Stark and Antikickback Problems – Draft A large cardiology group

advertisement

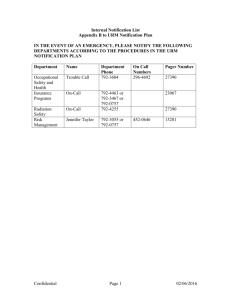

Stark and Antikickback Problems – Draft A large cardiology group that has historically admitted many patients to Hospital is to be acquired by Hospital. Hospital and physicians desire that, after the sale of their practice to the hospital, all of the physicians in the group will become employees of Hospital. Since there is no prohibition on the corporate practice of medicine in the state in which Hospital is located, everyone agrees that the employment relationship is permissible under state law. You are regulatory counsel for the Hospital and you are being asked by Hospital’s CEO to address the following questions: 1. Does a payment to the physicians for purchase of their practice constitute a “financial relationship” that implicates the Stark Law? If a physician accepts the offer of employment at Hospital, does the payment of salary and benefits to that physician constitute a “financial relationship” that implicates the Stark Law? 2. If either (or both) the payment for purchase of the practice or payment of a salary to a physician for services as an employee is a “financial relationship” that implicates the Stark Law, what Stark law exception(s) may apply to each? What are the requirements for the exception(s)? After a long period of negotiations, Hospital and the cardiologists agree on a price for purchase of the practice. On the same day and after an equally long period of negotiations, the cardiologists execute employment agreements with Hospital. The employment agreements are to become effective in 30 days, upon the close of the sale of the cardiology practice to Hospital. All of the employment agreements provide for employee compensation that is at very top (but not exceeding) the fair market value range for the physician’s clinical services as established by a third party valuation firm. The hospital CFO has concerns about the magnitude of the compensation that the physicians will receive as employees, and writes an e-mail to Hospital’s CEO stating, “unless these physicians suddenly start sending more patients to our cardiac surgery program after they become employees, this hospital is going to lose a lot of money on this deal. If we pay these physicians the agreed purchase price for their practice plus the compensation that is promised in their employment agreements, our net on the services of the cardiologists is probably going to be less than zero.” The Hospital CEO responds, “Don’t worry. I have a good relationship with these docs. It’s all going to work out.” Hospital’s CFO forwards the e-mail chain to Hospital’s Compliance Officer and asks, “Do we have a Stark Law issue here?” 3. Do you think that Hospital will have a “Stark Law issue” as a result of the compensation to be paid to the physicians through the acquisition transaction and their subsequent employment? Does it matter that Hospital’s CFO believes that the hospital will lose money as a result of its dealings with the cardiologists if the cardiologists don’t increase the number of patients that they refer to Hospital’s cardiac surgery program? Does Hospital’s knowledge that it will lose money on the transaction if the physicians don’t increase their referrals suggest any other legal concerns, such as under the Antkickback statute? If so, why? If not, why not? Five days before the acquisition transaction with cardiology group is scheduled to close, Hospital receives notice that a former hospital bookkeeper has filed a qui tam action under the Federal False Claims Act. The qui tam complaint alleges that, for at least two years, Hospital has violated the Stark Law and Antikickback Statute through its financial relationships with the cardiology group. Hospital’s board of directors, on advice of outside counsel, asks Hospital’s Compliance Officer to quietly investigate the “financial relationships” that Hospital has had with the cardiology group over the last two years. The Compliance Officer learns that Hospital had a one year agreement with the cardiology group that provided for compensation to the group for its physicians to be “on call” and available to treat patients who need immediate specialist services in Hospital’s emergency department and inpatient floors. The Compliance Officer knows that this is a common type of compensation arrangement at Hospital, as well as at hospitals throughout the United States, because the availability of specialist physician services is generally regarded as necessary for hospitals to comply with EMTALA and other federal or state legal and regulatory requirements, and physicians generally won’t provide the necessary availability without some compensation. However, the Compliance Officer is concerned because she finds a valuation report from an outside valuation firm, which is dated just one month before the execution date of the on-call coverage agreement, that indicates that the maximum fair market value compensation for on-call coverage by the cardiologists is 20% less than the amount that the cardiologists were actually paid under their call coverage agreement. She is also concerned because the on-call coverage agreement expired over a year ago and was not renewed, yet the cardiologists have continued to receive monthly compensation as if the agreement were still effective, up to and including in the current month. 