357 + BM* βBM + CO * βCO + NX* βNX)*(1 + (GR + SBy)) – (Capital Costs + Operating Costs + Maintenance + Taxes and Insurance)) + D) - (40-Y) 30 Case 2: Fuel Subsidies NPVY, P or O = x ˉ Y…40 (((BD*βBD + (1*BD) + BF*βBF*300.357 + (1*BF) + BM*βBM + CO*βCO + NX*βNX)*(1 + (GR + SBy)) – (Capital Costs + Operating Costs + Maintenance + Taxes and Insurance)) + D) - (40-Y) Case 3: Wastewater NPVY, P or O = x ˉ Y…40 (((BD*βBD*334.845 + BF*βBF*300.357 + BM*βBM + CO*βCO + NX*βNX)*(1 + (GR + SBy)) – (Capital Costs + Operating Costs – (W+F) + Maintenance + Taxes and Insurance)) + D) - (40-Y) Case 4: Tofu Case NPVY, P or O = x ˉ Y…40 (((BD*βBD*334.845 + BF*βBF*300.357 + BM*βT + CO*βCO + NX*βNX)*(1 + (GR + SBy)) – (Capital Costs + Operating Costs + Maintenance + Taxes and Insurance)) + D) - (40-Y) 31 Results The first table in each scenario indicates the years in which the photobioreactor (PBR) or open pond first generates a profit and has a positive NPV. The less-than and greater-than signs indicate a goal was reached before or after the time horizon of the study, respectively. The first scenario is the base case (Table 3) which assumes all the values outlined above in its calculations. The subsequent scenarios are all slight derivatives of the base case. The second scenario (Table 4) is the Fuel Subsidy case in which a $1/gallon subsidy is given to the algae farm for each gallon of biofuel and biodiesel it produces. This is on top of the producer price stated earlier, which is assumed to be 70% of the retail value of each fuel. Scenario three (Table 5) is the Wastewater case in which it is assumed that the algae farm receives wastewater at no cost from the local wastewater treatment facility and that the wastewater is nutrient dense enough so as to not warrant the use of applied fertilizer. The water and fertilizer costs are therefore $0 in this case. The fourth scenario (Table 6) to be discussed is the Tofu case in which the value of the biomass is sold as a substitute for tofu, which sells at approximately $4000/ton42 instead of the current $200/ton for algae biomass. Table 3 2% 3.50% 5% 1st Year Positive NPV 1st Profitable Year Open Pond 2019 2013 < 2010 PBR > 2040 > 2040 2031 Open Pond 2029 2026 2024 PBR > 2040 > 2040 2036 % Biofuel 0.206 0.012 -0.0013 % Biodiesel 0.662 0.021 0.0013 % Biomass 0.007 0.002 -0.0002 % NOX 0.054 0.028 -0.0032 PBR Annual Average Annual Std dev Annual % Change 32 % CO2 0.076 0.021 0.0026 Revenue $123,270.25 $99,283.66 $10,239.01 Costs $339,356.00 0 0 PROFIT -$216,408.44 $99,343.37 $10,239.01 Annual Average Annual Std dev Annual % Change % Biofuel 0.204 0.0103 -0.0010 % Diesel 0.657 0.0275 0.0018 % Biomass 0.007 0.0019 -0.0002 Annual Average Annual Std dev Annual % Change Revenue $92,762.88 $73,057.96 7597.771884 Costs $75,448.00 0 0 Profit $17,308.10 $73,040.45 7584.994631 Annual Average Annual Std dev Annual % Change OPEN POND % NOX 0.062 0.0368 -0.0041 % CO2 0.073 0.0245 0.0027 In the base case we see that the open pond systems become profitable many years before the PBR systems by an average of 13+ years, given that that PBR systems with a 2% and 3.5% growth rate never become profitable. There are minimal differences in the importance of each byproduct in the revenue streams, likely due to the differences in the random numbers in the 1000 iterations per year. In both systems, biodiesel makes up the majority of the revenue stream. As time goes on, NOX becomes an increasingly less important revenue stream (-.41%/yr) while CO2 becomes an increasingly valuable revenue stream (.27%/yr). The standard deviation of the revenues was 78.7% of the annual average for the open pond systems and 80.4% for the PBRs. Table 4 2% 3.50% 5% 1st Year Positive NPV 1st Profitable Year Open Pond 2013 < 2010 < 2010 Open Pond 2026 2024 2022 PBR > 2040 2034 2026 33 PBR > 2040 2037 2033 PBR Annual Average Annual Std dev Annual % Change % GAS 0.219 0.012 -0.0012 % Diesel 0.674 0.016 0.0010 % BIOMASS 0.006 0.001 -0.0001 Annual Average Annual Std dev Annual % Change Revenue $150,466.14 $116,837.73 $12,122.83 Costs $339,356.00 0 0 PROFIT -$188,791.33 $116,965.95 $12,122.83 Annual Average Annual Std dev Annual % Change % GAS 0.2174 0.0100 -0.0010 % Diesel 0.6697 0.0192 0.0013 % BIOMASS 0.0056 0.0011 -0.0001 Annual Average Annual Std dev Annual % Change Revenue $106,572.03 $80,680.92 $8,384.54 Costs $75,448.00 0 0 Profit $31,140.06 $80,664.28 $8,384.54 % NOX 0.042 0.018 -0.0021 % CO2 0.060 0.018 0.0023 % NOX 0.0473 0.0239 -0.0025 % CO2 0.0602 0.0180 0.0023 OPEN POND With the fuel subsidy in place for all thirty years, biofuel and biodiesel make up an average of 84.2% of the revenue stream, an increase of 3.8% over the base case. A positive NPV is achieved in 2013 for the open ponds at the pessimistic growth rate, and before 2010 for the moderate and optimistic growth rates. The PBR does not have a positive NPV at the pessimistic growth rate, but does so in 2034 at the moderate rate and 2026 at the optimistic rate. The open pond systems have their first profitable year an average of 12+ years sooner than PBRs. The standard