made the minutes available

advertisement

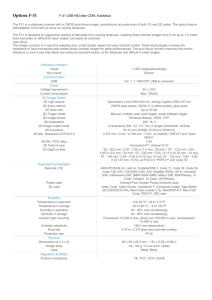

UNITED STATES ARMY MILITARY SURFACE DEPLOYMENT AND DISTRIBUTION COMMAND 1 SOLDIER WAY SCOTT AFB, IL 62225 DP3 Project Management Support Contract: W81GYE-12-C-0012 Defense Personal Property Program Project Management Support Services April 2014 Personal Property Forum (PPF) Minutes Date: 02 April 2014 Page 1 2/9/2016 Meeting Name: April 2014 Personal Property Forum (PPF) Date of Meeting: 02 April 2014 Location: Sheraton Four Points Conference Center, Fairview Heights, IL Minutes Prepared By: Tiffany Hayes James Norris-Landry Meeting Time: 0800-1600 CST 1. Purpose of Meeting April 2014 Personal Property Forum 2. Attendance at Meeting Name CAPT Aaron Stanley Aphrodite Kafka Jill Smith Craig McKinley Kenneth Billings Linda Hum Mary Decarpentry Mary Beth Varner Steven Bernardo Mekia Bradley Deborah Teague Michael Dobbs David Jones John Becker James Brunsman Brian Paul Terrie Anderson-Krebs Ana Douglass Danny Mathews Edward Naki Jerry Jordan Marty Calkins Sherri Snow Beth Holloway Rosia Lindsey Janice Griffin Jeff Sager Paul Giannakelos Tiffany Hayes James Norris-Landry Theresa Pyla Lt Col Gina Prevett Roni McDaniels Roland Amos Laura Bernardo Organization SDDC-PP SDDC-PP SDDC-PP SDDC-PP SDDC-PP SDDC-PP SDDC-PP SDDC-PP SDDC-PP SDDC-PP SDDC-PP SDDC-PP SDDC-PP SDDC-PP SDDC-PP SDDC-PP SDDC-PP SDDC-PP SDDC-PP SDDC-PP SDDC-PP SDDC-PP SDDC-PP SDDC-PP SDDC-PP SDDC-PP SDDC-PP SDDC-PP GDIT-PP GDIT-PP GDIT-PP USTRANSCOM PEO-T USTRANSCOM PEO-T USTRANSCOM PEO-T USTRANSCOM PEO-T Page 2 E-mail aaron.k.stanley2.mil@mail.mil Aphrodite.kafka.civ@mail.mil Jill.e.smith.civ@mail.mil Craig.c.mckinley.civ@mail.mil Kenneth.e.billings10.civ@mail.mil Linda.a.hum.civ@mail.mil Mary.decarpentry1.civ@mail.mil Mary.b.varner.civ@mail.mil Steven.r.bernardo.civ@mail.mil Mekia.k.bradley.civ@mail.mil Deborah.l.teague.civ@mail.mil Michael.l.dobbs2.civ@mail.mil David.e.jones17.civ@mail.mil John.l.becker.civ@mail.mil James.r.brunsman.civ@mail.mil Brian.l.paul2.civ@mail.mil Terrie.l.anderson-krebs.civ@mail.mil Ana.e.douglass.civ@mail.mil Danny.f.mathews.civ@mail.mil Edward.k.naki.civ@mail.mil Jerry.l.jordan16.civ@mail.mil Marty.w.calkins.civ@mail.mil Sherri.l.snow.civ@mail.mil Mary.e.holloway.civ@mail.mil Rosia.m.lindsey.civ@mail.mil Janice.d.griffin.civ@mail.mil Jeff.d.sager.civ@mail.mil Paul.giannakelos.civ@mail.mil Tiffany.s.hayes5.ctr@mail.mil James.d.norrislandry.ctr@mail.mil Theresa.m.pyla.ctr@mail.mil gina.l.prevett.mil@mail.mil roni.m.mcdaniels.civ@mail.mil roland.amos.civ@mail.mil laura.d.bernardo.civ@mail.mil 2/9/2016 George Thomas Donna Jack Brett Coakley Virginia Eilmus Steven Kelly Daniel Wolfert Andrea Gergan GSA GSA USAF MCO Navy MCO Army MCO HQ Navy NAVAL SUPPLY SYS COM george.j.thomas@gsa.gov donna.jack@gsa.gov brett.coakley.1@us.af.mil virginia.eilmus@navy.mil steven.r.kelly.civ@mail.mil daniel.wolfert@navy.mil Andrea.gergen@navy.mil 3. Meeting Agenda 1. Welcome/Opening Remarks/SDDC CG Remarks 2. SDDC Defense Personal Property Program (DP3) Updates 3. USTC Program Executive Office Defense Personal Property System (DPS) Updates 4. Rates 5. General Services Administration (GSA) 6. Operations 7. Storage and POV 8. Military Claims Office (MCO) 9. Quality Assurance 10. Wrap Up 4. Meeting Notes 1. Welcome/Opening Remarks/SDDC CG Remarks a. CAPT Stanley opened up by welcoming everyone and introduced the Military Surface Deployment and Distribution Command (SDDC) Commanding General, Major General (MG) Richardson. MG Richardson welcomed everyone and talked about SDDC and its business areas; International, Domestic, Personal Property, and Transportation Engineering Agency at a cost of $4B annually. The growth area for SDDC is in the domestic market. The Army currently pays for approximately 45% of moves. Where is the Army going to be 5 years from now? 120,000 less soldiers/customers… 560K to 440K, and all services are going to downsize. The Army will continue to train and PCS soldiers. How do I save the services money? Don’t want to decrease the quality. How do we reduce SDDC overhead? SDDC took a 25% personnel cut at the headquarters. This is on top of the 15% cut when we moved to Scott AFB. SDDC is now manned at 40% less from 2 years ago and operating at 4% of overhead. We will also look at ways to reduce redundancies. Let’s go back and challenge what we know and do today and ask “How do we want to operate in the future? What can we do that can cost less money? What are the things that we ask the Transportation Service Providers (TSPs) to do that cost us money that we can work at and see how we can change our business? Is what I do law or policy? If law, can it be done for less money at the same quality? If policy, we can change policy. SDDC needs to align business areas and eliminate redundancies. Will personal property transition to tenders? If so, it will take several years to move from the infancy stage to the full production. One TSP asked if MG Richardson could say anything about the Base Realignment and Closure Committee (BRAC) situation? MG