VIEW - APERC

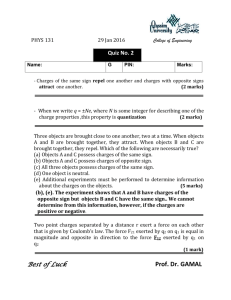

advertisement