notes 3 (2015)

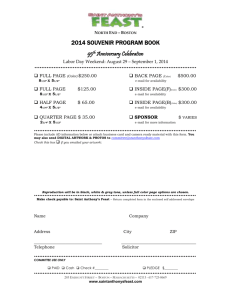

advertisement

Trust Money Management Exam Notes Part 3.3 Legal Profession Act 2007 (Qld); Part 3.3 Legal Profession Regulation 2007 Lawyers & trust accounts Relationships Barrister: fiduciary relationship (Carter v Palmer); unethical (r17(h),(l) Barristers Rule 2011) & unlawful for barrister to receive trust money: s246(1) LPA Barrister receiving money must immediately pass to solicitor (NSW Bar v Livesey) Despite s246(2)(b) no provision for barristers to set up account (Legal Services Commissioner v Griffiths) Solicitors: s248 Solicitors trust money trust account (held as bare trust w/ purpose to achieve commercial objective of client: Target Holdings v Redferns, Lord Browne-Wilkinson) Fiduciary relationship (In Re Hallett), scope: contract of retainer (Hospital Products); range of duties flow from retainer (Bax v Cavenham) Trustee–beneficiary (Jalmoon v Bow) Failure to deposit can only be breached under LPA; yet still possible for there to be breach of trust (Criminal Code responsibility) Reasons solicitor receives money: (1) Pay own account (office account) (2) Conduct business on behalf of beneficiary Client money and accounts to be held Solicitor may receive $: (1) Office account (s’tor’s money) (2) Trust/controlled money (client money) Trust money is s237 money ‘entrusted’: (a) legal costs in advance of providing services (b) controlled money: practice has written direction to deposit in account, other than general trust account, over which practice has or will have exclusive control) (c) transit money: $ received subject to instructions to pay/deliver to 3rd party other than associate of practice Need not be deposited; however if cash, must be deposited in trust account: s255 (d) power money: $ subject to power exercisable to deal w/ $ for/on behalf of another person E.g. power of attorney; record in Register of Powers and Estates: s57; record dealings: s56 Opening accounts and accounts to be held Trust account (s248): trust money unless controlled, transit or power money In most cases, deposited in trust account: s248(1) which ‘should be sacred’ (Re A Practitioner of the Supreme Court, Murray CJ) ≥1 account in Qld: s247(1) Cannot mix trust money except where permitted by law society (s257); cannot hold solicitor money in trust account (Johns v Law Society of NSW) Computerised trust accounting system: s31, 32 Regulations Transfer money out on client instructions or court order (s249); does not earn interest Opening account: failure to open may lead to disciplinary proceedings (In Re Three Solicitors) Money received trust account, as soon as practicable: s248(2)(b) ‘Law Practice Trust Account’ Within 14 days, appoint external examiner: s267(1) & notify QLS Must have general trust account w/ approved: s237, sch 2, s280 (ADI approval), s33(2) Controlled money account: deposited as soon as practicable: s251(1) must be held by approved ADI (s237). Cannot hold for ≥1 client: s251(6) Separate CMA for each client: s251(2) Purpose controlled money: enhancing value of $/property upon completion of matter: s238(3) Recording, receiving and paying trust money Recording Trust records: law practice must keep in permanent form: s261 Account must reflect true position (Re Barry) and allow for easy investigation; all names must be recorded (s262) Failure to keep accounts may lead to discipline (LSC v Johnston); must be kept for 7 years: ss59-60 Regulation Printed form: s29 Legal Profession Regulation 2007 Principal’s joint responsibility: principal solicitor is responsible even if accounting handled by clerk or secretary (LSC v Towers; LSC v Pennisi); must intervene where ‘some suspicion’ accounts not being kept scrupulously (Cheney v Qld Law Society); must supervise (Re Cremin) Partners liability: jointly & severally liable for failure to manage client money lawfully (s244); whether jointly liable depends on innocent partner’s supervision capabilities (In Re Three Solicitors; Re Mayes and the Legal Practitioners Act: innocent partner may be liable if ‘careless and reckless’) ILPA under same obligations (Legal Practitioner Director responsible) Trust records (s237): (a) Vouchers Receipts (not as file but record numbers): Cheque butts or cheque requisitions. Authorities to withdraw by electronic funds transfer (EFT). Deposit records. (b) Accounts Cash receipts book ($ into trust account) Cash payments books ($ out of trust account) Trust ledger accounts Transfer journal (c) Reconciliations: trial balances & monthly reconciliations Duty to reconcile: accts & ADI balance at end of month: s44(1) LPR, kept w/ trust records: s44(4): (1) ADI balance & 2 cash books: s44(2)(a) LPR (2) cash books & ledgers: s44(3)(a) (d) Statements: trust account ADI (‘bank’) statements Receiving and depositing money Forms of money