Summary of the paper - Critical Perspectives on Accounting

advertisement

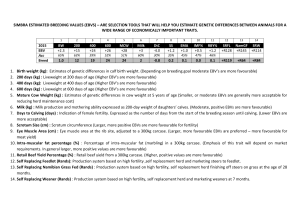

Impression Management in Distressed Banking Annual Reporting Review Author: Jonathan Njoku Kuwait-Maastricht Business School, Kazima Street, Block 3, Dasma, Kuwait E-mail: jonathan@kmbs.edu.kw Reviewer: Murniati Mukhlisin PhD Student, Adam Smith Business School University of Glasgow, Scotland, United Kingdom Senior Lecturer, Tazkia University College of Islamic Economics, Indonesia E-mail: m.mukhlisin.1@research.gla.ac.uk 1 Summary of the paper The objective of this paper is to critically explore how impression management (IM) was used in Oceanic Bank to hide the going concern uncertainties that the bank faced in 2009. Firstly, the author elaborates theories on nature, essence, and effects of the impression management. Secondly, the author presents cases on the impression management with a focus study on the Oceanic Bank. IM in this study is regarded as corporate narratives used by management to exaggerate financial prospect and diminish bad news. In essence, IM is to distort perception of outsiders on the achievements and prospects of an entity, through manipulation of the presentation of corporate reporting. Several theories explain how IM is exercised i.e. agency theory, attribution theory, signalling theory, legitimacy theory, and institutional theory. The conflict between agent and principal often creates motivation for managers to execute IM. IM has been used negatively to influence share price, misallocate capital through lowering the cost of capital, and shore up managerial compensation through enhanced share performance. In order words, IM mediates manipulation for earning management by several ways i.e. 1) making the narratives difficult to read, 2) emphasizing good news through numerical, words, and themes in visual, and structural methods, 3) choosing favourable benchmark and selective disclosure. However, the information must be credible and for that, it must be plausible, timely, complete, accurate, and congruent with managers’ personal incentives. Unlike agency theory, the signalling theory suggests other type of IM explained by managers of well performing firms who are more transparent. On the other hand, under legitimacy theory, IM explains reactions of firms in facing legitimacy threats. Under institutional theory, the firms use IM to conform with international expectations and norms in order to reduce internal and external inspections and to respond to institutional pressures. The effects of IM are perceived as discretionary disclosure that enhances the role of financial reporting in bridging information asymmetries between managers and outsiders, and as discretionary disclosure that exploits information asymmetries between managers and outsiders. Several theories explain the effects of IM on these two conflicting thoughts i.e. economic utility theory and behavioural theory. The economic utility theory suggests that sophisticated investors are able to filter information and they are not vulnerable to IM thus there is no harmful consequences towards the capital market. In this case, discretionary disclosure could reduce asymmetric information. However, under distressed banking, motivation to hide bad news in order to keep the firms alive would eventually 2 cause the share prices to fall. The utility theory holds assumption that not all users of annual report are sophisticated hence they are emotional. Behavioural theory on the other hand suggests that under market inefficiency, investors become appealing towards both substance and form of information when making decisions, therefore IM provokes share price reaction. This is the main focus of the study. The author selected Oceanic Bank as a case study to analyse IM through forms and contents of the Chairman’s statement in year 2006 and 2008 (the year when the bank was considered healthy and the year when the bank was announced distressed). Oceanic Bank was one the leading banks in Nigeria, succeeded to escape issues on capital requirement during 2005 banking consolidation screening. The narratives in the chairman’s statements are scrutinized using several signals such as obfuscating bad news through making text difficult to read, using pervasive language, emphasizing good news by manipulating information, emphasizing through words and themes, emphasizing good news by visual and structural ways, choosing favourable benchmark, choosing favourable earnings, shifting the blame, and claiming positive outcomes. Using content analysis method, the finding suggests that the Chairman’s statements tend to obfuscate bad news by making text more difficult to read, using persuasive language to disguise the firms from the users, emphasizing goods news, emphasizing positive financial performance, choosing favourable benchmarks and favourable earnings, and finally shifting the blame and claim positive outcomes. The author proved that the theories on IM work under the ‘story telling’ in the CBN Chairman’s Statements. Comments: This is interesting paper that provides comprehensive debates on several theories related to IM. However, the analysis part is not sufficient to contribute to theoretical development where the author only confirms the finding based on the available theories. The following comments may be useful to improve the paper. 1. Literature The author emphasized on theories on how IM is being exploited to satisfy the interest of the managers. Different types of ‘storytelling’ described by the author are regarded as different types of plots, characters and twists (Gabriel, 2000, p. 239) and they are capable of stimulating strong emotions of sympathy, anger, fear, anxiety and so forth. Perhaps this can enrich the discussion in the literature part that wrap all themes as types of storytelling. 3 2. Methodology and Result The author adopts critical ethnography that attempts to examine context specific social and cultural uses of accounting in organization. This type of ethnography work is very challenging such as to encounter several weaknesses of this methodology among others; limiting factors of language, the morphing effects of context, imperfections of the researcher, and ethical considerations surrounding the verification and ownership of data Rudkin (2002). A more systematic content analysis is one way to reduce the limitation on language and effects. For instance, the analysis in Section 4 is quite wordy and requires more effort for readers to understand the plots sentence by sentence. In this case, the author may need to conduct a more systematic content analysis (see Krippendorff (2012), Weber (1990)). The following description is one way to perform a systematic content analysis by first, arrange coding rules, see example below. Example of Coding Rule No. Elements 1 Obfuscate bad news by making text more difficult to read 2 Use persuasive language to disguise the firms from the users Emphasize goods news Emphasize positive financial performance Choose favourable benchmarks and favourable earnings Shift the blame and claim positive outcomes 3 4 5 6 Definition and Characteristics Presentation of statement that creates difficulty for users to understand i.e. paragraph, font size, font type. Coding Rule The presentation that makes readers difficult to read should be coded (one per sentence). Number 10 (?) Examples Pages 11 to 17 in 2008 statement were displayed in single and double column (mixed format). The following steps may involve in this method: conduct reliability process, code nodes and sub-nodes (if any), run result, run statistical significant test, and lastly analyse the result. NVivo software is helpful to ensure coverage of the contents. 4 3. Implication of the result The author may explore contribution to the theory on IM. For instance, what is the main theme out of several IM themes used to examine CBN? Are they overlapping, for instance, Gray, Kouhy, and Lavers (1995) argue that political economy, legitimacy, and stakeholder’s theory are overlapping theories. What is the main theory that governs several theories outlined by the author? References Gabriel, Yiannis. Storytelling in Organizations: Facts, Fictions, and Fantasies: Facts, Fictions, and Fantasies. Oxford University Press, 2000. Gray, R., Kouhy, R. and Lavers, S. (1995), "Corporate social and environmental reporting: a review of the literature and a longitudinal study of UK disclosure", Accounting, Auditing & Accountability Journal, Vol. 8 No. 2, pp. 47-77. Krippendorff, K. (2012), Content analysis: An introduction to its methodology, Sage. Rudkin, K. (2002), "Applying critical ethnographic methodology and method in accounting research", in Critical Perspective on Accounting Conference, New York. Weber, R. P. (1990), Basic content analysis, Sage. 5