Lloyds Banking Group Guide to Receiving Orders and Getting Paid

advertisement

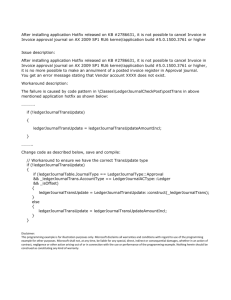

Lloyds Banking Group Guide to Receiving Orders and Getting Paid The purpose of this short guide is to: Explain how Lloyds Banking Group uses Purchase Orders (POs) for goods and services. Help you ensure payments can be made to you in a timely manner. Purchase orders Purchase Orders are issued to commission the supply of goods and services from suppliers. Each PO has a unique number. A sample PO is included towards the end of this guide for reference. The use of POs ensures that orders you receive have been pre-authorised, and provides you with improved visibility of our business requirements, contractual terms and price. It also simplifies our approval, invoice, and payment processes by automatically matching Invoice to PO details. Our preferred transmission method for POs is e-POs through our Supplier Hub and submission of e-invoices through the Ariba Network, but we may also send POs by email to a nominated supplier inbox for those suppliers who chose not to transact through Ariba. PO Revisions There may be occasions when we will amend the details of a Purchase Order and send you a revised order. If this happens, please take care that these amendments are not mistaken as new orders. Any duplicate deliveries would be at the supplier’s cost. Invoicing Sample invoices are included towards the end of this guide for reference. To ensure trouble free payment your invoice must include: The LBG PO number printed clearly on the invoice. These are usually 10 digits, typically “7000123456”. If you have not received a Purchase Order number, you must print the Control Centre code that you have obtained from the colleague that requested the goods or service from you, prefixed by ‘CC’ (for example: CC123456). The correct company name, e.g. Lloyds Bank plc, HBOS plc. You can identify this by the company logo on the purchase order. Your Company (vendor) name and address. The word Invoice (or if a credit, the words Credit Note). A unique invoice number. The invoice date. The value and currency o To comply with HMRC guidelines, the invoice should show the VAT breakdown, i.e. the net value of goods and services, the rate and amount of VAT, and the gross (total) value of the invoice. The VAT Registration Number The description of goods and/or services supplied, and (for Purchase Order invoices) the relevant PO line item number against each line on the invoice, reflecting the quantities/unit price/Units from the Purchase Order. Any unique reference number or information requested by your LBG business contact. We create a scanned image of all paper invoices we receive, so it is important that the invoice is clearly typed and easy to read and not defaced with handwritten annotations. Ideally the invoice should be on white A4 paper and clearly printed. Highlighter pens should not be used. Notes: 1. 2. 3. 4. Invoices that do not bear a PO number or a Control Centre code cannot be processed and will be returned to you. You must ask the individual who requested the goods/service to supply this for you to put on your invoice. TSB invoices should not be submitted mixed with Lloyds/Halifax/BoS invoices Any change to details for your business (example –bank account change) should be submitted separately from invoices. These should be sent on letter headed paper to the Accounts Payable address below. It will not be possible to act on changes noted on the face of invoices, or emailed instructions. Each invoice should only reference one Purchase Order or Control Centre. Summary invoices are not supported. Page 1/4 Format for emailed invoices/credit notes NOTE: If you send a digital invoice, do not send a paper version as well. Required file format is PDF. Invoices must be in a consistent orientation portrait/landscape so that the text is always displayed horizontally. Only one invoice per PDF file is allowed. Any supporting information to the invoice must be included within the same invoice PDF file (other document types are not supported). One email can contain several PDF files, maximum 20 files per email. Email cannot be larger than 9MB Invoice files compressed in zip format are not supported PDFs must not be password protected. If you are submitting invoices by email, then all the actionable information needs to be within the PDF file attachment, as only the PDF is processed.. No action will be taken on messages in the email body or subject line. To avoid delays in payment Ensure that all the information listed above has been included and is correct. This may seem obvious, but common reasons for invoice payment being delayed include: o VAT errors Calculation/totalling Missing VAT registration number o Address discrepancies between the PO and invoice Please remember to advise us of any change to your company name or address, so we can ensure our records are