mid I 2012 Solutions_v2

advertisement

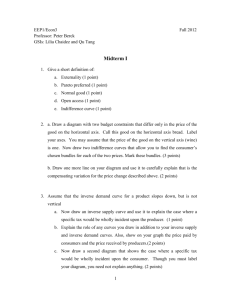

EEP1/ECONC3 Midterm I Solutions Fall 2012 Midterm I 1. Give a short definition of: a. Externality (1 point) Non pecuniary effect on a third party not involved in the transaction b. Pareto preferred (1 point) The allocation of goods that result after voluntary trade is pareto preferred to the allocation before. That is, the allocation of goods is pareto preferred to the initial allocation if everyone is at least as well or better off but nobody is worse off . c. Normal good (1 point) A good such that when income increases demand for it increases(demand curve shifts out/right). d. Open access (1 point) A resource where anybody, without restriction can enter. Open access resources are rival and non excludable. Example: fisheries e. Indifference curve (1 point) The set of all bundles that produce the same utility—level of satisfaction or well being---as any other point on the curve. 2. a. Draw a diagram with two budget constraints that differ only in the price of the good on the horizontal axis. Call this good on the horizontal axis bread. Label your axes. You may assume that the price of the good on the vertical axis (wine) is one. Now draw two indifference curves that allow you to find the consumer’s chosen bundles for each of the two prices. Mark these bundles. (3 points) 1 point for drawing the two budget constaints 2 points for showing the chosen bundles 1 Figure 1 The chosen bundles are A for budget constraint I. When there is an increase in the price of bread the new budget constraint is II. The chosen bundle under the lower price is bundle A, which consists of 5 units of bread and 10 of wine; this is given by the point of tangency of the indifference curve U0 and budget constraint I. The chosen bundle under the higher price is bundle B, which consists of 3 units of bread and 10 of wine. b. Draw one more line on your diagram and use it to carefully explain that is the compensating variation for the price change described above. (2 points) For compensating variation we compensate consumers by giving them enough income such that they are as happy as before even with the price change. 2 For a price increase CV is shown in figure 1; it is given by the vertical distance between budget constraint I and III, which is the budget constraint with a high price for bread and tangent to the old indifference curve. 3. Assume that the inverse demand curve for a product slopes down, but is not vertical a. Now draw an inverse supply curve and use it to explain the case where a specific tax would be wholly incident upon the producer. (1 point) 1 point for identifying that the incidence will fall fully on the producer is when the supply curve is vertical. . Consumer incidence is given by Pd-P*. Producer incidence is given by P*-Ps. In this case Pd-P*=0 and P*-Ps is the vertical distance shown in the graph below D-t 3 b. Explain the role of any curves you draw in addition to your inverse supply and inverse demand curves. Also, show on your graph the price paid by consumers and the price received by producers.(2 points) 1 point for explaining the D-t graph. ½ point for showing the price paid by producers. ½ point for showing the price paid by consumers. The D-t graph is the demand curve shifted down by the amount of the tax; the vertical distance between D and D-t is t. Ps and Pd are shown on the graph above. c. Now draw a second diagram that shows the case where a specific tax would be wholly incident upon the consumer. Though you must label your diagram, you need not explain anything. (2 points) 1 point for showing that it is when supply is horizontal when the full burden of the tax will fall on the consumer. ½ a point for showing consumer and producer price. ½ point for showing incidence D-t 4 4. Six people with identical tastes go to dinner together and agree to evenly split the bill for dinner. Each person prefers the hamburger dinner for $6 to the steak dinner for $10. However, all six people choose the steak dinner. a. Explain how this choice is individually rational (2 points). The choice is individually rational if for a person the steak is worth at least $6.67. This is because when the bill is split evenly, a single person’s expenditure for the steak is (10/6+other people’s expenditure/6), and for the hamburger is (6/6+other people’s expenditure/6). Therefore, the price difference between the hamburger and the steak is (10-6)/6=0.67. b. If one of these people went to dinner alone and had a choice between the hamburger for $6 and the steak for $6.50, can you tell which the diner would choose? What about steak for $7.50? (2 points) 1 point for each question If the steak is $6.5 this person will buy it since we know from (a) that she values it at least at $6.67. At a price of 7.5 we do not know whether this person will chose it since from (a) we only know that she values it at least at 6.67 but don’t know whether she values it at more than that. c. Give another example where the wrong choice is made because people share the consequences of their choice, rather than bear all the costs individually. (1 point) Examples where there are free riders, fisheries/bathroom are acceptable. 5