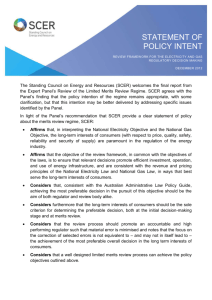

COAG Decision Regulation Impact Statement

advertisement