Richardson replied, “Right now, there is no BRAC. The Army will probably end up pushing for a BRAC, but not sure about the other services. There are consequences of a BRAC.” TSP Question: Do you have a timeline for Personal Property moving from tenders to contracts? MG Richardson replied, “It will be until years down the road, for this program change to move from infancy to production” What Page 3 2/9/2016 we’ll do is research the lessons learned behind other contracts and see what may or may not fit. A TSP cited, as a local agent, we have a Direct Procurement Method (DPM) contract. It seems that the Defense Personal Property System (DPS) is taking away contracts because DPM will be in DPS. If we have to go through the DPS, we’re going to take the extra equipment and manpower and downsize and we won’t be able to do our job when the time comes. CAPT Stanley replied that the DPM way forward is still in dialogue. Question: How is the retrograde for the pull-out of Afghanistan going? MG Richardson stated that, we are able to meet the requirement(s). 2. DP3 Updates a. Open Season We learned a number of lessons during the 2013 Open Season, and we plan to hold a limited scope open season this year. Our timeline to have rates in the system is the week of 7-11 April. b. Customer Satisfaction Survey (CSS) Concern SDDC has heard that some TSPs are withholding claims due to low survey scores and until the survey is changed, the customer’s claim will not be processed. SDDC’s position is that this is unacceptable and we are investigating these assertions before taking the appropriate action against the TSP. c. Best Value Score (BVS) Effective 15 May, the claims score is temporarily being removed from the BVS. Additional details to be forthcoming. d. 2014 Rate Filing Status With SDDC posting rates next week, we expect to see shipments booked shortly after. Industry asked if we could postpone shipping offices from booking shipments immediately to allow them time to view their TDL placements; rates will be available for all to use – TSPs and PPSOs. e. RSMO Consolidation 1 June 2014 is the expected date for some of those personnel who are re-locating to Scott Air Force Base. All four Regional Storage Management Offices will be closed by the end of the year. f. Peak Season i. We expect normal DOD projections this peak season. g. Shipment Refusals The peak season 2014 dates for unlimited refusals has not been set; we will continue to monitor the queue. TSPs are reminded to refuse ASAP, no later than 4 hours after receipt. SDDC currently shows slightly less than 5,000 shipments awaiting booking. h. Short Fuse Expansion The peak season 2014 dates for the short fuse window expansion have not yet been established. SDDC will continue to monitor the queue and make adjustments, as necessary. i. Concerns Page 4 2/9/2016 ii. There is an upcoming California Air Resources Board (CARB) meeting to further discuss this new requirement for trucks entering California. iii. The readjustment so that the Customer Satisfaction Survey access is only via Electronic Transportation Acquisition portal addresses cyber concern j. Code 2: Recommend Services use more containerized shipments 3. Defense Personal Property System (DPS) Updates a. 2014 Planned Releases: DPS release 1.6.12 is a security remediation/patch, and 1.6.13 is an OBI-COTS upgrade and will replace 1.7.1 i. Emergency Release 1.6.8a (17 Mar 2014) – This release was a result of problems during rate filing and has already been implemented. ii. Release 1.6.9 (18 Apr 2014) – This release is still on track. iii. Release 1.6.10 (2 May 2014) – This release is on track. It will include the CSS shortterm solution to the security problem (customers logging into DPS via ETA in order to complete the survey) until the long-term solution is implemented. iv. Release 1.6.11 (9 May 2014) – This release is necessary to remediate security remediation vulnerabilities and cannot wait until after Peak Season. v. Release 1.7.0 (6 Jun 2014) – This release is being re-planned. The DPS PMO is rolling in 2 new SCRs, one of which will be the long-term CSS solution. Do not know what the CSS long-term solution is going to be; the PMO is relying on the developer to suggest a solution. The T-GET interface is also changing, which accounts for the second new SCR. vi. Release 1.7.1 (20 Jun 2014) – will also be re-planned. vii. Windows 2008 COTS Product Upgrade (August 2014) – This update will enhance system performance. viii. Stand-up of Initial WebMethods Virtualized Environment (September 2014) – Just test and training. Going from having less hard code to business process modeling and should make it easier to make updates to the system in the future. ix. Database Partitioning (October 2014) – This should improve the performance of database query. x. Rate Filing Redesign (November 2014) – Problems identified during this filing season will be fixed. Rate filing processes within DPS will be completely re-looked at. Rate filing redesign will design out the use of Manugistics for rate filing. xi. DPS