4. Do you think that what the Compliance Officer has uncovered suggests that there is merit to the allegations in the qui tam complaint? Consider the following questions: a. Is the on-call coverage agreement a “financial relationship” that implicates the Stark Law? b. If so, must the financial relationship meet a Stark Law exception? (This question relates to whether the physicians are reasonably assumed to be making referrals of “designated health services” to Hospital) c. Is there a Stark exception that may apply to the on-call coverage arrangement? If so, what are the requirements for meeting this exception? d. Do the amounts that the physicians received for providing on call coverage constitute “remuneration” that could implicate the Antikickback Statute? If so, does the arrangement fit within a safe harbor? If you believe that it does fit within a safe harbor, please explain why by listing the requirements for the particular safe harbor and the evidence that each was met. If you do not believe that the arrangement fits within a safe harbor, please explain why by listing the requirements that the arrangement fails to meet, and why you believe that it fails to meet those requirements. Based solely on the information presented above, do you believe that there is sufficient evidence to support a finding that Hospital violated the Antikickback Statute through its on-call coverage arrangement with the cardiology group? Once her information gathering is complete, Hospital’s Compliance Officer sends an e-mail to Hospital’s CFO indicating that all payments to the cardiologists for on-call coverage should cease. Upon notification that they will no longer be receiving their now-expected compensation for providing on-call coverage, the physicians in the cardiology group become very angry. The President of the cardiology group sends an angry e-mail to Hospital’s CEO, telling Hospital’s CEO that she and her partners were under the impression that their on-call coverage compensation would continue even after they became hospital employees, and that they never would have signed their employment agreements if they thought this was not the case. The email goes on to point out that the cardiologists have been receiving and responding to calls from Hospital’s emergency department at all hours of the day and night, that these calls are disruptive to their other practice responsibilities and to their family lives, and they unanimously believe that they are entitled to additional compensation for accepting this burden. The President of the cardiology group tells the CEO, “We are not going to accept a situation in which we get less total annual compensation working for Hospital than we did when we were on our own, regardless of how much we are getting in the purchase and sale transaction.” The e-mail also goes on to state that the cardiology group will “walk away” from the acquisition deal with Hospital and start considering a different purchase offer from the hospital across town if Hospital’s CEO can’t guarantee that the on-call coverage compensation will not be reduced or eliminated, and also that Hospital’s CEO “will be sorry if that happens because Hospital’s cardiac surgery program will be all but dead.” Hospital’s CEO sends an e-mail to Hospital’s Compliance Officer and CFO stating, “You guys need to work this out. We don’t want to lose this deal. The physicians have been very loyal to the hospital and we need to be respectful of what they are asking. Once they are employees, we meet the Stark employment exception and the Antickback Statute won’t be an issue. Chill out and listen to what I am telling you." 5. Do you agree with Hospital’s CEO that, once the cardiologists are employees working under an employment agreement with Hospital, the relationship between the cardiologists and Hospital will fall under the Stark employment exception? Do you agree with Hospital’s CEO that, at that point, the Antikickback statute will “not be an issue”? Does your opinion vary based on whether past arrangement for call coverage compensation is made part of the employment arrangement? When formulating your answers, please consider the following questions: a. Does the employment arrangement demanded by the President of the cardiology group (which includes the same compensation for on-call coverage that the physicians received previously) comply with all of the requirements for the Stark employment exception? If you believe that the answer is yes, describe the factors that are the basis for your opinion, including the requirements for the Stark employment exception and the reason that you believe that this arrangement complies with each requirement. If your answer is no, please describe the factors that are the basis for your opinion, including the requirements for the Stark employment exception and which of those requirements you believe are not met by the arrangement. b. Is the Antikickback Statute implicated by the planned employment arrangement? Is your opinion on this issue affected by whether or not the arrangement violates the Stark Law? Would your opinion be different if the cardiologists ultimately accepted the employment arrangement without payments for on-call coverage? What if the cardiologists ultimately agree to lower payments for on-call coverage, payments that are consistent with the amount deemed fair market value by the third party valuation firm? 6. If you were counsel for Hospital, what advice would you give your client at this point? Would you advise going forward with the contemplated arrangements with the cardiologists? If so, would you recommend any changes to the arrangements before the parties execute the documents?