financial examiner/analyst ii - Department of Management Services

advertisement

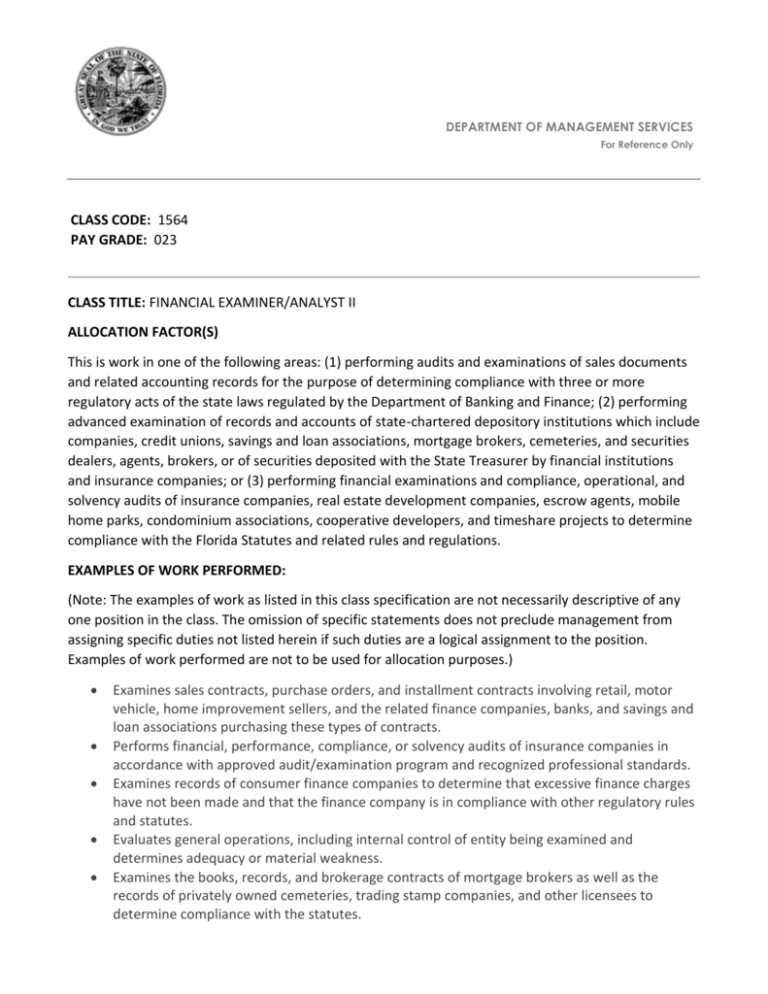

DEPARTMENT OF MANAGEMENT SERVICES For Reference Only CLASS CODE: 1564 PAY GRADE: 023 CLASS TITLE: FINANCIAL EXAMINER/ANALYST II ALLOCATION FACTOR(S) This is work in one of the following areas: (1) performing audits and examinations of sales documents and related accounting records for the purpose of determining compliance with three or more regulatory acts of the state laws regulated by the Department of Banking and Finance; (2) performing advanced examination of records and accounts of state-chartered depository institutions which include companies, credit unions, savings and loan associations, mortgage brokers, cemeteries, and securities dealers, agents, brokers, or of securities deposited with the State Treasurer by financial institutions and insurance companies; or (3) performing financial examinations and compliance, operational, and solvency audits of insurance companies, real estate development companies, escrow agents, mobile home parks, condominium associations, cooperative developers, and timeshare projects to determine compliance with the Florida Statutes and related rules and regulations. EXAMPLES OF WORK PERFORMED: (Note: The examples of work as listed in this class specification are not necessarily descriptive of any one position in the class. The omission of specific statements does not preclude management from assigning specific duties not listed herein if such duties are a logical assignment to the position. Examples of work performed are not to be used for allocation purposes.) Examines sales contracts, purchase orders, and installment contracts involving retail, motor vehicle, home improvement sellers, and the related finance companies, banks, and savings and loan associations purchasing these types of contracts. Performs financial, performance, compliance, or solvency audits of insurance companies in accordance with approved audit/examination program and recognized professional standards. Examines records of consumer finance companies to determine that excessive finance charges have not been made and that the finance company is in compliance with other regulatory rules and statutes. Evaluates general operations, including internal control of entity being examined and determines adequacy or material weakness. Examines the books, records, and brokerage contracts of mortgage brokers as well as the records of privately owned cemeteries, trading stamp companies, and other licensees to determine compliance with the statutes. 1564-FINANCIAL EXAMINER_ANALYST II-CS Makes investigations of consumer complaints against the regulated financial institutions by examining evidence, reviewing records, and interviewing witnesses. Defines scope and develops initial audit plans of assignments. Examines the books and records of financial institutions, insurance companies, and corporations for compliance with the reporting and remitting of abandoned/unclaimed property which consists of cash, stocks, and bonds. Trains new personnel in the same or lower class. Participates in the review and analysis of detailed portions of examinations by subordinate examiners. Writes detailed portions of examinations, loan portions of examinations, and examination reports as examiner-in-charge in small and medium size and relatively clean financial institutions or insurance companies. Examines bank notes, securities, and collateral, and evaluates the collectability of items in accordance with the state law. Prepares the more difficult schedules and reconciliations as required by supervisors in examination reports. Prepares statistical tabulations. Reviews, analyzes and evaluates reports, records and other financial data to determine compliance with the "Florida Security for Public Deposits Act." Examines the deposits of securities by insurance companies and other regulated entities to determine that all deposit requirements are met. Compiles evidence to be used in legislative or administrative proceedings and testifies when required. Develops, implements and monitors new and/or improved accounting programs, systems, procedures and guidelines dealing with the deposit or the pledging of securities or examination of insurance companies. Analyzes accounts or groups of accounts for irregularities. Performs related work as required. KNOWLEDGE, SKILLS AND ABILITIES: (Note: The knowledge, skills and abilities (KSA's) identified in this class specification represent those needed to perform the duties of this class. Additional knowledge, skills and abilities may be applicable for individual positions in the employing agency.) Knowledge of the techniques utilized in conducting examinations of financial institutions or insurance companies. Knowledge of the methods of compiling and analyzing data. Knowledge of accounting or auditing principles and procedures. Ability to recognize validity, authenticity and propriety of accounting and operating records. Ability to review, analyze and evaluate data. Ability to prepare reports. Ability to conduct audits of financial records. Ability to understand, interpret and apply laws, rules, regulations, policies and procedures. Ability to plan, organize and coordinate work assignments. Ability to communicate effectively. Ability to establish and maintain effective working relationships with others. Ability to conduct investigations or financial examinations. MINIMUM QUALIFICATIONS A bachelor's degree from an accredited college or university with major course of study in accounting, finance, economics, insurance, or risk management and one year of professional experience in accounting, examining, analyzing or auditing financial data within a financial institution, insurance company or other regulated entity, or in the registration of securities or securities dealers; or A master's degree from an accredited college or university with major course of study in accounting or business administration, or possession of a Certified Public Accountant (C.P.A.) certificate; or One year of experience as a Financial Examiner/Analyst I with the State of Florida. Professional or nonprofessional experience as described above can substitute on a year-foryear basis for the required college education. EFFECTIVE: 6/24/1994 HISTORY: 06/30/1989 11/28/1988