PMO provided the Defense Personal Property System 2014 Release Schedule dated 16 Apr 2014. Page 5 2/9/2016 Release Content PROD Install 1.6.9 SPRs 7122, 7123, 7124, 7141 18 Apr 14 1.6.10 SPRs 7112, 7176, 7179, 7181 2 May 14 1.6.11 SPRs 7188, 7189, and 7194 16 May 14 1.6.12 1.6.13 1.7.0 1.7.1 1.7.2 2.0 2.0 ECP 7132 (Oracle v11.2.04) COTS Upgrade ECP 7131 (Siebel v8.1.1.11) and 7130 (OBI v11.1.1.7) COTS Upgrades SCRs 6995, 7048, 7190, 7192 (Out-of-Cycle) ECP 7135 Windows Server 2012 COTS Upgrade ECP 7128 Database Partitioning ECP 7133 webMethods Environment Standup ECP 7127 Rate Filing Architecture Improvement 20 Jun 14 11 Jul 14 5 Sep 14 22 Sep 14 3 Oct 14 13 - 17 Oct 14 21 Nov 14 b. Changes to Customer Satisfaction Survey (CSS) i. New security requirements dictated changes to the CSS. ii. Short-term solution 1. Implemented with 1.6.10 release and it’s not going to be as convenient for customers to fill out their surveys. iii. Long-term solution 1. DPS release 1.7.0 is being re-planned. Do not have all information yet as it is in the hands of the developer. Will most likely be implemented during Peak Season. iv. Bottom Line: CAT I security vulnerability must be remediated, but we listened to Industry in that utilizing survey monkey was not the correct mechanism because users could not be authenticated. c. Contract Update i. The DPS contract was awarded in October 2013 to CACI. One of the challenges with the transition is that SRA was the developer for 10 years and knew the system well while CACI is new to DPS and has a learning curve to go through. CACI’s development environment was delayed due to missing hardware and software resulting in a 3.5 month delay. Since then, they have been playing catch-up from poor code quality from 1.6.0 and getting security updates completed. d. Notional Releases, FY15-18 i. Document Imaging (3rd QTR FY15) ii. Non-Temporary Storage, Re-designed User Interfaces for Self-Counseling and Page 6 2/9/2016 Counseling, Document Imaging, Web Services for TSP Data Transfer (4th QTR FY15) iii. Claims Redesign (1st QTR FY16) iv. Intra-Country Moves, Re-designed Shipment Management User Interfaces, and Incremental Migration of Existing Functionality to New Architecture (4th QTR FY16) v. Digital Signature (4th QTR FY17) vi. Direct Procurement Method and Incremental Migration of Existing Functionality to New Architecture (4th QTR FY17) vii. Automatic Reweighs and Joint/Combined Spouse Moves (4th QTR FY17) viii. Archiving Capability (3rd QTR FY18) e. Questions i. Comment: When you implement the releases, be very tactical with the dates/times. Lt Col Prevett: We do a lot of planning to ensure minimal impact to the users when implementing releases, but we also have a schedule we have to maintain. Should not have to take a system down during the day. This year, we are stuck with getting so many requirements done in less time than planned. Comment: Make sure that people know about the issues. Communication on these details is important. A comment was received stating there are issues with Internet Explorer. Lt. Col Prevett acknowledged this issue is known. In order to bring us up to where we need to be, every link to every website needs to be updated as one solution. However, Ms. McDaniels stated the DPS PMO has identified a solution using the Siebel Open User Interface that will allow us to be compatible with much less effort. The PMO still needs to plan this effort. Question: You use the term “user-friendly…what direction are we going to go with Customer Satisfaction Survey (CSS)? Please provide some clarification. Lt. Col Prevett: The link will eventually go back into the e-mail. Security vulnerabilities associated with lack of a digital signature were the reasons to back out of “user-friendly” mode so we are trying to get back into “user-friendly” mode. It requires digital signature in order to send an embedded links in an e-mail. We also need to ensure personnel login DPS authenticated. Question: Industry has requested a two-way interface for years. Efficient two-way interface that is secure; when will we see it? It could be cost efficient. Ms. McDaniels: This is still in the early design phase. It’s coming, but we do not have any hard dates. Earliest is late 2015. It will be advertised. Question: Is the DPS system going to be able to handle the 900+ TSPs to download their rates/reports? Lt Col Prevett: Unsure. If there are any problems, open a help desk ticket as soon as possible. If we see DPS Analytics go down, we reset it. OBI upgrade might resolve some of the analytics problems. Question: Will we have some new requirements for the new 2015 rate filing redesign? Lt Col Prevett: We haven’t started working on it yet. Ms. McDaniels: Rate filing is not a wholesale redesign and we are not writing new requirements. User interface should improve and be easier to use, but we are not changing the process inside the system. Main focus is to eliminate the security vulnerability with using Manugistics. Question: Is there a fall back process if there is a problem? Lt Col Prevett: Usually, we can roll back. It depends on what it is. We don’t anticipate any major problems since we go through at least 2 testing cycles before each release. 