deviation of the revenues was 75.9% that of the annual average for the open pond systems and 77.6% for the PBRs. 34 Table 5 1st Year Positive NPV 1st Profitable Year Open Pond 2019 2013 < 2010 PBR > 2040 > 2040 2031 Open Pond 2028 2026 2025 PBR > 2040 > 2040 2036 Annual Average Annual Std dev Annual % Change % GAS 0.206 0.012 -0.0013 % Diesel 0.662 0.020 0.0012 % BIOMASS 0.007 0.002 -0.0002 % NOX 0.054 0.028 -0.0031 % CO2 0.076 0.021 0.0026 Annual Average Annual Std dev Annual % Change Revenue $123,401.33 $99,492.40 $10,456.98 Costs $335,729.50 0 0 PROFIT -$215,931.98 $99,507.31 $10,456.98 Annual Average Annual Std dev Annual % Change % GAS 0.204 0.010 -0.0010 % Diesel 0.657 0.026 0.0018 % BIOMASS 0.007 0.002 -0.0002 % NOX 0.062 0.036 -0.0041 % CO2 0.075 0.022 0.0027 Annual Average Annual Std dev Annual % Change Revenue $87,273.04 $68,847.75 $7,172.04 Costs $73,448.00 0 0 PROFIT $11,812.37 $68,847.16 $7,172.04 2% 3.50% 5% PBR OPEN POND The open pond system is once again potentially profitable in all scenarios, with the first positive NPVs coming in at the same years under the same growth rates as the base case, as is the same for PBRs. This is likely due to the low costs for water and fertilizer relative to other inputs such as labor and capital expenses. The standard deviation of revenues is 77% of the overall average for open ponds and 78.8% for PBRs. 35 Table 6 1st Year Positive NPV 1st Profitable Year Open Pond 2017 2011 < 2010 PBR > 2040 2038 2029 Open Pond 2027 2026 2023 PBR > 2040 2039 2035 Annual Average Annual Std dev Annual % Change % GAS 0.180 0.005 -0.0005 % Diesel 0.582 0.035 0.0034 % BIOMASS 0.127 0.030 -0.0032 % NOX 0.047 0.023 -0.0026 % CO2 0.067 0.020 0.0025 Annual Average Annual Std dev Annual % Change Revenue $136,863.86 $108,539.51 $11,385.37 Costs $339,471.28 $838.95 $0.00 PROFIT -$202,607.43 $108,439.65 $11,385.37 Annual Average Annual Std dev Annual % Change % GAS 0.178 0.004 -0.0002 % Diesel 0.579 0.039 0.0036 % BIOMASS 0.127 0.028 -0.0030 % NOX 0.054 0.030 -0.0034 % CO2 0.066 0.020 0.0025 Annual Average Annual Std dev Annual % Change Revenue $96,995.29 $74,862.77 $7,678.65 Costs $75,414.83 $214.59 $0.00 PROFIT $21,580.47 $74,864.00 $7,678.65 2% 3.50% 5% PBR OPEN POND The most noticeable change is the increase of biomass in the revenue stream, now at 12.7% for both systems instead of .5-.7% before. The open pond system has a positive NPV at the pessimistic growth rate starting in 2017, becoming profitable 13+ years before PBRs, with the positive NPV for moderate coming in 2011 and before 2010 for the optimistic growth rate. The standard deviation of revenues is 77.4% for the open pond systems and 78.6% for PBRs. 36 Discussion The results of the model reinforce many earlier conclusions concerning the prospects of algae growth for carbon remediation in the US, and provide evidence for some previously unexplored ideas. First, CO2 offsetting constitutes 6 to 7.6% of the average revenues at every growth rate and under every scenario in which it is included. At the same time, the combination of gasoline and diesel fuel makes up over 70% of the revenue in every scenario and under every growth assumption (over 80% in the Wastewater and Fuel Subsidy scenarios). This makes CO2 only the 3rd most important source of revenue when looking at the viability of algae farms, or 4th if the use of algae substitute for tofu is a viable market. The fact that the value of CO2 is small relative to the value of the fuels implies that an energy policy designed to produce more transportation fuels domestically may have a greater impact on the viability of algae farms than a price on greenhouse gases. Secondly, in every case besides the tofu case, the NOX revenue is significantly higher than for biomass, averaging around eight times as much per year. In the tofu case, the biomass contributes about 150% more to the revenue stream than NOX. This suggests that unless a market is created for algae as a tofu substitute, an efficient algae farm would sell the NOX reduction credits and either co-fire the biomass for electricity generation or use it to fertilize the next batch of algae. With the algae-for-tofu market in place, revenues were approximately $13,000/Ha/yr greater for the PBR systems and $4,000/Ha/yr for the open pond systems over the base case, suggesting the tofu market could be more valuable using a photobioreactor design than an open pond design. Third, the standard deviations on the revenue streams are extremely high (75.9-80.4%), indicating the great uncertainty surrounding these systems. This large uncertainty is likely due to the dependence upon the prices of transportation fuels for the vast majority of the revenues, which are notoriously uncertain. Fourth, the 5% growth rates for open 37 pond systems always have positive NPVs before 2010, indicating that investing before 2010 would lead to positive returns by 2040. This makes sense and fits reality because of the many groups that are heavily investing in this technology cited earlier, including government, academic institutions and the private