Treasurer training outline

advertisement

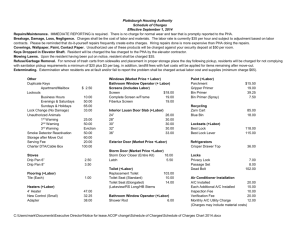

Treasurers Training Guide: May 20th and May 21st, 2013 This training is intended as an overview only—treasurer’s duties require a one-on-one session of about 1 hour and will be done as treasurers bring in August paperwork. Your first duty is your house budget, which must be submitted by May 28th, 2013 Youmna El-Ayache-Saad, Connie Lucas iccfinanceoffice@gmail.com 734-662-4414 x108 1. Review rent manager member list (this will normally be emailed to treasurers) a. Look for these issues: i. Is everyone at the house listed? Is anyone listed that’s not at the house? Total # of occupants is printed at bottom. ii. Has everyone been charged the right amount? iii. Does the balance due look ok? iv. Are the people being charged for doubles living with a roommate? v. This is the only reminder to housemates that charges are due--your job is to get everyone to pay on time, so post this or email it to EVERYONE as a reminder. vi. Please let us know if you see any problems. 2. Payment is always due on the 1st of the month, and $15 late fines are assessed on the 5th. Members will pay using our online system (accessible through the “charges” link on the ICC website). Individuals have access to their own account information, and there are tabs across the top of the Resident Web Access payment screen, including a “Transaction History.” This will display a breakdown of all the member’s charges and payments. 3. House budgets need to be voted on at a house meeting—use last year’s numbers as your starting point. September house charges were estimated based on the previous year’s budget. Your current year budget will include September, but we will only change charges for October onwards. You’ll need to account for how much you already paid in Sept. Consider these issues when figuring out your house charges: a. The number of residents last year versus this year. b. The amount and kind of food your house wants. If the house is interested in buying more organic and/or local products make sure to discuss how this will affect your budget. c. Once you have a good budget, make sure to subtract what was charged for September and divide the remaining balance due by 7 remaining payments. d. We’ll need a copy of the approved house budgets asap so monthly charges can be posted for October; that said, you’ll be able to alter your budget moving forward if the need arises. We post charges a week before they are due, so please get us your budget by May 28th, 2013 the latest. e. Track your spending! Part of budgeting is keeping track of how well you did at estimating your costs. We’ve given you a sample budget tracking sheet, but you can use your own if you prefer. 4. As you pay the house bills you need to be aware of how much money you have in the bank account. Enter all checks written on the green sheets and keep a running balance so you don’t overdraw the account. Each column on the right of the green sheet will be labeled with an expense category, and each time you write a check, enter it into the appropriate column. At the end of the month, the total of all expense columns should be subtracted from your beginning balance plus deposits. We will do this with you one-onone the first time. Make an appointment to come in sometime when you have at least 30 minutes to spend with us. 5. ICC-paid bills: The ICC pays for Student Buyers (SBA) and some Comcast. We will email you a report of ICC-paid expenses monthly. The SBA bill must be approved before we will pay it. The food steward and treasurer should look it over and make sure that all items charged were ordered and that there are receipts showing what was purchased. Make sure that you are collecting receipts for every purchase. When you get your SBA bill you need to compare the total of the receipts with the total of the bill. Revoke credit card privileges from anyone who does not turn in receipts. 6. What you need to bring into the office each month: a. Green sheet and ALL receipts by the 15th. Please staple each receipt to the corresponding check. b. Two-part Treasurers Monthly Report and bank statement. The bank statement is necessary to complete the month reports. The Credit Union mails one to “Treasurer” at the house right after the first of the month. Make sure your mail sorter knows who the treasurer is. We can also get one for you online if you need. I. Part 1 is a summary of the green sheet showing just the totals, not all the detailed expenditures. If your green sheet balances then this will balance too. Simply transfer totals over. II. Part 2 reconciles what the Credit Union says you have in the account to what your green sheet says you have. The difference is usually just checks you have written that the Credit Union doesn’t know about. Come into the office with your green sheet balanced and we’ll walk you through this the first time. III. Once you fill out the reports you will turn them in to us. When you bring them to the office we will make a copy for you to take back to your house. This report will only show expenses that go through your checking account. You should have a separate record of total expenses that include bills paid at the office. Only you will know if the house is spending more or less than budgeted, so you are responsible for making regular budget reports at house meetings. It’s a big part of your job! 7. Fines and additional charges–email. We require 2 “signatures” to process fines and additional charges. If your work manager wants to fine people, have them email you the first and last names and amounts to be charged and then IF you agree that the fines are legitimate, forward the email to us. Fines must be turned in in a timely manner. We won’t post fines that are more than 30 days old. This applies to office labor fines as well. 8. Amenities Fund – The ICC holds money in trust for each of the houses. You can spend this money on any long-term improvements to the house that the members agree upon. The items purchased through the House Amenities Fund are used to benefit present AND future members. All amenities fund purchases MUST be approved by house members at a house meeting. Wall votes and email votes will not be accepted. Steps to spending amenities money: a. Ask the finance dept. how much money is in your amenities fund. b. Vote to approve purchase at a house meeting. c. Purchase item—either pay directly with a house check or write a check to reimburse an individual who paid out of pocket. d. Fill out an Amenities Reimbursement Form. Attach meeting minutes, receipts, and carbon copy of the check used for the purchase. e. Bring all the paperwork to the Finance Office with your monthly accounting. We will take the money out of your amenities fund and credit it to the house. This will take place behind the scenes—you won’t see a deposit into your account. 9. Maintenance Reimbursements–Ask before you spend as maintenance funds are limited! 10. Money is transferred into house accounts upon request, so know your bank balance by keeping a tally on the green sheet and plan ahead.