4. Rates: The rates processor will kick off later this afternoon. Tomorrow the rates will be available in the morning for download in DPS. Any issue during rate filing needs to go to the helpdesk first. Page 7 2/9/2016 a. Alaska Bunker Surcharge (BSC) clarification i. Need to have total BSC for all Government Bill of Lading (GBL) shipments on the Ocean Bill of Lading (OBL). The OBL must list port to port. Ocean charges, port to port, are the only appropriate billing charges that can be invoiced under BSC. Must have a sail date, net weight of total container, and individual GBL Shipments. Follow what the 400NG is dictating. Need to standardize across the board. There were disputed charges since the port to door rates were not broken down. b. Invoicing discrepancies i. There were over 50,000 invoices that were in the PPSO queue last fall, and nearly all were approved and processed before Christmas. Great team effort. c. DPS OTO/BOTO/MOTO i. 30-40 boats have been processed so far since 01 Jan 14. Started moving some international OTOs. Finding some oddities and lessons learned to put into production. Using high-volume locations for testing. d. Azores Code 5 Contract Support i. It was believed that Azores was going to be in a draw-down phase. This isn’t going to happen. It is now an unaccompanied location. Available code 4 rates outbound only from Azores may not meet minimum requirements, Question: Did you solicit Code 4 rates? Mr. Becker: Coming out of Azores is Code 4. There are Code 4 rates solicited from Azores to the states in 54 channels Outbound. e. Miscellaneous Questions/Comments i. Question: Can you give me an update on a compromise for Storage in Transit (SIT) deliveries for International? Mr. Becker: IT14 will be changed. A change for the 520 resulted in a double payment. Mr. Paul: What was put into 14 was an option. If we make a language/guideline change, it will be in the best interest of the government so neither TSPs nor government will lose money. Mr. Becker: We will get something out before the rate cycle goes into effect, before May 15, 2014. Mr. Paul: We will get in touch with the PPSOs to ensure they know there is an option for approving 520; this is not one standard policy. ii. Comment: Add a correction to allow for crating on a bulky article (large-screen TV greater than 60”). Mr. Becker: We will take a look at that and address it. iii. Question: Can you give me a better idea on what you want on the OBL to meet the requirements? Mr. Becker: Biggest thing needed is need to know if we’re paying bunker for just a piece or the entire shipment. Port to port charges should be reflected as BSC, while port to door charges are only authorized a Bunker surcharge. 5. General Services Administration (GSA) a. Audits Overview i. Mission of Transportation Audit Division 1. Mission: GSA identifies and recovers Transportation Service Provider (TSP) overcharges and other debts relating to transportation bills paid by agencies around the world. 2. Vision: Transportation Audits will hire, develop and retain a dynamic world class work force that will continually improve internal processes to realize Page 8 2/9/2016 efficiencies; broadening our market share to recoup excess transportation charges for the American tax payer. ii. Transportation Audits Division 1. Accounts and Collections Branch a. Primarily manages the invoice from the time the notice of overcharge (NOC) is issued to the time the account is closed out. 2. Audit Policy and Review Branch a. Provides internal control, manage Agency Review and Assistance Program (ARAP) and monitors federal agency compliance with prepayment audit regulations, approves all agencies' prepayment audit programs, coordinates in-house prepayment audit activity, and issues reports detailing agency compliance. 3. Disputes Resolution Branch a. Interfaces directly with the TSPs with overcharges/protests/claims. b. Notice of Overcharge (GSA Form 7925) i. Once you receive this form, it gives you an opportunity to review it and describes what the issue was. It is the first demand for payment from GSA. You can protest it, pay it, or not do anything with it, which is wrong. Three-year mandate for payment. ii. Overcharge Collection Process 1. If you get an overcharge, you review it and once you determine the overcharge to be valid, GSA collects on the overcharge. iii. TSP Protest Process 1. 30 days from receipt of a NOC to protest it; GSA has 30 days to respond c. What can TSPs do to avoid overcharges? i. Ensure everything is correct on the invoices. Good notes in DPS and PowerTrack. Ensure data matches and is accurate. Provide documentation to support billings. d. Top Issues (20 Mar 2013 – 20 Mar 2014) i. Weight adjustments, auxiliary services, SIT charges, Terminations e. Key Audit Issues i. Protesting Notice of Overcharge (NOC) 1. First protest should come to GSA, not SDDC. GSA does not interpret regulations; coordinates with SDDC on a frequent basis for interpretation. Supporting documents must accompany each protest and GSA 7925 NOC. If US Treasury gets involved, they tack on 18% interest. ii. Status of Web TARPS Protest 1. Web-based transportation accounts payable system. Want to work with the carrier industry to help save money by eliminating paper. 