Answer Key to Practice Final Exam

advertisement

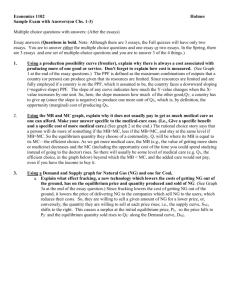

Economics 53 Introductory Microeconomics Practice Final Exam NAME:________________________ Answer all the questions. Allocate your time according to the points that each question is worth. There are 180 points in the exam. You should plan on spending 180 minutes to complete the exam. Part I Multiple Choice (48 Points, 1.5 Points each question) Please write the letter corresponding to the correct answer in the box below. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 D D B B A A B C C B C C A B D B 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 C D D A B A D B B C C A A C C C 1. Private markets do not account for externalities because A) externalities don’t occur in private markets. B) buyers and sellers in private markets are only interested in social benefit. C) buyers and sellers in private markets are only interested in social cost. D) buyers and sellers have no incentive to consider the effects of their behavior on others. 2. The attainable points in a production possibilities (PPF) graph are A) the points within the production possibilities frontier. B) the points along the production possibilities frontier. C) the points of the horizontal and vertical intercepts. D) All of the above 3. Comparative advantage means A) the ability to produce more of a product with the same amount of resources than any other producer. B) the ability to produce a good or service at a lower opportunity cost than any other producer. C) the ability to produce a good or service at a higher opportunity cost than any other producer. D) compared to others you are better at producing a product. 4. Which of the following will not shift the demand curve for a good? A) An increase in the number of buyers. B) An increase in the price of the good. C) A decrease in the price of a substitute good. D) An increase in household incomes 5. Suppose that when the price of hamburgers decreases, the Ruiz family increase their purchases of ketchup. A) hamburgers and ketchup are complements. B) hamburgers and ketchup and substitutes. C) hamburgers and ketchup are normal goods. D) hamburgers are normal goods and hot dogs are inferior goods. 6. Red Stone Creamery currently hires 5 workers. When it added a 6th worker, its output actually fell. Which of the following statements is true? A) The marginal product of the sixth worker must be negative. B) The average product of the sixth worker is negative. C) The sixth worker is not as skilled as the fifth worker. D) The total product becomes negative. 7. Refer to Table 10.2. Marginal revenue product of the ________ worker is $250. A) second B) third C) fourth D) fifth 8. Refer to Table 10.2. If workers are paid $150 per day, then the firm will hire ________ workers. A) two B) three C) four D) five 9. Jane has $500 a week to spend on clothing and food. The price of clothing is $25 and the price of food is $10. Jane spends her entire income when she purchases ________ units of clothing and ________ units of food. A) 10; 10 B) 25; 5 C) 12; 20 D) 16; 8 10. Assume leisure is a normal good. The substitution effect of a wage decrease implies a ________ demand for leisure and a ________ labor supply. A) lower; higher B) higher; lower C) higher; higher D) lower; lower 11. Peet's Coffee and Teas produces some flavorful varieties of Peet's brand coffee. Is Peet's a monopoly? A) Yes, there are no substitutes to Peet's coffee. B) Yes, Peet's is the only supplier of Peet's coffee in a market where there are high barriers to entry. C) No, although Peet's coffee is a unique product, there are many different brands of coffee that are very close substitutes. D) No, Peet's is not a monopoly because there are many branches of Peet's 12. A local electricity-generating company has a monopoly that is protected by an entry barrier that takes the form of A) perfectly inelastic demand curve. B) network externalities. C) economies of scale. D) control of a key raw material. Two discount superstores (Ultimate Saver and SuperDuper Saver) in a growing urban area are interested in expanding their market share. Both are interested in expanding the size of their store and parking lot to accommodate potential growth in their customer base. The following game depicts the strategic outcomes that result from the game. The profits (in millions of dollars) of the two discount superstores are shown in the table below. Figure 1 13. Refer to Figure 1. Is there a dominant strategy for Ultimate Saver and if so, what is it? A) The dominant strategy is to increase the size of the store and parking lot B) The dominant strategy is to not increase the size of the store and parking lot C) The dominant strategy is to collude with SuperDuper Saver D) There is no dominant strategy. 