received: (a) cheque (b) cash & coin: general trust money or transit money must be banked in trust account if received in cash (s255) even if direction to do otherwise (s255(2) o If ≥ $10,000: report to Australian Transaction Reports & Analysis Centre: Financial Transactions Reports Act 1988 (Cth) (c) EFT: solicitor must also receive doc from financial institution acknowledging receipt of money from account; special accounting required (d) Credit card: s242(2): w/ QLS approval; possibly QLS approval not necessary where there is immediate payment into trust account (Re Quinn) Process when money received: $ received when: direct possession (s242(1)(a)), indirect possession (s242(1)(b)) or power to deal with the $ (s242(1)(c)) Procedure (1) receipt: s242(2) LPA; s34(2) Regulation (2) record in cash receipts book and relevant ledger (3) deposit $ in account Depositing money: ‘as soon as practicable’ (s248(1) & 251) unless: written direction, controlled, power or transit $: s248(1) Transit $ must ‘as soon as practicable’ be dealt with as instructed: s253,254 Deposit record must be compiled failure: breach of LPA (Qld Law Society v Wakeling) Accidental $ in office account: solicitor should immediately pay into trust (Re Mallett); delay may lead to discipline (Re X) Using money in safe = breach of s248: LSC v Griffiths Paying money Holding trust $: must be held for client until authorised payment (s249(1)); may not be spent for debts unless entitled to $: s256(1) Forms of payment: (a) Trust acct cheque: s250(1); exception of EFT (b) Bank cheque (c) EFT: permitted w/ QLS written approval: s250(1)(b); (2)(d) o Direct Debit permitted in circumstances e.g. registered on PEXA for settlement moneys (d) Other payments prohibited, e.g. cash, ATM, telephone banking: s250(2) Dealing in cleared funds: no express duty to ensure funds are cleared; however solicitor should ensure money is available to beneficiary (QLS v Wakeling) & represented by cleared funds; otherwise, may be negligence or misappropriation (Re Cook; Re Barry) Trustee-solicitor must sign cheque; drawing uncleared funds professional discipline (LSC v Devenish) Inadvertent overdrawing/use of funds not there must be disclosed to QLS: LSC v Devenish (unsatisfactory professional conduct; naivety & carelessness fine) When $ can be paid out of trust account: (otherwise: max penalty 50 penalty units fine: s249(1)) (1) direction of person beneficially entitled to $: s249(1)(b) (2) authorised payment of solicitor’s costs: s258(1): procedures in regulation must be complied with (3) statutory deposit: s248(1)(b) LPA; s70(1) LPR (4) Unclaimed $ payment to Public Trustee: s713 (5) Payment authorised by court/law: s249(2) Breach s249 discipline. If fraud, solicitor may be struck from roll (QLS v Cummings); if money was not deposited in trust acct Criminal Code; payment contrary to instructions breach of fiduciary duty (McCann v Switzerland Insurance Australia) and trust (Re Batho) Joint beneficiaries: all must consent under s249(1); breach: unsatisfactory professional conduct or misconduct: LSC v Twohill; LSC v Wakeling Paying bills/accounts from trust If procedures in Regulation complied with: s258 LPA. Solicitor may withdraw to pay own account (s58 Legal Profession Regulation); must follow either procedure: 1. Solicitor requests/notifies client o Request: s58(3)(b)(i) LPR or written notice: s48(3)(b)(ii) LPR o Authorisation, either: i. Valid costs agreement provides for payment: s58(3)(a)(i) LPR ii. Instructions & authorisation by beneficiary: s58(3)(a)(ii) LPR. Writing kept permanent record: s58(50(a); verbally, must confirm in writing ≤ 5 days, kept permanent record: s58(5)(b) LPR iii. Solicitor already paid behalf of client; payment to reimburse: s58(3)(a)(iii) 2. Account rendered to client: if client does not object ≤ 7 days receiving it solicitor can withdraw $: s58(4)(a), 58(4)(b)(i) LPR o Client objects but does not apply costs assessment ≤60 days of having received bill solicitor can withdraw $: s58(4) LPR Statutory deposit schemes: Interest on lawyers’ trust accounts (IOLTA) Introduction QLS, 1960s; today, State Government since LPA 2004 (Qld). IOLTA appropriated for professional/public use. (1) Statutory deposit schemes (2) Residual balance schemes Statutory deposits scheme: made by 21 Jan: s70, 76 LPR. Onus on lawyer to make ‘deposit’ into ‘prescribed account’ on 31 January each year of 2/3 lowest balance of trust money held in previous year (unless < $3,000) Trust money = money in trust account + statutory deposit in prescribed account Procedure: (1) trust acct cheque payable Chief Executive of Department of Justice (2) deliver to ADI (3) deliver previous year’s letter of credit to ADI Insufficient: lesser amount sufficient to keep trust acct in credit deposited: s74(2) LPR No obligation for trustee-solicitor