740 service providers that are enrolled in TARPS, 604 are HHG. iii. Shuttle NOC Page 9 2/9/2016 1. A small truck does not constitute a shuttle; MUST be a “truck to truck transfer”. Worked with SDDC to determine proper interpretation. Provided directions to contract auditors. 400NG language has been updated. There must be a transfer between smaller truck and line haul equipment for a request to qualify as a shuttle. iv. Shuttle Supporting Documentation: In some cases, hard copies of the following may be required. 1. Dispatch logs 2. Weight tickets 3. Reweigh tickets 4. Equipment rental receipts v. Address Changes 1. Ensure the use of correct address to send payments and to protest (see slide). f. What is GSA doing to help? Participates in meetings; Identifies issues and obtains clarification on application of rates and rules to ensure overcharges are being issued correctly. g. Questions? i. Question: If we get a 20k lb shipment and we have to deliver, does that mean you won’t pay us for the delivery out of warehouse to destination? Mr. Thomas: We will only pay shuttle service if a truck to truck transfer is involved. Question: Can we add a shuttle webinar to further educate? Ms. Lindsey: Yes. Question: Are interest charges continuing in the protest? Mr. Thomas: Based on what I know, interest is accumulated during the protest process. Mr. Thomas confirmed that during the protest process, interest calculation is halted. Question: There wasn’t a requirement for a truck to truck transfer and the PPSO said they agreed and TSPs would get paid. Now, money is being taken back and it is unfair. Mr. Thomas: I will not apply a current process to a shipment that shipped before that business rule was implemented, but this business rule has not changed...”A Truck-to-Truck Transfer” constitute a shuttle. For any TSP, if you need to support your invoice, keep all documentation to support your billing. Question: March 7th saw an allowance, March 10th saw a denial. Explain? Mr. Thomas: Cannot answer that without TARPS. TSP was asked to forward those examples to Mr. Thomas at George.j.thomas@gsa.gov for a thorough review and response. 6. Operations a. SIT at origin and destination i. Origin – TSP must submit a pre-approval prior to the pickup date ii. Destination – When shipment arrives at destination TSP may request SIT if customer is unable to take delivery on the TSP’s 1st available delivery date b. Pro-gear (PBP&E) Changed to 2,000 lbs/7 lbs per cu ft for orders with an effective date on or after 1 May 14 Ensure Pro-gear is weighed separately. SCR 7608 will alert service member to excess cost if pro-gear weight exceeds 2000 lbs. Page 10 2/9/2016 c. Weight tickets (lost) TSPs are frequently requesting PPSO to correct weights. TSPs have 7 days to submit weight tickets. Required to update the shipping status in a timely manner. The Operations Team is reviewing this because it is causing problems with . d. Reweigh When a TSP goes and corrects the weight, that data is not captured in the audit trail. The reweigh needs to be put into the general remarks section so it can be seen. Include the original weight and reweigh and reasons for reweigh. e. Split shipments Confirm with agents or representative if shipment was split before updating shipment arrival. f. Shipments containing alcohol and customs fees This will be addressed at the meeting with the services to come to an agreement to standardize the process across the services. g. NTS-R pre-move survey i. Once they are booked in DPS, they are a Code D or Code 2 or International and become a DP3 shipment which falls under DTR part 4. If the customer is not ready to take delivery of that shipment within the allotted transit time, it would work better with the TSP to negotiate the dates. PPSOs confirm that the customer can take delivery on a specific date. TSP must do a pre-move survey to identify any special requirements. h. What can you do for us? i. Maintain communication with customers until delivery has been made. Confirm dates and have updated contact information. If customer has international number only, have them provide a stateside number of a family member or a friend. Provide the customer a copy of the GBL no later than the 1st pack date. Put detailed notes in DPS for unusual occurrences and provide dimensions of items to be crated (Navy issue). Update shipment status in a timely manner. A recommendation, as a courtesy, suggest the TSP contact the customer two Government business days prior to first pack date and confirm the date with customer. 