14. Refer to Figure 1. Is there a dominant strategy for SuperDuper Saver and if so, what is it? A) The dominant strategy is to collude with Ultimate Saver. B) The dominant strategy is to increase the size of the store and parking lot C) The dominant strategy is to not increase the size of the store and parking lot D) There is no dominant strategy. 15. Refer to Figure 1. What is the Nash equilibrium in this game? A) There is no Nash equilibrium in this game. B) SuperDuper Saver increases size and Ultimate Saver does not increase size C) Each firm does not increase in size D) Each firm increases in size 16. Refer to Figure 1. If Ultimate Saver and SuperDuper Saver could collude, what would they do? A) SuperDuper Saver does not increase in size while Ultimate Saver increases in size B) Both will not increase in size C) Ultimate Saver does not increase in size while SuperDuper Saver increases in size D) Both will increase in size 17. A key difficulty facing insurance companies is that individuals know more about their health than do insurance companies. What is this phenomenon called? A) moral hazard. B) adverse selection. C) asymmetric information. D) market signaling 18. Colleges and universities grant tenure to professors, making it virtually impossible to fire them after they have worked there for six or seven years. How can the tenure system lead to moral hazard? A) Because of the job security the tenure system provides, it tends to attract primarily those people who want to adopt controversial teaching methods and research topics B) Because of the job security the tenure system provides, academic institutions can attract highly talented people and pay lower salaries compared to the amount that faculty could earn in other occupations. C) The system encourages people who value job security the most to apply for these jobs, even they may not necessarily enjoy teaching as a career. D) Once a faculty member gets tenure they can reduce their productivity considerably without being fired. 19. Which of the following activities is a negative consumption externality? A) cleaning up the sidewalk on your block B) graduating from college C) repainting the house you live in to improve its appearance D) keeping a junked car parked on your front lawn 20. Which of the following characteristic is common to monopolistic competition and perfect competition? A) Barriers into the industry are low or non-existent. B) Firms produce identical products. C) Firms take market prices as given. D) Each firm faces a downward -sloping demand curve. 21. If 20 units are sold at a price of $50 and 30 units are sold at a price of $40, what is the value of the price elasticity of demand? Use the midpoint formula. A) -0.56. B) -1.8. C) -1. D) None of the above Figure 2 22. Refer to Figure 2. A perfectly inelastic demand curve is shown in A) Panel A. B) Panel B. C) Panel C. D) Panel D 23. What is the voting paradox? A) the idea that wealthy corporations are able to sway politicians to act in ways contrary to the desires of the majority B) people are aware that their votes will not change the political outcome since these outcomes are predetermined by a group of influential politicians C) the observation that less than 60 percent of those eligible to vote actually vote D) the observation that majority voting may not always result in consistent choices 24. The largest source of federal tax revenue in the United States comes from A) corporate taxes. B) individual income taxes. C) social insurance taxes. D) excise taxes 25. Billy-Bob who lives in Tennessee is thinking about buying a trailer home. The current price is $20,000, and next year he estimates that it will be $24,000. If the market interest rate is 10% he should A) not buy either this year or next B) buy now C) buy next year D) be indifferent between buying now or buying next year 26. Def Jam Corp is employing 100 units of labor and 50 units of capital to produce 2,000 CDs. Labor costs $10 per worker and capital costs $30 per unit. The marginal product of labor (MP L) is 3 and marginal product of capital (MPK) is 10. A) Def Jam is maximizing profits B) Def Jam could increase its profits by using more labor and less capital C) Def Jam could increase its profits by using more capital and less labor D) Def Jam could increase its profits by using less capital and less labor 27. If a firm is not able to expand its plant capacity immediately, it is A) bankrupt. B) operating in the long run. C) operating in the short run. D) losing money. 