updated. This needs to be submitted separately from invoices, by letter on headed paper. It will not be possible to act on changes noted on the face of invoices. o Missing/incorrect PO/line item/revision numbers If you are providing a continuing service and have more than one PO number relating to specific dates of supply, please ensure that the PO number quoted on the invoice relates to the correct time period If your invoice refers to more than one PO, please state clearly what amount is payable against each PO / line item number . Invoices, and any supporting information, should be sent to the Accounts Payable address (not the contact name on the PO, or other business contact). You may also need to send supporting information to your LBG business contact (if this has been agreed with them). Your business contact may need this to approve the invoice for payment. If you need to send us a copy invoice, it must be a “True and Certified” copy o by having the word ‘copy’ actually printed in the body of the invoice; o or by you, the supplier, having written the following statement on it, “I certify that this is a true and certified copy of the original invoice” and signed it. Suppliers that are live on our e-invoicing service should not be submitting paper/PDF invoice Duplicate invoices will delay processing of invoices already submit Payment Lloyds Banking Group’s standard payment method to suppliers is BACS. If you have a query regarding an outstanding payment please contact Accounts Payable: Telephone 0845 9013128 If you have already submitted invoice(s) to the total value of the PO you received, i.e. the PO has already been fully invoiced, Accounts Payable will not be able to process any further invoices for that PO. Please do not continue to submit invoices; refer first to your business contact. Page 2/4 Example Purchase Order (NB There are variations which may apply) Address we hold in your vendor record. Your address on your invoice should match this. Purchase Order number. 10 characters only. You must quote this on your invoice else your payment could be delayed. (/101 is not part of the PO number) LLOYDS BANKING GROUP ACCOUNTS PAYABLE BX1 1LT EMAIL : APInvoiceReceipt@lloydsbanking.com Your business contact for queries on the purchase order. Please print “Partner Code RRPB” against this line on invoices All values quoted exclusive of VAT. Line item number. Where there is more than one line item, you should state on your invoice which line/s you are invoicing for. Text may include “Please print “Partner Code RRPB” against this line on invoices” on invoices on invoicesch this charge Total value of purchase order, excluding VAT. Page 3/4 Sample Lloyds Banking Group Compliant Invoice Must have correct vendor name and address. Must be unique to supplier Internal Catalogue Vendor Addressed to Lloyds Banking Group or subsidiary Invoice date should not be in the future, or backdated more than 5 days Dummy Street, Dummy, BS1 1BS Tel: 01223 666555 INVOICE Lloyds Banking Group Accounts Payable BX1 1LT Invoice No: Invoice Date: Our Ref: Your Ref: PO No: Description ABC12345 DD/MM/YYYY LTSBINV0023 ATM2009 7000016396 Purchase Order No clearly visible. £ Line 1 – ATM Machines Partner Code RRPB 10 @ £150.00 Line 2 – Delivery charge 1 @ £25.00 £25.00 Line 3 – Installation 10 @ £18.00 £180.00 £1,500.00 In the event of queries, please contact A.N. Other, ext 12345 Net Total £1,705.00 VAT @ 15.00% £255.75 Invoice Total £1,960.75 VAT REG No: GB 123 4567 89 Internal Catalogue Vendor (an ABC Inc. company) Company Registered in England & Wales No: 12345678 Registered Office: 1 The Street, London W1A 2DD If you have not received a Purchase Order number, you must print the Control Centre code which has been provided by the requester prefixed by “CC”, for example, “CC123456” Breakdown aligns to breakdown on PO and includes line item numbers. If more than one PO, each line should give the PO to which it relates VAT: Rate (s) must be clearly stated. VAT Registration must be provided. All paper invoices/credit notes* to: All PDF invoice/credit notes* to : LLOYDS BANKING GROUP Accounts Payable BX1 1LT APInvoiceReceipt@lloydsbanking.com * Exceptions: Group Property Orders – If you receive Purchase Orders starting with “1xxxx” or are directed to invoice to OrdersPaymentsIncomingInvoices@Lloydsbanking.com, then these orders /payments will continue unaffected. Council – If you are a council invoicing business rates please do not amend the current invoicing address. E-Billing and AP Batch – For suppliers that also transact using the Lloyds Banking Group e-billing and AP Batch processes for invoice payment, then these files should continue to be sent to the previously advised address LEX Autolease orders/invoicing remains unaffected and should continue as per current process General Insurance claims orders/invoicing remains unaffected and should continue as per current process Page 4/4