Homework 06

UNC-Wilmington

Department of Economics and Finance

ECN 377

Dr. Chris Dumas

Homework 6

(due Tuesday, Sept. 15)

Multiple Choice and Matching Section

1) The "Significance Level of a test" ("alpha" = "α") is a measure of the reliability of a hypothesis test; it gives the probability of being _______.

a) correct when you decide to reject H

0 c) incorrect when you decide to reject H

0 b) correct when you decide to accept H d) both a and b

1

2) “As sample size (n) increases (that is, in the limit), if you take a bunch of random samples from a population, and then take the mean of each sample, the distribution of all of those means will have the shape of a normal

(bell-shaped) distribution, regardless of the shape of the distribution of the individual values in the population from which the samples were taken.” This amazing result that turns out to be important for many statistical tests is known as: a) the Turnpike Theorem b) the Gauss-Markov Theorem c) the Central Limit Theorem d) “For Whom the Bell-Shaped Distribution Tolls” Theorem

3) A “one-tailed” or “one-sided” hypothesis test is used to test whether: a) a population parameter is greater than a given number b) a population parameter is less than a given number c) a population parameter is different from a given number d) either a or b

4) A “two-tailed” or “two-sided” hypothesis test is used to test whether: a) a population parameter is greater than a given number b) a population parameter is less than a given number c) a population parameter is different from a given number d) either a or b

5) Starbucks provides an economist with data from a random sample survey of consumers. Starbucks hires the economist to determine whether the mean monthly expenditures on Starbucks coffee per consumer for all

Starbucks customers is greater than $4.00. From previous studies of consumers, Starbucks knows that the standard deviation of monthly expenditures on Starbucks coffee per consumer for all customers is $1.26. Which type of statistical test should the economist use to answer Starbucks’ question (and collect the $5000 consulting fee)? a) two-sided Z-test b) one-sided Z-test c) two-sided t-test d) one-sided t-test

6) Suppose that in the question 18 above, Starbucks did not know the standard deviation of mean monthly expenditures per consumer from previous studies. Which type of statistical test should be used to answer

Starbucks’ question? a) two-sided Z-test b) one-sided Z-test c) two-sided t-test d) one-sided t-test

7) Suppose, instead, that in question 18 above, Starbucks did not know the standard deviation, and Starbucks wanted to know whether mean monthly expenditures per customer was simply different from $3.00. Which type of statistical test should be used to answer Starbucks’ question? a) two-sided Z-test b) one-sided Z-test c) two-sided t-test d) one-sided t-test

8) Suppose that Dr. Dumas teaches two sections of Econometrics. He collects data on a random sample of students from each section and calculates the mean grade on Exam 1 for each section and the standard deviation of the grads on Exam 1 for each section. Which type of statistical test does Dr. Dumas use to determine whether the mean grade on Exam 1 for one section is statistically different from the mean grade of the other section? a) one-sided independent samples t-test c) two-sided independent samples t-test b) two-sided t-test d) two-sided dependent samples t-test

1

UNC-Wilmington

Department of Economics and Finance

ECN 377

Dr. Chris Dumas

9) Suppose an economist surveys a random sample of U.S. automobile dealers and collects data on average annual sales for each dealer in the sample. (The economist does not have data on the full population of U.S. auto dealers.) Suppose the economist re-surveys the same sample of dealers one year later and again collects data on each dealer’s annual sales. The economist wishes to test the hypothesis that there was no statistically significant difference in average annual sales from one year to the next. Which type of statistical test should be used to test this hypothesis? a) one-sided independent samples t-test b) one-sided t-test c) two-sided independent samples t-test d) two-sided dependent samples t-test

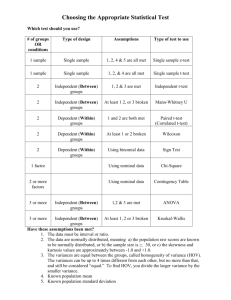

Matching. Match the letter of the following t-test descriptions with the corresponding SAS command below.

(There is an extra t-test description.) a) one-sample one-sided t-test H

1

: μ

1

> μ

0 b) one-sample one-sided t-test H

1

: μ

1

< μ

0 c) one-sample two sided t-test H

1

: μ

1

≠ μ

0 d) independent samples one-sided t-test e) independent samples two-sided t-test

10) f) dependent samples two-sided t-test proc ttest data =dataset01 h0 = 0 sides=2 alpha = 0.05

; paired pcinc2005*pcinc2000; run;

11) proc ttest data =dataset01 h0 = 23000 sides= 2 alpha = 0.05

; var pcinc2000; run;

12) proc sort data =dataset01; by vote2004; run; proc ttest data =dataset01 h0 = 0 sides= 2 alpha = 0.05

; class vote2004; var pcinc2000; run;

13) proc ttest data =dataset01 h0 = 20000 sides=U alpha = 0.05

; var pcinc2000; run;

14) proc ttest data =dataset01 h0 = 25000 sides=L alpha = 0.05

; var pcinc2000; run;

2

UNC-Wilmington

Department of Economics and Finance

ECN 377

Dr. Chris Dumas

Problem Section

15) Suppose that you collect the following random sample of measurements on variable X from individuals in a population: 12, 12, 13, 13, 13, 14, 14, 15, 19, 19, 20. Calculate for the sample: n, n-1, sum, mean, median, mode, sample variance, sample standard deviation, coefficient of variation, skewness, kurtosis. (Refer to the handout

“Descriptive Stats Example.”)