28. If the market price is $25 in a perfectly competitive market, the marginal revenue from selling the fifth unit is A) $25. B) $5. C) $125. D) Not enough information is given 29. A) B) C) D) The deadweight loss to society associated with a tax on a good will be greater if the demand price elasticity of the good is elastic will be greater if the demand price elasticity of the good is inelastic will be smaller if the tax incidence is mainly on the firms will be smaller if the tax incidence is mainly on the consumers 30. When the marginal social cost curve is below the marginal private cost curve A) the government should impose a tax B) a negative production externality exist C) a positive production externality exist D) society is producing at the optimal level 31. If the cross-price elasticity of two goods is negative, then those two goods are A) necessities B) inferior goods C) complements D) substitutes 32. Which of the following properties about costs is correct? A) When marginal cost is below average total cost, average total cost is rising B) The average fixed cost curve is U-shaped C) As the quantity of output increases, marginal cost eventually rises D) All of the above are correct Section II: Short Essay Questions (43 Points Total) Answer four (4) questions from Questions (1) through (6). You must answer Question (7). Question #1: A survey conducted at a local community college shows an increase in drug use by the students. Two competing explanations have been proposed: (1) Reduced police efforts have increased the availability of drugs on the streets (2) Cutbacks in drug awareness programs in high schools have decreased the awareness of the dangers of drug addiction. Local news reports also have noted that the price of drugs have increased. Can you determine which explanation is correct? You may use supply and demand graphs to answer this question. (7 Points) The first explanation would cause the supply curve to increase. If we hold demand constant then an increase in the supply curve will lower equilibrium price and increase equilibrium output. This explanation would explain the increase in drug use but the fall in the price would contradict the local news report, this explanation cannot be correct. The second explanation would cause the demand curve to increase. If we hold supply constant then an increase in the demand curve will raise equilibrium price and increase equilibrium output. This explanation would help explain the two observations of an increase in drug use by students and an increase in the price of drugs. The second explanation must be correct. Question #2: Batman is thinking about setting a private firm to provide police protection to Gotham City. Explain why Batman may find it difficult to provide police protection profitably. (7 Points) Batman will find that private firms will have a difficult time providing for public goods because of the problems of free-rider problem and drop in the bucket problem. Police protection will fall under the public good category because it is non-rival and non-excludable. A person who does not pay for police services will still be helped by Batman’s police force regardless of whether or not he paid. Thus people have an incentive not to contribute. This is the free-rider problem. A second problem is that each individual’s contribution is small relative to the total cost of providing police services. If a person doesn’t contribute, the quality and quantity of the police service will not be affected. If individuals realize this, they also have an incentive not to contribute. In the end, Batman will find it difficult to charge individuals for his police protection and the good will not be provided by his private firm. Question #3: Define the following terms: (1) Proportional Tax, (2) Progressive Tax, and (3) Regressive Tax. The U.S. tax system would fall under which category? (7 Points) Proportional Tax is a tax where the percentage of income paid in taxes is the same regardless of the income earned by a household. For example if a household that earns $10,000 pays 15% of their income in taxes while a household that earns $100,000 also pays 15% of their income in taxes then the tax system is proportional. Progressive Tax is a tax where the percentage of income paid in taxes is higher for high income households and lower for low income taxes. As an example a household that earns $10,000 would pay 10% of their income in taxes, while a household that earns $100,000 would pay 20% in taxes. Regressive Tax is a tax where the percentage of income paid in taxes is higher for low income households and lower for high income households. As an example a household that earns $10,000 would pay 20% of their income in taxes, while a household that earns $100,000 would pay 10% in taxes. The U.S. Tax system is a progressive tax system. Question #4: Define moral hazard. Give an example of moral hazard. What is a possible solution to the moral hazard problem? (7 Points) Moral hazard is the idea that the behavior of a party will change once an agreement or contract is reached. As an example, consider what