to tell beneficiary about scheme or right to receive interest [Drawing on the prescribed amount: LPR & LPA do not allow overdrawing of trust acct. Letter of credit relied to draw on money in prescribed acct: s74(1) LPR. Steps: (1) estimate $ required to pay & keep acct in credit (2) ADI ‘demand draft’; drawing of $ (3) prescribed acct $ trust acct (4) pay $ out of trust acct] Regulation and liability Regulation, audit and supervision 1. Government: Minister of Justice 2. Law Society: regulators; powers of investigation: s263-266; 540-581 3. Legal Services Commissioner: asks Law Society to investigate allegations/suspicions: s297 4. External examiners/auditor: must be appointed: s267(1) Failure to audit discipline (Re Zaghini; QLS v Cummings). False records/statements discipline (Mellifont v QLS) 5. Peers in profession: whistle-blowing duty (260) and reported to QLS, when (a) solicitor aware of irregularity for their practice or (b) belief on reasonable grounds of irregularity in another practice Inform in writing Delay in reporting discipline, e.g. reprimand (LSC v Devenish: fine; also overdrawing) Civil liability Compensation: restitution to make good the loss, w/ interest (Nocton v Lord Ashburton), assessed at date court makes its order (Re Dawson; Target Holdings v Redferns). However, Youyang v Minter Ellison suggests that it is at the time of the breach. Q: position the trustee would have been in if the terms of trust had been honoured? Whether there has been accounting: Misappropriation from the trust account with no accounting: rateable proportion of shortfall (Keefe v NSW Law Society) as impossible to trace payment of money: In re Grey, an Insolvent (1900) VLR Where there has been proper accounting: ‘according to the intention of the fraudster’; breach in respect of beneficiary in whose ledger payment recorded (Magarey Farlam Lawyers Trust Account (No 3), Debelle J) Account of profits Under fiduciary relationship, where a profit or secret commission is earned, an account of profits may be ordered: Boardman v Phipps. Where s’tor acts honesty, allowance for work & skill may be made (Boardman); authority to suggest may also be where dishonest (Warman v Dwyer) If $ removed from trust account w/out attribution to beneficiary, perhaps Keefe’s ‘rateable’ approach: apportioned rateably between beneficiaries in proportion to sums held to their credit at time of breach Liability for another’s breach S’tor may be liable as constructive trustee where knowing receipt or knowing assistance (Barnes v Addy, Lord Selbourne) Recipient liability: no need to show dishonesty (Ashman v Price & Williams); Central Q is knowledge, which should make it unconscionable for s’tor to retain benefit of receipt (Bank of Credit and Commerce International v Akindele) Liability does not arise where s’tor receives $ as trustee (must be in own right) (Twinsectra v Yardley; El Ajou v Dollar Land Holdings) Accessory liability: Previously, 5-point gradation of knowledge (Baden v Societe Generale)s; courts denied s’tor liability unless lack of probity (Equiticorp v Hawkins NZ). This gradation affirmed as useful in Australia (Farah Constructions) Aus HC in Farah Constructions rejected Royal Brunei (UK) which held that s’tor dishonesty required, not merely knowledge of another’s dishonest & fraudulent design. It was not previously considered in Australia (Consul Developments). Civil (and professional) liability of partners: Where partner breaches trust in ordinary course of business of firm, is liable to same extent as partner so acting or omitting to act: s13 Partnership Act 1891 (Qld), s14 General law Romano v Chapple, Moynihan J Compensation from LPT/LPC/QCAT Compensation may be awarded by LPC/QCAT as a result of disciplinary proceedings (LSC v Rowlands) Compensation cannot be made if already received from court/Fidelity Fund: s465(2); disciplinary compensation order does not create issue estoppel for civil proceedings ≤ $7,500/complainant or as agreed by solicitor: s456(4)(b), 458(2)(c) LPA Criminal responsibility LPA offences: failure to keep proper accounts (s261), e.g. Failure to deposit $ in trust account, max 100 penalty units: s248 Failure to deposit controlled $ in controlled $ account, max 50 penalty units (s251) Failure to comply w/ making payment restrictions for trust acct (s249), controlled acct (252), max 50 penalty units Criminal Code offences Stealing: s390, 319,393,395 ‘Trustee’ stealing’: s568 R v Bell: fraudulent conversion of trust money; still may apply at common law LSC v Wood: ‘fraudulent transactions were incompatible with the utter integrity which must mark those held out by the court as being fit to practice’ Professional discipline Admission and certification Power to grant certification allows QLS to refuse to grant/cancel/suspend certification LPA