7. Top 10 CSS Comments Top CSS comments include: TSPs not unpacking at destination; misplaced hardware; reassembling items properly; crew unprepared (lack of equipment); unprofessional behavior appearance. Providing for TSPs to be aware of customer issues where improvements can be made. 8. Question: What is the timeframe for the top 10? Ms. Lindsey: This is from the first of the 2014 year until now. We get these all the time. It is the same list from last year. CAPT Stanley: Would love to find a way to partner together and try to fix these things and knock them off this list permanently. Question: Tracking is more important than having late shipments? Ms. Lindsey: We don’t hear much about late shipments. Question: When we get a customer request for reweigh, are you telling us to no longer go into the reweigh queue for fear of billing issues? Ms. Lindsey: TSPs will continue to do reweigh the way they have in the past. There is no change. Question: Are you expecting a certified weight ticket for the Pro-gear and how do you want that weight recorded? Ms. Lindsey: You will do it Page 11 2/9/2016 the same way you do it today. The member is just limited to 2,000lbs. 9. RSMO Consolidation a. SDDC will establish a Storage Management Office at SDDC HQ on June 1, 2014. Core duties will remain. Will re-engineer the Warehouse Inspection process. Won’t be regionally aligned anymore. Need to identify methodology for quality assurance. Question: Are you saying the same company is going to have East/West? Mr. McKinley: There will be either one award or separate awards. Question: Have we gotten any further on termination of shipments. Is there a way we can discuss with JAG these questions. Mr. McKinley: We are still working on this and we have a meeting at 2 tomorrow to discuss these issues as well. Question: Update on where we are with old NTS invoices. Mr. McKinley: Mr. Hosley said a forthcoming Syncada modification will allow updates and you can work old invoices to be paid electronically. CAPT Stanley: The backlog of NTS invoicing and the DPM way ahead will be discussed tomorrow with the Services. DFAS’s role in this process is critical. 10. Phase III Update a. Status to date: We are developing NTS requirements for DPS with the Services, USTC J4, DPS PMO, and the RSMOs. The requirements for the BVS module in DPS for NTS will be adjusted in accordance with the change in the frequency of warehouse inspections. CAPT Stanley: With regards to DPM process, there are about 5-6 courses of action that Services are considering. 11. Military Claims Office a. Concerns: A continued concern is moldy shipments and how to mitigate them. TSPs are responsible to mitigate this issue. Rules have been drafted for water/mold issues. Want to change the DTR (proposed) in section 410. Question: Is this guidance going to tell our drivers what to do if the shipment has mold? MCO: The TSP in possession of the shipment when mold is discovered is responsible for mitigation. You can separate the shipment if part of it has mold and the rest does not. SDDC QA Team: Contact the SDDC Operations Team if you have that issue. SDDC QA Team: Currently right now, you do not have to pick up that shipment if there is mold/water damage. It’s the same thing for residential. Contact the PPSO while you are there at residence. USTC J4: The DTR is the authoritative procedure that the PPSO has to follow. Our goal is to have the mold rules put out by May 15, 2014. Question: Is anyone at SDDC tracking the companies that have reoccurring mold on a regular basis? CAPT Stanley: We will track at SDDC HQ. Question: If you have a mold problem and it has been cleaned and you deliver a shipment and the mold returns, who’s responsible? MCO: You can always deny a claim. The answer is, it depends. Each situation is different. If you have sufficient evidence that you are not responsible for the mold, then you will most likely be excused from liability and responsibility of the mold. Question: Can you give some insight on the new mold procedures? MCO: If you first discover mold at the delivery, as the TSP you are responsible to take care of that. If you have a moldy shipment, you shouldn’t be delivering that shipment anyways. If you are not found to be liable, then you can be reimbursed. Question: Was it taken into consideration for locations that have a higher susceptibility to mold? MCO: Yes, they were considered. Yes, mold is everywhere. The issue is when it spores and multiplies. Okinawa’s climate appears to be the focus but the same can be said for climates in other areas across the globe. TSPs are increasingly denying liability for mold shipments out of Okinawa using “inherent vice” as a reason to escape liability. This argument on its face value is not sufficient. The TSP must provide clear and convincing evidence that they are not liable. Not every shipment coming out of Okinawa has mold so simply claiming “inherent vice” is not a sufficient enough argument to relieve the TSP of liability. b. There are issues with repair estimates and claimant dissatisfaction with repairs made. An Page 12 2/9/2016 estimate must come from a firm that will do the repair for cost quoted. Whether the TSP is responsible or not is a separate issue. c. There