would happen if a bank knows the Federal Reserve will bail it out in the event it becomes insolvent (bankrupt). If the bank knows this, then it might have an incentive to engage in risky behavior because they know even if their bets fail, they will be protected. Another example could be a professional athlete with a guaranteed contract. Once he gets a contract he has little incentive to play hard. The best solution to solve a moral hazard problem is to create incentives to get the party to engage in desirable behavior. For example, there could be a clause in the contract which requires the athlete to pay back some of the money if he engages in negative behavior, etc… Question #5: Describe how output and price is determined in the Price-Leadership Model. (7 Points) In the price leadership model the assumption is that the oligopoly is comprised of a dominant firm and several smaller firms. The dominant firm takes the lead by determining a price to sell its product. The smaller firms are price takers and will charge whatever price the dominant firm charges. These small firms can sell as much output as they want at this price. The dominant firm will then supply the difference between what the other firms supply and the market demand. Price and output levels will be between what a monopolist would produce and charge and what a perfectly competitive firm would produce and charge. Question #6: Do you agree or disagree with the following statement: A firm that is suffering losses in the short-run will always be better off if they shut down immediately. Explain your answer. (7 Points) This statement is false. Firms will only shut down if the price of the output is below the average variable cost (P < AVC). As long as price is greater than AVC, the firm should continue to operate in the short-run even if it is suffering economic losses. It will, however, exit the industry in the long-run. Question #7 (REQUIRED) (15 Points) In the class we have covered several examples of market failure. Market failures occur when resources are misallocated and the economy produces too much or too little of a good at market equilibrium . (a) Provide three examples of market failures. Several examples of market failure include 1. Monopolies 2. Oligopolies 3. Monopolistic Competition 4. Taxes 5. Externalities 6. Public goods 7. Asymmetric Information (b) Some have argued that one of government’s main roles in the economy is to correct market failure when they occur. Discuss how the government can address the market failure problem in each of the examples that you listed in Part (a). For monopolies the government can impose anti-trust legislation to prevent monopolies from developing in certain industries. For oligopolies, the government can impose anti-collusion laws that prevent big firms from getting together and making joint price and output decisions. For monopolistic competition, government can impose truth-in-advertising laws that prevent firms from creating artificial product differentiation and thus developing market power. With taxes, the government can reduce taxes or eliminate it to get the optimal level of production. Externalities involve several governmental solutions including taxes, subsidies, and direct regulation. Public goods under provision can be solved by the government directly getting involved in the provision of the goods. Asymmetric information can be solved by requiring one party to provide information to the other party so they can make an informed decision (i.e. requiring car owners to provide prospective buyers a detailed report showing all the maintenance work done on a used car). Part III Quantitative and Graphical Section (89 Points Total) You must show your work to receive full or partial credit. Question #8: Taxes (20 Points) The graph (Figure 3) below represents the market for pizza. (a) Suppose the government imposes a $3 per unit tax on the suppliers of pizza. Illustrate how this tax will affect Figure 3 above. (2 Points) The tax will shift the supply curve by the amount of the tax. Thus the new supply curve will be exactly $3 higher at each point. (b) Find the initial (before the tax) equilibrium price and quantity. Calculate the consumer surplus, producer surplus and total surplus before the tax. (3 Points) From the graph we see that market equilibrium is found at P = $4 and Q = 40 (thousand) CS = (1/2)(40)($2) = $40 PS = (1/2)(40)($4) = $80 Total Surplus = $120 (c) Find the equilibrium price and quantity after the tax is imposed. What is the price that consumers pay? What is the price that suppliers receive? (3 Points) See graph above. The new equilibrium is where the new supply curve intersects the old demand curve. At that point P = $5 and quantity = 20 (thousand) Consumers have to pay the market price or $5. However suppliers will