16) Suppose a beauty products firm has produced a new, “less slimy,” hand lotion (This problem suggested by my

7-year old daughter, Myers.). A sample of 30 bottles of the new, “less slimy” lotion has a mean slime index of

29. Assuming that the standard deviation of the slime index for the population of new lotion bottles is 4 slime index units (the same as that of the old lotion), can the firm’s marketers advertise that the slime index of the new lotion is, in fact, statistically less than 34 slime index units (with a confidence level of 95%)? SHOW YOUR

WORK, including the null hypothesis (H

0

) and the alternative hypothesis (H

1

) that you are testing!

17) Suppose you have macroeconomic data on the annual GDP growth rates in 2010 for a large population of developing countries. The mean GDP growth rate for this population of countries is 3.5 with a population standard deviation of 0.4. You receive annual GDP growth rate data for 2010 for 5 additional developing countries that were not in the original population of countries. For this sample of 5 countries, the average annual

GDP growth rate is 3.1. Assuming that the standard deviation for the new sample of countries is the same as the standard deviation for the population of countries, can we conclude that the two growth rates are statistically the same, using a significance level of 5%? SHOW YOUR WORK, including the null hypothesis (H

0

) and the alternative hypothesis (H

1

) that you are testing!

18) Suppose you do a survey to measure the unemployment rate in a random sample of 50 counties drawn from the population of all counties in the USA. You calculate that the sample mean unemployment rate for the counties is 6.3, and the sample standard deviation is 0.4. One political party claims that the average unemployment rate across all counties in the USA is larger than 5.5; conduct a statistical hypothesis test to support/refute this claim using a confidence level of 95%. SHOW YOUR WORK, including the null hypothesis

(H

0

) and the alternative hypothesis (H

1

) that you are testing!

19) Suppose you know from prior studies that the population of working (non-retired) investors makes, on average, 20 stock trades per year. Suppose that a random sample of 100 retired investors indicates that each retired investor makes, on average, 25 stock trades per year, with a sample standard deviation of 7 trades per year.

Is the average number of trades made by each group statistically different (with a significance level of 5%)?

SHOW YOUR WORK, including the null hypothesis (H

0

) and the alternative hypothesis (H

1

) that you are testing!

20) Suppose an economist wishes to determine whether annual expenditures per household are, on average, larger in the state of New York or the state of California. The economist surveys a random sample of 600 California households and determines that the mean annual expenditure per household is $38,000 with a standard deviation of $1,900. A random sample of 500 New York households has a mean annual expenditure per household of

$42,000 with a standard deviation of $2,300. Conduct a hypothesis test to determine whether mean annual household expenditures are larger in New York than in California with a confidence level of 95%.

SHOW

YOUR WORK, including the null hypothesis (H

0

) and the alternative hypothesis (H

1

) that you are testing!

Calculate the 95% Confidence Interval for mean annual household expenditures in California . SHOW YOUR

WORK!

21) Based on the information in the problem above, (a) Calculate the smallest sample size necessary to estimate mean annual household expenditures in California with an allowed error of +/- $1,000 and a significance level of

5%. Assume the standard deviation of annual household expenditure in California is $1,900. SHOW YOUR

WORK! (b) Did the economist collect a sample that was too large or too small to achieve this allowed error and confidence level? Very briefly, how do you know?

3

UNC-Wilmington

Department of Economics and Finance

County

(i)

Unemployment 2008

(X1 i

)

Unemployment 2009

(X2 i

)

Difference between first and second observations,

D i

= X2 i

– X1 i

ECN 377

Dr. Chris Dumas

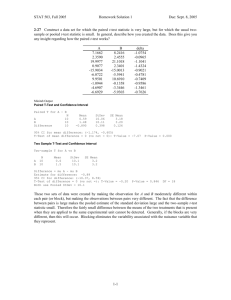

22) Suppose an economist wants to determine whether unemployment increased in her state from 2008 to 2009.

She selects a random sample of 10 counties in her state and assembles unemployment rate data for 2008 and 2009 as shown in the table below. Use the appropriate t-test to determine whether there was a statistically significant change in the unemployment rate with a confidence level of 95%.

Squared Deviations of the Differences

(D i

- 𝐷 ) 2

1

2

3

4

8.6

10.5

6.3

7.5

9.3

10.3

7.0

6.9

5

6

7

8

9

10

9.1

4.5

5.8

6.4

8.6

6.4

10.2

5.0

6.2

6.8

8.7

7.0

4