s9, 37-38, 44, 46 Disciplinary tribunals One ‘suitability matter’ is failure to comply w/ law relating to management of trust $: s9(1)(j) LSC v Clapin, LSC v Quinn, LSC v Baxter Legal Services Commissioner v Baxter [2013] QCAT 59 Facts Partner of law firm w/ gambling problem misappropriated and attempted to conceal ~ $6.7m client funds from 18 beneficiaries Some money repaid; over >$3.5 owing when discipline application heard Held Professional misconduct (s419), name removed from Roll as not a fit & proper person to engage in legal practice Judgment Cooperation w/ disciplinary process ‘to his credit’ but ‘carry little weight in the face of the serious and extensive nature of his misconduct ‘High standards of honesty and integrity are to be expected of members of the legal profession and in particular, in the way they operate trust accounts’ Deliberate fraud is affront to necessary integrity: LSC v Williams [2005] LPT 006. Systematic deceit is ‘glaringly incompatible with the utter integrity which must mark those held out by the court to the public as fit to practice’ Legal Services Commissioner v Wood [2012] QCAT 185 Facts Managing partner convicted on 2 counts fraud, 1 count forgery 10 years imprisonment Misappropriated funds from firm’s trust acct and used other funds to dishonesty obtain loans to cover up misappropriations; large amount of money ($1.2m defrauded clients from Fidelity Fund) Held Professional misconduct (s419 – not fit or proper person to engage in legal practice who could not be entrusted w/ important duties & grave responsibilities: AG v Bax), name removed from Roll Judgment Legal profession ‘has long required the highest standards of integrity’ Conduct was ‘serious breaches of honesty and trust that go to the heart of a solicitor’s professional obligations’ ‘Serious offence’ capable of constituting professional misconduct: s420 Even if misconduct not engaged directly in course of practice, may be so connected so as to amount to professional misconduct (fit + proper person qualities): A Solicitor v Counsel of the Law Society of New South Wales Public protection: LSC v Wherry Pressure and illness LSC v Wilson: experienced practitioner w/ personal circumstances Competency, honesty and diligence Public needs protection from legal practitioners who ‘are ignorant of the basic rules of proper professional practice, indifferent to rudimentary professional requirements, and unable to uphold the highest standards of honest conduct’: Legal Practitioners Conduct Board v Figwer Additional information not from PPT slides (just in case!) Lawyers’ accounts (has not been covered in PPT slides) Lawyers costs & costs agreements: legal practitioners can undertake legal work & be paid: s24(1),(4) Legal costs: court scale or valid costs agreement: s319(1); costs agreement: client–solicitor, solicitor–barrister, client–barrister, 3rd party paying: s322(1); must be in writing: s322(2) Billing and recovery: bill must be delivered (s329) and include (1) lump sum or itemized items: s330 (2) signature on behalf of law practice: s330 (3) statement of rights to assessment; client may request lump sum itemized: s332(1) Costs agreement enforceable like any contract: s326. 30 days since bill delivered to commence action: s329(1); court may abridge period: s329(2) Costs assessment and review of costs agreements: Costs assessment: may be sought by client, 3rd party paying or law practice: s335(1)-(2) or lawyers: s336. Application may be made regardless of whether paid: s335(3), 336(2)-(3), 337(2)-(3) Clients + third party payers have 12 months within delivery/payment: s335(5) Lawyers–lawyer bill: 60 days to contest: s335(5) law practice’s own bill: ≥30 days must pass: s337(4) Application made to court (r743A Uniform Civil Procedure Rule) w/ overriding criterion: reasonableness of $ charged. Considerations: skill, labour & responsibility; complexity, novelty or difficulty, quality, time: s42(2) Usually costs paid by client unless assessor finds legal costs reduced ≤ 15% of $ charged: s342 Lawyer misconduct Legal Services Commissioner: s343 Costs agreement: set aside if Court decides not fair/reasonable: s328(1). Factors, e.g. fraud, misrepresentation, presence/absence of required disclosures, relative circumstances of lawyer & client. Court can substitute its own fair amount, considering costs assessor factors (above): s328(5),(7) Trust account, controlled money and power money statements: statement client, after matter completed: s54(6)(a) Separate accounts for matter: trust $: s54(2), controlled $: s54(3), power $: s54(4); not required for transit $: s54(1). Details: dealings that have to be recorded per LPA & regulation: s54(5) False statements discipline (Re G, A Solicitor: suspension) ‘Unsophisticated’ client: disclose more comprehensive information (LSC v Madden)