not receive all $5 since they have to pay $3 in taxes to the government, in the end they will only end up with $2. (d) Who bears the burden of the tax? Explain (3 Points) Before the tax consumers paid $4, after the tax consumers now have to pay $5. They are worse off by $1. Thus they pay $1 out of the $3 tax, thus their burden is 1/3 = 33.33%. On the other hand, firms before the tax received $4, after the tax firms only receive $2. They are worse off by $2. Thus they pay $2 out of the $3 tax, thus their burden is 2/3 = 66.67%. Firms will thus bear the burden of the tax. (e) Calculate the consumer surplus, producer surplus, government revenue and total surplus after the tax has been imposed. (3 Points) We can calculate based on the graph above. CS = (1/2)($1)(20) = $10 PS = (1/2)($2)(20) = $20 Gov Revenue = $3(20) = $60 TS = CS + PS + Gov Tax revenue = $90 (f) Calculate the deadweight loss associated with the tax. (3 Points) Compare the total surplus before the tax ($120) with total surplus after the tax ($90). The economy has lost $30 in total surplus and thus this is the deadweight loss. Alternatively, you could have calculated the area of the triangle labeled above as the DWL. Area = $3(20)(1/2) = $30 (g) Suppose that the demand curve for pizza was more inelastic than was drawn on the diagram. Would you expect that suppliers would be able to shift more or less of the tax burden onto consumers? Explain your answer (3 Points) If demand was more inelastic then pizza suppliers would be able to shift more of the tax burden on to consumers. By definition, an inelastic demand means that consumers will not be very responsive to changes in price. If price increases by a lot, quantity demanded will decrease by a small percentage. Thus pizza suppliers could pass more of the tax onto the consumers without fear of losing a lot of demand for their product. Question #9: Economics of Uncertainty (7 Points) (a) Does the above graph show diminishing marginal utility? Explain your answer. (3 Points) The above graph does not show diminishing marginal utility. To see this look at the marginal utility as we go from $0 to $20,000. Total utility increases from 0 utils to 50 utils which implies marginal utility is 50. Consider what happens when we go from $60,000 to $80,000. Total utility incrases from 150 to 200, which implies a marginal utility of 50. As income increases marginal utility is still at 50. Therefore this graph is showing us constant marginal utility not diminishing. Wayne is a high-roller gambler in Las Vegas. After a very successful night of blackjack, Wayne is up $40,000. The casino manager comes over to Wayne and offers him the following high stakes game. Wayne can keep his $40,000 winnings or he can take one roll of the die. If the die turns up 5 or 6 then Wayne will win an additional $40,000 ($80,000 total). If the die turns up 3 or 4, then Wayne will not win any additional money and will thus have $40,000. If the die rolls a 1 or a 2, then Wayne will lose $40,000 and end up with nothing. (b) Calculate the expected value of Wayne’s winnings if he chooses not to play the casino manager’s game. Calculate the expected value of Wayne’s winnings if he does choose to play the casino manager’s game. (2 Points) Expected value of not playing the game: $40,000 x 1 = $40,000 Expected value of playing the game: (1/3)$80,000 + (1/3)$40,000 + (1/3)($0) = $40,000 (c) Calculate the expected utility of Wayne’s winnings if he chooses not to play the casino manager’s game. Calculate the expected utility of Wayne’s winnings if he does choose to play the casino manager’s game. (2 Points) Expected utlity of not playing the game: 100 x 1 = 100 Expected utlity of playing the game: (1/3)200 + (1/3)100 + (1/3)0 = 100 (d) If Wayne prefers not to play the casino manager’s game does that imply that he is risk adverse, risk neutral or risk loving. Explain your reasoning. (4 Points) If Wayne chooses not to play the casino manager’s game that implies that he is risk adverse. Even though both games have the same expected value and utility, the fact that Wayne would prefer the certain outcome to the uncertain outcome reveals that he is risk adverse. Question #10: Monopoly (10 Points) Shaggy is the only seller of Scooby Snacks and thus has a monopoly in the production of that good. Figure 2 below shows Shaggy’s demand, marginal revenue and cost curves. (a) If Shaggy is a profit-maximizing monopolist, what is the quantity of Scooby Snacks he will produce? What price will he charge for each bag of Scooby Snacks? (2 Points) Shaggy will produce where MR=MC. According to the graph that will be at Q = 630. We can see that at Q = 630, he will see where that Q intersects the demand curve which will determine the price he can charge which is P = $68. (b) What is the profit/loss for Shaggy