are problems with payment after settlement. Checks bouncing or payment hasn’t been received. d. In a multiple handler situation, the presumption is the last handler is responsible. Last handlers are claiming prior handlers are responsible and denying claim with little to no evidence to support an allegation on the prior handler. Question: What can you do about missing items that you know they were delivered? MCO: How do you know you delivered it? Did you unpack for them? Question: How do we prove we delivered it? Will initialing the inventory do it? MCO: Initially on the inventory is some evidence. I haven’t seen this problem a lot. Customers have 75 days to declare they have stuff that is lost or damaged. Proving items have been delivered is difficult. Question: A customer claims they lost a box of items. He calls back and says he found everything. Next thing I know, I have a huge claim. MCO: You contact the MCO and they will help you. Once you get a claims notice and you know you delivered those items, you probably need the MCO involved in the situation. Was the claim a chargeback from the GBL TSP? Answer: Yes. MCO: That’s between you and the GBL TSP. If you don’t think you’re responsible, you need to fight that with the TSP. e. MCOs have seen initial offers that included LOV or appearance allowance for some items. This is not acceptable under the DP3 Claims and Liability Rules. f. MCOs have seen TSPs rejecting 50/50 settlements based on allegations that damage occurred while shipment was in custody of the Government, without sufficient evidence. These claims have mostly happened in Germany. g. TSPs can only see when Loss/Damage Reports are filed in DPS in ZULU time. The 75 day clock is based upon when the report was filed in local time at the destination location. SDDC Qualifications Team: If there is a question whether the report was filed in the 75-77th day, send a screenshot to the PPSO of when the shipment was put into complete status and have the PPSO take a screenshot of the audit trail. 12. Quality Assurance a. Open Season 2014 i. Conduct from Jul – Oct. ii. Open for new Intrastate TSPs and current Intrastate TSPs where capacity is needed iii. Always allowance for MOTO/BOTO TSPs to enter iv. Not open for additional markets v. Intrastate – additional states will be open during future Open Seasons (it caused confusion last time) vi. SDDC Pamphlet 55-4, update and will be posted on SDDC website. Questions: 55-4 update, can you give me an idea of the terms of the update? Dave Jones: Minor changes. b. QA Basics i. Maintain current External Certificate Authority (ECA) ii. Maintain active DPS account. Keep everything updated. iii. Maintain required bond limits. $ 150,000 increase deadline 15 May 2014. Reviewing Page 13 2/9/2016 2.5% of revenue rule. Question: Are you going to provide a number back to the TSP to determine what their bonding level should be? How do you get to the number? Dave Jones: TSPs should be monitoring, but we also review the TSP and determine it. iv. Insurance and Bonds must be updated annually. Question: Insurance and bonds are continuous until cancelled, when do we update the bonds and insurance? SDDC Qualifications: You still have to update it annually. v. Annual Qualifications will be conducted from Sep – Oct vi. Monitoring refusals/timeouts during peak season. Question: What do you mean timeouts? Dave Jones: TSPs should refuse shipments in 2-4 hours, Just 24 hours. vii. Updating the Appendix B (TOS) and Chapter 405. c. Most Common Revocation Actions i. Late financials and bad financials cause us to lose TSPs. ii. Failure to maintain active Operating Authority iii. Annual Qualifications failed to be submitted within prescribed timeline Question: Presidents are busy and sometimes miss the timeline. Dave Jones: The president MUST submit within the timeline and they receive two emails about the timeline. Question: Would you allow the folks for the CIP and COR to reapply for 2014? CAPT Stanley: There has to be bounds and rules to the program. Dave is trying to take a look at the issues across the program and these are the common issues and are trying to provide awareness to said issues. I can go back and have a conversation about this. We take into consideration about different circumstances. I need you to pay attention to the 55-4 manual. If the language isn’t clear, I want to make it clear for everyone. If you have an issue, I can go back and take a look. iv. Failure to maintain required bond limits d. Best Value Score i. Performance Score (PS) calculation change. 