sector. Finally, the differences in first years of profitability between open pond and photobioreactor systems are significant, always at least a decade apart. The photobioreactor system is never profitable under the 2% growth rate, and only profitable under the 3.5% growth rate for the fuel subsidy and tofu market scenarios. This is likely due in large part to capital cost differences, as much of the operating cost differences are because the photobioreactors have higher productivities and require more staff. The capital costs ratio (PBR/open pond) is 5.73:1, while the operating costs ratio is 3.35:1 and the revenue ratio is only 1.42:1. For photobioreactor systems to become a more viable investment there must be a significant reduction in capital costs, or a significant increase in the productivity of the same capital investment, as some portion of the productivity gains will likely be nullified by operating cost increases. 38 Conclusions A long-term algae farm would be unlikely to only include only one or two of these cases; optimally it would take into account all of these options at some point. Fuel subsidies could be used in the beginning years until the system becomes profitable. Dry biomass would be co-fired or used as fertilizer until the marketing scheme for algae as a tofu substitute is viable enough to warrant its sale to the market. Long-term negotiations between a wastewater treatment plant and an algae company could lead to the development of a pipeline to centrally located algae farms. In comparison to other low-carbon energy options, algae has some significant advantages and some disadvantages. First, an algae farm actually has the potential to sequester CO2 in a profitable manner, especially with open ponds. This represents a significant advantage over CCS, which could cost anywhere from $20-27021 per ton of CO2 to sequester. The uncertainty of price represents a significant challenge for utilities since they need to set rates based on long term cost forecasts; whereas CCS requires large initial capital investments21, an algae farm could be slowly scaled up to meet mitigation needs. Moreover, the parasitic load will require either the replacement of lost generation capacity from one of every three coal plants22 with CCS or significant investments in energy efficiency. The energy efficiency investments seem more likely given the potential to save money by doing so, according to McKinsey and Company63. Secondly, the limited amount of coal available on the earth64 make renewable forms of energy like solar and wind attractive methods of future electricity generation. However neither are currently price competitive in their fully distributed form on any reasonable scale24, 25. An algae farm is also not necessarily competition for solar or wind: an algae farm could buy CO2 if coal63 Granade et al. Unlocking Energy Efficiency in the US Economy. Rep. McKinsey & Company, July 2009. Web. 21 Apr. 2010. <http://www.mckinsey.com/clientservice/electricpowernaturalgas/downloads/ 64 "World Distribution of Coal." Encyclopedia - Britannica Online Encyclopedia. Web. 21 Apr. 2010. <http://www.britannica.com/EBchecked/topic/122863/coal/50690/World-distribution-of-coal>. 39 fired electricity generation stopped, or it could be used as a cheap mitigation system for an increasingly smaller coal-generation capacity in the United States, all the while producing renewable domestically. Finally, the potential for algae as a carbon remediation mechanism is obviously limited by the amount of transportation fuel used, which could easily shrink over time with the electrification of automobiles in either plug-in or full electric models, the increased use of public transportation or even hydrogen cars. The first two possibilities are more likely than the third, but the third could eliminate the need for transportation fuel entirely full electric vehicles would likely be preceded by plug-in hybrids, which still require liquid fuels. This model is for an approximately 400 hectare system, and says nothing about whether or not algae can meet the United States’ long term carbon reduction goals. Moreover, the widespread scaling up of algae farms could present its own set of problems like water and fertilizer scarcity and land limitations surrounding coal-fired power plants. Taking into account data from private facilities would enhance the reliability of this analysis significantly. Future work should look into increasing both the reliability and scalability of algae farm designs. Second, the market for dry algal biomass as a valuable co-product is not very well understood; it needs to be explored because the system is noticeably less viable on transportation fuels and pollution reduction alone. Finally, knowing how the renewable fuels requirements will affect an algae farm is very important. A permanent increase in the price of transportation fuels will improve algae’s economic viability, but would make modes of transportation that do not use gasoline, ethanol or diesel relatively more viable than they otherwise would be. 40