at the profit maximizing output? (2 Points) Profit = TR – TC TR = (630)($68) = $42,840 Total cost = ATC x Q We know from the graph that at Q = 630, ATC = $75 Thus TC = $75 x 630 = $47,250 Profit = $42,840 - $47,250 = -$4410 (c) If the production of Scooby Snacks was done under perfect competition industry, what would be the quantity produced? What would be the price charged under perfect competition. Compare the quantity produced and priced charged under perfect competition with that under a monopoly. Under which situation is the quantity greater? Under which situation is the price greater? (4 Points) In perfect competition MR will equal P which will equal the demand curve. Thus MR=demand. Profit maximization will occur where MR = MC or in this case where demand = MC. The firm will produce at 800 units and charge $54. Clearly the quantity produced is greater under perfect competition (800 vs. 630 units), while the price charged is greater under a monopoly where (P=$68 vs. P = $54). (d) What will happen to Shaggy the monopolist in the long-run? (2 Points) Since Shaggy is earning negative profits he will not stay in the industry and will exit the industry in the long-run. Question 11: Total Costs and Perfect Competition (14 Points) Mercy Hospital is a small community hospital in Trinity County, CA. Assume that small community hospitals are a perfectly competitive industry. Quantity of Hospital Beds (Q) Total Variable Costs (TVC) 0 Total Costs (TC) 0 Total Fixed Costs (TFC) 1080 Average Variable Costs (AVC) N/A Average Total Costs (ATC) N/A Marginal Cost (MC) 1080 Average Fixed Costs (AFC) N/A 1 1080 400 1480 1080 400 1480 400 2 1080 850 1930 540 425 965 450 3 1080 1350 2430 360 450 810 500 4 1080 1900 2980 270 475 745 550 5 1080 2500 3580 216 500 716 600 6 1080 3200 4280 180 533.33 713.33 700 N/A (a) Complete the table above (7 Points) (b) If the price of medical hospitalization is $520 per night, how many hospital beds will Mercy Hospital offer? Explain your answer. (3 Points) Profit Maximization will occur where MR=MC Because Mercy Hospital is perfectly competitive, MR=P. Thus MR=$520. We see that at Q=3 beds, MR=$520 while MC=$500. Since MR>MC the hospital should supply that bed. However at Q=4 beds, MR=$520 while MC = $550. Since MR<MC, the hospital will not supply the 4 th bed. Thus Mercy Hospitla will supply 3 beds. (c) Calculate the profit level of Mercy Hospital (2 Points) Profit=Total Revenue – Total Costs Total Revenue = P x Q = $520 x 3 =$1560 Total Costs = 2430 Profit = -$870 (d) Will Mercy Hospital continue to operate in the short-run? Explain your answer. What will happen to Mercy Hospital in the long-run? (2 Points) Shut down point is where P < AVC. At Q = 3 we know that P = $520 and AVC = 450 Since P > AVC, the hospital will continue to operate even though it is experiencing a loss. In the long-run the hospital will leave the industry. Question #12 Demand and Supply (8 Points; 2 Points each) Suppose we are analyzing the market for hot chocolate. Graphically illustrated the impact each of the following would have on demand and/or supply. Clearly show how equilibrium price and quantity have changed. Make sure your axes and curves are clearly labeled. (a) Winter starts and the weather turns sharply colder As winter starts, tastes and preferences will shift towards a soothing cup of hot chocolate. We would expect demand to increase. The result will be higher equilibrium price and quantity. (b) A better method of harvesting cocoa beans is introduced A better method of harvesting cocoa means that suppliers can supply hot chocolate more cheaply. It is an improvement in technology. The supply curve will shift to the right. The result will be lower price and higher quantity. (c) Producers expect the price of hot chocolate to increase next month Expectations will affect firm behavior. If a firm believes that prices of their good will increase next month, they will reduce supply today. The supply curve will shift to the left. The result will be higher price and lower quantity. (d) The price of whipped cream falls We can assume that whipped cream and hot chocolate are complements. If the price of whipped cream falls we would expect the demand for its complement (hot chocolate) to increase. The end result will be the same as in Part (a). Question #13: Oligopoly (Cournot Model) 10 Points Two firms (Ryanair and EasyJet) are the only air carriers that fly out of London’s Gatwick Airport. The two airlines are very similar in terms of their costs, strategic approach, and market outlook. Moreover, the firms have nearly identical individual demand curves. The number of flights by Ryanair depends on the number of flights by EasyJet and vice-versa. The reaction functions are as follows: QR = 900 - 0.5QE (Reaction function for Ryanair) QE = 900 – 