1. Current PS = CSS 50% + Claims Score 20% 2. Effective 15 May 2014 PS = CSS 70% 3. Claims Score will return. ii. Minimum Performance Score for 2014 Rate Cycle 1. dHHG 48.00 2. iHHG 51.00 3. iUB 56.00 13. CSS Initiatives a. ICSS Sunset date unknown. The direct links are going to be gone within 2 months. b. Customer Access to TOPS survey no longer available, so the helpdesk now supports this. 14. CSS Completion Trends a. Helpdesk has gone up, member log in has gone down. Please encourage the customers to go to Move.mil or the ETA website to finish their surveys. Question: How easy is it for the member to remember or know or have access to what their login or password is? Mekia Page 14 2/9/2016 Bradley: The customer just has to send a request to reset their password. On the ETA homepage, there is a spot where the customer can click to retrieve their password and they will receive it quickly. The members can create their own password. When a customer comes into the PPSO, the PPSO creates their account. Tell the customer before they leave origin to log into DPS and set up their information. Question: Is there any way to tell if a customer is active in ETA? Mike Dobbs: The members should know how to login and initiate their shipment and be able to get into the system. Question: Did the counseled members have to be done through their login and password or do they have PPSO counselors set it up? Mike Dobbs: Customers are logging in if they are doing self-counseling. Mekia Bradley: The customer created their ETA account when doing a self-counseling. We can see who did the self-counseling by user id. Question: Has the percentage of customers completing the survey increased or decreased? Mike Dobbs: It has gone up significantly. Losing the direct link, we can expect those numbers to go down. We want to be able to use the resources we have now to become statistically valid. As soon as we lose the visibility of the ICSS, I’m the one that will have to crunch the numbers. Question: Does the helpdesk do all the questions or just the TSPs? Mike Dobbs: They are still asking all the 12 questions, to my knowledge. 15. CSS Completion a. Customers are educated to login to complete CSS. Question: How do I address the 9/10 customers about what they need to do to complete the survey. Will they know what I am talking about? Mike Dobbs: PPSOs are supposed to be educated in being able to assist the customers. b. TSPs should not use the helpdesk for CSS as a primary method. CAPT Stanley: This does not need to take effect this summer. We will work through this methodology. 16. Questions a. Take a look at the 3rd party services and not allow 3rd party authorizations at destination. Puerto Rico, someone needs to help them since they are all new to this. Puerto Rico cannot bill shipments. Mr. Becker: They had an issue where they lost personnel. A new person is being trained to address these issues. Questions: Can I get a follow up on the actions taken on the TSPs statements from the CSS. If there’s any manipulation going on, something needs to be done. CAPT Stanley: We will take a look at this and follow up and will proceed accordingly. Question: TSP community would be willing to help with an ICSS replacement. Jill Smith: We are trying to get an SCR developed and we would certainly use your information to get it into the SCR. 17. Wrap Up a. CAPT Stanley thanked everyone for coming out and ended the conference at 1542. 5. Action Items Action SDDC will review the feasibility of allowing TSPs to see all available warehouses. Update: A customer advisory will be disseminated. Page 15 Assigned to Due Date* Rosia Lindsey 30 Days 2/9/2016 SDDC will review TSP documentation and crating requirements for large items (i.e. 60” projection TV) and, if warranted, amend the domestic 400NG (Item 130G) to incorporate an accessorial charge. SDDC will conduct a webinar to educate TSPs on shuttle truck reimbursement requirements/usage. John Becker TBD Rates (billing)/Operations (operational) Team John Becker TBD Dave Jones 30 Days Dave Jones 10 July Dave Jones Ongoing Process John Becker TBD Rosia Lindsey 30 Days John Becker TBD SDDC will provide guidance on SIT, when there are no approved locations within 100 miles. Rosia Lindsey SIT discount rate in same line as discount rate (look into separating) Update: Based on internal discussion with SDDC, this may require an SCR. John Becker Will be in the June 2014 issue of the “NUCU” 2-3 Years SDDC will review TSP documentation regarding OCONUS shipments, and, if required, provide additional guidance within the IT14 (Item 520) SDDC will coordinate with the Military Claims Offices to provide additional guidance on the process and procedures necessary when mold is discovered in split shipments. SDDC will review the 55-4 program application and revocation length for TSPs who fail to submit timely annual qualification documentation, ie., Certificate of Independent Pricing/Certificate of Responsibility. SDDC will educate PPSOs and TSPs to encourage customers to call the system response center during Peak Season, since the survey link is disabled. Agents request 400NG discount visibility on all GBLs. Update: SDDC cannot affect change to this. SDDC will coordinate with the Military Service Headquarters to provide additional guidance for iHHG shipments that contain wine. Update: A customer advisory will be disseminated SDDC will provide a clarification on Alaska bunker surcharge billing requirements. 30 Days *as of 5 May 2014 6. Next Meeting Date: TBD Agenda: TBD Time: Page 16 TBD Location: TBD 2/9/2016