0.5QR (Reaction function for EasyJet) Where Q = number of flights out of Gatwick Airport (a) Graph the reaction functions for EasyJet and Ryanair on the same graph. Put the number of flights by Ryanair on the y-axis, and the quantity of flights flown by EasyJet on the x-axis. (5 Points) To graph you need to find the x and y intercepts for both reaction functions. The y-intercept for Ryanair is found by finding the number of flights Ryanair would provide if EasyJet did not have any flights. In this case Q = 900 – 0.5(0) = 900. To find the x-intercept for Ryanair, the question would be how many flights would EasyJet have to provide for Ryanair to not fly at all. Solve for 0 = 900 -0.5Q for Q = 1800. The method for drawing the reaction function for EasyJet is similar. (b) Solve for the best response equilibrium. At the best response equilibrium, how many flights will Ryanair fly? At the best response equilibrium, how many flights will EasyJet fly? What will be the total number of flights (Q = QR + QE) flying out of Gatwick Airport? (3 Points) QR = 900 - 0.5[900 – 0.5QR] Since QE = 900 – 0.5QR Simplifying we get QR =900 – 450 – 0.25QR = 450 – 0.25QR 0.75QR = 450 QR = 600 If QR = 600 then clearly QE = 600 since QE = 900 – 0.5(600) = 600 The total number of flights will be 600 + 600 = 1200 flights (c) If EasyJet were to become a monopolist at Gatwick airport, what would the total number of flights that would fly out of Gatwick Airport (2 Points) If EasyJet is a monopoly that means they are the only provider of flights from Gatwick, which would imply that Ryanair does not provide any flights QR = 0. Therefore Easyjet will provide QE = 900-0.5(0) = 900 flights. Question #14: Externalities (10 Points) A fertilizer plant near Coalinga produces bags of cow manure. The fertilizer plant produces a noxious odor that produces an external cost for households living near the plant. Let Q = number of bags of fertilizers produced per week Let MPC = marginal private cost = 2 + 0.000175Q Let MSC = marginal social cost = 2 + 0.000225Q Let MPB = marginal private benefit = P = 10 – 0.00025Q (a) What type of externality is described in the scenario above? (2 Points) It is a negative production externality. (b) Determine the output and price that would be established by market equilibrium. (For quantity round your answer to the nearest whole number; for price round your answer to the nearest penny) (2 Points) Market equilibrium would be found where MPB = MPC Plugging in the equations from above we get 10 – 0.00025Q = 2 + 0.000175Q Solve for Q 8 = 0.000425Q Q = 18824 units Since P = 10 – 0.00025Q plug in for Q P = 10 – 0.00025(18824) = $5.29 (c) Determine the socially efficient output and price. (For quantity round your answer to the nearest whole number; for price round your answer to the nearest penny) (3 Points) Social optimal level is where MSC = MSB Because there is no externality on the consumption side MSB = MPB Use the fact that MSC = 2 + 0.000225Q and MSB = 10 – 0.00025Q 2 + 0.000225Q = 10 – 0.00025Q Solving for Q 0.000475Q = 8 Q = 16,842 units P = 10 – 0.00025(16842) = $5.79 (d) Propose at least two solutions to get the fertilizer plant to produce at the socially optimal level. (3 Points) The government could impose a tax equal to the size of the negative externality A court injunction could be issued or a liability judgment awarded against the plant which will force the plant to take into account the social costs. Direct regulation by the government If the number of affected parties are small and transaction costs are low a private solution might be worked out (Coarse Theorem). Question #15: Present Value (10 Points) This year the St. Louis Rams football team signed Sam Bradford to a $50,000,000 guaranteed contract. The contract states that Bradford will be paid $10 million per year over the next 5 years beginning next year. Sports Illustrated states that this $50,000,000 contract is the biggest contract ever awarded to a rookie quarterback. (a) Calculate the present value of Bradford’s contract. Assume that the interest rate is 10%. Is Bradford’s contract worth $50,000,000? (7 Points) PV $10,000,000 $10,000,000 $10,000,000 $10,000,000 $10,000,000 (1.10) (1.10) 2 (1.10) 3 (1.10) 4 (1.10) 5 Solving we get $37,907,868 which is not bad money but definitely not worth $50,000,000 (b) If interest rates were to increase what would happen to the present value of Bradford’s contract? Explain your answer. (3 Points) An increase in the interest rate will cause the denominator in each term to get bigger. The present value of each future payment will therefore decrease. As a result the PV will fall. You could easily prove this to yourself by changing the interest rate to 15% instead of 10% and you would find that the present value of the contract would fall to $33,521,551.